Currency Overlay

How think and act Big-Players when hedging their

Share-, Currency-, Commodity- and Interest Risk?

In general, the exchange of amounts in different currencies is a zero-sum game. The reason that some participants of the foreign exchange market manage their foreign currency positions actively make it to some of them possible to operate above the zero-border. Thus, to the

market manage their foreign currency positions actively make it to some of them possible to operate above the zero-border. Thus, to the burden of other participants.

burden of other participants.  The Market

The prospect of the foreign exchange market has changed increasingly in recent years. It is no longer considered as a minor product of

The Market

The prospect of the foreign exchange market has changed increasingly in recent years. It is no longer considered as a minor product of international trading- and capital markets, it is now also respected as a form of investment. Funds- and Hedge Fund Manager, whose strategies

international trading- and capital markets, it is now also respected as a form of investment. Funds- and Hedge Fund Manager, whose strategies often don't meet the expectations because of low volatility in the equity markets, decided to create foreign exchange strategies and startet to

often don't meet the expectations because of low volatility in the equity markets, decided to create foreign exchange strategies and startet to build their own currency funds. Funds are going increasingly more sophisticated in the use of currency vehicles in order to increase their gains.

build their own currency funds. Funds are going increasingly more sophisticated in the use of currency vehicles in order to increase their gains. At least it will be tempted so, because the predictability is nearly impossible, because there are myriad of paramers which couldn't be sufficient

At least it will be tempted so, because the predictability is nearly impossible, because there are myriad of paramers which couldn't be sufficient calculated, e.g. human logic.

The Participants

calculated, e.g. human logic.

The Participants A look into the publications of the funds shows it: there is no doubt about that the number of Funds investing into

A look into the publications of the funds shows it: there is no doubt about that the number of Funds investing into currencies is having more and more popularity. On the contrary most Asset Managers, Treasurer and Cash

currencies is having more and more popularity. On the contrary most Asset Managers, Treasurer and Cash Manager deal with currencies for a transactional background, i.e. underlying. That means, behind a trade is in

Manager deal with currencies for a transactional background, i.e. underlying. That means, behind a trade is in most cases a "real" transaction with goods or fixed assets, e.g. shares. So far no pure aim for profit, just rather a

most cases a "real" transaction with goods or fixed assets, e.g. shares. So far no pure aim for profit, just rather a hedge or a simple change from one currency to another currency, because it is needed physically today or in the

hedge or a simple change from one currency to another currency, because it is needed physically today or in the future. The behaviour for improvement is reduced to the negotiation of better prices regarding the change.

future. The behaviour for improvement is reduced to the negotiation of better prices regarding the change. Smaller customers do it by phone, middle customers by their Treasury Management System and larger customers

Smaller customers do it by phone, middle customers by their Treasury Management System and larger customers with special broker-software which is online with multiple banks. The best bank-offer gets the deal.

with special broker-software which is online with multiple banks. The best bank-offer gets the deal. The decission of the Bank resp. the Institutional Market Participant

It can be discussed about the benefits of such software. On the one side it is just simply easy to calculate the profit threshold for the market

The decission of the Bank resp. the Institutional Market Participant

It can be discussed about the benefits of such software. On the one side it is just simply easy to calculate the profit threshold for the market participant, i.e. the customer. On the other hand there is the question about the timing. Should the order now at 11:00:00, at 11:00:10 or at

participant, i.e. the customer. On the other hand there is the question about the timing. Should the order now at 11:00:00, at 11:00:10 or at 11:01:00 executed and where is then the rate? This coincidence factor cannot be calculated and the band within a minute in the foreign

11:01:00 executed and where is then the rate? This coincidence factor cannot be calculated and the band within a minute in the foreign exchange market can be huge, relatively seen to the tough negotiations for one or two pips only.

exchange market can be huge, relatively seen to the tough negotiations for one or two pips only. The Winner and the Loser

About one thing all market participants agree: currency risk is always present, as long

The Winner and the Loser

About one thing all market participants agree: currency risk is always present, as long as it is not naturally hedged (e.g. assets vs. capital, revenues vs. expenses in the same

as it is not naturally hedged (e.g. assets vs. capital, revenues vs. expenses in the same currency at the same time). This risk must be recognized and managed. Banks offer to

currency at the same time). This risk must be recognized and managed. Banks offer to especially institutional customers, thereof mainly from the volumes perspective the

especially institutional customers, thereof mainly from the volumes perspective the funds with their enormous resources, tailored resp. structured products in order to have

funds with their enormous resources, tailored resp. structured products in order to have the currency exposure under control at lowest possible costs. But the principle of a zero-

the currency exposure under control at lowest possible costs. But the principle of a zero- sum game is still present. The questions arise, who are the losers in that global trading

sum game is still present. The questions arise, who are the losers in that global trading system. At the end of the day all of us in the one or other form. May it be by direct

system. At the end of the day all of us in the one or other form. May it be by direct losses, non-taken gains, higher margins on the products which we trade or consume

losses, non-taken gains, higher margins on the products which we trade or consume daily. Therefore the global circle is going to be closed. Nevertheless, every market

daily. Therefore the global circle is going to be closed. Nevertheless, every market participant is trying for his own benefit to get his best possible optimum. This leads to

participant is trying for his own benefit to get his best possible optimum. This leads to the question where this optimum can be fixed and how high the tolerance for losses is for each single participant?

the question where this optimum can be fixed and how high the tolerance for losses is for each single participant? Pension Funds which do not manage their currency exposure proactive and therefore don't hedge, expose themselves clear and take into

Pension Funds which do not manage their currency exposure proactive and therefore don't hedge, expose themselves clear and take into account the gains and losses occurred by exchange rate. Hence, it exists on the one hand a financing matter and on the other hand a portfolio

account the gains and losses occurred by exchange rate. Hence, it exists on the one hand a financing matter and on the other hand a portfolio efficiency question. If Enterprises and Pension Funds take this risk just into account it can be derived the assumption that those risks are

efficiency question. If Enterprises and Pension Funds take this risk just into account it can be derived the assumption that those risks are managed separately in another asset class in order to get back in the "save" profit zone. Most of the Companies and Funds drive on a strategy

managed separately in another asset class in order to get back in the "save" profit zone. Most of the Companies and Funds drive on a strategy in the middle. That means, hedge currency exposure partially and additionally the volatility from price differences occurred by currency

in the middle. That means, hedge currency exposure partially and additionally the volatility from price differences occurred by currency exchange effects.

exchange effects. With the attempt to save the earnings and to expand them, pension funds continuously increase the part of shares denominated in foreign

