Negative Interest Rates:

Paradoxum At-Arms-Length vs. Agreement

Negative interest rates make great demands on the Treasury. Not just for external investment,

also especially regarding intercompany interest yield.

Negative Interest Rates: great demands to the Corporate Treasury

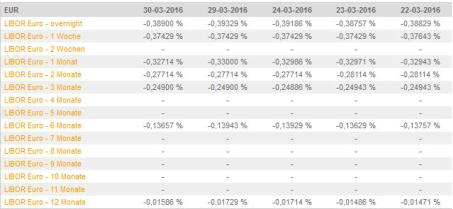

The topic of negative interest rates arrived already also in the corporate treasury. Thereby treasurers are faced with the question for the right interest rate with consideration of current interest rates for EUR and CHF for maturity until 1 year. Those rates are commonly applied for all kind loans with term < 1 year with one payment, loans with variable interest payments, cash pool interest rates and certainly also intercompany interest rates. A) Up until today is was especially regarding tax issues recommended to apply for the at-arms-length rule. That means, market rate plus margin for intercompany loans which would have been set by an independent third party = bank. This, in combination with own group re- financing costs as a benchmark, was until these days the common best practice formula for the “right” interest rate. B) This is the reason, why perhaps in almost all loan agreements concerning ic-loans (whether in the treasury policy, cash pool agreements or single loan agreements) just e.g.“3-months LIBOR + x%” is mentioned. But: if you like to get from an independent third party bank today a loan, the bank will apply in almost all cases a floor of 0% + margin instead of the real negative rate + margin. It happened quite often in the past months that banks came up with this additional rule afterwards the closing of the deal. Ourselves do not know about any law case in which a customer defended the true rate in front of a court. At the end he might become right, but in fact he lost for sure the bank how gave him the loan. And which bank is willing to give a new loan if she know about a juridical issue with one of his banking competitors? Back to intercompany banking. The question is, what outweighs more: the well known principle of at-arms-length or the legal loan agreement? I think, this question must be answered for each single case separately. At this time it wouldn’t be a big issue to set a floor of 0% for cash pools in central Europe. Assumed that the pool participants are mostly debtors vs. the pool master, otherwise it would not make big sense! The other way around the group leading entity should think about negative rates in the pool. But be aware for local tax auditors. Because in a nutshell, everybody like to get the best result for his own portfolio. That means, also central Europe entities should be reviewed case by case. In any event, much more sensitive is the situation in exotic countries. There it is common practice that tax authorities do not debate a long time if they think about the possibility of hidden distribution of earnings. This might be the case if a floor of 0% would be suddenly applied by the foreign lending group mother, even an independent third bank would do the same. Such a juridical dispute becomes quite fast very expensive and may have serious negative impacts, also on operational activities. In such cases it would be wise to apply for the exactly terms of the loan agreement and to abstain from an amendment. Contact us, we would be glad to show you the possible opportunities!

Negative Interest Rates:

Paradoxum At-Arms-

Length vs. Agreement

Negative interest rates make great demands on the

Treasury. Not just for external investment, also

especially regarding intercompany interest yield.

Negative Interest Rates: great demands

to the Corporate Treasury

The topic of negative interest rates arrived already also in the corporate treasury. Thereby treasurers are faced with the question for the right interest rate with consideration of current interest rates for EUR and CHF for maturity until 1 year. Those rates are commonly applied for all kind loans with term < 1 year with one payment, loans with variable interest payments, cash pool interest rates and certainly also intercompany interest rates. A) Up until today is was especially regarding tax issues recommended to apply for the at-arms-length rule. That means, market rate plus margin for intercompany loans which would have been set by an independent third party = bank. This, in combination with own group re- financing costs as a benchmark, was until these days the common best practice formula for the “right” interest rate. B) This is the reason, why perhaps in almost all loan agreements concerning ic-loans (whether in the treasury policy, cash pool agreements or single loan agreements) just e.g.“3-months LIBOR + x%” is mentioned. But: if you like to get from an independent third party bank today a loan, the bank will apply in almost all cases a floor of 0% + margin instead of the real negative rate + margin. It happened quite often in the past months that banks came up with this additional rule afterwards the closing of the deal. Ourselves do not know about any law case in which a customer defended the true rate in front of a court. At the end he might become right, but in fact he lost for sure the bank how gave him the loan. And which bank is willing to give a new loan if she know about a juridical issue with one of his banking competitors? Back to intercompany banking. The question is, what outweighs more: the well known principle of at-arms-length or the legal loan agreement? I think, this question must be answered for each single case separately. At this time it wouldn’t be a big issue to set a floor of 0% for cash pools in central Europe. Assumed that the pool participants are mostly debtors vs. the pool master, otherwise it would not make big sense! The other way around the group leading entity should think about negative rates in the pool. But be aware for local tax auditors. Because in a nutshell, everybody like to get the best result for his own portfolio. That means, also central Europe entities should be reviewed case by case. In any event, much more sensitive is the situation in exotic countries. There it is common practice that tax authorities do not debate a long time if they think about the possibility of hidden distribution of earnings. This might be the case if a floor of 0% would be suddenly applied by the foreign lending group mother, even an independent third bank would do the same. Such a juridical dispute becomes quite fast very expensive and may have serious negative impacts, also on operational activities. In such cases it would be wise to apply for the exactly terms of the loan agreement and to abstain from an amendment. Contact us, we would be glad to show you the possible opportunities!