Cash Pooling - Country Considerations

Cash Pooling is allowed in many countries, in some just partially and

in others it is prohibited. Here an overwiew about those specifications.

Techniques are the one, but country

one, but country specific restrictions

specific restrictions the other. It is in many

the other. It is in many countries basically possible to

countries basically possible to maintain cash pooling on an automatized basis.

maintain cash pooling on an automatized basis. However, it is always unavoidable to consider carefully

However, it is always unavoidable to consider carefully items like tax, legal and liability aspects. Those change

items like tax, legal and liability aspects. Those change quite strong from country to country.

Whether cash pooling is possible in the particular country

quite strong from country to country.

Whether cash pooling is possible in the particular country depend from many factors. For example also which bank is

depend from many factors. For example also which bank is elected as the provider, because in some regions it requires

elected as the provider, because in some regions it requires special licenses. Also the legal structure of the group is often

special licenses. Also the legal structure of the group is often important. These and further questions, e.g. thin capitalization

important. These and further questions, e.g. thin capitalization rules, taxes) need to be clarified in every case very carefully.

rules, taxes) need to be clarified in every case very carefully. Based on our experience with introducing, enhancing and

Based on our experience with introducing, enhancing and improving cash pool structures globally we prepared a brief

improving cash pool structures globally we prepared a brief manuscript, intended to get a first and impression what is

manuscript, intended to get a first and impression what is possible and what would become rather a problem in a

possible and what would become rather a problem in a specific country when introducing cash pooling.

specific country when introducing cash pooling.  The full manuscript has 48 pages and contains information

The full manuscript has 48 pages and contains information about following countries:

about following countries: Europe:

Europe: Albania, Austria, Belgium, Bulgaria, Croatia, Czech Republic,

Albania, Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Finnland, France, Germany, Greece, Hungary, Italy,

Denmark, Finnland, France, Germany, Greece, Hungary, Italy, Luxemburg, Netherlands, Poland, Portugal, Romania, Russia,

Luxemburg, Netherlands, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland,

Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, United Kingdom.

Turkey, Ukraine, United Kingdom. Asia / Pacific:

Australia, China, Hong Kong, India, Indonesia, Japan, Korea,

Asia / Pacific:

Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Taiwan, Thailand.

Malaysia, Singapore, Taiwan, Thailand. Latin America:

Argentina, Brasil, Columbia, Chile, Dominican Republic,

Latin America:

Argentina, Brasil, Columbia, Chile, Dominican Republic, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Mexico,

Ecuador, El Salvador, Guatemala, Haiti, Honduras, Mexico, Panama, Peru, Puerto Rico, Venezuela.

Panama, Peru, Puerto Rico, Venezuela. Middle East:

Afganistan, Bahrain, Egypt, Iraq, Lebanon, Oman, Pakistan,

Middle East:

Afganistan, Bahrain, Egypt, Iraq, Lebanon, Oman, Pakistan, Qatar, Saudi Arabia, Syria, UAE, Yemen.

Africa:

Cameroon, Cote d’Ivoire, DR Congo, Kenya, Nigeria, Senegal, South Africa, Tanzania, Uganda, Zambia.

Qatar, Saudi Arabia, Syria, UAE, Yemen.

Africa:

Cameroon, Cote d’Ivoire, DR Congo, Kenya, Nigeria, Senegal, South Africa, Tanzania, Uganda, Zambia. Get this paper as PDF for CHF 49.- * here (payment with credit card or paypal):

Get this paper as PDF for CHF 49.- * here (payment with credit card or paypal): *+ 7,7% VAT if delivery is within Switzerland

Note: after the payment is made you get the document by seperate e-mail within one, max. two business days.

*+ 7,7% VAT if delivery is within Switzerland

Note: after the payment is made you get the document by seperate e-mail within one, max. two business days.

one, but country

one, but country specific restrictions

specific restrictions the other. It is in many

the other. It is in many countries basically possible to

countries basically possible to maintain cash pooling on an automatized basis.

maintain cash pooling on an automatized basis. However, it is always unavoidable to consider carefully

However, it is always unavoidable to consider carefully items like tax, legal and liability aspects. Those change

items like tax, legal and liability aspects. Those change quite strong from country to country.