With the attempt to save the earnings and to expand them, pension funds continuously increase the part of shares denominated in foreign currencies. Doing this, they increase their currency exposure. That in combination with the active management of investment vehicle is the

currencies. Doing this, they increase their currency exposure. That in combination with the active management of investment vehicle is the main reason for the expandation of the professional category of the Cash Manager. In former times those tasks have been managed

main reason for the expandation of the professional category of the Cash Manager. In former times those tasks have been managed outsourced to specialized companies, but in line with the always more upcoming internationalization the currency exchange risk is also

outsourced to specialized companies, but in line with the always more upcoming internationalization the currency exchange risk is also increasing. Unification of currencies, like the Euro, are the absolute exception to reduce that risk.

increasing. Unification of currencies, like the Euro, are the absolute exception to reduce that risk. Get the Optimum, regardless what the intention of the Market Participant is

It must be distinguished between

Get the Optimum, regardless what the intention of the Market Participant is

It must be distinguished between 1. Trading, Production and Service Enterprises (the companies) and

1. Trading, Production and Service Enterprises (the companies) and 2. Institutional Investors.

2. Institutional Investors. The first group attempt, as already mentioned above, minimizing their risk while the second group try to

The first group attempt, as already mentioned above, minimizing their risk while the second group try to generate gains with those risks. But both have one and the same consensus: get the optimum out

generate gains with those risks. But both have one and the same consensus: get the optimum out of the currency market.

Currency Overlay

In a strategic and tactical investment process, FX can be a separate asset class and currency exposure can reduce expected portfolio risk.

of the currency market.

Currency Overlay

In a strategic and tactical investment process, FX can be a separate asset class and currency exposure can reduce expected portfolio risk. Active currency overlay positions are in general uncorrelated with bond and equity positions. A successful active FX management increases the

Active currency overlay positions are in general uncorrelated with bond and equity positions. A successful active FX management increases the portfolio return and should be viewed as a natural part in a fund's alpha process.

portfolio return and should be viewed as a natural part in a fund's alpha process. Our Partner, Mercury Control AG, Switzerland, applies a strictly disciplined style rotation strategy, based on continuous macro, political and flow

analysis across the G7 currencies and are combined with technical forecasting tools. The trading style itself is selected from the following

Our Partner, Mercury Control AG, Switzerland, applies a strictly disciplined style rotation strategy, based on continuous macro, political and flow

analysis across the G7 currencies and are combined with technical forecasting tools. The trading style itself is selected from the following options, accordingly:

•

Momentum

options, accordingly:

•

Momentum •

Range

•

Range •

Volatility

Momentung Trading

•

Volatility

Momentung Trading Momentum Trading acts as the overarching style, inasmuch as it determines trade execution according to a principal outlook for mid- to long-

Momentum Trading acts as the overarching style, inasmuch as it determines trade execution according to a principal outlook for mid- to long- term movements governing the FX market. Its role is also to set the stage for Range Trading - the most commonly applied FX trading style - by

term movements governing the FX market. Its role is also to set the stage for Range Trading - the most commonly applied FX trading style - by identifying the maximum and minimum range lines to execute trades, according to risk-return principles.

identifying the maximum and minimum range lines to execute trades, according to risk-return principles. Range Trading

Range Trading Range Trading, on the other hand, analyzes the underlying channeling patterns (range) resulting from currently prevailing "paid price"

Range Trading, on the other hand, analyzes the underlying channeling patterns (range) resulting from currently prevailing "paid price" scenarios. The clear goal is to trade as long as possible within such a range in order to maximize the value-adding potential of this style .

scenarios. The clear goal is to trade as long as possible within such a range in order to maximize the value-adding potential of this style . Volatility (Vega) Trading

Volatility (Vega) Trading A final rotation to Volatility Trading occurs when a previously applied range "breaks out" to either side and no clear continuation is immediately

A final rotation to Volatility Trading occurs when a previously applied range "breaks out" to either side and no clear continuation is immediately detectable. As a result, options are written on the existing short (sold) or long (bought) positions. However, once all Volatility Trading

detectable. As a result, options are written on the existing short (sold) or long (bought) positions. However, once all Volatility Trading possibilities are exhausted there is a logical movement back to Momentum or Range Trading.

possibilities are exhausted there is a logical movement back to Momentum or Range Trading. The risk or hedge ratio between 0% and 100% and the base currency specified by the client defines the proportional amount of the mandate's

The risk or hedge ratio between 0% and 100% and the base currency specified by the client defines the proportional amount of the mandate's absolute currency exposure. This means, either an active or a passive managed mandate.

Active currency management enables the client to reduce risk and add return to an international portfolio whereas the passive

approach negates the foreign exchange risk and reduces the diversification benefits from international investments

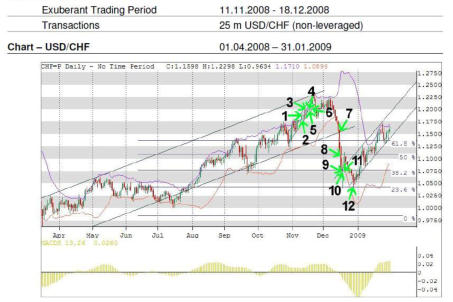

Case Study

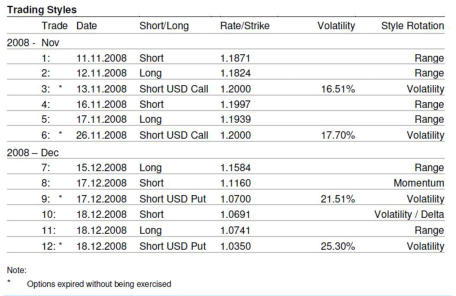

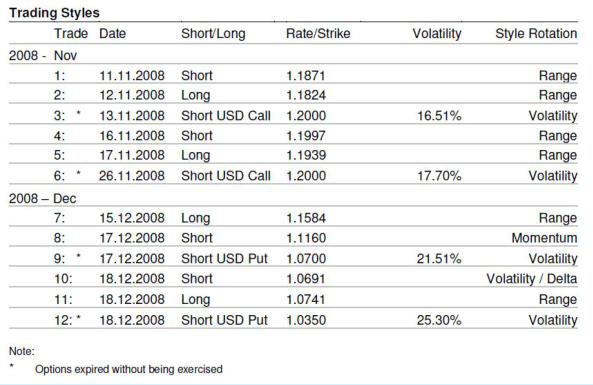

The following is a case study for a customer:

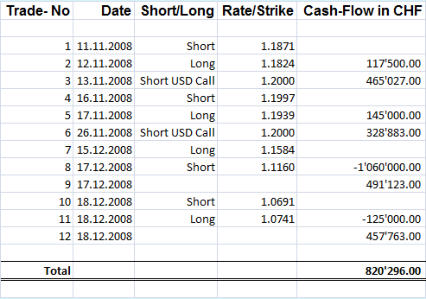

Related Cash Flows to above mentioned trades:

In other words, a Treasurer with functional currency CHF and need of reducing FX-exposure for $ 7.2m is now able to compensate his loss of

absolute currency exposure. This means, either an active or a passive managed mandate.

