Working Capital / Tied Capital

Leaning of working capital processes reduce interest expenses,

release capital and improve key figures!

Working Capital may be defined by efficiency of a company and their shortterm financial health. A positive working capital means that a company is theoretically

financial health. A positive working capital means that a company is theoretically able to pay the shortterm liabilities. Nevertheless, with the requirement that

able to pay the shortterm liabilities. Nevertheless, with the requirement that sufficient liquidity is available. Negative working capital means the respective

sufficient liquidity is available. Negative working capital means the respective opposite.

Short Term Assets - Short Term Liabilities = Working Capital

opposite.

Short Term Assets - Short Term Liabilities = Working Capital (whereas short-term means with a remaining maturity of less than a year)

(whereas short-term means with a remaining maturity of less than a year) Terms, Key Performance Indicators

•

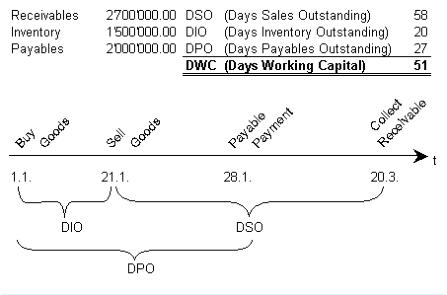

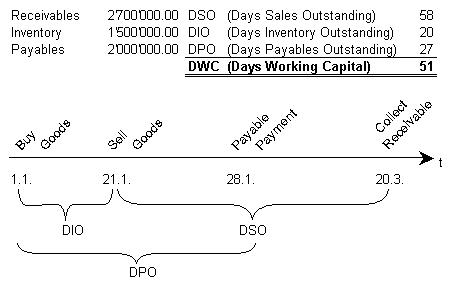

Days Sales Outstanding (DSO): Difference in days between invoice date and customer payment

•

Days Payable Outstanding (DPO): Difference in days between supplier invoice date and payment to supplier

•

Days Inventory Outstanding (DIO): Difference in days between invoice date of the supplier and the invoice to the customer for a specific good.

(Because the cash impact is not counting with the physical entry- or exit of the good in the warehouse. It is the invoice date of the supplier

invoice resp. invoice to the customer -> be aware of accruals!)

•

Days Working Capital (DWC) - Days, how long it needs to convert working capital in revenue. Also called “Cash Days”.

Calculation

1.

Direct Method: DSO - DPO + DIO = DWC

2.

Indirect Method: (WC[t2] - WC[t2] x 365 ) / Yearly Turnover = DWC

Example

With an assumed capital cost ratio of 8% the kpi’s of working capital

Terms, Key Performance Indicators

•

Days Sales Outstanding (DSO): Difference in days between invoice date and customer payment

•

Days Payable Outstanding (DPO): Difference in days between supplier invoice date and payment to supplier

•

Days Inventory Outstanding (DIO): Difference in days between invoice date of the supplier and the invoice to the customer for a specific good.

(Because the cash impact is not counting with the physical entry- or exit of the good in the warehouse. It is the invoice date of the supplier

invoice resp. invoice to the customer -> be aware of accruals!)

•

Days Working Capital (DWC) - Days, how long it needs to convert working capital in revenue. Also called “Cash Days”.

Calculation

1.

Direct Method: DSO - DPO + DIO = DWC

2.

Indirect Method: (WC[t2] - WC[t2] x 365 ) / Yearly Turnover = DWC

Example

With an assumed capital cost ratio of 8% the kpi’s of working capital have these results:

have these results: DSO: 34'800.-

DSO: 34'800.- DIO: 6'666.67

DIO: 6'666.67 DPO: -12'000.-

DPO: -12'000.-  That equeals total costs of 29’466.67. Depending on further

That equeals total costs of 29’466.67. Depending on further circumstances these costs have also a direct impat to the liquidity.

circumstances these costs have also a direct impat to the liquidity. The triggers for an optimization or trade receivables, trade payables

The triggers for an optimization or trade receivables, trade payables and mainly inventory turnover. For a sustainable success it is

and mainly inventory turnover. For a sustainable success it is mandatory to act strategic. That means, not just begging customers

mandatory to act strategic. That means, not just begging customers for faster paymen or vendors for later payment. More from inside to

for faster paymen or vendors for later payment. More from inside to outside and thinking in clusters. Just this way a winning achievement

outside and thinking in clusters. Just this way a winning achievement is possible. Are you interested how much your working capital cost and how much funds are locked? You will be surprised! Click here, in the

is possible. Are you interested how much your working capital cost and how much funds are locked? You will be surprised! Click here, in the download area is a free excel tool to calculate those numbers.

download area is a free excel tool to calculate those numbers. Key Elements for Working Capital Management

Key Elements for Working Capital Management •

Improvement of working capital unlocks frozen liquid funds, increase the free cash flow and reduce the inventory- and capital costs. (n.b. Free

•

Improvement of working capital unlocks frozen liquid funds, increase the free cash flow and reduce the inventory- and capital costs. (n.b. Free Cash Flow = [Operating Cash Flow] + [Investment Cash Flow])

Cash Flow = [Operating Cash Flow] + [Investment Cash Flow]) •

Consciously improvement of working capital processes release in average 20% - 30% tight capital.

•

Consciously improvement of working capital processes release in average 20% - 30% tight capital. •

The value of the company increase by re-investing the released funds. In consqueence the turnover rise what will lead to a better operational

•

The value of the company increase by re-investing the released funds. In consqueence the turnover rise what will lead to a better operational cash flow by sametime reducing capital costs (same conditions assumed)

•

Working Capital is also an indicator for an upcoming crisis. If working capital rise faster than the turnover it means that more capital must have

cash flow by sametime reducing capital costs (same conditions assumed)

•

Working Capital is also an indicator for an upcoming crisis. If working capital rise faster than the turnover it means that more capital must have been used that is at the end of the day just locked in operational processes. About three years before a liquidity crisis the ratio of [WC] /

been used that is at the end of the day just locked in operational processes. About three years before a liquidity crisis the ratio of [WC] / [Balance Sheet Total] increase clearly.

