Hedge Accounting

If IFRS or US-Gaap accounting standards are applied, changes of value can

be booked that it doesn’t affect the net income and has therefore significant impact!

Following explanations refer to Hedge Accounting according the International Accounting Standards (IAS) Up until the beginning of this century Hedge Accounting was practice only in the US according SFAS 133. Meanwhile, the International

Up until the beginning of this century Hedge Accounting was practice only in the US according SFAS 133. Meanwhile, the International Accounting Standards consider Hedge Accounting as well as a common practice. Hence, article IAS 39 was born who integrates himself

Accounting Standards consider Hedge Accounting as well as a common practice. Hence, article IAS 39 was born who integrates himself harmoncially in the existing accounting standards, but in practice often considered as controversial and complex. IFRS let’s mostly no choice

harmoncially in the existing accounting standards, but in practice often considered as controversial and complex. IFRS let’s mostly no choice whether to adopt any rule or not. But in case of IAS 39 it is optional to acknowledge it.

whether to adopt any rule or not. But in case of IAS 39 it is optional to acknowledge it. Permanent Change

Accounting standards, especially IFRS, may change often the contents. That’s also the case for IAS 39, who should be replaced by IFRS 9. For

Permanent Change

Accounting standards, especially IFRS, may change often the contents. That’s also the case for IAS 39, who should be replaced by IFRS 9. For the current status regarding Hedgee Accounting please review often the IFRS Bulletin. The following explanations refer to the well established

the current status regarding Hedgee Accounting please review often the IFRS Bulletin. The following explanations refer to the well established and adopted process according IAS 39.

and adopted process according IAS 39. Basic Principles

Basic Principles Values, regardless whether they are in the current ledger or occur just in the future, are subject to regular changes because of multiple reasons.

Values, regardless whether they are in the current ledger or occur just in the future, are subject to regular changes because of multiple reasons. A quite frequent reason is the change of value because of currency movements. This may be the case because of investments (=translational)

A quite frequent reason is the change of value because of currency movements. This may be the case because of investments (=translational) or future cash flows (=transactional). Those variations are considered in the common accounting principles as effective in the income

or future cash flows (=transactional). Those variations are considered in the common accounting principles as effective in the income statement. In consequence, it leads to unwanted side-results which have a significant impact to the profit or loss in a company. Especially

statement. In consequence, it leads to unwanted side-results which have a significant impact to the profit or loss in a company. Especially currency deviations can be shaked out with countertrades (hedge) to the operational basic trade (underlying). Nevertheless the result of those

currency deviations can be shaked out with countertrades (hedge) to the operational basic trade (underlying). Nevertheless the result of those deviations are still considered in the income statement, as long no Hedge Accounting is applied.

deviations are still considered in the income statement, as long no Hedge Accounting is applied. Because the subject matter of measurement and correct assignment of hedging instrument to the underlying may become quite complex, the

Because the subject matter of measurement and correct assignment of hedging instrument to the underlying may become quite complex, the key question of Hedge Accounting is rather not the correct booking of items from income statement to general ledger. It is more in the question

key question of Hedge Accounting is rather not the correct booking of items from income statement to general ledger. It is more in the question of how to identify and measure both trades correct.

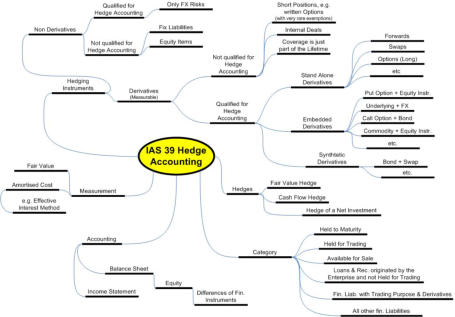

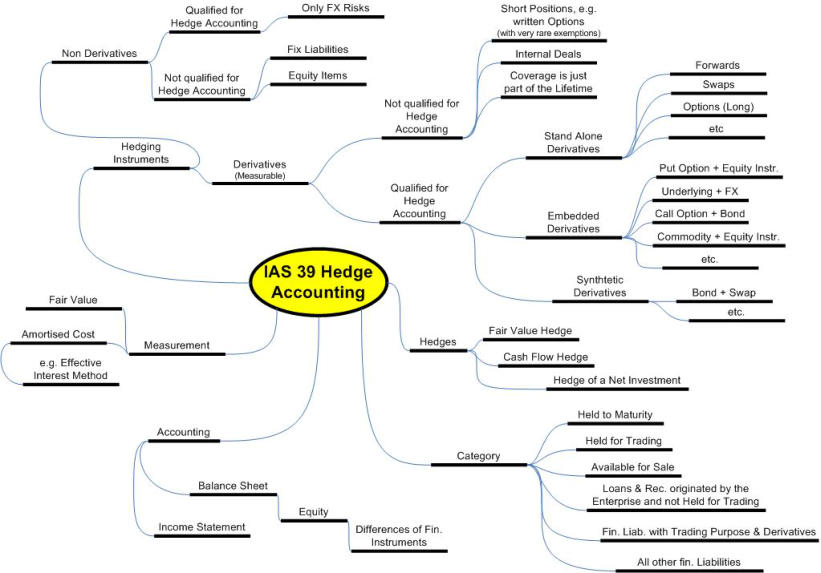

of how to identify and measure both trades correct. Overview about relevant Hedge Accounting contents

That means, someone need to be aware how the underlying shall be classified and also how the hedging instrument relates to the underlying. If

Overview about relevant Hedge Accounting contents

That means, someone need to be aware how the underlying shall be classified and also how the hedging instrument relates to the underlying. If those characteristics meet symmetrical, currency deviations can be considered instead of in the income statement now without income effects

those characteristics meet symmetrical, currency deviations can be considered instead of in the income statement now without income effects in the equity.