Active currency management enables the client to reduce risk and add return to an international portfolio whereas the passive

approach negates the foreign exchange risk and reduces the diversification benefits from international investments

Case Study

The following is a case study for a customer:

Related Cash Flows to above mentioned trades:

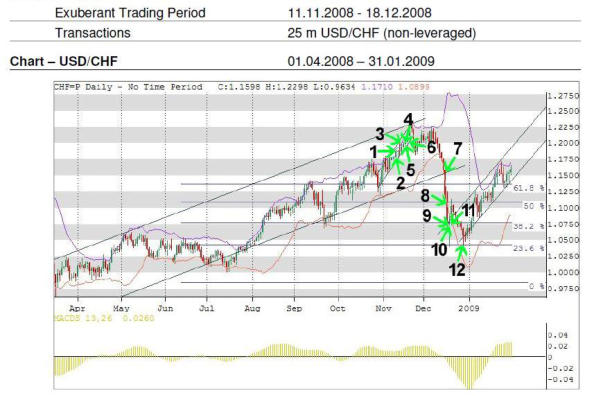

In other words, a Treasurer with functional currency CHF and need of reducing FX-exposure for $ 7.2m is now able to compensate his loss of long USD 7.2m x (1.0741-1.1871)= - CHF 813’600 with the gain of the overlay transactions whereas a Treasurer or Fund-Manager with need

long USD 7.2m x (1.0741-1.1871)= - CHF 813’600 with the gain of the overlay transactions whereas a Treasurer or Fund-Manager with need of opimizing his $ 25m investment achieved an annualized gross-profit of 28,2%.

of opimizing his $ 25m investment achieved an annualized gross-profit of 28,2%. Hint: in case of using Currency Overlay for hedging purpose, we recommend according best practice risk management to apply a value at risk

Hint: in case of using Currency Overlay for hedging purpose, we recommend according best practice risk management to apply a value at risk  approach in order to adjust the overlay portfolio to the current underlying and complete it with an absolute loss amount.

approach in order to adjust the overlay portfolio to the current underlying and complete it with an absolute loss amount. Do you like to know more about Currency Overlay? Don’t hesitate and contact us.

Do you like to know more about Currency Overlay? Don’t hesitate and contact us.

market manage their foreign currency positions actively make it to some of them possible to operate above the zero-border. Thus, to the

market manage their foreign currency positions actively make it to some of them possible to operate above the zero-border. Thus, to the burden of other participants.

burden of other participants.  The Market

The prospect of the foreign exchange market has changed increasingly in recent years. It is no longer considered as a minor product of

The Market

The prospect of the foreign exchange market has changed increasingly in recent years. It is no longer considered as a minor product of international trading- and capital markets, it is now also respected as a form of investment. Funds- and Hedge Fund Manager, whose strategies

international trading- and capital markets, it is now also respected as a form of investment. Funds- and Hedge Fund Manager, whose strategies often don't meet the expectations because of low volatility in the equity markets, decided to create foreign exchange strategies and startet to

often don't meet the expectations because of low volatility in the equity markets, decided to create foreign exchange strategies and startet to build their own currency funds. Funds are going increasingly more sophisticated in the use of currency vehicles in order to increase their gains.

build their own currency funds. Funds are going increasingly more sophisticated in the use of currency vehicles in order to increase their gains. At least it will be tempted so, because the predictability is nearly impossible, because there are myriad of paramers which couldn't be sufficient

At least it will be tempted so, because the predictability is nearly impossible, because there are myriad of paramers which couldn't be sufficient calculated, e.g. human logic.

The Participants

calculated, e.g. human logic.

The Participants A look into the publications of the funds shows it: there is no doubt about that the number of Funds investing into

A look into the publications of the funds shows it: there is no doubt about that the number of Funds investing into currencies is having more and more popularity. On the contrary most Asset Managers, Treasurer and Cash

currencies is having more and more popularity. On the contrary most Asset Managers, Treasurer and Cash Manager deal with currencies for a transactional background, i.e. underlying. That means, behind a trade is in

Manager deal with currencies for a transactional background, i.e. underlying. That means, behind a trade is in most cases a "real" transaction with goods or fixed assets, e.g. shares. So far no pure aim for profit, just rather a

most cases a "real" transaction with goods or fixed assets, e.g. shares. So far no pure aim for profit, just rather a hedge or a simple change from one currency to another currency, because it is needed physically today or in the

hedge or a simple change from one currency to another currency, because it is needed physically today or in the future. The behaviour for improvement is reduced to the negotiation of better prices regarding the change.

future. The behaviour for improvement is reduced to the negotiation of better prices regarding the change. Smaller customers do it by phone, middle customers by their Treasury Management System and larger customers

Smaller customers do it by phone, middle customers by their Treasury Management System and larger customers with special broker-software which is online with multiple banks. The best bank-offer gets the deal.

with special broker-software which is online with multiple banks. The best bank-offer gets the deal. The decission of the Bank resp. the Institutional Market Participant

It can be discussed about the benefits of such software. On the one side it is just simply easy to calculate the profit threshold for the market

The decission of the Bank resp. the Institutional Market Participant

It can be discussed about the benefits of such software. On the one side it is just simply easy to calculate the profit threshold for the market participant, i.e. the customer. On the other hand there is the question about the timing. Should the order now at 11:00:00, at 11:00:10 or at

participant, i.e. the customer. On the other hand there is the question about the timing. Should the order now at 11:00:00, at 11:00:10 or at 11:01:00 executed and where is then the rate? This coincidence factor cannot be calculated and the band within a minute in the foreign

11:01:00 executed and where is then the rate? This coincidence factor cannot be calculated and the band within a minute in the foreign exchange market can be huge, relatively seen to the tough negotiations for one or two pips only.

exchange market can be huge, relatively seen to the tough negotiations for one or two pips only. The Winner and the Loser

About one thing all market participants agree: currency risk is always present, as long

The Winner and the Loser

About one thing all market participants agree: currency risk is always present, as long as it is not naturally hedged (e.g. assets vs. capital, revenues vs. expenses in the same

as it is not naturally hedged (e.g. assets vs. capital, revenues vs. expenses in the same currency at the same time). This risk must be recognized and managed. Banks offer to

currency at the same time). This risk must be recognized and managed. Banks offer to especially institutional customers, thereof mainly from the volumes perspective the

especially institutional customers, thereof mainly from the volumes perspective the funds with their enormous resources, tailored resp. structured products in order to have

funds with their enormous resources, tailored resp. structured products in order to have the currency exposure under control at lowest possible costs. But the principle of a zero-

the currency exposure under control at lowest possible costs. But the principle of a zero- sum game is still present. The questions arise, who are the losers in that global trading

sum game is still present. The questions arise, who are the losers in that global trading system. At the end of the day all of us in the one or other form. May it be by direct

system. At the end of the day all of us in the one or other form. May it be by direct losses, non-taken gains, higher margins on the products which we trade or consume

losses, non-taken gains, higher margins on the products which we trade or consume daily. Therefore the global circle is going to be closed. Nevertheless, every market

daily. Therefore the global circle is going to be closed. Nevertheless, every market participant is trying for his own benefit to get his best possible optimum. This leads to

participant is trying for his own benefit to get his best possible optimum. This leads to the question where this optimum can be fixed and how high the tolerance for losses is for each single participant?

