Inhouse Banking

Best possible results in group treasury departments depend from professional banking, but not

only external, especially also internal with Inhouse Banking a lot of potentials may come up.

Inhouse Bank - Banking is not necesseraly Banking

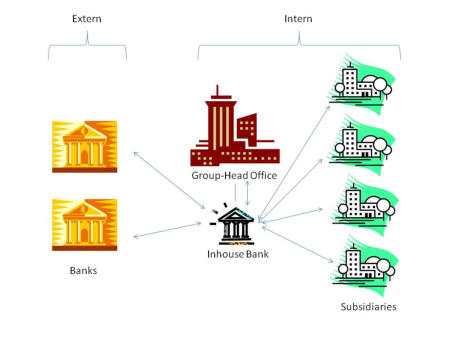

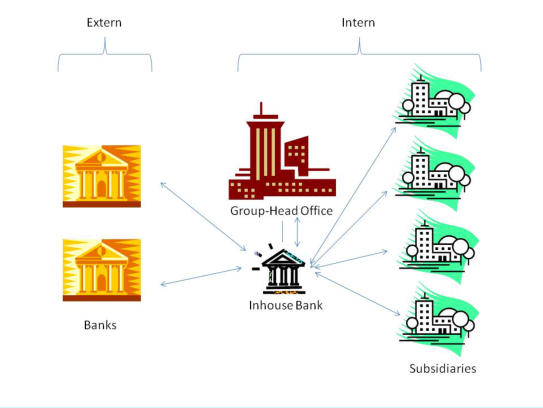

Basically it must be distinguished between three kind of different bankings: 1. The classic external Banking in which a 1:1 connection exist of the several group members and one resp. more external banks and which is managed decentralized. 2. Corporate Banking, which is on the one hand the central banking element at the head-office of a group and localized at the head office: o internally responsible mostly for financing matters including internal loans and larger foreign exchange transactions; o and / or renders on the other hand banking services also for external companies (e.g. leasing). 3. Inhouse Banking, which is a perfect copy of an external bank for all internal companies. This article considers only topics regarding Inhouse Banking. Following a schematical diagram of an Inhouse Banking structure.Legal Structure of an Inhouse Bank

A so called Inhouse Bank may be 1. within the legal structure of a group an imaginary construct which has no own legal personality and no own booking cycle, or 2. a (mostly) identical legal person like the overall corporate group mother and has his own cost center and / or even an own booking cycle. 3. But a real Inhouse Bank may be - mostly in larger corporates - an independent legal company for which the group mother is the shareholder and is also controlled by it. This legally independent Inhouse Bank has so far the right to enter in all kind of financial transactions on her own accountability with internal- and especially external partners. Hence, such a legal independent company is also considered as an independent tax subject. Particularly regarding tax items the topic transfer-pricing becomes popular and allows to manage all kind of financial transactions uncoupled from the operational sector. And under circumstances also in a more beneficial environment abroad which enables best possible bilateral tax agreements between countries the group has a stake on internal companies. In consequence, a possible lower tax rate for profits is then possible. Precisely as follows:The ideal Location for an Inhouse Bank

A) Tax issues

The legally independent Inhouse Bank is a own tax subject with all rights and obligations. That means, that the tax objects of the Inhouse Bank, notably all financial transactions to the inside and to the outside can lead to a more beneficial tax rate (from the point of view of the group). As profit tax or as capital tax. Furthermore additional tax benefits may be achieved by an elaborated location for the Inhouse Bank. Especially regarding double-treaty agreements between different countries it is possible to benefit from easier and often lower tax processes and tax rates. Example: Group A has his head office in France and has subsidiaries in South Africa, Indonesia and Australia. The double-tax treaty agreements between France and those countries are far worser than they are for the Netherlands and those countries. Therefore, a location for the Inhouse Bank in the Netherlands would make more sense (what is quite often the real case) than to have it next the the head office in France, although both countries are members of the EU.B) Processing issues

Everyone would like to offer his clients a lowest possible price for his products and services in order to achieve competition advantages. Therefore cost optimization is always a topic.Particulary standard processes, which may be with support of better software more efficient, need increasingly less technical knowledge and could be also managed in countries with lower education (and cheaper) levels. Of course, only if the quality is not hurt by that quantitative benefits. An example is the centralization of payment processes, keyword Payment Factory. But also processes for which know-how is just hardly to source and a shift for a specific service to another country becomes necessary, e.g. it-services for which India is quite popular.Consistent Processes

Standardization of processes have in most cases quite significant advantages. Not only because of quantitative issues, moreover especially because of quality reasons. An Inhouse Bank is the best example for such a process optimization in the whole financial environment within a corporate group. Instead, every single subsidiary, each for themselve, manages her liquidity balances at many banks and on much more external bank accounts. Such liquidity could be centralized on nostro-accounts at the Inhouse Bank while the payments (except some minor ones like wages and salaries) are routed through a centralized Payment Factory. Same for foreign exchange transactions and loans which are agreed then only with the Inhouse Bank anymore. This leads to tremendous potentials for more safety, transparancy and efficiency.Risk Mitigation

Safety is the most important aspect regarding Risk Management. It is always possible for an Inhouse Bank to manage the foreign

exchange- and interest exposure at its best, because all transations of the subsidiaries are centralized at the Inhouse Bank. In

consequence, potentials of netting are easier possible with all the deversified benefits as well as a transparent and highly efficient

exposure management.