Requirements for Hedge Accounting

in the equity.

Requirements for Hedge Accounting •

The hedge must be highly effective (up to date at least 80%, maximum 125% -> but is in review by the IFRS board).

•

The hedge must be highly effective (up to date at least 80%, maximum 125% -> but is in review by the IFRS board). •

High possibility of occurance for the underlying and that this undlerying represents a risk for the company.

•

High possibility of occurance for the underlying and that this undlerying represents a risk for the company. •

A hedge must be effective during the whole lifetime of the underlying.

•

A hedge must be effective during the whole lifetime of the underlying. •

It needs a detailed documentation which describes the purpose and reason for the hedging transaction.

•

It needs a detailed documentation which describes the purpose and reason for the hedging transaction. Example for a Cash Flow Hedge

Example for a Cash Flow Hedge •

Reliability of the budget / finance- or liquidity plan must be reviewed.

•

Reliability of the budget / finance- or liquidity plan must be reviewed. •

Financial and operational capability of the projected activities must be given.

•

Financial and operational capability of the projected activities must be given. •

The likelihood of impact for the underlying must be quite save.

•

The likelihood of impact for the underlying must be quite save. •

Duration of the hedge need to be considered: as longer an event is in the future, as more unlikely his occurance is.

•

Duration of the hedge need to be considered: as longer an event is in the future, as more unlikely his occurance is. Example for a Cash Flow Hedge Documentation

Example for a Cash Flow Hedge Documentation Company:

Company: Test-Holding abc

Test-Holding abc Hedge-Ref.:

Hedge-Ref.: test123

Date:

test123

Date: 30.06.xx

Underlying:

30.06.xx

Underlying: Purchase of Company xyz as per 31.01.yy for the amount of CHF 10’000’000

Purchase of Company xyz as per 31.01.yy for the amount of CHF 10’000’000 Hedge Instrument:

Hedge Instrument: Forward Outright sale USD/CHF for CHF 10’000’000 at Citi Bank New York, Ref. 56789

Forward Outright sale USD/CHF for CHF 10’000’000 at Citi Bank New York, Ref. 56789 Hedging-Type:

Hedging-Type: Cash Flow Hedge

Cash Flow Hedge Description:

Description: “On 20.06.xx the companies Test-Holding abc and Company xyz agreed that Test-Holding takes over 55% of the xyz-shares for the price of

“On 20.06.xx the companies Test-Holding abc and Company xyz agreed that Test-Holding takes over 55% of the xyz-shares for the price of CHF 10’000’000. The financing happen by own liquid funds of USD. In order that the calculated purchase price in the functional curreny of Test-

CHF 10’000’000. The financing happen by own liquid funds of USD. In order that the calculated purchase price in the functional curreny of Test- Holding is not changing anymore until the settlement date, the exchange rate has been fixed until that date. This represents a perfect hedge

Holding is not changing anymore until the settlement date, the exchange rate has been fixed until that date. This represents a perfect hedge and the effectiveness is given during the whole duration.”

and the effectiveness is given during the whole duration.” This example shows a 1:1 hedge. But there is also the possibility to summarize underlyings and hedges in portfolios. But this requires that the

This example shows a 1:1 hedge. But there is also the possibility to summarize underlyings and hedges in portfolios. But this requires that the correlation within the portfolio is given with a high degree and that the hedging instruments match the risk-content of the underlying.

correlation within the portfolio is given with a high degree and that the hedging instruments match the risk-content of the underlying. Not everything can be considered for Hedge Accounting

Hedging Instruments

Not everything can be considered for Hedge Accounting

Hedging Instruments Basically only instruments are allowed for hedging which are also feasible for it. Not allowed are for instance obligations like sold (written)

Basically only instruments are allowed for hedging which are also feasible for it. Not allowed are for instance obligations like sold (written) Options, Short Positions and Equity Instruments (all with very rare exemptions, especially in SFAS). Also not applicable are trades within a

Options, Short Positions and Equity Instruments (all with very rare exemptions, especially in SFAS). Also not applicable are trades within a corporate group, because they would not offset the risk on consolidated level. If a subsidiary would like to apply Hedge Accounting it must give

corporate group, because they would not offset the risk on consolidated level. If a subsidiary would like to apply Hedge Accounting it must give the evidence that the hedge is at the end of the day made with a third party, even this happen in a second or third step throught the goup’s

the evidence that the hedge is at the end of the day made with a third party, even this happen in a second or third step throught the goup’s treasury service center. Last but not least, instruments which do not cover the whole lifetime of the risk do not qualify.

treasury service center. Last but not least, instruments which do not cover the whole lifetime of the risk do not qualify. Undleryings

Undleryings For underlyings it is postulated that they contain similar values. For example cash flows from future purchases cannot be netted with cash flows