the question where this optimum can be fixed and how high the tolerance for losses is for each single participant? Pension Funds which do not manage their currency exposure proactive and therefore don't hedge, expose themselves clear and take into

Pension Funds which do not manage their currency exposure proactive and therefore don't hedge, expose themselves clear and take into account the gains and losses occurred by exchange rate. Hence, it exists on the one hand a financing matter and on the other hand a portfolio

account the gains and losses occurred by exchange rate. Hence, it exists on the one hand a financing matter and on the other hand a portfolio efficiency question. If Enterprises and Pension Funds take this risk just into account it can be derived the assumption that those risks are

efficiency question. If Enterprises and Pension Funds take this risk just into account it can be derived the assumption that those risks are managed separately in another asset class in order to get back in the "save" profit zone. Most of the Companies and Funds drive on a strategy

managed separately in another asset class in order to get back in the "save" profit zone. Most of the Companies and Funds drive on a strategy in the middle. That means, hedge currency exposure partially and additionally the volatility from price differences occurred by currency

in the middle. That means, hedge currency exposure partially and additionally the volatility from price differences occurred by currency exchange effects.

exchange effects. With the attempt to save the earnings and to expand them, pension funds continuously increase the part of shares denominated in foreign

With the attempt to save the earnings and to expand them, pension funds continuously increase the part of shares denominated in foreign currencies. Doing this, they increase their currency exposure. That in combination with the active management of investment vehicle is the

currencies. Doing this, they increase their currency exposure. That in combination with the active management of investment vehicle is the main reason for the expandation of the professional category of the Cash Manager. In former times those tasks have been managed

main reason for the expandation of the professional category of the Cash Manager. In former times those tasks have been managed outsourced to specialized companies, but in line with the always more upcoming internationalization the currency exchange risk is also

outsourced to specialized companies, but in line with the always more upcoming internationalization the currency exchange risk is also increasing. Unification of currencies, like the Euro, are the absolute exception to reduce that risk.

increasing. Unification of currencies, like the Euro, are the absolute exception to reduce that risk. Get the Optimum, regardless what the intention of the Market Participant is

It must be distinguished between

Get the Optimum, regardless what the intention of the Market Participant is

It must be distinguished between 1. Trading, Production and Service Enterprises (the companies) and

1. Trading, Production and Service Enterprises (the companies) and 2. Institutional Investors.

2. Institutional Investors. The first group attempt, as already mentioned above, minimizing their risk while the second group try to

The first group attempt, as already mentioned above, minimizing their risk while the second group try to generate gains with those risks. But both have one and the same consensus: get the optimum out

generate gains with those risks. But both have one and the same consensus: get the optimum out of the currency market.

Currency Overlay

In a strategic and tactical investment process, FX can be a separate asset class and currency exposure can reduce expected portfolio risk.

of the currency market.

Currency Overlay

In a strategic and tactical investment process, FX can be a separate asset class and currency exposure can reduce expected portfolio risk. Active currency overlay positions are in general uncorrelated with bond and equity positions. A successful active FX management increases the

Active currency overlay positions are in general uncorrelated with bond and equity positions. A successful active FX management increases the portfolio return and should be viewed as a natural part in a fund's alpha process.

portfolio return and should be viewed as a natural part in a fund's alpha process. Our Partner, Mercury Control AG, Switzerland, applies a strictly disciplined style rotation strategy, based on continuous macro, political and flow

analysis across the G7 currencies and are combined with technical forecasting tools. The trading style itself is selected from the following

Our Partner, Mercury Control AG, Switzerland, applies a strictly disciplined style rotation strategy, based on continuous macro, political and flow

analysis across the G7 currencies and are combined with technical forecasting tools. The trading style itself is selected from the following options, accordingly:

•

Momentum

options, accordingly:

•

Momentum •

Range

•

Range •

Volatility

Momentung Trading

•

Volatility

Momentung Trading Momentum Trading acts as the overarching style, inasmuch as it determines trade execution according to a principal outlook for mid- to long-

Momentum Trading acts as the overarching style, inasmuch as it determines trade execution according to a principal outlook for mid- to long- term movements governing the FX market. Its role is also to set the stage for Range Trading - the most commonly applied FX trading style - by

term movements governing the FX market. Its role is also to set the stage for Range Trading - the most commonly applied FX trading style - by identifying the maximum and minimum range lines to execute trades, according to risk-return principles.

identifying the maximum and minimum range lines to execute trades, according to risk-return principles. Range Trading

Range Trading Range Trading, on the other hand, analyzes the underlying channeling patterns (range) resulting from currently prevailing "paid price"

Range Trading, on the other hand, analyzes the underlying channeling patterns (range) resulting from currently prevailing "paid price" scenarios. The clear goal is to trade as long as possible within such a range in order to maximize the value-adding potential of this style .

scenarios. The clear goal is to trade as long as possible within such a range in order to maximize the value-adding potential of this style . Volatility (Vega) Trading

Volatility (Vega) Trading A final rotation to Volatility Trading occurs when a previously applied range "breaks out" to either side and no clear continuation is immediately

A final rotation to Volatility Trading occurs when a previously applied range "breaks out" to either side and no clear continuation is immediately detectable. As a result, options are written on the existing short (sold) or long (bought) positions. However, once all Volatility Trading

detectable. As a result, options are written on the existing short (sold) or long (bought) positions. However, once all Volatility Trading possibilities are exhausted there is a logical movement back to Momentum or Range Trading.

possibilities are exhausted there is a logical movement back to Momentum or Range Trading. The risk or hedge ratio between 0% and 100% and the base currency specified by the client defines the proportional amount of the mandate's

The risk or hedge ratio between 0% and 100% and the base currency specified by the client defines the proportional amount of the mandate's absolute currency exposure. This means, either an active or a passive managed mandate.

Active currency management enables the client to reduce risk and add return to an international portfolio whereas the passive

approach negates the foreign exchange risk and reduces the diversification benefits from international investments

Case Study

The following is a case study for a customer:

Related Cash Flows to above mentioned trades:

In other words, a Treasurer with functional currency CHF and need of reducing FX-exposure for $ 7.2m is now able to compensate his loss of

absolute currency exposure. This means, either an active or a passive managed mandate.