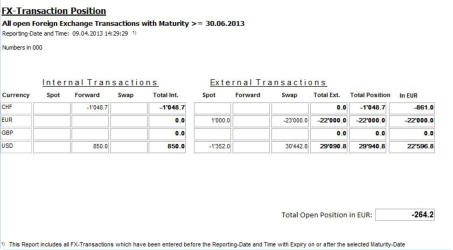

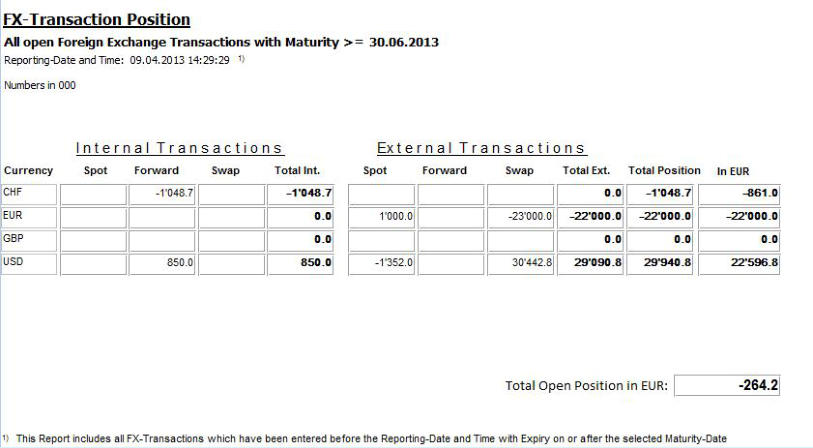

In the following a real example of foreign exchange positions:

This report seems to be petty. But behind this Inhouse Bank approach for fx-positions are comletely new considerations which may have enormeous impact. 1. It will be distinguished between internal and external fx-risks incl. associated credit facilited and settlement risks. Internal risks are significant lower and to kept under better control than external risks. 2. With this approach it is possible to establish a portfolio hedging strategy with focus on the overall risk and not just on single currency pairs. In this example the total open position for the group is just EUR 264,2 instead of 5 times different numbers. To hedge the overall position is done now with only one fx-transaction and this one is small. That keeps the credit facility for fx-transactions as low as possible and therefore as cheap as possible and last but not least as easy as possible. Nevertheless, the cash flow at risk methodology may be adapted for the net group position for the single currency pair and is in this example mainly in EUR/USD only.Summary

The Inhouse Bank (IHB) is much more than just a well-intentioned central point for some tasks in the finance departement. Instead, the IHB offers immediately after introduction very important benefits regarding • Cost EfficiencyKosteneffizienz • Process Control • Risik Mitigation Possbilities • Tax Optimazation Opportunities Quite large potentials which can be optimized with relative low efforts than it would be possible (if so) in case of decentral structure. A very careful draft design is essential to achieve long-range and largest possible results for all concerned sections. A careful project is always, but especially for the introduction and enhancement of an Inhouse Bank a key requirement. Not only the long-range advantages, also the ultimate short term achievements are prominent and have a great significance for all corporates which are designated to introduce an Inhouse Bank. Contact us, we would be glad to show you the possible opportunities!

Inhouse Banking

Best possible results in group treasury departments

depend from professional banking, but not only

external, especially also internal with Inhouse

Banking a lot of potentials may come up.

Inhouse Bank - Banking is not

necesseraly Banking

Basically it must be distinguished between three kind of different bankings: 1. The classic external Banking in which a 1:1 connection exist of the several group members and one resp. more external banks and which is managed decentralized. 2. Corporate Banking, which is on the one hand the central banking element at the head-office of a group and localized at the head office: o internally responsible mostly for financing matters including internal loans and larger foreign exchange transactions; o and / or renders on the other hand banking services also for external companies (e.g. leasing). 3. Inhouse Banking, which is a perfect copy of an external bank for all internal companies. This article considers only topics regarding Inhouse Banking. Following a schematical diagram of an Inhouse Banking structure.Legal Structure of an Inhouse Bank

