Loans

Loans - that’s something everybody seems to know and understand.

Not necessarely! The practice often shows considerable comprehension questions.

Loans are considered generally often as fiddling, totally intelligible and more over, as a simple financial agreement. But in practice quite often comprehensive questions arise which lead sometimes to serious problems because of a lack of technical knowledge and/or legal

often comprehensive questions arise which lead sometimes to serious problems because of a lack of technical knowledge and/or legal understandings.

understandings. Fundamentials

Technical

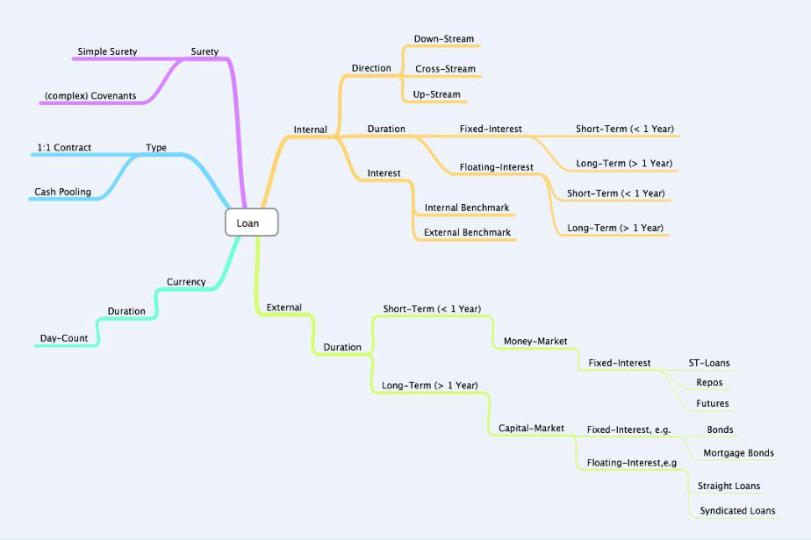

This small mindmap shows that a loan has many facings. Dependent, what the goal of a loans is, many different details should be

Fundamentials

Technical

This small mindmap shows that a loan has many facings. Dependent, what the goal of a loans is, many different details should be considered carefully:

considered carefully: Technical Questions

1.

Interest source, e.g. from a newspaper or not approved google hits instead of a common market source - e.g. LIBOR, EURIBOR etc.

Technical Questions

1.

Interest source, e.g. from a newspaper or not approved google hits instead of a common market source - e.g. LIBOR, EURIBOR etc. 2.

Interest calculation, e.g. because of the currency and duration the correct day-count coventions need to be applied.

2.

Interest calculation, e.g. because of the currency and duration the correct day-count coventions need to be applied. 3.

Fundamential calculations, e.g. a loan which started at 30.06.xx and ends at 31.12.xx with a prolongation to 30.06.yy is calculated

3.

Fundamential calculations, e.g. a loan which started at 30.06.xx and ends at 31.12.xx with a prolongation to 30.06.yy is calculated 30.12.xx - 31.12.xx and 01.01.yy - 30.06.yy. Here, one day is missing, the day from 31.12.xx- 01.01.yy!

Legal Aspects

30.12.xx - 31.12.xx and 01.01.yy - 30.06.yy. Here, one day is missing, the day from 31.12.xx- 01.01.yy!

Legal Aspects The following explanations refer to the greatest possible extend on commercial law from 1. World

The following explanations refer to the greatest possible extend on commercial law from 1. World countries, e.g. Middle-Europe, North-America. But dependent on the specific country there may be

countries, e.g. Middle-Europe, North-America. But dependent on the specific country there may be clear differences in the local law!

clear differences in the local law! The substantial characteristics of a (money)loan is the obligation of the lender to deliver to the

The substantial characteristics of a (money)loan is the obligation of the lender to deliver to the borrower a certain amount for a specific time by transfer of ownership (delivery-obligation) and the

borrower a certain amount for a specific time by transfer of ownership (delivery-obligation) and the borrower has the obligation to repay the amount at the end (re-payment obligation). Additionally it

borrower has the obligation to repay the amount at the end (re-payment obligation). Additionally it is an essential attribute of the lender to leave the amount during the live-time of the loan at the

is an essential attribute of the lender to leave the amount during the live-time of the loan at the borrower (relinquish-obligation).

borrower (relinquish-obligation). However, the interest is for a loan not necessarely to be defined, as exiting it may sound in the first moment. Because interest is not equal

However, the interest is for a loan not necessarely to be defined, as exiting it may sound in the first moment. Because interest is not equal the loan, it is a separate item, i.e. the compensation of the lender for the usage of capital (= loan) during a certain period of time. So, in

the loan, it is a separate item, i.e. the compensation of the lender for the usage of capital (= loan) during a certain period of time. So, in common affairs interest is just payable if they had been agreed. Basically. But: in most of the laws there is an additional clause which says

common affairs interest is just payable if they had been agreed. Basically. But: in most of the laws there is an additional clause which says that in commercial business interest is payable also without a special agreement.