Managing Working Capital

[Balance Sheet Total] increase clearly.

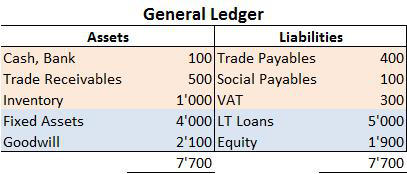

Managing Working Capital Working Capital is per definition the short term part of a general ledger (see above). But it will be managed also by long term driven positions. Short

Working Capital is per definition the short term part of a general ledger (see above). But it will be managed also by long term driven positions. Short Term: operational processes (Purchase, Sales, Payments). Long Term: liquidity effective procedures like the disposal of fixed assets for cash or

Term: operational processes (Purchase, Sales, Payments). Long Term: liquidity effective procedures like the disposal of fixed assets for cash or repayment of long term liabilities and also change in equity for capital fund.

repayment of long term liabilities and also change in equity for capital fund. Approach for Improvment

Approach for Improvment A) Vendors

Don’t

A) Vendors

Don’t •

Don’t start to extend payments to suppliers - at the end the end the customer is paying.

•

Especially key-vendors are essential. If those vendors stop to deliver, you are unable to produce anything.

•

Don’t start to extend payments to suppliers - at the end the end the customer is paying.

•

Especially key-vendors are essential. If those vendors stop to deliver, you are unable to produce anything. •

Reminders for late payment, evil calls or bad credit-worthiness are the consequences.

•

Reminders for late payment, evil calls or bad credit-worthiness are the consequences. •

Among troubles, what costs also time and money, you will enter into a risk to get worse conditions for existing and new vendors and certainly

•

Among troubles, what costs also time and money, you will enter into a risk to get worse conditions for existing and new vendors and certainly also banks.

Instead

also banks.

Instead •

Prioritize verndors and segregate them for todays and future deliveries as well as for financial processes.

•

Prioritize verndors and segregate them for todays and future deliveries as well as for financial processes.  •

Rate your vendors individually, i.e. for readiness for deliver, quality of the deliveries, financial health, conditions. How vendors can be ratet is

•

Rate your vendors individually, i.e. for readiness for deliver, quality of the deliveries, financial health, conditions. How vendors can be ratet is part of our article in our news-corner here as an example for banks..

part of our article in our news-corner here as an example for banks..  •

At least yearly negotiations with vendors. Time for personal meetings are well invested, instead just simple letters like: “beginning with next

•

At least yearly negotiations with vendors. Time for personal meetings are well invested, instead just simple letters like: “beginning with next month, we pay your invoices 4 days later”.

month, we pay your invoices 4 days later”.  Read also our article about vendor management here.

Read also our article about vendor management here. B) Inventory

Don’t

B) Inventory

Don’t •

Reduction of a safety stock can cost much more as it seems to be on a paper.

•

The consequences start with higher delivery costs, because a lower stock increase the number of orders per cycle. Higher prices arise in the

•

Reduction of a safety stock can cost much more as it seems to be on a paper.

•

The consequences start with higher delivery costs, because a lower stock increase the number of orders per cycle. Higher prices arise in the following because of scale-effects and also potential dissatisfaction of customers need to be considered because they don’t get their products

following because of scale-effects and also potential dissatisfaction of customers need to be considered because they don’t get their products in the right time.

•

Impacts on turnover based incentives for the sales staff and the management may lead to troubles up to resignation and dismissals.

in the right time.

•

Impacts on turnover based incentives for the sales staff and the management may lead to troubles up to resignation and dismissals. Instead

Instead •

Deversify between semi-finished goods and finished goods. Semi-finished goods have an impact to the producution and have therefore just

•

Deversify between semi-finished goods and finished goods. Semi-finished goods have an impact to the producution and have therefore just indirect impact to the satisfaction of customers. Finished goods have an ultimate direct impact to the customers and therefore to the turnover.

indirect impact to the satisfaction of customers. Finished goods have an ultimate direct impact to the customers and therefore to the turnover. •

Distinguish for goods with high, middle and low inventory turnover.

•

Distinguish for goods with high, middle and low inventory turnover. •

All goods should be compared by supplier in a matrix and clustered for the ideal lot size. See also our excel tool to calculate the ideal lot-size

•

All goods should be compared by supplier in a matrix and clustered for the ideal lot size. See also our excel tool to calculate the ideal lot-size by Andler for free download in our download area.

by Andler for free download in our download area.  C) Customers

C) Customers Don’t

Don’t •

Don’t dictate from one day to the other new payment terms. In the best case the customers ignore the new terms, but then nothing is

•

Don’t dictate from one day to the other new payment terms. In the best case the customers ignore the new terms, but then nothing is achieved. In the worst case customers quit the friendship.

achieved. In the worst case customers quit the friendship. •

Every customer is individual. Thus, don’t measure all customers with the same objectves.

•

Every customer is individual. Thus, don’t measure all customers with the same objectves. •

Don’t think that customers stay because the product might a good one.

•

Don’t assume that a customer stays always the same.

Instead

•

Don’t think that customers stay because the product might a good one.

•

Don’t assume that a customer stays always the same.

Instead •

Differentiate large and small customers as well as good and poor payer.

