Currency-, Commodity and Interest-Hedging

Acknowledge the risk and manage it!

Risk in currencies, commodities or interest are denominated in absolute amounts of outstanding receivables and payables which are subject of currency-, commodity- or interestrate movements. The risk on this exposure arise through uncertainty about the future of movements in foreign

currency-, commodity- or interestrate movements. The risk on this exposure arise through uncertainty about the future of movements in foreign exchange- or interestrates, i.e. the price-risk.

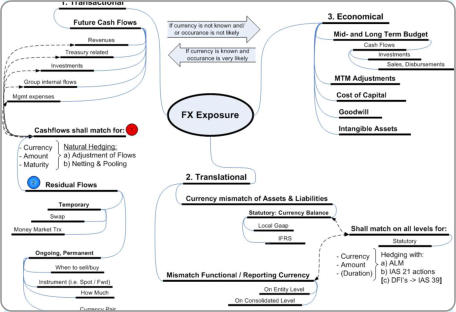

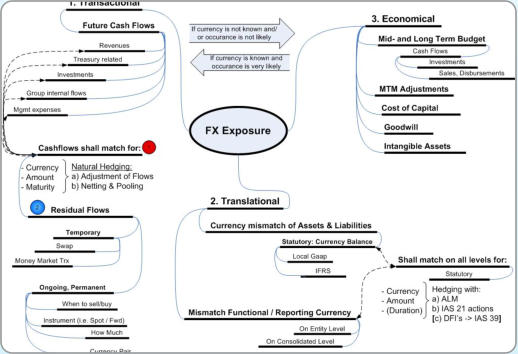

exchange- or interestrates, i.e. the price-risk. Risks, also called exposures, can be transactional (physicle transactions in the future), translational (out of translations) or economical

Risks, also called exposures, can be transactional (physicle transactions in the future), translational (out of translations) or economical (transactions, for which the occurance is not likely or safely known) .

(transactions, for which the occurance is not likely or safely known) . Example:

Example: You have on your foreign exchange account a recievable

You have on your foreign exchange account a recievable in EUR for which you get 0,50% interest. At the same time

in EUR for which you get 0,50% interest. At the same time you have a payable in CHF for which you have to pay

you have a payable in CHF for which you have to pay 6,5% current account interest. You need the EUR in 1

6,5% current account interest. You need the EUR in 1 month to pay an invoice, hence you don't like to sell the

month to pay an invoice, hence you don't like to sell the CHF vs. the EUR to avoid a currency exposure. At a rate

CHF vs. the EUR to avoid a currency exposure. At a rate of 1.25 for 1/2 mio EUR you have to pay net CHF 3’125.-

of 1.25 for 1/2 mio EUR you have to pay net CHF 3’125.- Improvement possibility:

Improvement possibility: Change the EUR into CHF for the time of 1 month with a

Change the EUR into CHF for the time of 1 month with a currency swap. Because the EUR interest is higher than

currency swap. Because the EUR interest is higher than the CHF interest, you get following offer from your Bank:

the CHF interest, you get following offer from your Bank: Sell EUR/CHF at 1.25 spot and buy it back in 1 month at

Sell EUR/CHF at 1.25 spot and buy it back in 1 month at 1.2488. The netresult is now a gain of CHF 600.- (-

1.2488. The netresult is now a gain of CHF 600.- (- opportunity interest EUR + loss of CHF interest - exchange

opportunity interest EUR + loss of CHF interest - exchange rate difference) instead of a loss of 3’125.-.

rate difference) instead of a loss of 3’125.-.  Differend kind of approaches limit the goal of currency-, commodity- and interestmanagement to the individual hedging of a specific cash-flow in

Differend kind of approaches limit the goal of currency-, commodity- and interestmanagement to the individual hedging of a specific cash-flow in the future to minimize currency- or interesteffects. But by hedging, i.e. freezing a currency-, commodity or interest price you also loose the

the future to minimize currency- or interesteffects. But by hedging, i.e. freezing a currency-, commodity or interest price you also loose the possibility of gains. Therefore the key-question is

possibility of gains. Therefore the key-question is Does the Risk control us or do we control the Risk?