For underlyings it is postulated that they contain similar values. For example cash flows from future purchases cannot be netted with cash flows from future sales and then hedged with one single instrument. It should be clear that underlyings can be identified without a doubt and the

from future sales and then hedged with one single instrument. It should be clear that underlyings can be identified without a doubt and the effectiveness of the hedge is traceable and also that a classification can be made.

effectiveness of the hedge is traceable and also that a classification can be made. Summary

Hedge Accounting can be a very good technique to monitor deviations in values without effect to the incoment statement. Thus, the net-result of

Summary

Hedge Accounting can be a very good technique to monitor deviations in values without effect to the incoment statement. Thus, the net-result of a company can be reduced by unwanted side-effects and is therefore more related to operational items. But the requirements are quite strong

a company can be reduced by unwanted side-effects and is therefore more related to operational items. But the requirements are quite strong and my change from time to time. Therefore it is strongly recommended to ask for competent support by introducing Hedge Accounting and it is

and my change from time to time. Therefore it is strongly recommended to ask for competent support by introducing Hedge Accounting and it is also recommended to review the hedging process periodically by an independent party. That means, competence must be given not only in

also recommended to review the hedging process periodically by an independent party. That means, competence must be given not only in terms of accounting matters, it needs also a strong understanding of the hedging process.

terms of accounting matters, it needs also a strong understanding of the hedging process.

Up until the beginning of this century Hedge Accounting was practice only in the US according SFAS 133. Meanwhile, the International

Up until the beginning of this century Hedge Accounting was practice only in the US according SFAS 133. Meanwhile, the International Accounting Standards consider Hedge Accounting as well as a common practice. Hence, article IAS 39 was born who integrates himself

Accounting Standards consider Hedge Accounting as well as a common practice. Hence, article IAS 39 was born who integrates himself harmoncially in the existing accounting standards, but in practice often considered as controversial and complex. IFRS let’s mostly no choice

harmoncially in the existing accounting standards, but in practice often considered as controversial and complex. IFRS let’s mostly no choice whether to adopt any rule or not. But in case of IAS 39 it is optional to acknowledge it.

whether to adopt any rule or not. But in case of IAS 39 it is optional to acknowledge it. Permanent Change

Accounting standards, especially IFRS, may change often the contents. That’s also the case for IAS 39, who should be replaced by IFRS 9. For

Permanent Change

Accounting standards, especially IFRS, may change often the contents. That’s also the case for IAS 39, who should be replaced by IFRS 9. For the current status regarding Hedgee Accounting please review often the IFRS Bulletin. The following explanations refer to the well established

the current status regarding Hedgee Accounting please review often the IFRS Bulletin. The following explanations refer to the well established and adopted process according IAS 39.

and adopted process according IAS 39. Basic Principles

Basic Principles Values, regardless whether they are in the current ledger or occur just in the future, are subject to regular changes because of multiple reasons.

Values, regardless whether they are in the current ledger or occur just in the future, are subject to regular changes because of multiple reasons. A quite frequent reason is the change of value because of currency movements. This may be the case because of investments (=translational)

A quite frequent reason is the change of value because of currency movements. This may be the case because of investments (=translational) or future cash flows (=transactional). Those variations are considered in the common accounting principles as effective in the income

or future cash flows (=transactional). Those variations are considered in the common accounting principles as effective in the income statement. In consequence, it leads to unwanted side-results which have a significant impact to the profit or loss in a company. Especially

statement. In consequence, it leads to unwanted side-results which have a significant impact to the profit or loss in a company. Especially currency deviations can be shaked out with countertrades (hedge) to the operational basic trade (underlying). Nevertheless the result of those

currency deviations can be shaked out with countertrades (hedge) to the operational basic trade (underlying). Nevertheless the result of those deviations are still considered in the income statement, as long no Hedge Accounting is applied.

deviations are still considered in the income statement, as long no Hedge Accounting is applied. Because the subject matter of measurement and correct assignment of hedging instrument to the underlying may become quite complex, the

Because the subject matter of measurement and correct assignment of hedging instrument to the underlying may become quite complex, the key question of Hedge Accounting is rather not the correct booking of items from income statement to general ledger. It is more in the question

key question of Hedge Accounting is rather not the correct booking of items from income statement to general ledger. It is more in the question of how to identify and measure both trades correct.

of how to identify and measure both trades correct. Overview about relevant Hedge Accounting contents

That means, someone need to be aware how the underlying shall be classified and also how the hedging instrument relates to the underlying. If

Overview about relevant Hedge Accounting contents

That means, someone need to be aware how the underlying shall be classified and also how the hedging instrument relates to the underlying. If those characteristics meet symmetrical, currency deviations can be considered instead of in the income statement now without income effects

those characteristics meet symmetrical, currency deviations can be considered instead of in the income statement now without income effects in the equity.

Requirements for Hedge Accounting

in the equity.

Requirements for Hedge Accounting •

The hedge must be highly effective (up to date at least 80%, maximum 125% -> but is in review by the IFRS board).

•

The hedge must be highly effective (up to date at least 80%, maximum 125% -> but is in review by the IFRS board). •

High possibility of occurance for the underlying and that this undlerying represents a risk for the company.