Interest has additionally fundamential legal characteristics: If an agreement for interest is missing, one may conclude that it is in fact not a

that in commercial business interest is payable also without a special agreement.

Interest has additionally fundamential legal characteristics: If an agreement for interest is missing, one may conclude that it is in fact not a loan in common sense, hence a repayment of the loan is not an obligation! This has impact especially in delicate situations, like insolvency

loan in common sense, hence a repayment of the loan is not an obligation! This has impact especially in delicate situations, like insolvency of a group, where up- or cross-stream loans have been made between different legal firms; of course it is also an important topic for tax

of a group, where up- or cross-stream loans have been made between different legal firms; of course it is also an important topic for tax reasons. That means, it’s also a transfer pricing matter.

Last but not least it has to be mentioned that in many countries there is no explicit duty to prepare a written loan agreement. For instance in

reasons. That means, it’s also a transfer pricing matter.

Last but not least it has to be mentioned that in many countries there is no explicit duty to prepare a written loan agreement. For instance in Switzerland art. 11 sect. 1 in connection with art. 312 OR. Even this happen in some laws it is very important to point out here that the

Switzerland art. 11 sect. 1 in connection with art. 312 OR. Even this happen in some laws it is very important to point out here that the consequences of missing writings may lead to serious problems at the lender and also at the borrower!

consequences of missing writings may lead to serious problems at the lender and also at the borrower! Legal Questions

Legal Questions 1.

Liability questions - wrong issued or booked loans my lead to serious problems!

1.

Liability questions - wrong issued or booked loans my lead to serious problems! 2.

Tax questions - transfer pricing: regarding internal loans; dependent on the direction (see above) there may be too high or to low

2.

Tax questions - transfer pricing: regarding internal loans; dependent on the direction (see above) there may be too high or to low interest rates applied and may be considered from the the tax departement as a hidden dividend.

interest rates applied and may be considered from the the tax departement as a hidden dividend. 3.

Documentation - is a written (legal binding) loan agreement issued and in case of prolongation, correct adjusted?

3.

Documentation - is a written (legal binding) loan agreement issued and in case of prolongation, correct adjusted? Contents of a Loan

Every on commercial basic principles based loan should consider the following points:

Contents of a Loan

Every on commercial basic principles based loan should consider the following points: 1.

Lender

1.

Lender 2.

Borrower

2.

Borrower 3.

Date of Agreement

3.

Date of Agreement 4.

Currency

4.

Currency 5.

Amount

6.

Start- and Enddate

5.

Amount

6.

Start- and Enddate 7.

Reference

7.

Reference 8.

Nature of the loan (internal or external)

8.

Nature of the loan (internal or external) 9.

Day count convention (Act/360, 30/360, Act/365, Act/Act)

10.

Interest definition (p.a., s.a.)

9.

Day count convention (Act/360, 30/360, Act/365, Act/Act)

10.

Interest definition (p.a., s.a.) 11.

Interst payment (fix, monthly, semi-annually etc.)

12.

Fix- or floating legs

11.

Interst payment (fix, monthly, semi-annually etc.)

12.

Fix- or floating legs 13.

Account of the lender

13.

Account of the lender 14.

Account of the borrower

14.

Account of the borrower 15.

A free text for remarks

15.

A free text for remarks 16.

Interest fixing dates

16.

Interest fixing dates 17.

Authorized signatures

17.

Authorized signatures Snake-Pits in the interest calculation

Mainly corporates which have no specialized treasury software (e.g. our system STS) calculate the interest in Excel and make sometimes

Snake-Pits in the interest calculation

Mainly corporates which have no specialized treasury software (e.g. our system STS) calculate the interest in Excel and make sometimes errors in the interest calculation. In the following the main problem posings:

errors in the interest calculation. In the following the main problem posings:  Day Count Convention

Day Count Convention Depending on the currency and the duration of the loan there are different methods of calculating interest based on international best

Depending on the currency and the duration of the loan there are different methods of calculating interest based on international best practice standards.

Example: Short-Term Loan, EUR for 1/2 year, 31.12.15 - 30.06.16 (2016 is a lump leap year)

practice standards.