Active currency management enables the client to reduce risk and add return to an international portfolio whereas the passive

approach negates the foreign exchange risk and reduces the diversification benefits from international investments

Case Study

The following is a case study for a customer:

Related Cash Flows to above mentioned trades:

In other words, a Treasurer with functional currency CHF and need of reducing FX-exposure for $ 7.2m is now able to compensate his loss of long USD 7.2m x (1.0741-1.1871)= - CHF 813’600 with the gain of the overlay transactions whereas a Treasurer or Fund-Manager with need

long USD 7.2m x (1.0741-1.1871)= - CHF 813’600 with the gain of the overlay transactions whereas a Treasurer or Fund-Manager with need of opimizing his $ 25m investment achieved an annualized gross-profit of 28,2%.

of opimizing his $ 25m investment achieved an annualized gross-profit of 28,2%. Hint: in case of using Currency Overlay for hedging purpose, we recommend according best practice risk management to apply a value at risk

Hint: in case of using Currency Overlay for hedging purpose, we recommend according best practice risk management to apply a value at risk  approach in order to adjust the overlay portfolio to the current underlying and complete it with an absolute loss amount.

approach in order to adjust the overlay portfolio to the current underlying and complete it with an absolute loss amount. Do you like to know more about Currency Overlay? Don’t hesitate and contact us.

Do you like to know more about Currency Overlay? Don’t hesitate and contact us.

Currency Overlay

How think and act Big-Players when hedging their

Share-, Currency-, Commodity- and Interest Risk?

In general, the exchange of amounts in different currencies is a zero-

sum game. The reason that some participants of the foreign exchange market manage their foreign currency positions actively

exchange market manage their foreign currency positions actively make it to some of them possible to operate above the zero-border.

make it to some of them possible to operate above the zero-border. Thus, to the burden of other participants.

The Market

The prospect of the foreign exchange market has changed

Thus, to the burden of other participants.

The Market

The prospect of the foreign exchange market has changed increasingly in recent years. It is no longer considered as a minor

increasingly in recent years. It is no longer considered as a minor product of international trading- and capital markets, it is now also

product of international trading- and capital markets, it is now also respected as a form of investment. Funds- and Hedge Fund

respected as a form of investment. Funds- and Hedge Fund Manager, whose strategies often don't meet the expectations

Manager, whose strategies often don't meet the expectations because of low volatility in the equity markets, decided to create

because of low volatility in the equity markets, decided to create foreign exchange strategies and startet to build their own currency

foreign exchange strategies and startet to build their own currency funds. Funds are going increasingly more sophisticated in the use of

funds. Funds are going increasingly more sophisticated in the use of currency vehicles in order to increase their gains. At least it will be

currency vehicles in order to increase their gains. At least it will be tempted so, because the predictability is nearly impossible, because

tempted so, because the predictability is nearly impossible, because there are myriad of paramers which couldn't be sufficient calculated,

there are myriad of paramers which couldn't be sufficient calculated, e.g. human logic.

The Participants

A look into the publications of the

e.g. human logic.

The Participants

A look into the publications of the funds shows it: there is no doubt

funds shows it: there is no doubt about that the number of Funds

about that the number of Funds investing into currencies is having

investing into currencies is having more and more popularity. On the

more and more popularity. On the contrary most Asset Managers,

contrary most Asset Managers, Treasurer and Cash Manager deal

Treasurer and Cash Manager deal with currencies for a transactional

with currencies for a transactional background, i.e. underlying. That

background, i.e. underlying. That means, behind a trade is in most

means, behind a trade is in most cases a "real" transaction with goods or fixed assets, e.g. shares. So

cases a "real" transaction with goods or fixed assets, e.g. shares. So far no pure aim for profit, just rather a hedge or a simple change

far no pure aim for profit, just rather a hedge or a simple change from one currency to another currency, because it is needed

from one currency to another currency, because it is needed physically today or in the future. The behaviour for improvement is

physically today or in the future. The behaviour for improvement is reduced to the negotiation of better prices regarding the change.

reduced to the negotiation of better prices regarding the change. Smaller customers do it by phone, middle customers by their

Smaller customers do it by phone, middle customers by their Treasury Management System and larger customers with special

Treasury Management System and larger customers with special broker-software which is online with multiple banks. The best bank-

broker-software which is online with multiple banks. The best bank- offer gets the deal.

The decission of the Bank resp. the Institutional Market

offer gets the deal.

The decission of the Bank resp. the Institutional Market Participant

Participant It can be discussed about the benefits of such software. On the one

It can be discussed about the benefits of such software. On the one side it is just simply easy to calculate the profit threshold for the

side it is just simply easy to calculate the profit threshold for the market participant, i.e. the customer. On the other hand there is the

market participant, i.e. the customer. On the other hand there is the question about the timing. Should the order now at 11:00:00, at

question about the timing. Should the order now at 11:00:00, at 11:00:10 or at 11:01:00 executed and where is then the rate? This

11:00:10 or at 11:01:00 executed and where is then the rate? This coincidence factor cannot be calculated and the band within a

coincidence factor cannot be calculated and the band within a minute in the foreign exchange market can be huge, relatively seen

minute in the foreign exchange market can be huge, relatively seen to the tough negotiations for one or two pips only.

The Winner and the Loser

About one thing all market participants agree: currency risk is always

present, as long as it is not naturally hedged (e.g. assets vs. capital,

to the tough negotiations for one or two pips only.

The Winner and the Loser

About one thing all market participants agree: currency risk is always

present, as long as it is not naturally hedged (e.g. assets vs. capital, revenues vs. expenses in the same currency at the same time). This

revenues vs. expenses in the same currency at the same time). This risk must be recognized and managed. Banks offer to especially

risk must be recognized and managed. Banks offer to especially institutional customers, thereof mainly from the volumes perspective

institutional customers, thereof mainly from the volumes perspective the funds with their enormous resources, tailored resp. structured

the funds with their enormous resources, tailored resp. structured products in order to have the currency exposure under control at

products in order to have the currency exposure under control at lowest possible costs. But the principle of a zero-sum game is still

lowest possible costs. But the principle of a zero-sum game is still present. The questions arise, who are the losers in that global

present. The questions arise, who are the losers in that global trading system. At the end of the day all of us in the one or other

trading system. At the end of the day all of us in the one or other form. May it be by direct losses, non-taken gains, higher margins on

form. May it be by direct losses, non-taken gains, higher margins on the products which we trade or consume daily. Therefore the global

the products which we trade or consume daily. Therefore the global circle is going to be closed. Nevertheless, every market participant is

circle is going to be closed. Nevertheless, every market participant is trying for his own benefit to get his best possible optimum. This

trying for his own benefit to get his best possible optimum. This leads to the question where this optimum can be fixed and how high

leads to the question where this optimum can be fixed and how high the tolerance for losses is for each single participant?

Pension Funds which do not manage their currency exposure

the tolerance for losses is for each single participant?