•

High possibility of occurance for the underlying and that this undlerying represents a risk for the company. •

A hedge must be effective during the whole lifetime of the underlying.

•

A hedge must be effective during the whole lifetime of the underlying. •

It needs a detailed documentation which describes the purpose and reason for the hedging transaction.

•

It needs a detailed documentation which describes the purpose and reason for the hedging transaction. Example for a Cash Flow Hedge

Example for a Cash Flow Hedge •

Reliability of the budget / finance- or liquidity plan must be reviewed.

•

Reliability of the budget / finance- or liquidity plan must be reviewed. •

Financial and operational capability of the projected activities must be given.

•

Financial and operational capability of the projected activities must be given. •

The likelihood of impact for the underlying must be quite save.

•

The likelihood of impact for the underlying must be quite save. •

Duration of the hedge need to be considered: as longer an event is in the future, as more unlikely his occurance is.

•

Duration of the hedge need to be considered: as longer an event is in the future, as more unlikely his occurance is. Example for a Cash Flow Hedge Documentation

Example for a Cash Flow Hedge Documentation Company:

Company: Test-Holding abc

Test-Holding abc Hedge-Ref.:

Hedge-Ref.: test123

Date:

test123

Date: 30.06.xx

Underlying:

30.06.xx

Underlying: Purchase of Company xyz as per 31.01.yy for the amount of CHF 10’000’000

Purchase of Company xyz as per 31.01.yy for the amount of CHF 10’000’000 Hedge Instrument:

Hedge Instrument: Forward Outright sale USD/CHF for CHF 10’000’000 at Citi Bank New York, Ref. 56789

Forward Outright sale USD/CHF for CHF 10’000’000 at Citi Bank New York, Ref. 56789 Hedging-Type:

Hedging-Type: Cash Flow Hedge

Cash Flow Hedge Description:

Description: “On 20.06.xx the companies Test-Holding abc and Company xyz agreed that Test-Holding takes over 55% of the xyz-shares for the price of

“On 20.06.xx the companies Test-Holding abc and Company xyz agreed that Test-Holding takes over 55% of the xyz-shares for the price of CHF 10’000’000. The financing happen by own liquid funds of USD. In order that the calculated purchase price in the functional curreny of Test-

CHF 10’000’000. The financing happen by own liquid funds of USD. In order that the calculated purchase price in the functional curreny of Test- Holding is not changing anymore until the settlement date, the exchange rate has been fixed until that date. This represents a perfect hedge

Holding is not changing anymore until the settlement date, the exchange rate has been fixed until that date. This represents a perfect hedge and the effectiveness is given during the whole duration.”

and the effectiveness is given during the whole duration.” This example shows a 1:1 hedge. But there is also the possibility to summarize underlyings and hedges in portfolios. But this requires that the

This example shows a 1:1 hedge. But there is also the possibility to summarize underlyings and hedges in portfolios. But this requires that the correlation within the portfolio is given with a high degree and that the hedging instruments match the risk-content of the underlying.

correlation within the portfolio is given with a high degree and that the hedging instruments match the risk-content of the underlying. Not everything can be considered for Hedge Accounting

Hedging Instruments

Not everything can be considered for Hedge Accounting

Hedging Instruments Basically only instruments are allowed for hedging which are also feasible for it. Not allowed are for instance obligations like sold (written)

Basically only instruments are allowed for hedging which are also feasible for it. Not allowed are for instance obligations like sold (written) Options, Short Positions and Equity Instruments (all with very rare exemptions, especially in SFAS). Also not applicable are trades within a

Options, Short Positions and Equity Instruments (all with very rare exemptions, especially in SFAS). Also not applicable are trades within a corporate group, because they would not offset the risk on consolidated level. If a subsidiary would like to apply Hedge Accounting it must give

corporate group, because they would not offset the risk on consolidated level. If a subsidiary would like to apply Hedge Accounting it must give the evidence that the hedge is at the end of the day made with a third party, even this happen in a second or third step throught the goup’s

the evidence that the hedge is at the end of the day made with a third party, even this happen in a second or third step throught the goup’s treasury service center. Last but not least, instruments which do not cover the whole lifetime of the risk do not qualify.

treasury service center. Last but not least, instruments which do not cover the whole lifetime of the risk do not qualify. Undleryings

Undleryings For underlyings it is postulated that they contain similar values. For example cash flows from future purchases cannot be netted with cash flows

For underlyings it is postulated that they contain similar values. For example cash flows from future purchases cannot be netted with cash flows from future sales and then hedged with one single instrument. It should be clear that underlyings can be identified without a doubt and the

from future sales and then hedged with one single instrument. It should be clear that underlyings can be identified without a doubt and the effectiveness of the hedge is traceable and also that a classification can be made.

effectiveness of the hedge is traceable and also that a classification can be made. Summary

Hedge Accounting can be a very good technique to monitor deviations in values without effect to the incoment statement. Thus, the net-result of

Summary

Hedge Accounting can be a very good technique to monitor deviations in values without effect to the incoment statement. Thus, the net-result of a company can be reduced by unwanted side-effects and is therefore more related to operational items. But the requirements are quite strong

a company can be reduced by unwanted side-effects and is therefore more related to operational items. But the requirements are quite strong and my change from time to time. Therefore it is strongly recommended to ask for competent support by introducing Hedge Accounting and it is

and my change from time to time. Therefore it is strongly recommended to ask for competent support by introducing Hedge Accounting and it is also recommended to review the hedging process periodically by an independent party. That means, competence must be given not only in

also recommended to review the hedging process periodically by an independent party. That means, competence must be given not only in terms of accounting matters, it needs also a strong understanding of the hedging process.

terms of accounting matters, it needs also a strong understanding of the hedging process.