Example: Short-Term Loan, EUR for 1/2 year, 31.12.15 - 30.06.16 (2016 is a lump leap year) 1.

Act/360

(1’000’000 x 1.0% x 182) / 360 x 100 = 5’055.56

2.

30/360

(1’000’000 x 1.0% x 180) / 360 x 100 = 5’000.00

3.

Act/365

(1’000’000 x 1.0% x 182) / 365 x 100 = 4’986.30

4.

Act/Act

(1’000’000 x 1.0% x 182) / 366 x 100 = 4’972.68

In this example for the short-term loan in EUR for 1/2 year the day count convention act/360 is correct. If others are applied, e.g. because of

1.

Act/360

(1’000’000 x 1.0% x 182) / 360 x 100 = 5’055.56

2.

30/360

(1’000’000 x 1.0% x 180) / 360 x 100 = 5’000.00

3.

Act/365

(1’000’000 x 1.0% x 182) / 365 x 100 = 4’986.30

4.

Act/Act

(1’000’000 x 1.0% x 182) / 366 x 100 = 4’972.68

In this example for the short-term loan in EUR for 1/2 year the day count convention act/360 is correct. If others are applied, e.g. because of a lack of professional knowledge, wrong interest is applied.

a lack of professional knowledge, wrong interest is applied. Time

We often saw in financial departments the problem that days are calculated wrong at all.

Time

We often saw in financial departments the problem that days are calculated wrong at all. Example: A loan is agreed from Jan. 1st 2016 - Mar. 31st 2016 and is going to be prolongated until Jun. 30th 2016.

Example: A loan is agreed from Jan. 1st 2016 - Mar. 31st 2016 and is going to be prolongated until Jun. 30th 2016. 1.

01.01.16 - 31.03.16 and 01.04.16 - 30.06.16 = 90 days + 90 days = 180 days

1.

01.01.16 - 31.03.16 and 01.04.16 - 30.06.16 = 90 days + 90 days = 180 days -> that’s wrong in two ways:

a) Interest calculation starts just at the date when the funds are on the account of the borrower (valude date, not booking date). On

-> that’s wrong in two ways:

a) Interest calculation starts just at the date when the funds are on the account of the borrower (valude date, not booking date). On 01.01.xx ni a year in most of the countries of the world this is no working day, hence there can’t be a credit on the account; earliest at

01.01.xx ni a year in most of the countries of the world this is no working day, hence there can’t be a credit on the account; earliest at 02.01.xx. But because 02.01.16 is a saturday (we assume, the loan is between a british- and a german company), the amount can be

02.01.xx. But because 02.01.16 is a saturday (we assume, the loan is between a british- and a german company), the amount can be credited earliest on 04.01.2016.

credited earliest on 04.01.2016. b) Between 31.03.16 and 01.04.2016 no interest was calculated.

b) Between 31.03.16 and 01.04.2016 no interest was calculated. 2.

04.01.16 - 31.03.16 und 31.03.16 - 30.06.16 = 87 days + 91 days = 178 days.

2.

04.01.16 - 31.03.16 und 31.03.16 - 30.06.16 = 87 days + 91 days = 178 days. Correct.

Correct. Interest Fixings

Interest Fixings The most applied interest sources are the official fixings for instance LIBOR or EURIBOR. Those rates cover the period up to one year in

The most applied interest sources are the official fixings for instance LIBOR or EURIBOR. Those rates cover the period up to one year in different time grids.

different time grids. LIBOR: Overnight, 1 Week, 2 Weeks und then 1, 2, 3 ..12 Months

EURIBOR: 1 Week, 2 Weeks, 3 Weeks und then 1, 2, 3 .. 12 Months

Important to know is at a fixing that there is a difference between FIXING-DATE und VALUE-DATE. The Fixing-Date is always 2 working

LIBOR: Overnight, 1 Week, 2 Weeks und then 1, 2, 3 ..12 Months

EURIBOR: 1 Week, 2 Weeks, 3 Weeks und then 1, 2, 3 .. 12 Months

Important to know is at a fixing that there is a difference between FIXING-DATE und VALUE-DATE. The Fixing-Date is always 2 working days (of the currency, not the country) prior the date when funds are physically transferred.

days (of the currency, not the country) prior the date when funds are physically transferred.  Examples:

3.

01.01.16 -> Value Date Monday, 04.01.16 -> Zinsfixing = Wednesday, 30.12.2015

Examples:

3.

01.01.16 -> Value Date Monday, 04.01.16 -> Zinsfixing = Wednesday, 30.12.2015 4.