Does the Risk control us or do we control the Risk? 1.

Qualify the Risk (Export / Import / Financing / Profit)

1.

Qualify the Risk (Export / Import / Financing / Profit) 2.

Quantify the Risk (Total Risk is e.g. USD 10'000)

2.

Quantify the Risk (Total Risk is e.g. USD 10'000) 3.

Manage the Risk and use Chances (Riskpotential vs. Value at Risk)

3.

Manage the Risk and use Chances (Riskpotential vs. Value at Risk) Only after these steps are consequently introduced it is possible to decide which instruments are best dedicated for hedging. This could be

Only after these steps are consequently introduced it is possible to decide which instruments are best dedicated for hedging. This could be Money-Market-, Forward-, Options-, Commodity or other Hedges. Be aware of IAS 39 if you report according IFRS, there are special

Money-Market-, Forward-, Options-, Commodity or other Hedges. Be aware of IAS 39 if you report according IFRS, there are special requirements to monitor and control these hedges. Reference is made to Hedge Accounting.

requirements to monitor and control these hedges. Reference is made to Hedge Accounting. Strategy

Strategy Basis of every action should be, at least in the foreign exchange, commodity and interest makret, to decide rational and think strategical.

Basis of every action should be, at least in the foreign exchange, commodity and interest makret, to decide rational and think strategical. Therefore we recommend before doing any hedging first to find out what is the potential of natural hedging and then figure out the absolute 0-

Therefore we recommend before doing any hedging first to find out what is the potential of natural hedging and then figure out the absolute 0- base. This is the point where exchange-, commodity and interest prices brake the critical threshold of bringing the company into a dangerous

base. This is the point where exchange-, commodity and interest prices brake the critical threshold of bringing the company into a dangerous situation. Such a hedging on this threshold shall be always 100% and of course, should cost nearly nothing.

situation. Such a hedging on this threshold shall be always 100% and of course, should cost nearly nothing. Everything above this critical threshold, i.e. worst case scenario, shall be individually analysed and hedged. We are pleased to inform you how

Everything above this critical threshold, i.e. worst case scenario, shall be individually analysed and hedged. We are pleased to inform you how you can implement successfully and sustainable such a strategy.

Legal

Basically most legal institutions like governments or SEC does not require that you hedge your fx-, commodity or interest risks: But: every

you can implement successfully and sustainable such a strategy.

Legal

Basically most legal institutions like governments or SEC does not require that you hedge your fx-, commodity or interest risks: But: every company has the strong obligation doing everything to avoid bankruptcy. Basicly all members of the top management like the CEO and CFO, in

company has the strong obligation doing everything to avoid bankruptcy. Basicly all members of the top management like the CEO and CFO, in some cases also the Treasurer can be made responsible for such a damage. We are pleased to figure out for you what these risks are for your

some cases also the Treasurer can be made responsible for such a damage. We are pleased to figure out for you what these risks are for your company.

Reasons for a hedge or coordination of currency- and interest rate risks

•

Minimize negative risk (n.b.: risk can be also positive, can be found out in stress-tests, see also stress test in our treasury software),

company.

Reasons for a hedge or coordination of currency- and interest rate risks

•

Minimize negative risk (n.b.: risk can be also positive, can be found out in stress-tests, see also stress test in our treasury software), •

Avoid interest costs

•

Better and safer calculation of sales prices,

•

Avoid interest costs

•

Better and safer calculation of sales prices, •

Advantages in competition versus competitors,

•

Advantages in competition versus competitors, •

Short-, mid- and longterm financial and liquidity planning,

•

Short-, mid- and longterm financial and liquidity planning, •

Secure the Existence!

•

Secure the Existence! Read more about this important topic here in our news-corner.