Whether cash pooling is possible in the particular country

quite strong from country to country.

Whether cash pooling is possible in the particular country depend from many factors. For example also which bank is

depend from many factors. For example also which bank is elected as the provider, because in some regions it requires

elected as the provider, because in some regions it requires special licenses. Also the legal structure of the group is often

special licenses. Also the legal structure of the group is often important. These and further questions, e.g. thin capitalization

important. These and further questions, e.g. thin capitalization rules, taxes) need to be clarified in every case very carefully.

rules, taxes) need to be clarified in every case very carefully. Based on our experience with introducing, enhancing and

Based on our experience with introducing, enhancing and improving cash pool structures globally we prepared a brief

improving cash pool structures globally we prepared a brief manuscript, intended to get a first and impression what is

manuscript, intended to get a first and impression what is possible and what would become rather a problem in a

possible and what would become rather a problem in a specific country when introducing cash pooling.

specific country when introducing cash pooling.  The full manuscript has 48 pages and contains information

The full manuscript has 48 pages and contains information about following countries:

about following countries: Europe:

Europe: Albania, Austria, Belgium, Bulgaria, Croatia, Czech Republic,

Albania, Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Finnland, France, Germany, Greece, Hungary, Italy,

Denmark, Finnland, France, Germany, Greece, Hungary, Italy, Luxemburg, Netherlands, Poland, Portugal, Romania, Russia,

Luxemburg, Netherlands, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland,

Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, United Kingdom.

Turkey, Ukraine, United Kingdom. Asia / Pacific:

Australia, China, Hong Kong, India, Indonesia, Japan, Korea,

Asia / Pacific:

Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Taiwan, Thailand.

Malaysia, Singapore, Taiwan, Thailand. Latin America:

Argentina, Brasil, Columbia, Chile, Dominican Republic,

Latin America:

Argentina, Brasil, Columbia, Chile, Dominican Republic, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Mexico,

Ecuador, El Salvador, Guatemala, Haiti, Honduras, Mexico, Panama, Peru, Puerto Rico, Venezuela.

Panama, Peru, Puerto Rico, Venezuela. Middle East:

Afganistan, Bahrain, Egypt, Iraq, Lebanon, Oman, Pakistan,

Middle East:

Afganistan, Bahrain, Egypt, Iraq, Lebanon, Oman, Pakistan, Qatar, Saudi Arabia, Syria, UAE, Yemen.

Africa:

Cameroon, Cote d’Ivoire, DR Congo, Kenya, Nigeria, Senegal, South Africa, Tanzania, Uganda, Zambia.

Qatar, Saudi Arabia, Syria, UAE, Yemen.

Africa:

Cameroon, Cote d’Ivoire, DR Congo, Kenya, Nigeria, Senegal, South Africa, Tanzania, Uganda, Zambia. Get this paper as PDF for CHF 49.- * here (payment with credit card or paypal):

Get this paper as PDF for CHF 49.- * here (payment with credit card or paypal): *+ 7,7% VAT if delivery is within Switzerland

Note: after the payment is made you get the document by seperate e-mail within one, max. two business days.

*+ 7,7% VAT if delivery is within Switzerland

Note: after the payment is made you get the document by seperate e-mail within one, max. two business days.

Cash Pooling -

Country Considerations

Cash Pooling is allowed in many countries, in some just

partially and in others it is prohibited. Here an overwiew

about those specifications.

Techniques are the one, but country specific restrictions the other. It is in many

specific restrictions the other. It is in many countries basically possible to maintain cash

countries basically possible to maintain cash pooling on an automatized basis. However, it is always

pooling on an automatized basis. However, it is always unavoidable to consider carefully items like tax, legal and

unavoidable to consider carefully items like tax, legal and liabilities. Those change quite strong from country to country.

Whether cash pooling is possible in the particular country depend

liabilities. Those change quite strong from country to country.

Whether cash pooling is possible in the particular country depend from many factors. For example also which bank is elected as the

from many factors. For example also which bank is elected as the provider, because in some regions it requires special licenses. Also

provider, because in some regions it requires special licenses. Also the legal structure of the group is often important. These and further

the legal structure of the group is often important. These and further questions, e.g. thin capitalization rules, taxes) need to be clarified in

questions, e.g. thin capitalization rules, taxes) need to be clarified in every case very carefully.