A so called Inhouse Bank may be 1. within the legal structure of a group an imaginary construct which has no own legal personality and no own booking cycle, or 2. a (mostly) identical legal person like the overall corporate group mother and has his own cost center and / or even an own booking cycle. 3. But a real Inhouse Bank may be - mostly in larger corporates - an independent legal company for which the group mother is the shareholder and is also controlled by it. This legally independent Inhouse Bank has so far the right to enter in all kind of financial transactions on her own accountability with internal- and especially external partners. Hence, such a legal independent company is also considered as an independent tax subject. Particularly regarding tax items the topic transfer-pricing becomes popular and allows to manage all kind of financial transactions uncoupled from the operational sector. And under circumstances also in a more beneficial environment abroad which enables best possible bilateral tax agreements betwenn countries the group has a stake on internal companies. In consequence, a possible lower tax rate for profits is then possible. Precisely as follows:The ideal Location for an Inhouse Bank

A) Tax issues

The legally independent Inhouse Bank is a own tax subject with all rights and obligations. That means, that the tax objects of the Inhouse Bank, notably all financial transactions to the inside and to the outside can lead to a more beneficial tax rate (from the point of view of the group). As profit tax or as capital tax. Furthermore addtional tax benefits may be achieved by an elaborated location for the Inhouse Bank. Especially regarding double-treaty agreements between different countries is it possible to benefit from easier and often lower tax processes and tax rates. Example: Group A has his head office in France and has subsidiaries in South Africa, Indonesia and Australia. The double-tax treaty agreements between France and those countries are far worser than they are for the Netherlands and those countries. Therefore, a location for the Inhouse Bank in the Netherlands would make more sense (what is quite often the real case) than to have it next the the head office in France, although both countries are members of the EU.B) Processing issues

Everyone would like to offer his clients a lowest possible price for his products and services in order to achieve competition advantages. Therefore cost optimization is always a topic.Particulary standard processes, which may be with support of better software more efficient, need increasingly less technical knowledge and could be also managed in countries with lower education (and cheaper) levels. Of course, only if the quality is not hurt by that quantitative benefits. And example is the centralization of payment processes, keyword Payment Factory. But also processes for which know-how is just hardly to source and a shift for a specific service to another country becomes necessary, e.g. it-services for which India is quite popular.Consistent Processes

Standardization of processes have in most cases quite significant advantages. Not only because of quantitative issues, moreover especially because of quality reasons. An Inhouse Bank is the best example for such a process optimization in the whole financial environment within a corporate group. Instead every single subsidiary, each for themselve, manages her liquidity balances at many banks and on much more external bank accounts. Such liquidity could be centralized on nostro-accounts at the Inhouse Bank while the payments (except some minor ones like wages and salaries) are routed through a centralized Payment Factory. Same for foreign exchange transactions and loans which are agreed then only with the Inhouse Bank anymore. This leads to tremendous potentials for more safety, transparancy and efficiency.Risk Mitigation

Safety is the most important aspect regarding Risk Management. It is

always possible for an Inhouse Bank to manage the foreign exchange-

and interest exposure at its best, because all transations of the

subsidiaries are centralized at the Inhouse Bank. In consequence,

potentials of netting are easier possible with all the deversified benefits

as well as a transparent and highly efficient exposure management.

In the following a real example of foreign exchange positions:

This report seems to be petty. But behind this Inhouse Bank approach for fx-positions are comletely new considerations which may have enormeous impact. 1. It will be distinguished between internal and external fx-risks incl. associated credit facilited and settlement risks. Internal risks are significant lower and to kept under better control than external risks. 2. With this approach it is possible to establish a portfolio hedging strategy with focus on the overall risk and not just on single currency pairs. In this example the total open position for the group is just EUR 264,2 instead of 5 times different numbers. To hedge the overall position is done now with only one fx- transaction and this one is small. That keeps the credit facility for fx-transactions as low as possible and therefore as cheap as possible and last but not least as easy as possible. Nevertheless, the cash flow at risk methodology may be adapted for the net group position for the single currency pair and is in this example mainly in EUR/USD only.Summary

The Inhouse Bank (IHB) is much more than just a well-intentioned central point for some tasks in the finance departement. Instead, the IHB offers immediately after introduction very important benefits regarding • Cost EfficiencyKosteneffizienz • Process Control • Risik Mitigation Possbilities • Tax Optimazation Opportunities Quite large potentials which can be optimized with relative low efforts than it would be possible (if so) in case of decentral structure. A very careful draft design is essential to achieve long-range and largest possible results for all concerned sections. A careful project is always, but especially for the introduction and enhancement of an Inhouse Bank a key requirement. Not only the long-range advantages, also the ultimate short term achievements are prominent and have a great significance for all corporates which are designated to introduce an Inhouse Bank. Contact us, we would be glad to show you the possible opportunities!