Read more about this important topic here in our news-corner.

currency-, commodity- or interestrate movements. The risk on this exposure arise through uncertainty about the future of movements in foreign

currency-, commodity- or interestrate movements. The risk on this exposure arise through uncertainty about the future of movements in foreign exchange- or interestrates, i.e. the price-risk.

exchange- or interestrates, i.e. the price-risk. Risks, also called exposures, can be transactional (physicle transactions in the future), translational (out of translations) or economical

Risks, also called exposures, can be transactional (physicle transactions in the future), translational (out of translations) or economical (transactions, for which the occurance is not likely or safely known) .

(transactions, for which the occurance is not likely or safely known) . Example:

Example: You have on your foreign exchange account a recievable

You have on your foreign exchange account a recievable in EUR for which you get 0,50% interest. At the same time

in EUR for which you get 0,50% interest. At the same time you have a payable in CHF for which you have to pay

you have a payable in CHF for which you have to pay 6,5% current account interest. You need the EUR in 1

6,5% current account interest. You need the EUR in 1 month to pay an invoice, hence you don't like to sell the

month to pay an invoice, hence you don't like to sell the CHF vs. the EUR to avoid a currency exposure. At a rate

CHF vs. the EUR to avoid a currency exposure. At a rate of 1.25 for 1/2 mio EUR you have to pay net CHF 3’125.-

of 1.25 for 1/2 mio EUR you have to pay net CHF 3’125.- Improvement possibility:

Improvement possibility: Change the EUR into CHF for the time of 1 month with a

Change the EUR into CHF for the time of 1 month with a currency swap. Because the EUR interest is higher than

currency swap. Because the EUR interest is higher than the CHF interest, you get following offer from your Bank:

the CHF interest, you get following offer from your Bank: Sell EUR/CHF at 1.25 spot and buy it back in 1 month at

Sell EUR/CHF at 1.25 spot and buy it back in 1 month at 1.2488. The netresult is now a gain of CHF 600.- (-

1.2488. The netresult is now a gain of CHF 600.- (- opportunity interest EUR + loss of CHF interest - exchange

opportunity interest EUR + loss of CHF interest - exchange rate difference) instead of a loss of 3’125.-.

rate difference) instead of a loss of 3’125.-.  Differend kind of approaches limit the goal of currency-, commodity- and interestmanagement to the individual hedging of a specific cash-flow in

Differend kind of approaches limit the goal of currency-, commodity- and interestmanagement to the individual hedging of a specific cash-flow in the future to minimize currency- or interesteffects. But by hedging, i.e. freezing a currency-, commodity or interest price you also loose the

the future to minimize currency- or interesteffects. But by hedging, i.e. freezing a currency-, commodity or interest price you also loose the possibility of gains. Therefore the key-question is

possibility of gains. Therefore the key-question is Does the Risk control us or do we control the Risk?

Does the Risk control us or do we control the Risk? 1.

Qualify the Risk (Export / Import / Financing / Profit)

1.

Qualify the Risk (Export / Import / Financing / Profit) 2.

Quantify the Risk (Total Risk is e.g. USD 10'000)

2.

Quantify the Risk (Total Risk is e.g. USD 10'000) 3.

Manage the Risk and use Chances (Riskpotential vs. Value at Risk)

3.

Manage the Risk and use Chances (Riskpotential vs. Value at Risk) Only after these steps are consequently introduced it is possible to decide which instruments are best dedicated for hedging. This could be

Only after these steps are consequently introduced it is possible to decide which instruments are best dedicated for hedging. This could be Money-Market-, Forward-, Options-, Commodity or other Hedges. Be aware of IAS 39 if you report according IFRS, there are special

Money-Market-, Forward-, Options-, Commodity or other Hedges. Be aware of IAS 39 if you report according IFRS, there are special requirements to monitor and control these hedges. Reference is made to Hedge Accounting.

requirements to monitor and control these hedges. Reference is made to Hedge Accounting. Strategy

Strategy Basis of every action should be, at least in the foreign exchange, commodity and interest makret, to decide rational and think strategical.