•

Differentiate large and small customers as well as good and poor payer. •

Have an interest for the customers of your customer in order to find out what those 2nd line customers request and how they behave. Thereby

•

Have an interest for the customers of your customer in order to find out what those 2nd line customers request and how they behave. Thereby you have a good basis for individual negotiations. Afterwards you are in a much better position to discuss more favourite payment and

you have a good basis for individual negotiations. Afterwards you are in a much better position to discuss more favourite payment and delivery terms.

delivery terms. •

Be consequent with bad payer. Urge them max. twice and go then further with legal actions. Because it is much wiser to waive turnover as to

•

Be consequent with bad payer. Urge them max. twice and go then further with legal actions. Because it is much wiser to waive turnover as to spend the products for nothing! Just alone with turnover on nice sheets nobody can pay their liabilities. That’s also the reason why turnover is

spend the products for nothing! Just alone with turnover on nice sheets nobody can pay their liabilities. That’s also the reason why turnover is quite a bad kpi for incentives.

quite a bad kpi for incentives. Read more about Working Capital in our article “Working Capital as Barometer of Effencieny”.

Contact us, we would be glad to show you the possible opportunities!

Read more about Working Capital in our article “Working Capital as Barometer of Effencieny”.

Contact us, we would be glad to show you the possible opportunities!

financial health. A positive working capital means that a company is theoretically

financial health. A positive working capital means that a company is theoretically able to pay the shortterm liabilities. Nevertheless, with the requirement that

able to pay the shortterm liabilities. Nevertheless, with the requirement that sufficient liquidity is available. Negative working capital means the respective

sufficient liquidity is available. Negative working capital means the respective opposite.

Short Term Assets - Short Term Liabilities = Working Capital

opposite.

Short Term Assets - Short Term Liabilities = Working Capital (whereas short-term means with a remaining maturity of less than a year)

(whereas short-term means with a remaining maturity of less than a year) Terms, Key Performance Indicators

•

Days Sales Outstanding (DSO): Difference in days between invoice date and customer payment

•

Days Payable Outstanding (DPO): Difference in days between supplier invoice date and payment to supplier

•

Days Inventory Outstanding (DIO): Difference in days between invoice date of the supplier and the invoice to the customer for a specific good.

(Because the cash impact is not counting with the physical entry- or exit of the good in the warehouse. It is the invoice date of the supplier

invoice resp. invoice to the customer -> be aware of accruals!)

•

Days Working Capital (DWC) - Days, how long it needs to convert working capital in revenue. Also called “Cash Days”.

Calculation

1.

Direct Method: DSO - DPO + DIO = DWC

2.

Indirect Method: (WC[t2] - WC[t2] x 365 ) / Yearly Turnover = DWC

Example

With an assumed capital cost ratio of 8% the kpi’s of working capital

Terms, Key Performance Indicators

•

Days Sales Outstanding (DSO): Difference in days between invoice date and customer payment

•

Days Payable Outstanding (DPO): Difference in days between supplier invoice date and payment to supplier

•

Days Inventory Outstanding (DIO): Difference in days between invoice date of the supplier and the invoice to the customer for a specific good.

(Because the cash impact is not counting with the physical entry- or exit of the good in the warehouse. It is the invoice date of the supplier

invoice resp. invoice to the customer -> be aware of accruals!)

•

Days Working Capital (DWC) - Days, how long it needs to convert working capital in revenue. Also called “Cash Days”.

Calculation

1.

Direct Method: DSO - DPO + DIO = DWC

2.

Indirect Method: (WC[t2] - WC[t2] x 365 ) / Yearly Turnover = DWC

Example

With an assumed capital cost ratio of 8% the kpi’s of working capital have these results:

have these results: DSO: 34'800.-

DSO: 34'800.- DIO: 6'666.67

DIO: 6'666.67 DPO: -12'000.-

DPO: -12'000.-  That equeals total costs of 29’466.67. Depending on further

That equeals total costs of 29’466.67. Depending on further circumstances these costs have also a direct impat to the liquidity.

circumstances these costs have also a direct impat to the liquidity. The triggers for an optimization or trade receivables, trade payables

The triggers for an optimization or trade receivables, trade payables and mainly inventory turnover. For a sustainable success it is

and mainly inventory turnover. For a sustainable success it is mandatory to act strategic. That means, not just begging customers

mandatory to act strategic. That means, not just begging customers for faster paymen or vendors for later payment. More from inside to

for faster paymen or vendors for later payment. More from inside to outside and thinking in clusters. Just this way a winning achievement

outside and thinking in clusters. Just this way a winning achievement is possible. Are you interested how much your working capital cost and how much funds are locked? You will be surprised! Click here, in the

is possible. Are you interested how much your working capital cost and how much funds are locked? You will be surprised! Click here, in the download area is a free excel tool to calculate those numbers.

download area is a free excel tool to calculate those numbers. Key Elements for Working Capital Management

Key Elements for Working Capital Management •

Improvement of working capital unlocks frozen liquid funds, increase the free cash flow and reduce the inventory- and capital costs. (n.b. Free

•

Improvement of working capital unlocks frozen liquid funds, increase the free cash flow and reduce the inventory- and capital costs. (n.b. Free Cash Flow = [Operating Cash Flow] + [Investment Cash Flow])

Cash Flow = [Operating Cash Flow] + [Investment Cash Flow]) •

Consciously improvement of working capital processes release in average 20% - 30% tight capital.

•

Consciously improvement of working capital processes release in average 20% - 30% tight capital. •

The value of the company increase by re-investing the released funds. In consqueence the turnover rise what will lead to a better operational

•

The value of the company increase by re-investing the released funds. In consqueence the turnover rise what will lead to a better operational cash flow by sametime reducing capital costs (same conditions assumed)

•

Working Capital is also an indicator for an upcoming crisis. If working capital rise faster than the turnover it means that more capital must have

cash flow by sametime reducing capital costs (same conditions assumed)

•

Working Capital is also an indicator for an upcoming crisis. If working capital rise faster than the turnover it means that more capital must have been used that is at the end of the day just locked in operational processes. About three years before a liquidity crisis the ratio of [WC] /

been used that is at the end of the day just locked in operational processes. About three years before a liquidity crisis the ratio of [WC] / [Balance Sheet Total] increase clearly.