Contact us, we would be glad to show you the possible opportunities!

Hedge Accounting

If IFRS or US-Gaap accounting standards are applied, changes of

value can be booked that it doesn’t affect the net income and

has therefore significant impact!

Following explanations refer to Hedge Accounting according the International Accounting Standards (IAS)

Up until the beginning of this century Hedge Accounting was practice

International Accounting Standards (IAS)

Up until the beginning of this century Hedge Accounting was practice only in the US according SFAS 133. Meanwhile, the International

only in the US according SFAS 133. Meanwhile, the International Accounting Standards consider Hedge Accounting as well as a

Accounting Standards consider Hedge Accounting as well as a common practice. Hence, article IAS 39 was born who integrates

common practice. Hence, article IAS 39 was born who integrates himself harmoncially in the existing accounting standards, but in

himself harmoncially in the existing accounting standards, but in practice often considered as controversial and complex. IFRS let’s

practice often considered as controversial and complex. IFRS let’s mostly no choice whether to adopt any rule or not. But in case of IAS

mostly no choice whether to adopt any rule or not. But in case of IAS 39 it is optional to acknowledge it.

Permanent Change

Accounting standards, especially IFRS, may change often the

39 it is optional to acknowledge it.

Permanent Change

Accounting standards, especially IFRS, may change often the contents. That’s also the case for IAS 39, who should be replaced by

contents. That’s also the case for IAS 39, who should be replaced by IFRS 9. For the current status regarding Hedgee Accounting please

IFRS 9. For the current status regarding Hedgee Accounting please review often the IFRS Bulletin. The following explanations refer to the

review often the IFRS Bulletin. The following explanations refer to the well established and adopted process according IAS 39.

Basic Principles

well established and adopted process according IAS 39.

Basic Principles Values, regardless whether they are in the current ledger or occur just

in the future, are subject to regular changes because of multiple

Values, regardless whether they are in the current ledger or occur just

in the future, are subject to regular changes because of multiple reasons. A quite frequent reason is the change of value because of

reasons. A quite frequent reason is the change of value because of currency movements. This may be the case because of investments

currency movements. This may be the case because of investments (=translational) or future cash flows (=transactional). Those variations

are considered in the common accounting principles as effective in

(=translational) or future cash flows (=transactional). Those variations

are considered in the common accounting principles as effective in the income statement. In consequence, it leads to unwanted side-

the income statement. In consequence, it leads to unwanted side- results which have a significant impact to the profit or loss in a

results which have a significant impact to the profit or loss in a company. Especially currency deviations can be shaked out with

company. Especially currency deviations can be shaked out with countertrades (hedge) to the operational basic trade (underlying).

countertrades (hedge) to the operational basic trade (underlying). Nevertheless the result of those deviations are still considered in the

Nevertheless the result of those deviations are still considered in the income statement, as long no Hedge Accounting is applied.

income statement, as long no Hedge Accounting is applied. Because the subject matter of measurement and correct assignment

Because the subject matter of measurement and correct assignment of hedging instrument to the underlying may become quite complex,

of hedging instrument to the underlying may become quite complex, the key question of Hedge Accounting is rather not the correct

the key question of Hedge Accounting is rather not the correct booking of items from income statement to general ledger. It is more

booking of items from income statement to general ledger. It is more in the question of how to identify and measure both trades correct.

Overview about relevant Hedge Accounting contents

(For a better view of this Mind Map please review it on a Desktop-

in the question of how to identify and measure both trades correct.

Overview about relevant Hedge Accounting contents

(For a better view of this Mind Map please review it on a Desktop- Screen, because this site is optimized for Smartphones and Tablets)

That means, someone need to be aware how the underlying shall be

Screen, because this site is optimized for Smartphones and Tablets)

That means, someone need to be aware how the underlying shall be classified and also how the hedging instrument relates to the

classified and also how the hedging instrument relates to the underlying. If those characteristics meet symmetrical, currency

underlying. If those characteristics meet symmetrical, currency deviations can be considered instead of in the income statement now

deviations can be considered instead of in the income statement now without income effects in the equity.

Requirements for Hedge Accounting

•

The hedge must be highly effective (up to date at least 80%,

without income effects in the equity.

Requirements for Hedge Accounting

•

The hedge must be highly effective (up to date at least 80%, maximum 125% -> but is in review by the IFRS board).

maximum 125% -> but is in review by the IFRS board). •

High possibility of occurance for the underlying and that this

•

High possibility of occurance for the underlying and that this undlerying represents a risk for the company.

•

A hedge must be effective during the whole lifetime of the

undlerying represents a risk for the company.

•

A hedge must be effective during the whole lifetime of the underlying.

•

It needs a detailed documentation which describes the purpose

underlying.

•

It needs a detailed documentation which describes the purpose and reason for the hedging transaction.