Basis of every action should be, at least in the foreign exchange, commodity and interest makret, to decide rational and think strategical. Therefore we recommend before doing any hedging first to find out what is the potential of natural hedging and then figure out the absolute 0-

Therefore we recommend before doing any hedging first to find out what is the potential of natural hedging and then figure out the absolute 0- base. This is the point where exchange-, commodity and interest prices brake the critical threshold of bringing the company into a dangerous

base. This is the point where exchange-, commodity and interest prices brake the critical threshold of bringing the company into a dangerous situation. Such a hedging on this threshold shall be always 100% and of course, should cost nearly nothing.

situation. Such a hedging on this threshold shall be always 100% and of course, should cost nearly nothing. Everything above this critical threshold, i.e. worst case scenario, shall be individually analysed and hedged. We are pleased to inform you how

Everything above this critical threshold, i.e. worst case scenario, shall be individually analysed and hedged. We are pleased to inform you how you can implement successfully and sustainable such a strategy.

Legal

Basically most legal institutions like governments or SEC does not require that you hedge your fx-, commodity or interest risks: But: every

you can implement successfully and sustainable such a strategy.

Legal

Basically most legal institutions like governments or SEC does not require that you hedge your fx-, commodity or interest risks: But: every company has the strong obligation doing everything to avoid bankruptcy. Basicly all members of the top management like the CEO and CFO, in

company has the strong obligation doing everything to avoid bankruptcy. Basicly all members of the top management like the CEO and CFO, in some cases also the Treasurer can be made responsible for such a damage. We are pleased to figure out for you what these risks are for your

some cases also the Treasurer can be made responsible for such a damage. We are pleased to figure out for you what these risks are for your company.

Reasons for a hedge or coordination of currency- and interest rate risks

•

Minimize negative risk (n.b.: risk can be also positive, can be found out in stress-tests, see also stress test in our treasury software),

company.

Reasons for a hedge or coordination of currency- and interest rate risks

•

Minimize negative risk (n.b.: risk can be also positive, can be found out in stress-tests, see also stress test in our treasury software), •

Avoid interest costs

•

Better and safer calculation of sales prices,

•

Avoid interest costs

•

Better and safer calculation of sales prices, •

Advantages in competition versus competitors,

•

Advantages in competition versus competitors, •

Short-, mid- and longterm financial and liquidity planning,

•

Short-, mid- and longterm financial and liquidity planning, •

Secure the Existence!

•

Secure the Existence! Read more about this important topic here in our news-corner.

Read more about this important topic here in our news-corner.

Contact us, we would be glad to show you the possible opportunities!

!

Currency-, Commodity and

Interest-Hedging

Acknowledge the risk and manage it!

Risk in currencies, commodities or interest are denominated in absolute amounts of outstanding receivables and payables which are

absolute amounts of outstanding receivables and payables which are subject of currency-, commodity- or interestrate movements. The risk

subject of currency-, commodity- or interestrate movements. The risk on this exposure arise through uncertainty about the future of

on this exposure arise through uncertainty about the future of movements in foreign exchange- or interestrates, i.e. the price-risk.

Risks, also called exposures, can be transactional (physicle

movements in foreign exchange- or interestrates, i.e. the price-risk.

Risks, also called exposures, can be transactional (physicle transactions in the future), translational (out of translations) or

transactions in the future), translational (out of translations) or economical (transactions, for which the occurance is not likely or

economical (transactions, for which the occurance is not likely or safely known) .

safely known) . Example:

You have on your foreign exchange account a recievable in EUR for

Example:

You have on your foreign exchange account a recievable in EUR for which you get 0,50% interest. At the same time you have a payable in

which you get 0,50% interest. At the same time you have a payable in CHF for which you have to pay 6,5% current account interest. You

CHF for which you have to pay 6,5% current account interest. You need the EUR in 1 month to pay an invoice, hence you don't like to

need the EUR in 1 month to pay an invoice, hence you don't like to sell the CHF vs. the EUR to avoid a currency exposure. At a rate of

sell the CHF vs. the EUR to avoid a currency exposure. At a rate of 1.25 for 1/2 mio EUR you have to pay net CHF 3’125.-

Improvement possibility:

1.25 for 1/2 mio EUR you have to pay net CHF 3’125.-

Improvement possibility: Change the EUR into CHF for the time of 1 month with a currency