Managing Working Capital

[Balance Sheet Total] increase clearly.

Managing Working Capital Working Capital is per definition the short term part of a general ledger (see above). But it will be managed also by long term driven positions. Short

Working Capital is per definition the short term part of a general ledger (see above). But it will be managed also by long term driven positions. Short Term: operational processes (Purchase, Sales, Payments). Long Term: liquidity effective procedures like the disposal of fixed assets for cash or

Term: operational processes (Purchase, Sales, Payments). Long Term: liquidity effective procedures like the disposal of fixed assets for cash or repayment of long term liabilities and also change in equity for capital fund.

repayment of long term liabilities and also change in equity for capital fund. Approach for Improvment

Approach for Improvment A) Vendors

Don’t

A) Vendors

Don’t •

Don’t start to extend payments to suppliers - at the end the end the customer is paying.

•

Especially key-vendors are essential. If those vendors stop to deliver, you are unable to produce anything.

•

Don’t start to extend payments to suppliers - at the end the end the customer is paying.

•

Especially key-vendors are essential. If those vendors stop to deliver, you are unable to produce anything. •

Reminders for late payment, evil calls or bad credit-worthiness are the consequences.

•

Reminders for late payment, evil calls or bad credit-worthiness are the consequences. •

Among troubles, what costs also time and money, you will enter into a risk to get worse conditions for existing and new vendors and certainly

•

Among troubles, what costs also time and money, you will enter into a risk to get worse conditions for existing and new vendors and certainly also banks.

Instead

also banks.

Instead •

Prioritize verndors and segregate them for todays and future deliveries as well as for financial processes.

•

Prioritize verndors and segregate them for todays and future deliveries as well as for financial processes.  •

Rate your vendors individually, i.e. for readiness for deliver, quality of the deliveries, financial health, conditions. How vendors can be ratet is

•

Rate your vendors individually, i.e. for readiness for deliver, quality of the deliveries, financial health, conditions. How vendors can be ratet is part of our article in our news-corner here as an example for banks..

part of our article in our news-corner here as an example for banks..  •

At least yearly negotiations with vendors. Time for personal meetings are well invested, instead just simple letters like: “beginning with next

•

At least yearly negotiations with vendors. Time for personal meetings are well invested, instead just simple letters like: “beginning with next month, we pay your invoices 4 days later”.

month, we pay your invoices 4 days later”.  Read also our article about vendor management here.

Read also our article about vendor management here. B) Inventory

Don’t

B) Inventory

Don’t •

Reduction of a safety stock can cost much more as it seems to be on a paper.

•

The consequences start with higher delivery costs, because a lower stock increase the number of orders per cycle. Higher prices arise in the

•

Reduction of a safety stock can cost much more as it seems to be on a paper.

•

The consequences start with higher delivery costs, because a lower stock increase the number of orders per cycle. Higher prices arise in the following because of scale-effects and also potential dissatisfaction of customers need to be considered because they don’t get their products

following because of scale-effects and also potential dissatisfaction of customers need to be considered because they don’t get their products in the right time.

•

Impacts on turnover based incentives for the sales staff and the management may lead to troubles up to resignation and dismissals.

in the right time.

•

Impacts on turnover based incentives for the sales staff and the management may lead to troubles up to resignation and dismissals. Instead

Instead •

Deversify between semi-finished goods and finished goods. Semi-finished goods have an impact to the producution and have therefore just

•

Deversify between semi-finished goods and finished goods. Semi-finished goods have an impact to the producution and have therefore just indirect impact to the satisfaction of customers. Finished goods have an ultimate direct impact to the customers and therefore to the turnover.

indirect impact to the satisfaction of customers. Finished goods have an ultimate direct impact to the customers and therefore to the turnover. •

Distinguish for goods with high, middle and low inventory turnover.

•

Distinguish for goods with high, middle and low inventory turnover. •

All goods should be compared by supplier in a matrix and clustered for the ideal lot size. See also our excel tool to calculate the ideal lot-size

•

All goods should be compared by supplier in a matrix and clustered for the ideal lot size. See also our excel tool to calculate the ideal lot-size by Andler for free download in our download area.

by Andler for free download in our download area.  C) Customers

C) Customers Don’t

Don’t •

Don’t dictate from one day to the other new payment terms. In the best case the customers ignore the new terms, but then nothing is

•

Don’t dictate from one day to the other new payment terms. In the best case the customers ignore the new terms, but then nothing is achieved. In the worst case customers quit the friendship.

achieved. In the worst case customers quit the friendship. •

Every customer is individual. Thus, don’t measure all customers with the same objectves.

•

Every customer is individual. Thus, don’t measure all customers with the same objectves. •

Don’t think that customers stay because the product might a good one.

•

Don’t assume that a customer stays always the same.

Instead

•

Don’t think that customers stay because the product might a good one.

•

Don’t assume that a customer stays always the same.

Instead •

Differentiate large and small customers as well as good and poor payer.

•

Differentiate large and small customers as well as good and poor payer. •

Have an interest for the customers of your customer in order to find out what those 2nd line customers request and how they behave. Thereby

•

Have an interest for the customers of your customer in order to find out what those 2nd line customers request and how they behave. Thereby you have a good basis for individual negotiations. Afterwards you are in a much better position to discuss more favourite payment and

you have a good basis for individual negotiations. Afterwards you are in a much better position to discuss more favourite payment and delivery terms.

delivery terms. •

Be consequent with bad payer. Urge them max. twice and go then further with legal actions. Because it is much wiser to waive turnover as to

•

Be consequent with bad payer. Urge them max. twice and go then further with legal actions. Because it is much wiser to waive turnover as to spend the products for nothing! Just alone with turnover on nice sheets nobody can pay their liabilities. That’s also the reason why turnover is

spend the products for nothing! Just alone with turnover on nice sheets nobody can pay their liabilities. That’s also the reason why turnover is quite a bad kpi for incentives.

quite a bad kpi for incentives. Read more about Working Capital in our article “Working Capital as Barometer of Effencieny”.