Example for a Cash Flow Hedge

and reason for the hedging transaction.

Example for a Cash Flow Hedge •

Reliability of the budget / finance- or liquidity plan must be

•

Reliability of the budget / finance- or liquidity plan must be reviewed.

reviewed. •

Financial and operational capability of the projected activities

•

Financial and operational capability of the projected activities must be given.

•

The likelihood of impact for the underlying must be quite save.

•

Duration of the hedge need to be considered: as longer an

must be given.

•

The likelihood of impact for the underlying must be quite save.

•

Duration of the hedge need to be considered: as longer an event is in the future, as more unlikely his occurance is.

Example for a Cash Flow Hedge Documentation

event is in the future, as more unlikely his occurance is.

Example for a Cash Flow Hedge Documentation Company:

Company: Test-Holding abc

Hedge-Ref.:

test123

Date:

Test-Holding abc

Hedge-Ref.:

test123

Date: 30.06.xx

30.06.xx Underlying:

Underlying: Purchase of Company xyz as per 31.01.yy for

Purchase of Company xyz as per 31.01.yy for the amount of CHF 10’000’000

Hedge Instrument:

Forward Outright sale USD/CHF for CHF

the amount of CHF 10’000’000

Hedge Instrument:

Forward Outright sale USD/CHF for CHF 10’000’000 at Citi Bank New York, Ref. 56789

Hedging-Type:

Cash Flow Hedge

10’000’000 at Citi Bank New York, Ref. 56789

Hedging-Type:

Cash Flow Hedge Description:

Description: “On 20.06.xx the companies Test-Holding abc and Company xyz

“On 20.06.xx the companies Test-Holding abc and Company xyz agreed that Test-Holding takes over 55% of the xyz-shares for the

agreed that Test-Holding takes over 55% of the xyz-shares for the price of CHF 10’000’000. The financing happen by own liquid funds of

USD. In order that the calculated purchase price in the functional

price of CHF 10’000’000. The financing happen by own liquid funds of

USD. In order that the calculated purchase price in the functional curreny of Test-Holding is not changing anymore until the settlement

curreny of Test-Holding is not changing anymore until the settlement date, the exchange rate has been fixed until that date. This

date, the exchange rate has been fixed until that date. This represents a perfect hedge and the effectiveness is given during the

represents a perfect hedge and the effectiveness is given during the whole duration.”

This example shows a 1:1 hedge. But there is also the possibility to

whole duration.”

This example shows a 1:1 hedge. But there is also the possibility to summarize underlyings and hedges in portfolios. But this requires

summarize underlyings and hedges in portfolios. But this requires that the correlation within the portfolio is given with a high degree and

that the correlation within the portfolio is given with a high degree and that the hedging instruments match the risk-content of the underlying.

Not everything can be considered for Hedge Accounting

Hedging Instruments

that the hedging instruments match the risk-content of the underlying.

Not everything can be considered for Hedge Accounting

Hedging Instruments Basically only instruments are allowed for hedging which are also

Basically only instruments are allowed for hedging which are also feasible for it. Not allowed are for instance obligations like sold

feasible for it. Not allowed are for instance obligations like sold (written) Options, Short Positions and Equity Instruments (all with

(written) Options, Short Positions and Equity Instruments (all with very rare exemptions, especially in SFAS). Also not applicable are

very rare exemptions, especially in SFAS). Also not applicable are trades within a corporate group, because they would not offset the

trades within a corporate group, because they would not offset the risk on consolidated level. If a subsidiary would like to apply Hedge

risk on consolidated level. If a subsidiary would like to apply Hedge Accounting it must give the evidence that the hedge is at the end of

Accounting it must give the evidence that the hedge is at the end of the day made with a third party, even this happen in a second or third

the day made with a third party, even this happen in a second or third step throught the goup’s treasury service center. Last but not least,

step throught the goup’s treasury service center. Last but not least, instruments which do not cover the whole lifetime of the risk do not

instruments which do not cover the whole lifetime of the risk do not qualify.

Undleryings

qualify.

Undleryings For underlyings it is postulated that they contain similar values. For

For underlyings it is postulated that they contain similar values. For example cash flows from future purchases cannot be netted with

example cash flows from future purchases cannot be netted with cash flows from future sales and then hedged with one single

cash flows from future sales and then hedged with one single instrument. It should be clear that underlyings can be identified

instrument. It should be clear that underlyings can be identified without a doubt and the effectiveness of the hedge is traceable and

without a doubt and the effectiveness of the hedge is traceable and also that a classification can be made.

Summary

Hedge Accounting can be a very good technique to monitor

also that a classification can be made.

Summary

Hedge Accounting can be a very good technique to monitor deviations in values without effect to the incoment statement. Thus,

deviations in values without effect to the incoment statement. Thus, the net-result of a company can be reduced by unwanted side-effects

the net-result of a company can be reduced by unwanted side-effects and is therefore more related to operational items. But the

and is therefore more related to operational items. But the requirements are quite strong and my change from time to time.

requirements are quite strong and my change from time to time. Therefore it is strongly recommended to ask for competent support by

introducing Hedge Accounting and it is also recommended to review

Therefore it is strongly recommended to ask for competent support by

introducing Hedge Accounting and it is also recommended to review the hedging process periodically by an independent party. That

the hedging process periodically by an independent party. That means, competence must be given not only in terms of accounting

means, competence must be given not only in terms of accounting matters, it needs also a strong understanding of the hedging process.