Based on our experience with introducing, enhancing and improving

every case very carefully.

Based on our experience with introducing, enhancing and improving cash pool structures globally we prepared a brief manuscript,

cash pool structures globally we prepared a brief manuscript, intended to get a first and impression what is possible and what would

intended to get a first and impression what is possible and what would become rather a problem in a specific country when introducing cash

become rather a problem in a specific country when introducing cash pooling.

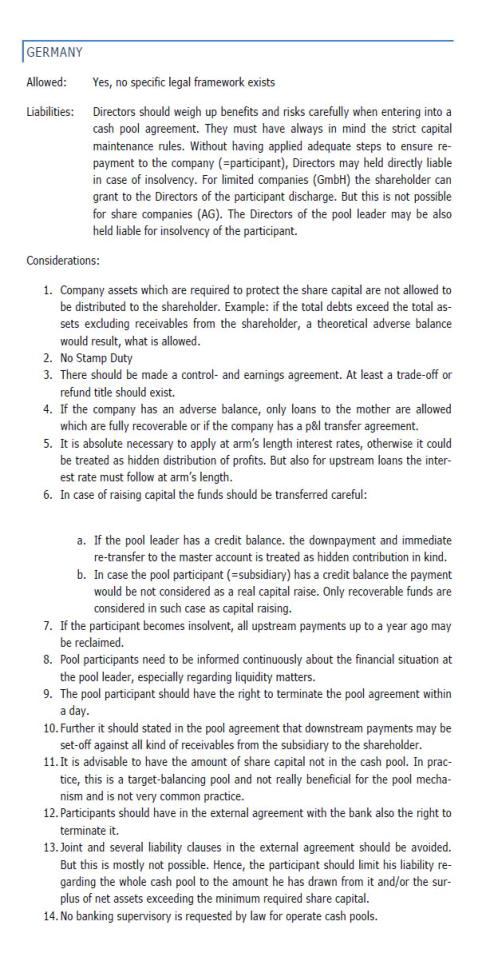

An example is visible in the Desktop view

The full manuscript has 48 pages and contains information about

pooling.

An example is visible in the Desktop view

The full manuscript has 48 pages and contains information about following countries:

following countries: Europe:

Albania, Austria, Belgium, Bulgaria, Croatia, Czech Republic,

Europe:

Albania, Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Finnland, France, Germany, Hungary, Italy, Luxembourg,

Denmark, Finnland, France, Germany, Hungary, Italy, Luxembourg, Netherlands, Poland, Portugal, Romania, Russia, Slovakia, Slovenia,

Netherlands, Poland, Portugal, Romania, Russia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, United Kingdom.

Spain, Sweden, Switzerland, Turkey, Ukraine, United Kingdom. Asia / Pacific:

Asia / Pacific: Australia, China, Hong Kong, India, Indonesia, Japan, Korea,

Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Taiwan, Thailand.

Latin America:

Argentina, Brasil, Columbia, Chile, Dominican Republic, Ecuador, El

Malaysia, Singapore, Taiwan, Thailand.

Latin America:

Argentina, Brasil, Columbia, Chile, Dominican Republic, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Mexico, Panama, Peru, Puerto

Salvador, Guatemala, Haiti, Honduras, Mexico, Panama, Peru, Puerto Rico, Venezuela.

Middle East:

Rico, Venezuela.

Middle East: Afganistan, Bahrain, Egypt, Iraq, Lebanon, Oman, Pakistan, Qatar,

Afganistan, Bahrain, Egypt, Iraq, Lebanon, Oman, Pakistan, Qatar, Saudi Arabia, Syria, UAE, Yemen.

Saudi Arabia, Syria, UAE, Yemen. Africa:

Cameroon, Cote d’Ivoire, DR Congo, Kenya, Nigeria, Senegal, South

Africa:

Cameroon, Cote d’Ivoire, DR Congo, Kenya, Nigeria, Senegal, South Africa, Tanzania, Uganda, Zambia.