Contact us, we would be glad to show you the possible opportunities!

Read more about Working Capital in our article “Working Capital as Barometer of Effencieny”.

Contact us, we would be glad to show you the possible opportunities!

Working Capital / Tied Capital

Leaning of working capital processes reduce interest expenses,

release capital and improve key figures!

Working Capital may be defined by efficiency of a company and their

efficiency of a company and their shortterm financial health. A

shortterm financial health. A positive working capital means that

positive working capital means that a company is theoretically able to

a company is theoretically able to pay the shortterm liabilities.

pay the shortterm liabilities. Nevertheless, with the requirement

Nevertheless, with the requirement that sufficient liquidity is available.

that sufficient liquidity is available. Negative working capital means the

Negative working capital means the respective opposite.

Short Term Assets - Short Term Liabilities = Working Capital

respective opposite.

Short Term Assets - Short Term Liabilities = Working Capital (whereas short-term means with a remaining maturity of less than a

(whereas short-term means with a remaining maturity of less than a year)

Terms, Key Performance Indicators

•

Days Sales Outstanding (DSO): Difference in days between

invoice date and customer payment

•

Days Payable Outstanding (DPO): Difference in days between

supplier invoice date and payment to supplier

•

Days Inventory Outstanding (DIO): Difference in days between

invoice date of the supplier and the invoice to the customer for

a specific good. (Because the cash impact is not counting with

the physical entry- or exit of the good in the warehouse. It is

the invoice date of the supplier invoice resp. invoice to the

customer -> be aware of accruals!)

•

Days Working Capital (DWC) - Days, how long it needs to

convert working capital in revenue. Also called “Cash Days”.

Calculation

1.

Direct Method: DSO - DPO + DIO = DWC

2.

Indirect Method: (WC[t2] - WC[t2] x 365 ) / Yearly Turnover =

DWC

Example

With an assumed capital cost ratio of 8% the kpi’s of working capital

year)

Terms, Key Performance Indicators

•

Days Sales Outstanding (DSO): Difference in days between

invoice date and customer payment

•

Days Payable Outstanding (DPO): Difference in days between

supplier invoice date and payment to supplier

•

Days Inventory Outstanding (DIO): Difference in days between

invoice date of the supplier and the invoice to the customer for

a specific good. (Because the cash impact is not counting with

the physical entry- or exit of the good in the warehouse. It is

the invoice date of the supplier invoice resp. invoice to the

customer -> be aware of accruals!)

•

Days Working Capital (DWC) - Days, how long it needs to

convert working capital in revenue. Also called “Cash Days”.

Calculation

1.

Direct Method: DSO - DPO + DIO = DWC

2.

Indirect Method: (WC[t2] - WC[t2] x 365 ) / Yearly Turnover =

DWC

Example

With an assumed capital cost ratio of 8% the kpi’s of working capital have these results:

DSO: 34'800.-

DIO: 6'666.67

DPO: -12'000.-

That equeals total costs of 29’466.67. Depending on further

have these results:

DSO: 34'800.-

DIO: 6'666.67

DPO: -12'000.-

That equeals total costs of 29’466.67. Depending on further circumstances these costs have also a direct impat to the liquidity.

circumstances these costs have also a direct impat to the liquidity. The triggers for an optimization or trade receivables, trade payables

The triggers for an optimization or trade receivables, trade payables and mainly inventory turnover. For a sustainable success it is

and mainly inventory turnover. For a sustainable success it is mandatory to act strategic. That means, not just begging customers

mandatory to act strategic. That means, not just begging customers for faster paymen or vendors for later payment. More from inside to

for faster paymen or vendors for later payment. More from inside to outside and thinking in clusters. Just this way a winning achievement

outside and thinking in clusters. Just this way a winning achievement is possible. Are you interested how much your working capital

is possible. Are you interested how much your working capital cost and how much funds are locked? You will be surprised!

cost and how much funds are locked? You will be surprised! Click here, in the download area is a free excel tool to calculate

Click here, in the download area is a free excel tool to calculate those numbers.

Key Elements for Working Capital Management

those numbers.

Key Elements for Working Capital Management •

Improvement of working capital unlocks frozen liquid funds,

•

Improvement of working capital unlocks frozen liquid funds, increase the free cash flow and reduce the inventory- and

increase the free cash flow and reduce the inventory- and capital costs. (n.b. Free Cash Flow = [Operating Cash Flow] +

capital costs. (n.b. Free Cash Flow = [Operating Cash Flow] + [Investment Cash Flow])

[Investment Cash Flow]) •

Consciously improvement of working capital processes

•

Consciously improvement of working capital processes release in average 20% - 30% tight capital.

release in average 20% - 30% tight capital. •

The value of the company increase by re-investing the

•

The value of the company increase by re-investing the released funds. In consqueence the turnover rise what will

released funds. In consqueence the turnover rise what will lead to a better operational cash flow by sametime reducing

lead to a better operational cash flow by sametime reducing capital costs (same conditions assumed)

•

Working Capital is also an indicator for an upcoming crisis. If

capital costs (same conditions assumed)

•

Working Capital is also an indicator for an upcoming crisis. If working capital rise faster than the turnover it means that more

capital must have been used that is at the end of the day just

working capital rise faster than the turnover it means that more

capital must have been used that is at the end of the day just locked in operational processes. About three years before a

locked in operational processes. About three years before a liquidity crisis the ratio of [WC] / [Balance Sheet Total]

liquidity crisis the ratio of [WC] / [Balance Sheet Total] increase clearly.

Managing Working Capital

increase clearly.