Contact us, we would be glad to show you the possible

opportunities!

matters, it needs also a strong understanding of the hedging process.

Contact us, we would be glad to show you the possible

opportunities!

International Accounting Standards (IAS)

Up until the beginning of this century Hedge Accounting was practice

International Accounting Standards (IAS)

Up until the beginning of this century Hedge Accounting was practice only in the US according SFAS 133. Meanwhile, the International

only in the US according SFAS 133. Meanwhile, the International Accounting Standards consider Hedge Accounting as well as a

Accounting Standards consider Hedge Accounting as well as a common practice. Hence, article IAS 39 was born who integrates

common practice. Hence, article IAS 39 was born who integrates himself harmoncially in the existing accounting standards, but in

himself harmoncially in the existing accounting standards, but in practice often considered as controversial and complex. IFRS let’s

practice often considered as controversial and complex. IFRS let’s mostly no choice whether to adopt any rule or not. But in case of IAS

mostly no choice whether to adopt any rule or not. But in case of IAS 39 it is optional to acknowledge it.

Permanent Change

Accounting standards, especially IFRS, may change often the

39 it is optional to acknowledge it.

Permanent Change

Accounting standards, especially IFRS, may change often the contents. That’s also the case for IAS 39, who should be replaced by

contents. That’s also the case for IAS 39, who should be replaced by IFRS 9. For the current status regarding Hedgee Accounting please

IFRS 9. For the current status regarding Hedgee Accounting please review often the IFRS Bulletin. The following explanations refer to the

review often the IFRS Bulletin. The following explanations refer to the well established and adopted process according IAS 39.

Basic Principles

well established and adopted process according IAS 39.

Basic Principles Values, regardless whether they are in the current ledger or occur just

in the future, are subject to regular changes because of multiple

Values, regardless whether they are in the current ledger or occur just

in the future, are subject to regular changes because of multiple reasons. A quite frequent reason is the change of value because of

reasons. A quite frequent reason is the change of value because of currency movements. This may be the case because of investments

currency movements. This may be the case because of investments (=translational) or future cash flows (=transactional). Those variations

are considered in the common accounting principles as effective in

(=translational) or future cash flows (=transactional). Those variations

are considered in the common accounting principles as effective in the income statement. In consequence, it leads to unwanted side-

the income statement. In consequence, it leads to unwanted side- results which have a significant impact to the profit or loss in a

results which have a significant impact to the profit or loss in a company. Especially currency deviations can be shaked out with

company. Especially currency deviations can be shaked out with countertrades (hedge) to the operational basic trade (underlying).

countertrades (hedge) to the operational basic trade (underlying). Nevertheless the result of those deviations are still considered in the

Nevertheless the result of those deviations are still considered in the income statement, as long no Hedge Accounting is applied.

income statement, as long no Hedge Accounting is applied. Because the subject matter of measurement and correct assignment

Because the subject matter of measurement and correct assignment of hedging instrument to the underlying may become quite complex,

of hedging instrument to the underlying may become quite complex, the key question of Hedge Accounting is rather not the correct

the key question of Hedge Accounting is rather not the correct booking of items from income statement to general ledger. It is more

booking of items from income statement to general ledger. It is more in the question of how to identify and measure both trades correct.

Overview about relevant Hedge Accounting contents

(For a better view of this Mind Map please review it on a Desktop-

in the question of how to identify and measure both trades correct.

Overview about relevant Hedge Accounting contents

(For a better view of this Mind Map please review it on a Desktop- Screen, because this site is optimized for Smartphones and Tablets)

That means, someone need to be aware how the underlying shall be

Screen, because this site is optimized for Smartphones and Tablets)

That means, someone need to be aware how the underlying shall be classified and also how the hedging instrument relates to the

classified and also how the hedging instrument relates to the underlying. If those characteristics meet symmetrical, currency

underlying. If those characteristics meet symmetrical, currency deviations can be considered instead of in the income statement now

deviations can be considered instead of in the income statement now without income effects in the equity.

Requirements for Hedge Accounting

•

The hedge must be highly effective (up to date at least 80%,

without income effects in the equity.

Requirements for Hedge Accounting

•

The hedge must be highly effective (up to date at least 80%, maximum 125% -> but is in review by the IFRS board).

maximum 125% -> but is in review by the IFRS board). •

High possibility of occurance for the underlying and that this

•

High possibility of occurance for the underlying and that this undlerying represents a risk for the company.

•

A hedge must be effective during the whole lifetime of the

undlerying represents a risk for the company.

•

A hedge must be effective during the whole lifetime of the underlying.

•

It needs a detailed documentation which describes the purpose

underlying.

•

It needs a detailed documentation which describes the purpose and reason for the hedging transaction.

Example for a Cash Flow Hedge

and reason for the hedging transaction.

Example for a Cash Flow Hedge •

Reliability of the budget / finance- or liquidity plan must be

•

Reliability of the budget / finance- or liquidity plan must be reviewed.

reviewed. •

Financial and operational capability of the projected activities

•

Financial and operational capability of the projected activities must be given.