Pension Funds which do not manage their currency exposure proactive and therefore don't hedge, expose themselves clear and

proactive and therefore don't hedge, expose themselves clear and take into account the gains and losses occurred by exchange rate.

take into account the gains and losses occurred by exchange rate. Hence, it exists on the one hand a financing matter and on the other

Hence, it exists on the one hand a financing matter and on the other hand a portfolio efficiency question. If Enterprises and Pension

hand a portfolio efficiency question. If Enterprises and Pension Funds take this risk just into account it can be derived the

Funds take this risk just into account it can be derived the assumption that those risks are managed separately in another

assumption that those risks are managed separately in another asset class in order to get back in the "save" profit zone. Most of the

asset class in order to get back in the "save" profit zone. Most of the Companies and Funds drive on a strategy in the middle. That

Companies and Funds drive on a strategy in the middle. That means, hedge currency exposure partially and additionally the

means, hedge currency exposure partially and additionally the volatility from price differences occurred by currency exchange

volatility from price differences occurred by currency exchange effects.

With the attempt to save the earnings and to expand them, pension

effects.

With the attempt to save the earnings and to expand them, pension funds continuously increase the part of shares denominated in

funds continuously increase the part of shares denominated in foreign currencies. Doing this, they increase their currency

foreign currencies. Doing this, they increase their currency exposure. That in combination with the active management of

exposure. That in combination with the active management of investment vehicle is the main reason for the expandation of the

investment vehicle is the main reason for the expandation of the professional category of the Cash Manager. In former times those

professional category of the Cash Manager. In former times those tasks have been managed outsourced to specialized companies, but

tasks have been managed outsourced to specialized companies, but in line with the always more upcoming internationalization the

in line with the always more upcoming internationalization the currency exchange risk is also increasing. Unification of currencies,

currency exchange risk is also increasing. Unification of currencies, like the Euro, are the absolute exception to reduce that risk.

Get the Optimum, regardless what the intention of the

like the Euro, are the absolute exception to reduce that risk.

Get the Optimum, regardless what the intention of the Market Participant is

Market Participant is It must be distinguished

It must be distinguished between

1. Trading, Production and

between

1. Trading, Production and Service Enterprises (the

Service Enterprises (the companies) and

2. Institutional Investors.

companies) and

2. Institutional Investors. The first group attempt, as already mentioned above, minimizing

The first group attempt, as already mentioned above, minimizing their risk while the second group try to generate gains with those

their risk while the second group try to generate gains with those risks. But both have one and the same consensus: get the

risks. But both have one and the same consensus: get the optimum out of the currency market.

optimum out of the currency market. Currency Overlay

In a strategic and tactical investment process, FX can be a separate

Currency Overlay

In a strategic and tactical investment process, FX can be a separate asset class and currency exposure can reduce expected portfolio

asset class and currency exposure can reduce expected portfolio risk. Active currency overlay positions are in general uncorrelated

risk. Active currency overlay positions are in general uncorrelated with bond and equity positions. A successful active FX management

with bond and equity positions. A successful active FX management increases the portfolio return and should be viewed as a natural part

increases the portfolio return and should be viewed as a natural part in a fund's alpha process.

Our Partner, Mercury Control AG, Switzerland, applies a strictly

in a fund's alpha process.

Our Partner, Mercury Control AG, Switzerland, applies a strictly disciplined style rotation strategy, based on continuous macro,

disciplined style rotation strategy, based on continuous macro, political and flow analysis across the G7 currencies and are

political and flow analysis across the G7 currencies and are combined with technical forecasting tools. The trading style itself is

combined with technical forecasting tools. The trading style itself is selected from the following options, accordingly:

•

Momentum

selected from the following options, accordingly:

•

Momentum •

Range

•

Volatility

Momentung Trading

•

Range

•

Volatility

Momentung Trading Momentum Trading acts as the overarching style, inasmuch as it

Momentum Trading acts as the overarching style, inasmuch as it determines trade execution according to a principal outlook for mid-

determines trade execution according to a principal outlook for mid- to long-term movements governing the FX market. Its role is also to

to long-term movements governing the FX market. Its role is also to set the stage for Range Trading - the most commonly applied FX

set the stage for Range Trading - the most commonly applied FX trading style - by identifying the maximum and minimum range lines

trading style - by identifying the maximum and minimum range lines to execute trades, according to risk-return principles.

Range Trading

to execute trades, according to risk-return principles.

Range Trading Range Trading, on the other hand, analyzes the underlying

Range Trading, on the other hand, analyzes the underlying channeling patterns (range) resulting from currently prevailing "paid

channeling patterns (range) resulting from currently prevailing "paid price" scenarios. The clear goal is to trade as long as possible within

price" scenarios. The clear goal is to trade as long as possible within such a range in order to maximize the value-adding potential of this

such a range in order to maximize the value-adding potential of this style .

Volatility (Vega) Trading

style .

Volatility (Vega) Trading A final rotation to Volatility Trading occurs when a previously applied

A final rotation to Volatility Trading occurs when a previously applied range "breaks out" to either side and no clear continuation is

range "breaks out" to either side and no clear continuation is immediately detectable. As a result, options are written on the

immediately detectable. As a result, options are written on the existing short (sold) or long (bought) positions. However, once all

existing short (sold) or long (bought) positions. However, once all Volatility Trading possibilities are exhausted there is a logical

Volatility Trading possibilities are exhausted there is a logical movement back to Momentum or Range Trading.

The risk or hedge ratio between 0% and 100% and the base

movement back to Momentum or Range Trading.

The risk or hedge ratio between 0% and 100% and the base currency specified by the client defines the proportional amount of

currency specified by the client defines the proportional amount of the mandate's absolute currency exposure. This means, either an

the mandate's absolute currency exposure. This means, either an active or a passive managed mandate.

Active currency management enables the client to reduce

risk and add return to an international portfolio whereas the

passive approach negates the foreign exchange risk and

reduces the diversification benefits from international

investments

Case Study

The following is a case study for a customer:

Related Cash Flows to above mentioned trades:

In other words, a Treasurer with functional currency CHF and need

active or a passive managed mandate.

Active currency management enables the client to reduce

risk and add return to an international portfolio whereas the

passive approach negates the foreign exchange risk and

reduces the diversification benefits from international

investments

Case Study

The following is a case study for a customer:

Related Cash Flows to above mentioned trades:

In other words, a Treasurer with functional currency CHF and need of reducing FX-exposure for $ 7.2m is now able to compensate his

of reducing FX-exposure for $ 7.2m is now able to compensate his loss of long USD 7.2m x (1.0741-1.1871)= - CHF 813’600 with the

loss of long USD 7.2m x (1.0741-1.1871)= - CHF 813’600 with the gain of the overlay transactions whereas a Treasurer or Fund-

gain of the overlay transactions whereas a Treasurer or Fund- Manager with need of opimizing his $ 25m investment achieved an

Manager with need of opimizing his $ 25m investment achieved an annualized gross-profit of 28,2%.