Change the EUR into CHF for the time of 1 month with a currency swap. Because the EUR interest is higher than the CHF interest, you

swap. Because the EUR interest is higher than the CHF interest, you get following offer from your Bank: Sell EUR/CHF at 1.25 spot and buy

get following offer from your Bank: Sell EUR/CHF at 1.25 spot and buy it back in 1 month at 1.2488. The netresult is now a gain of CHF 600.-

it back in 1 month at 1.2488. The netresult is now a gain of CHF 600.- (- opportunity interest EUR + loss of CHF interest - exchange rate

(- opportunity interest EUR + loss of CHF interest - exchange rate difference) instead of a loss of 3’125.-.

Differend kind of approaches limit the goal of currency-, commodity-

difference) instead of a loss of 3’125.-.

Differend kind of approaches limit the goal of currency-, commodity- and interestmanagement to the individual hedging of a specific cash-

and interestmanagement to the individual hedging of a specific cash- flow in the future to minimize currency- or interesteffects. But by

flow in the future to minimize currency- or interesteffects. But by hedging, i.e. freezing a currency-, commodity or interest price you also

loose the possibility of gains. Therefore the key-question is

Does the Risk control us or do we control the Risk?

hedging, i.e. freezing a currency-, commodity or interest price you also

loose the possibility of gains. Therefore the key-question is

Does the Risk control us or do we control the Risk? 1.

Qualify the Risk (Export / Import / Financing / Profit)

1.

Qualify the Risk (Export / Import / Financing / Profit) 2.

Quantify the Risk (Total Risk is e.g. USD 10'000)

3.

Manage the Risk and use Chances (Riskpotential vs. Value at

2.

Quantify the Risk (Total Risk is e.g. USD 10'000)

3.

Manage the Risk and use Chances (Riskpotential vs. Value at Risk)

Only after these steps are consequently introduced it is possible to

Risk)

Only after these steps are consequently introduced it is possible to decide which instruments are best dedicated for hedging. This could

decide which instruments are best dedicated for hedging. This could be Money-Market-, Forward-, Options-, Commodity or other Hedges.

be Money-Market-, Forward-, Options-, Commodity or other Hedges. Be aware of IAS 39 if you report according IFRS, there are special

Be aware of IAS 39 if you report according IFRS, there are special requirements to monitor and control these hedges. Reference is made

to Hedge Accounting.

Strategy

Basis of every action should be, at least in the foreign exchange,

requirements to monitor and control these hedges. Reference is made

to Hedge Accounting.

Strategy

Basis of every action should be, at least in the foreign exchange, commodity and interest makret, to decide rational and think

commodity and interest makret, to decide rational and think strategical. Therefore we recommend before doing any hedging first

strategical. Therefore we recommend before doing any hedging first to find out what is the potential of natural hedging and then figure out

to find out what is the potential of natural hedging and then figure out the absolute 0-base. This is the point where exchange-, commodity

the absolute 0-base. This is the point where exchange-, commodity and interest prices brake the critical threshold of bringing the company

into a dangerous situation. Such a hedging on this threshold shall be

and interest prices brake the critical threshold of bringing the company

into a dangerous situation. Such a hedging on this threshold shall be always 100% and of course, should cost nearly nothing.

Everything above this critical threshold, i.e. worst case scenario, shall

always 100% and of course, should cost nearly nothing.

Everything above this critical threshold, i.e. worst case scenario, shall be individually analysed and hedged. We are pleased to inform you

be individually analysed and hedged. We are pleased to inform you how you can implement successfully and sustainable such a strategy.

Legal

Basically most legal institutions like governments or SEC does not

how you can implement successfully and sustainable such a strategy.

Legal

Basically most legal institutions like governments or SEC does not require that you hedge your fx-, commodity or interest risks: But: every

company has the strong obligation doing everything to avoid

require that you hedge your fx-, commodity or interest risks: But: every

company has the strong obligation doing everything to avoid bankruptcy. Basicly all members of the top management like the CEO

bankruptcy. Basicly all members of the top management like the CEO and CFO, in some cases also the Treasurer can be made responsible

and CFO, in some cases also the Treasurer can be made responsible for such a damage. We are pleased to figure out for you what these

for such a damage. We are pleased to figure out for you what these risks are for your company.