•

The likelihood of impact for the underlying must be quite save.

•

Duration of the hedge need to be considered: as longer an

must be given.

•

The likelihood of impact for the underlying must be quite save.

•

Duration of the hedge need to be considered: as longer an event is in the future, as more unlikely his occurance is.

Example for a Cash Flow Hedge Documentation

event is in the future, as more unlikely his occurance is.

Example for a Cash Flow Hedge Documentation Company:

Company: Test-Holding abc

Hedge-Ref.:

test123

Date:

Test-Holding abc

Hedge-Ref.:

test123

Date: 30.06.xx

30.06.xx Underlying:

Underlying: Purchase of Company xyz as per 31.01.yy for

Purchase of Company xyz as per 31.01.yy for the amount of CHF 10’000’000

Hedge Instrument:

Forward Outright sale USD/CHF for CHF

the amount of CHF 10’000’000

Hedge Instrument:

Forward Outright sale USD/CHF for CHF 10’000’000 at Citi Bank New York, Ref. 56789

Hedging-Type:

Cash Flow Hedge

10’000’000 at Citi Bank New York, Ref. 56789

Hedging-Type:

Cash Flow Hedge Description:

Description: “On 20.06.xx the companies Test-Holding abc and Company xyz

“On 20.06.xx the companies Test-Holding abc and Company xyz agreed that Test-Holding takes over 55% of the xyz-shares for the

agreed that Test-Holding takes over 55% of the xyz-shares for the price of CHF 10’000’000. The financing happen by own liquid funds of

USD. In order that the calculated purchase price in the functional

price of CHF 10’000’000. The financing happen by own liquid funds of

USD. In order that the calculated purchase price in the functional curreny of Test-Holding is not changing anymore until the settlement

curreny of Test-Holding is not changing anymore until the settlement date, the exchange rate has been fixed until that date. This

date, the exchange rate has been fixed until that date. This represents a perfect hedge and the effectiveness is given during the

represents a perfect hedge and the effectiveness is given during the whole duration.”

This example shows a 1:1 hedge. But there is also the possibility to

whole duration.”

This example shows a 1:1 hedge. But there is also the possibility to summarize underlyings and hedges in portfolios. But this requires

summarize underlyings and hedges in portfolios. But this requires that the correlation within the portfolio is given with a high degree and

that the correlation within the portfolio is given with a high degree and that the hedging instruments match the risk-content of the underlying.

Not everything can be considered for Hedge Accounting

Hedging Instruments

that the hedging instruments match the risk-content of the underlying.

Not everything can be considered for Hedge Accounting

Hedging Instruments Basically only instruments are allowed for hedging which are also

Basically only instruments are allowed for hedging which are also feasible for it. Not allowed are for instance obligations like sold

feasible for it. Not allowed are for instance obligations like sold (written) Options, Short Positions and Equity Instruments (all with

(written) Options, Short Positions and Equity Instruments (all with very rare exemptions, especially in SFAS). Also not applicable are

very rare exemptions, especially in SFAS). Also not applicable are trades within a corporate group, because they would not offset the

trades within a corporate group, because they would not offset the risk on consolidated level. If a subsidiary would like to apply Hedge

risk on consolidated level. If a subsidiary would like to apply Hedge Accounting it must give the evidence that the hedge is at the end of

Accounting it must give the evidence that the hedge is at the end of the day made with a third party, even this happen in a second or third

the day made with a third party, even this happen in a second or third step throught the goup’s treasury service center. Last but not least,

step throught the goup’s treasury service center. Last but not least, instruments which do not cover the whole lifetime of the risk do not

instruments which do not cover the whole lifetime of the risk do not qualify.

Undleryings

qualify.

Undleryings For underlyings it is postulated that they contain similar values. For

For underlyings it is postulated that they contain similar values. For example cash flows from future purchases cannot be netted with

example cash flows from future purchases cannot be netted with cash flows from future sales and then hedged with one single

cash flows from future sales and then hedged with one single instrument. It should be clear that underlyings can be identified

instrument. It should be clear that underlyings can be identified without a doubt and the effectiveness of the hedge is traceable and

without a doubt and the effectiveness of the hedge is traceable and also that a classification can be made.

Summary

Hedge Accounting can be a very good technique to monitor

also that a classification can be made.

Summary

Hedge Accounting can be a very good technique to monitor deviations in values without effect to the incoment statement. Thus,

deviations in values without effect to the incoment statement. Thus, the net-result of a company can be reduced by unwanted side-effects

the net-result of a company can be reduced by unwanted side-effects and is therefore more related to operational items. But the

and is therefore more related to operational items. But the requirements are quite strong and my change from time to time.

requirements are quite strong and my change from time to time. Therefore it is strongly recommended to ask for competent support by

introducing Hedge Accounting and it is also recommended to review

Therefore it is strongly recommended to ask for competent support by

introducing Hedge Accounting and it is also recommended to review the hedging process periodically by an independent party. That

the hedging process periodically by an independent party. That means, competence must be given not only in terms of accounting

means, competence must be given not only in terms of accounting matters, it needs also a strong understanding of the hedging process.

Contact us, we would be glad to show you the possible

opportunities!

matters, it needs also a strong understanding of the hedging process.

Contact us, we would be glad to show you the possible

opportunities!