Hint: in case of using Currency Overlay for hedging purpose, we

annualized gross-profit of 28,2%.

Hint: in case of using Currency Overlay for hedging purpose, we recommend according best practice risk management to apply a

recommend according best practice risk management to apply a value at risk approach in order to adjust the overlay portfolio to the

value at risk approach in order to adjust the overlay portfolio to the current underlying and complete it with an absolute loss amount.

Do you like to know more about Currency Overlay?

Don’t hesitate and contact us.

current underlying and complete it with an absolute loss amount.

Do you like to know more about Currency Overlay?

Don’t hesitate and contact us.

exchange market manage their foreign currency positions actively

exchange market manage their foreign currency positions actively make it to some of them possible to operate above the zero-border.

make it to some of them possible to operate above the zero-border. Thus, to the burden of other participants.

The Market

The prospect of the foreign exchange market has changed

Thus, to the burden of other participants.

The Market

The prospect of the foreign exchange market has changed increasingly in recent years. It is no longer considered as a minor

increasingly in recent years. It is no longer considered as a minor product of international trading- and capital markets, it is now also

product of international trading- and capital markets, it is now also respected as a form of investment. Funds- and Hedge Fund

respected as a form of investment. Funds- and Hedge Fund Manager, whose strategies often don't meet the expectations

Manager, whose strategies often don't meet the expectations because of low volatility in the equity markets, decided to create

because of low volatility in the equity markets, decided to create foreign exchange strategies and startet to build their own currency

foreign exchange strategies and startet to build their own currency funds. Funds are going increasingly more sophisticated in the use of

funds. Funds are going increasingly more sophisticated in the use of currency vehicles in order to increase their gains. At least it will be

currency vehicles in order to increase their gains. At least it will be tempted so, because the predictability is nearly impossible, because

tempted so, because the predictability is nearly impossible, because there are myriad of paramers which couldn't be sufficient calculated,

there are myriad of paramers which couldn't be sufficient calculated, e.g. human logic.

The Participants

A look into the publications of the

e.g. human logic.

The Participants

A look into the publications of the funds shows it: there is no doubt

funds shows it: there is no doubt about that the number of Funds

about that the number of Funds investing into currencies is having

investing into currencies is having more and more popularity. On the

more and more popularity. On the contrary most Asset Managers,

contrary most Asset Managers, Treasurer and Cash Manager deal

Treasurer and Cash Manager deal with currencies for a transactional

with currencies for a transactional background, i.e. underlying. That

background, i.e. underlying. That means, behind a trade is in most

means, behind a trade is in most cases a "real" transaction with goods or fixed assets, e.g. shares. So

cases a "real" transaction with goods or fixed assets, e.g. shares. So far no pure aim for profit, just rather a hedge or a simple change

far no pure aim for profit, just rather a hedge or a simple change from one currency to another currency, because it is needed

from one currency to another currency, because it is needed physically today or in the future. The behaviour for improvement is

physically today or in the future. The behaviour for improvement is reduced to the negotiation of better prices regarding the change.

reduced to the negotiation of better prices regarding the change. Smaller customers do it by phone, middle customers by their

Smaller customers do it by phone, middle customers by their Treasury Management System and larger customers with special

Treasury Management System and larger customers with special broker-software which is online with multiple banks. The best bank-

broker-software which is online with multiple banks. The best bank- offer gets the deal.

The decission of the Bank resp. the Institutional Market

offer gets the deal.

The decission of the Bank resp. the Institutional Market Participant

Participant It can be discussed about the benefits of such software. On the one

It can be discussed about the benefits of such software. On the one side it is just simply easy to calculate the profit threshold for the

side it is just simply easy to calculate the profit threshold for the market participant, i.e. the customer. On the other hand there is the

market participant, i.e. the customer. On the other hand there is the question about the timing. Should the order now at 11:00:00, at

question about the timing. Should the order now at 11:00:00, at 11:00:10 or at 11:01:00 executed and where is then the rate? This

11:00:10 or at 11:01:00 executed and where is then the rate? This coincidence factor cannot be calculated and the band within a

coincidence factor cannot be calculated and the band within a minute in the foreign exchange market can be huge, relatively seen

minute in the foreign exchange market can be huge, relatively seen to the tough negotiations for one or two pips only.

The Winner and the Loser

About one thing all market participants agree: currency risk is always

present, as long as it is not naturally hedged (e.g. assets vs. capital,

to the tough negotiations for one or two pips only.

The Winner and the Loser

About one thing all market participants agree: currency risk is always

present, as long as it is not naturally hedged (e.g. assets vs. capital, revenues vs. expenses in the same currency at the same time). This

revenues vs. expenses in the same currency at the same time). This risk must be recognized and managed. Banks offer to especially

risk must be recognized and managed. Banks offer to especially institutional customers, thereof mainly from the volumes perspective

institutional customers, thereof mainly from the volumes perspective the funds with their enormous resources, tailored resp. structured

the funds with their enormous resources, tailored resp. structured products in order to have the currency exposure under control at

products in order to have the currency exposure under control at lowest possible costs. But the principle of a zero-sum game is still

lowest possible costs. But the principle of a zero-sum game is still present. The questions arise, who are the losers in that global

present. The questions arise, who are the losers in that global trading system. At the end of the day all of us in the one or other

trading system. At the end of the day all of us in the one or other form. May it be by direct losses, non-taken gains, higher margins on

form. May it be by direct losses, non-taken gains, higher margins on the products which we trade or consume daily. Therefore the global

the products which we trade or consume daily. Therefore the global circle is going to be closed. Nevertheless, every market participant is

circle is going to be closed. Nevertheless, every market participant is trying for his own benefit to get his best possible optimum. This

trying for his own benefit to get his best possible optimum. This leads to the question where this optimum can be fixed and how high

leads to the question where this optimum can be fixed and how high the tolerance for losses is for each single participant?

Pension Funds which do not manage their currency exposure

the tolerance for losses is for each single participant?

Pension Funds which do not manage their currency exposure proactive and therefore don't hedge, expose themselves clear and

proactive and therefore don't hedge, expose themselves clear and take into account the gains and losses occurred by exchange rate.

take into account the gains and losses occurred by exchange rate. Hence, it exists on the one hand a financing matter and on the other

Hence, it exists on the one hand a financing matter and on the other hand a portfolio efficiency question. If Enterprises and Pension

hand a portfolio efficiency question. If Enterprises and Pension Funds take this risk just into account it can be derived the

Funds take this risk just into account it can be derived the assumption that those risks are managed separately in another

assumption that those risks are managed separately in another asset class in order to get back in the "save" profit zone. Most of the

asset class in order to get back in the "save" profit zone. Most of the Companies and Funds drive on a strategy in the middle. That

Companies and Funds drive on a strategy in the middle. That means, hedge currency exposure partially and additionally the

means, hedge currency exposure partially and additionally the volatility from price differences occurred by currency exchange

volatility from price differences occurred by currency exchange effects.