Get this paper as PDF for CHF 49.- * here (payment with credit

Africa, Tanzania, Uganda, Zambia.

Get this paper as PDF for CHF 49.- * here (payment with credit card or paypal):

*+ 8% VAT if delivery is within Switzerland

card or paypal):

*+ 8% VAT if delivery is within Switzerland Note: after the payment is made you get the document by seperate e-

Note: after the payment is made you get the document by seperate e- mail within one, max. two business days.

mail within one, max. two business days.

specific restrictions the other. It is in many

specific restrictions the other. It is in many countries basically possible to maintain cash

countries basically possible to maintain cash pooling on an automatized basis. However, it is always

pooling on an automatized basis. However, it is always unavoidable to consider carefully items like tax, legal and

unavoidable to consider carefully items like tax, legal and liabilities. Those change quite strong from country to country.

Whether cash pooling is possible in the particular country depend

liabilities. Those change quite strong from country to country.

Whether cash pooling is possible in the particular country depend from many factors. For example also which bank is elected as the

from many factors. For example also which bank is elected as the provider, because in some regions it requires special licenses. Also

provider, because in some regions it requires special licenses. Also the legal structure of the group is often important. These and further

the legal structure of the group is often important. These and further questions, e.g. thin capitalization rules, taxes) need to be clarified in

questions, e.g. thin capitalization rules, taxes) need to be clarified in every case very carefully.

Based on our experience with introducing, enhancing and improving

every case very carefully.

Based on our experience with introducing, enhancing and improving cash pool structures globally we prepared a brief manuscript,

cash pool structures globally we prepared a brief manuscript, intended to get a first and impression what is possible and what would

intended to get a first and impression what is possible and what would become rather a problem in a specific country when introducing cash

become rather a problem in a specific country when introducing cash pooling.

An example is visible in the Desktop view

The full manuscript has 48 pages and contains information about

pooling.

An example is visible in the Desktop view

The full manuscript has 48 pages and contains information about following countries:

following countries: Europe:

Albania, Austria, Belgium, Bulgaria, Croatia, Czech Republic,

Europe:

Albania, Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Finnland, France, Germany, Hungary, Italy, Luxembourg,

Denmark, Finnland, France, Germany, Hungary, Italy, Luxembourg, Netherlands, Poland, Portugal, Romania, Russia, Slovakia, Slovenia,

Netherlands, Poland, Portugal, Romania, Russia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, United Kingdom.

Spain, Sweden, Switzerland, Turkey, Ukraine, United Kingdom. Asia / Pacific:

Asia / Pacific: Australia, China, Hong Kong, India, Indonesia, Japan, Korea,

Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Taiwan, Thailand.

Latin America:

Argentina, Brasil, Columbia, Chile, Dominican Republic, Ecuador, El

Malaysia, Singapore, Taiwan, Thailand.

Latin America:

Argentina, Brasil, Columbia, Chile, Dominican Republic, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Mexico, Panama, Peru, Puerto

Salvador, Guatemala, Haiti, Honduras, Mexico, Panama, Peru, Puerto Rico, Venezuela.

Middle East:

Rico, Venezuela.

Middle East: Afganistan, Bahrain, Egypt, Iraq, Lebanon, Oman, Pakistan, Qatar,

Afganistan, Bahrain, Egypt, Iraq, Lebanon, Oman, Pakistan, Qatar, Saudi Arabia, Syria, UAE, Yemen.

Saudi Arabia, Syria, UAE, Yemen. Africa:

Cameroon, Cote d’Ivoire, DR Congo, Kenya, Nigeria, Senegal, South

Africa:

Cameroon, Cote d’Ivoire, DR Congo, Kenya, Nigeria, Senegal, South Africa, Tanzania, Uganda, Zambia.

Get this paper as PDF for CHF 49.- * here (payment with credit

Africa, Tanzania, Uganda, Zambia.

Get this paper as PDF for CHF 49.- * here (payment with credit card or paypal):

*+ 8% VAT if delivery is within Switzerland

card or paypal):

*+ 8% VAT if delivery is within Switzerland Note: after the payment is made you get the document by seperate e-

Note: after the payment is made you get the document by seperate e- mail within one, max. two business days.

mail within one, max. two business days.