Managing Working Capital Working Capital is per definition the short term part of a general

Working Capital is per definition the short term part of a general ledger (see above). But it will be managed also by long term driven

ledger (see above). But it will be managed also by long term driven positions. Short Term: operational processes (Purchase, Sales,

positions. Short Term: operational processes (Purchase, Sales, Payments). Long Term: liquidity effective procedures like the

Payments). Long Term: liquidity effective procedures like the disposal of fixed assets for cash or repayment of long term liabilities

disposal of fixed assets for cash or repayment of long term liabilities and also change in equity for capital fund.

Approach for Improvment

and also change in equity for capital fund.

Approach for Improvment A) Vendors

Don’t

•

Don’t start to extend payments to suppliers - at the end the

A) Vendors

Don’t

•

Don’t start to extend payments to suppliers - at the end the end the customer is paying.

•

Especially key-vendors are essential. If those vendors stop to

end the customer is paying.

•

Especially key-vendors are essential. If those vendors stop to deliver, you are unable to produce anything.

•

Reminders for late payment, evil calls or bad credit-worthiness

deliver, you are unable to produce anything.

•

Reminders for late payment, evil calls or bad credit-worthiness are the consequences.

•

Among troubles, what costs also time and money, you will

are the consequences.

•

Among troubles, what costs also time and money, you will enter into a risk to get worse conditions for existing and new

enter into a risk to get worse conditions for existing and new vendors and certainly also banks.

Instead

•

Prioritize verndors and segregate them for todays and future

vendors and certainly also banks.

Instead

•

Prioritize verndors and segregate them for todays and future deliveries as well as for financial processes.

•

Rate your vendors individually, i.e. for readiness for deliver,

deliveries as well as for financial processes.

•

Rate your vendors individually, i.e. for readiness for deliver, quality of the deliveries, financial health, conditions. How

quality of the deliveries, financial health, conditions. How vendors can be ratet is part of our article in our news-corner

vendors can be ratet is part of our article in our news-corner here as an example for banks..

•

At least yearly negotiations with vendors. Time for personal

here as an example for banks..

•

At least yearly negotiations with vendors. Time for personal meetings are well invested, instead just simple letters like:

meetings are well invested, instead just simple letters like: “beginning with next month, we pay your invoices 4 days

“beginning with next month, we pay your invoices 4 days later”.

Read also our article about vendor management here.

B) Inventory

Don’t

•

Reduction of a safety stock can cost much more as it seems to

later”.

Read also our article about vendor management here.

B) Inventory

Don’t

•

Reduction of a safety stock can cost much more as it seems to be on a paper.

•

The consequences start with higher delivery costs, because a

be on a paper.

•

The consequences start with higher delivery costs, because a lower stock increase the number of orders per cycle. Higher

lower stock increase the number of orders per cycle. Higher prices arise in the following because of scale-effects and also

prices arise in the following because of scale-effects and also potential dissatisfaction of customers need to be considered

potential dissatisfaction of customers need to be considered because they don’t get their products in the right time.

•

Impacts on turnover based incentives for the sales staff and

because they don’t get their products in the right time.

•

Impacts on turnover based incentives for the sales staff and the management may lead to troubles up to resignation and

the management may lead to troubles up to resignation and dismissals.

dismissals. Instead

•

Deversify between semi-finished goods and finished goods.

Instead

•

Deversify between semi-finished goods and finished goods. Semi-finished goods have an impact to the producution and

Semi-finished goods have an impact to the producution and have therefore just indirect impact to the satisfaction of

have therefore just indirect impact to the satisfaction of customers. Finished goods have an ultimate direct impact to

customers. Finished goods have an ultimate direct impact to the customers and therefore to the turnover.

•

Distinguish for goods with high, middle and low inventory

the customers and therefore to the turnover.

•

Distinguish for goods with high, middle and low inventory turnover.

•

All goods should be compared by supplier in a matrix and

turnover.

•

All goods should be compared by supplier in a matrix and clustered for the ideal lot size. See also our excel tool to

clustered for the ideal lot size. See also our excel tool to calculate the ideal lot-size by Andler for free download in our

calculate the ideal lot-size by Andler for free download in our download area.

C) Customers

Don’t

•

Don’t dictate from one day to the other new payment terms. In

download area.

C) Customers

Don’t

•

Don’t dictate from one day to the other new payment terms. In the best case the customers ignore the new terms, but then

the best case the customers ignore the new terms, but then nothing is achieved. In the worst case customers quit the

nothing is achieved. In the worst case customers quit the friendship.

•

Every customer is individual. Thus, don’t measure all

friendship.

•

Every customer is individual. Thus, don’t measure all customers with the same objectves.

customers with the same objectves. •

Don’t think that customers stay because the product might a

•

Don’t think that customers stay because the product might a good one.

•

Don’t assume that a customer stays always the same.

good one.

•

Don’t assume that a customer stays always the same. Instead

•

Differentiate large and small customers as well as good and

Instead

•

Differentiate large and small customers as well as good and poor payer.

•

Have an interest for the customers of your customer in order to

find out what those 2nd line customers request and how they

poor payer.

•

Have an interest for the customers of your customer in order to

find out what those 2nd line customers request and how they behave. Thereby you have a good basis for individual

behave. Thereby you have a good basis for individual  negotiations. Afterwards you are in a much better position to

negotiations. Afterwards you are in a much better position to discuss more favourite payment and delivery terms.

•

Be consequent with bad payer. Urge them max. twice and go

discuss more favourite payment and delivery terms.

•

Be consequent with bad payer. Urge them max. twice and go then further with legal actions. Because it is much wiser to

then further with legal actions. Because it is much wiser to waive turnover as to spend the products for nothing! Just

waive turnover as to spend the products for nothing! Just alone with turnover on nice sheets nobody can pay their

alone with turnover on nice sheets nobody can pay their liabilities. That’s also the reason why turnover is quite a bad

liabilities. That’s also the reason why turnover is quite a bad kpi for incentives.

Read more about Working Capital in our article “Working

Capital as Barometer of Effencieny”.