With the attempt to save the earnings and to expand them, pension

effects.

With the attempt to save the earnings and to expand them, pension funds continuously increase the part of shares denominated in

funds continuously increase the part of shares denominated in foreign currencies. Doing this, they increase their currency

foreign currencies. Doing this, they increase their currency exposure. That in combination with the active management of

exposure. That in combination with the active management of investment vehicle is the main reason for the expandation of the

investment vehicle is the main reason for the expandation of the professional category of the Cash Manager. In former times those

professional category of the Cash Manager. In former times those tasks have been managed outsourced to specialized companies, but

tasks have been managed outsourced to specialized companies, but in line with the always more upcoming internationalization the

in line with the always more upcoming internationalization the currency exchange risk is also increasing. Unification of currencies,

currency exchange risk is also increasing. Unification of currencies, like the Euro, are the absolute exception to reduce that risk.

Get the Optimum, regardless what the intention of the

like the Euro, are the absolute exception to reduce that risk.

Get the Optimum, regardless what the intention of the Market Participant is

Market Participant is It must be distinguished

It must be distinguished between

1. Trading, Production and

between

1. Trading, Production and Service Enterprises (the

Service Enterprises (the companies) and

2. Institutional Investors.

companies) and

2. Institutional Investors. The first group attempt, as already mentioned above, minimizing

The first group attempt, as already mentioned above, minimizing their risk while the second group try to generate gains with those

their risk while the second group try to generate gains with those risks. But both have one and the same consensus: get the

risks. But both have one and the same consensus: get the optimum out of the currency market.

optimum out of the currency market. Currency Overlay

In a strategic and tactical investment process, FX can be a separate

Currency Overlay

In a strategic and tactical investment process, FX can be a separate asset class and currency exposure can reduce expected portfolio

asset class and currency exposure can reduce expected portfolio risk. Active currency overlay positions are in general uncorrelated

risk. Active currency overlay positions are in general uncorrelated with bond and equity positions. A successful active FX management

with bond and equity positions. A successful active FX management increases the portfolio return and should be viewed as a natural part

increases the portfolio return and should be viewed as a natural part in a fund's alpha process.

Our Partner, Mercury Control AG, Switzerland, applies a strictly

in a fund's alpha process.

Our Partner, Mercury Control AG, Switzerland, applies a strictly disciplined style rotation strategy, based on continuous macro,

disciplined style rotation strategy, based on continuous macro, political and flow analysis across the G7 currencies and are

political and flow analysis across the G7 currencies and are combined with technical forecasting tools. The trading style itself is

combined with technical forecasting tools. The trading style itself is selected from the following options, accordingly:

•

Momentum

selected from the following options, accordingly:

•

Momentum •

Range

•

Volatility

Momentung Trading

•

Range

•

Volatility

Momentung Trading Momentum Trading acts as the overarching style, inasmuch as it

Momentum Trading acts as the overarching style, inasmuch as it determines trade execution according to a principal outlook for mid-

determines trade execution according to a principal outlook for mid- to long-term movements governing the FX market. Its role is also to

to long-term movements governing the FX market. Its role is also to set the stage for Range Trading - the most commonly applied FX

set the stage for Range Trading - the most commonly applied FX trading style - by identifying the maximum and minimum range lines

trading style - by identifying the maximum and minimum range lines to execute trades, according to risk-return principles.

Range Trading

to execute trades, according to risk-return principles.

Range Trading Range Trading, on the other hand, analyzes the underlying

Range Trading, on the other hand, analyzes the underlying channeling patterns (range) resulting from currently prevailing "paid

channeling patterns (range) resulting from currently prevailing "paid price" scenarios. The clear goal is to trade as long as possible within

price" scenarios. The clear goal is to trade as long as possible within such a range in order to maximize the value-adding potential of this

such a range in order to maximize the value-adding potential of this style .

Volatility (Vega) Trading

style .

Volatility (Vega) Trading A final rotation to Volatility Trading occurs when a previously applied

A final rotation to Volatility Trading occurs when a previously applied range "breaks out" to either side and no clear continuation is

range "breaks out" to either side and no clear continuation is immediately detectable. As a result, options are written on the

immediately detectable. As a result, options are written on the existing short (sold) or long (bought) positions. However, once all

existing short (sold) or long (bought) positions. However, once all Volatility Trading possibilities are exhausted there is a logical

Volatility Trading possibilities are exhausted there is a logical movement back to Momentum or Range Trading.

The risk or hedge ratio between 0% and 100% and the base

movement back to Momentum or Range Trading.

The risk or hedge ratio between 0% and 100% and the base currency specified by the client defines the proportional amount of

currency specified by the client defines the proportional amount of the mandate's absolute currency exposure. This means, either an

the mandate's absolute currency exposure. This means, either an active or a passive managed mandate.

Active currency management enables the client to reduce

risk and add return to an international portfolio whereas the

passive approach negates the foreign exchange risk and

reduces the diversification benefits from international

investments

Case Study

The following is a case study for a customer:

Related Cash Flows to above mentioned trades:

In other words, a Treasurer with functional currency CHF and need

active or a passive managed mandate.

Active currency management enables the client to reduce

risk and add return to an international portfolio whereas the

passive approach negates the foreign exchange risk and

reduces the diversification benefits from international

investments

Case Study

The following is a case study for a customer:

Related Cash Flows to above mentioned trades:

In other words, a Treasurer with functional currency CHF and need of reducing FX-exposure for $ 7.2m is now able to compensate his

of reducing FX-exposure for $ 7.2m is now able to compensate his loss of long USD 7.2m x (1.0741-1.1871)= - CHF 813’600 with the

loss of long USD 7.2m x (1.0741-1.1871)= - CHF 813’600 with the gain of the overlay transactions whereas a Treasurer or Fund-

gain of the overlay transactions whereas a Treasurer or Fund- Manager with need of opimizing his $ 25m investment achieved an

Manager with need of opimizing his $ 25m investment achieved an annualized gross-profit of 28,2%.

Hint: in case of using Currency Overlay for hedging purpose, we

annualized gross-profit of 28,2%.

Hint: in case of using Currency Overlay for hedging purpose, we recommend according best practice risk management to apply a

recommend according best practice risk management to apply a value at risk approach in order to adjust the overlay portfolio to the

value at risk approach in order to adjust the overlay portfolio to the current underlying and complete it with an absolute loss amount.

Do you like to know more about Currency Overlay?

Don’t hesitate and contact us.

current underlying and complete it with an absolute loss amount.

Do you like to know more about Currency Overlay?

Don’t hesitate and contact us.