Reasons for a hedge or coordination of currency- and

risks are for your company.

Reasons for a hedge or coordination of currency- and interest rate risks

interest rate risks •

Minimize negative risk (n.b.: risk can be also positive, can be

•

Minimize negative risk (n.b.: risk can be also positive, can be found out in stress-tests, see also stress test in our treasury

found out in stress-tests, see also stress test in our treasury software),

•

Avoid interest costs

•

Better and safer calculation of sales prices,

•

Advantages in competition versus competitors,

•

Short-, mid- and longterm financial and liquidity planning,

•

Secure the Existence!

Read more about this important topic here.

Contact us, we would be glad to show you the possible

opportunities!

software),

•

Avoid interest costs

•

Better and safer calculation of sales prices,

•

Advantages in competition versus competitors,

•

Short-, mid- and longterm financial and liquidity planning,

•

Secure the Existence!

Read more about this important topic here.

Contact us, we would be glad to show you the possible

opportunities!

absolute amounts of outstanding receivables and payables which are

absolute amounts of outstanding receivables and payables which are subject of currency-, commodity- or interestrate movements. The risk

subject of currency-, commodity- or interestrate movements. The risk on this exposure arise through uncertainty about the future of

on this exposure arise through uncertainty about the future of movements in foreign exchange- or interestrates, i.e. the price-risk.

Risks, also called exposures, can be transactional (physicle

movements in foreign exchange- or interestrates, i.e. the price-risk.

Risks, also called exposures, can be transactional (physicle transactions in the future), translational (out of translations) or

transactions in the future), translational (out of translations) or economical (transactions, for which the occurance is not likely or

economical (transactions, for which the occurance is not likely or safely known) .

safely known) . Example:

You have on your foreign exchange account a recievable in EUR for

Example:

You have on your foreign exchange account a recievable in EUR for which you get 0,50% interest. At the same time you have a payable in

which you get 0,50% interest. At the same time you have a payable in CHF for which you have to pay 6,5% current account interest. You

CHF for which you have to pay 6,5% current account interest. You need the EUR in 1 month to pay an invoice, hence you don't like to

need the EUR in 1 month to pay an invoice, hence you don't like to sell the CHF vs. the EUR to avoid a currency exposure. At a rate of

sell the CHF vs. the EUR to avoid a currency exposure. At a rate of 1.25 for 1/2 mio EUR you have to pay net CHF 3’125.-

Improvement possibility:

1.25 for 1/2 mio EUR you have to pay net CHF 3’125.-

Improvement possibility: Change the EUR into CHF for the time of 1 month with a currency

Change the EUR into CHF for the time of 1 month with a currency swap. Because the EUR interest is higher than the CHF interest, you

swap. Because the EUR interest is higher than the CHF interest, you get following offer from your Bank: Sell EUR/CHF at 1.25 spot and buy

get following offer from your Bank: Sell EUR/CHF at 1.25 spot and buy it back in 1 month at 1.2488. The netresult is now a gain of CHF 600.-

it back in 1 month at 1.2488. The netresult is now a gain of CHF 600.- (- opportunity interest EUR + loss of CHF interest - exchange rate

(- opportunity interest EUR + loss of CHF interest - exchange rate difference) instead of a loss of 3’125.-.

Differend kind of approaches limit the goal of currency-, commodity-

difference) instead of a loss of 3’125.-.

Differend kind of approaches limit the goal of currency-, commodity- and interestmanagement to the individual hedging of a specific cash-

and interestmanagement to the individual hedging of a specific cash- flow in the future to minimize currency- or interesteffects. But by

flow in the future to minimize currency- or interesteffects. But by hedging, i.e. freezing a currency-, commodity or interest price you also

loose the possibility of gains. Therefore the key-question is

Does the Risk control us or do we control the Risk?

hedging, i.e. freezing a currency-, commodity or interest price you also

loose the possibility of gains. Therefore the key-question is

Does the Risk control us or do we control the Risk? 1.