Contact us, we would be glad to show you the possible

opportunities!

kpi for incentives.

Read more about Working Capital in our article “Working

Capital as Barometer of Effencieny”.

Contact us, we would be glad to show you the possible

opportunities!

efficiency of a company and their

efficiency of a company and their shortterm financial health. A

shortterm financial health. A positive working capital means that

positive working capital means that a company is theoretically able to

a company is theoretically able to pay the shortterm liabilities.

pay the shortterm liabilities. Nevertheless, with the requirement

Nevertheless, with the requirement that sufficient liquidity is available.

that sufficient liquidity is available. Negative working capital means the

Negative working capital means the respective opposite.

Short Term Assets - Short Term Liabilities = Working Capital

respective opposite.

Short Term Assets - Short Term Liabilities = Working Capital (whereas short-term means with a remaining maturity of less than a

(whereas short-term means with a remaining maturity of less than a year)

Terms, Key Performance Indicators

•

Days Sales Outstanding (DSO): Difference in days between

invoice date and customer payment

•

Days Payable Outstanding (DPO): Difference in days between

supplier invoice date and payment to supplier

•

Days Inventory Outstanding (DIO): Difference in days between

invoice date of the supplier and the invoice to the customer for

a specific good. (Because the cash impact is not counting with

the physical entry- or exit of the good in the warehouse. It is

the invoice date of the supplier invoice resp. invoice to the

customer -> be aware of accruals!)

•

Days Working Capital (DWC) - Days, how long it needs to

convert working capital in revenue. Also called “Cash Days”.

Calculation

1.

Direct Method: DSO - DPO + DIO = DWC

2.

Indirect Method: (WC[t2] - WC[t2] x 365 ) / Yearly Turnover =

DWC

Example

With an assumed capital cost ratio of 8% the kpi’s of working capital

year)

Terms, Key Performance Indicators

•

Days Sales Outstanding (DSO): Difference in days between

invoice date and customer payment

•

Days Payable Outstanding (DPO): Difference in days between

supplier invoice date and payment to supplier

•

Days Inventory Outstanding (DIO): Difference in days between

invoice date of the supplier and the invoice to the customer for

a specific good. (Because the cash impact is not counting with

the physical entry- or exit of the good in the warehouse. It is

the invoice date of the supplier invoice resp. invoice to the

customer -> be aware of accruals!)

•

Days Working Capital (DWC) - Days, how long it needs to

convert working capital in revenue. Also called “Cash Days”.

Calculation

1.

Direct Method: DSO - DPO + DIO = DWC

2.

Indirect Method: (WC[t2] - WC[t2] x 365 ) / Yearly Turnover =

DWC

Example

With an assumed capital cost ratio of 8% the kpi’s of working capital have these results:

DSO: 34'800.-

DIO: 6'666.67

DPO: -12'000.-

That equeals total costs of 29’466.67. Depending on further

have these results:

DSO: 34'800.-

DIO: 6'666.67

DPO: -12'000.-

That equeals total costs of 29’466.67. Depending on further circumstances these costs have also a direct impat to the liquidity.

circumstances these costs have also a direct impat to the liquidity. The triggers for an optimization or trade receivables, trade payables

The triggers for an optimization or trade receivables, trade payables and mainly inventory turnover. For a sustainable success it is

and mainly inventory turnover. For a sustainable success it is mandatory to act strategic. That means, not just begging customers

mandatory to act strategic. That means, not just begging customers for faster paymen or vendors for later payment. More from inside to

for faster paymen or vendors for later payment. More from inside to outside and thinking in clusters. Just this way a winning achievement

outside and thinking in clusters. Just this way a winning achievement is possible. Are you interested how much your working capital

is possible. Are you interested how much your working capital cost and how much funds are locked? You will be surprised!

cost and how much funds are locked? You will be surprised! Click here, in the download area is a free excel tool to calculate

Click here, in the download area is a free excel tool to calculate those numbers.

Key Elements for Working Capital Management

those numbers.

Key Elements for Working Capital Management •

Improvement of working capital unlocks frozen liquid funds,

•

Improvement of working capital unlocks frozen liquid funds, increase the free cash flow and reduce the inventory- and

increase the free cash flow and reduce the inventory- and capital costs. (n.b. Free Cash Flow = [Operating Cash Flow] +

capital costs. (n.b. Free Cash Flow = [Operating Cash Flow] + [Investment Cash Flow])

[Investment Cash Flow]) •

Consciously improvement of working capital processes

•

Consciously improvement of working capital processes release in average 20% - 30% tight capital.

release in average 20% - 30% tight capital. •

The value of the company increase by re-investing the

•

The value of the company increase by re-investing the released funds. In consqueence the turnover rise what will

released funds. In consqueence the turnover rise what will lead to a better operational cash flow by sametime reducing

lead to a better operational cash flow by sametime reducing capital costs (same conditions assumed)

•

Working Capital is also an indicator for an upcoming crisis. If

capital costs (same conditions assumed)

•

Working Capital is also an indicator for an upcoming crisis. If working capital rise faster than the turnover it means that more

capital must have been used that is at the end of the day just

working capital rise faster than the turnover it means that more

capital must have been used that is at the end of the day just locked in operational processes. About three years before a

locked in operational processes. About three years before a liquidity crisis the ratio of [WC] / [Balance Sheet Total]

liquidity crisis the ratio of [WC] / [Balance Sheet Total] increase clearly.

Managing Working Capital

increase clearly.

Managing Working Capital Working Capital is per definition the short term part of a general

Working Capital is per definition the short term part of a general ledger (see above). But it will be managed also by long term driven

ledger (see above). But it will be managed also by long term driven positions. Short Term: operational processes (Purchase, Sales,

positions. Short Term: operational processes (Purchase, Sales, Payments). Long Term: liquidity effective procedures like the

Payments). Long Term: liquidity effective procedures like the disposal of fixed assets for cash or repayment of long term liabilities

disposal of fixed assets for cash or repayment of long term liabilities and also change in equity for capital fund.

Approach for Improvment

and also change in equity for capital fund.

Approach for Improvment A) Vendors

Don’t

•

Don’t start to extend payments to suppliers - at the end the

A) Vendors

Don’t

•

Don’t start to extend payments to suppliers - at the end the end the customer is paying.

•

Especially key-vendors are essential. If those vendors stop to

end the customer is paying.

•

Especially key-vendors are essential. If those vendors stop to deliver, you are unable to produce anything.

•

Reminders for late payment, evil calls or bad credit-worthiness

deliver, you are unable to produce anything.

•

Reminders for late payment, evil calls or bad credit-worthiness are the consequences.

•

Among troubles, what costs also time and money, you will

are the consequences.

•

Among troubles, what costs also time and money, you will enter into a risk to get worse conditions for existing and new

enter into a risk to get worse conditions for existing and new vendors and certainly also banks.

Instead

•

Prioritize verndors and segregate them for todays and future

vendors and certainly also banks.

Instead

•

Prioritize verndors and segregate them for todays and future deliveries as well as for financial processes.

•

Rate your vendors individually, i.e. for readiness for deliver,

deliveries as well as for financial processes.

•

Rate your vendors individually, i.e. for readiness for deliver, quality of the deliveries, financial health, conditions. How

quality of the deliveries, financial health, conditions. How vendors can be ratet is part of our article in our news-corner

vendors can be ratet is part of our article in our news-corner here as an example for banks..

•

At least yearly negotiations with vendors. Time for personal

here as an example for banks..

•

At least yearly negotiations with vendors. Time for personal meetings are well invested, instead just simple letters like:

meetings are well invested, instead just simple letters like: “beginning with next month, we pay your invoices 4 days

“beginning with next month, we pay your invoices 4 days later”.

Read also our article about vendor management here.

B) Inventory

Don’t

•

Reduction of a safety stock can cost much more as it seems to

later”.

Read also our article about vendor management here.

B) Inventory

Don’t

•

Reduction of a safety stock can cost much more as it seems to be on a paper.

•

The consequences start with higher delivery costs, because a

be on a paper.

•

The consequences start with higher delivery costs, because a lower stock increase the number of orders per cycle. Higher

lower stock increase the number of orders per cycle. Higher prices arise in the following because of scale-effects and also

prices arise in the following because of scale-effects and also potential dissatisfaction of customers need to be considered

potential dissatisfaction of customers need to be considered because they don’t get their products in the right time.

•

Impacts on turnover based incentives for the sales staff and

because they don’t get their products in the right time.

•

Impacts on turnover based incentives for the sales staff and the management may lead to troubles up to resignation and

the management may lead to troubles up to resignation and dismissals.

dismissals. Instead

•

Deversify between semi-finished goods and finished goods.

Instead

•

Deversify between semi-finished goods and finished goods. Semi-finished goods have an impact to the producution and

Semi-finished goods have an impact to the producution and have therefore just indirect impact to the satisfaction of

have therefore just indirect impact to the satisfaction of customers. Finished goods have an ultimate direct impact to

customers. Finished goods have an ultimate direct impact to the customers and therefore to the turnover.

•

Distinguish for goods with high, middle and low inventory

the customers and therefore to the turnover.

•

Distinguish for goods with high, middle and low inventory turnover.

•

All goods should be compared by supplier in a matrix and

turnover.

•

All goods should be compared by supplier in a matrix and clustered for the ideal lot size. See also our excel tool to

clustered for the ideal lot size. See also our excel tool to calculate the ideal lot-size by Andler for free download in our

calculate the ideal lot-size by Andler for free download in our download area.

C) Customers

Don’t

•

Don’t dictate from one day to the other new payment terms. In

download area.

C) Customers

Don’t

•

Don’t dictate from one day to the other new payment terms. In the best case the customers ignore the new terms, but then

the best case the customers ignore the new terms, but then nothing is achieved. In the worst case customers quit the

nothing is achieved. In the worst case customers quit the friendship.

•

Every customer is individual. Thus, don’t measure all

friendship.

•

Every customer is individual. Thus, don’t measure all customers with the same objectves.

customers with the same objectves. •

Don’t think that customers stay because the product might a

•

Don’t think that customers stay because the product might a good one.

•

Don’t assume that a customer stays always the same.

good one.

•

Don’t assume that a customer stays always the same. Instead

•

Differentiate large and small customers as well as good and

Instead

•

Differentiate large and small customers as well as good and poor payer.

•

Have an interest for the customers of your customer in order to

find out what those 2nd line customers request and how they

poor payer.

•

Have an interest for the customers of your customer in order to

find out what those 2nd line customers request and how they behave. Thereby you have a good basis for individual

behave. Thereby you have a good basis for individual  negotiations. Afterwards you are in a much better position to

negotiations. Afterwards you are in a much better position to discuss more favourite payment and delivery terms.

•

Be consequent with bad payer. Urge them max. twice and go

discuss more favourite payment and delivery terms.

•

Be consequent with bad payer. Urge them max. twice and go then further with legal actions. Because it is much wiser to

then further with legal actions. Because it is much wiser to waive turnover as to spend the products for nothing! Just

waive turnover as to spend the products for nothing! Just alone with turnover on nice sheets nobody can pay their

alone with turnover on nice sheets nobody can pay their liabilities. That’s also the reason why turnover is quite a bad

liabilities. That’s also the reason why turnover is quite a bad kpi for incentives.

Read more about Working Capital in our article “Working

Capital as Barometer of Effencieny”.

Contact us, we would be glad to show you the possible

opportunities!

kpi for incentives.

Read more about Working Capital in our article “Working

Capital as Barometer of Effencieny”.

Contact us, we would be glad to show you the possible

opportunities!