Qualify the Risk (Export / Import / Financing / Profit)

1.

Qualify the Risk (Export / Import / Financing / Profit) 2.

Quantify the Risk (Total Risk is e.g. USD 10'000)

3.

Manage the Risk and use Chances (Riskpotential vs. Value at

2.

Quantify the Risk (Total Risk is e.g. USD 10'000)

3.

Manage the Risk and use Chances (Riskpotential vs. Value at Risk)

Only after these steps are consequently introduced it is possible to

Risk)

Only after these steps are consequently introduced it is possible to decide which instruments are best dedicated for hedging. This could

decide which instruments are best dedicated for hedging. This could be Money-Market-, Forward-, Options-, Commodity or other Hedges.

be Money-Market-, Forward-, Options-, Commodity or other Hedges. Be aware of IAS 39 if you report according IFRS, there are special

Be aware of IAS 39 if you report according IFRS, there are special requirements to monitor and control these hedges. Reference is made

to Hedge Accounting.

Strategy

Basis of every action should be, at least in the foreign exchange,

requirements to monitor and control these hedges. Reference is made

to Hedge Accounting.

Strategy

Basis of every action should be, at least in the foreign exchange, commodity and interest makret, to decide rational and think

commodity and interest makret, to decide rational and think strategical. Therefore we recommend before doing any hedging first

strategical. Therefore we recommend before doing any hedging first to find out what is the potential of natural hedging and then figure out

to find out what is the potential of natural hedging and then figure out the absolute 0-base. This is the point where exchange-, commodity

the absolute 0-base. This is the point where exchange-, commodity and interest prices brake the critical threshold of bringing the company

into a dangerous situation. Such a hedging on this threshold shall be

and interest prices brake the critical threshold of bringing the company

into a dangerous situation. Such a hedging on this threshold shall be always 100% and of course, should cost nearly nothing.

Everything above this critical threshold, i.e. worst case scenario, shall

always 100% and of course, should cost nearly nothing.

Everything above this critical threshold, i.e. worst case scenario, shall be individually analysed and hedged. We are pleased to inform you

be individually analysed and hedged. We are pleased to inform you how you can implement successfully and sustainable such a strategy.

Legal

Basically most legal institutions like governments or SEC does not

how you can implement successfully and sustainable such a strategy.

Legal

Basically most legal institutions like governments or SEC does not require that you hedge your fx-, commodity or interest risks: But: every

company has the strong obligation doing everything to avoid

require that you hedge your fx-, commodity or interest risks: But: every

company has the strong obligation doing everything to avoid bankruptcy. Basicly all members of the top management like the CEO

bankruptcy. Basicly all members of the top management like the CEO and CFO, in some cases also the Treasurer can be made responsible

and CFO, in some cases also the Treasurer can be made responsible for such a damage. We are pleased to figure out for you what these

for such a damage. We are pleased to figure out for you what these risks are for your company.

Reasons for a hedge or coordination of currency- and

risks are for your company.

Reasons for a hedge or coordination of currency- and interest rate risks

interest rate risks •

Minimize negative risk (n.b.: risk can be also positive, can be

•

Minimize negative risk (n.b.: risk can be also positive, can be found out in stress-tests, see also stress test in our treasury

found out in stress-tests, see also stress test in our treasury software),

•

Avoid interest costs

•

Better and safer calculation of sales prices,

•

Advantages in competition versus competitors,

•

Short-, mid- and longterm financial and liquidity planning,

•

Secure the Existence!

Read more about this important topic here.

Contact us, we would be glad to show you the possible

opportunities!

software),

•

Avoid interest costs

•

Better and safer calculation of sales prices,

•

Advantages in competition versus competitors,

•

Short-, mid- and longterm financial and liquidity planning,

•

Secure the Existence!

Read more about this important topic here.

Contact us, we would be glad to show you the possible

opportunities!