15.03.16 -> Value Date Tuesday, 15.03.16 -> Zinsfixing = Friday, 11.03.16

Last but not least: always distinguish between booking and value-date!

4.

15.03.16 -> Value Date Tuesday, 15.03.16 -> Zinsfixing = Friday, 11.03.16

Last but not least: always distinguish between booking and value-date! Contact us, we would be glad to show you the possible opportunities!

Contact us, we would be glad to show you the possible opportunities!

often comprehensive questions arise which lead sometimes to serious problems because of a lack of technical knowledge and/or legal

often comprehensive questions arise which lead sometimes to serious problems because of a lack of technical knowledge and/or legal understandings.

understandings. Fundamentials

Technical

This small mindmap shows that a loan has many facings. Dependent, what the goal of a loans is, many different details should be

Fundamentials

Technical

This small mindmap shows that a loan has many facings. Dependent, what the goal of a loans is, many different details should be considered carefully:

considered carefully: Technical Questions

1.

Interest source, e.g. from a newspaper or not approved google hits instead of a common market source - e.g. LIBOR, EURIBOR etc.

Technical Questions

1.

Interest source, e.g. from a newspaper or not approved google hits instead of a common market source - e.g. LIBOR, EURIBOR etc. 2.

Interest calculation, e.g. because of the currency and duration the correct day-count coventions need to be applied.

2.

Interest calculation, e.g. because of the currency and duration the correct day-count coventions need to be applied. 3.

Fundamential calculations, e.g. a loan which started at 30.06.xx and ends at 31.12.xx with a prolongation to 30.06.yy is calculated

3.

Fundamential calculations, e.g. a loan which started at 30.06.xx and ends at 31.12.xx with a prolongation to 30.06.yy is calculated 30.12.xx - 31.12.xx and 01.01.yy - 30.06.yy. Here, one day is missing, the day from 31.12.xx- 01.01.yy!

Legal Aspects

30.12.xx - 31.12.xx and 01.01.yy - 30.06.yy. Here, one day is missing, the day from 31.12.xx- 01.01.yy!

Legal Aspects The following explanations refer to the greatest possible extend on commercial law from 1. World

The following explanations refer to the greatest possible extend on commercial law from 1. World countries, e.g. Middle-Europe, North-America. But dependent on the specific country there may be

countries, e.g. Middle-Europe, North-America. But dependent on the specific country there may be clear differences in the local law!

clear differences in the local law! The substantial characteristics of a (money)loan is the obligation of the lender to deliver to the

The substantial characteristics of a (money)loan is the obligation of the lender to deliver to the borrower a certain amount for a specific time by transfer of ownership (delivery-obligation) and the

borrower a certain amount for a specific time by transfer of ownership (delivery-obligation) and the borrower has the obligation to repay the amount at the end (re-payment obligation). Additionally it

borrower has the obligation to repay the amount at the end (re-payment obligation). Additionally it is an essential attribute of the lender to leave the amount during the live-time of the loan at the

is an essential attribute of the lender to leave the amount during the live-time of the loan at the borrower (relinquish-obligation).

borrower (relinquish-obligation). However, the interest is for a loan not necessarely to be defined, as exiting it may sound in the first moment. Because interest is not equal

However, the interest is for a loan not necessarely to be defined, as exiting it may sound in the first moment. Because interest is not equal the loan, it is a separate item, i.e. the compensation of the lender for the usage of capital (= loan) during a certain period of time. So, in

the loan, it is a separate item, i.e. the compensation of the lender for the usage of capital (= loan) during a certain period of time. So, in common affairs interest is just payable if they had been agreed. Basically. But: in most of the laws there is an additional clause which says

common affairs interest is just payable if they had been agreed. Basically. But: in most of the laws there is an additional clause which says that in commercial business interest is payable also without a special agreement.

Interest has additionally fundamential legal characteristics: If an agreement for interest is missing, one may conclude that it is in fact not a

that in commercial business interest is payable also without a special agreement.

Interest has additionally fundamential legal characteristics: If an agreement for interest is missing, one may conclude that it is in fact not a loan in common sense, hence a repayment of the loan is not an obligation! This has impact especially in delicate situations, like insolvency

loan in common sense, hence a repayment of the loan is not an obligation! This has impact especially in delicate situations, like insolvency of a group, where up- or cross-stream loans have been made between different legal firms; of course it is also an important topic for tax

of a group, where up- or cross-stream loans have been made between different legal firms; of course it is also an important topic for tax reasons. That means, it’s also a transfer pricing matter.

Last but not least it has to be mentioned that in many countries there is no explicit duty to prepare a written loan agreement. For instance in

reasons. That means, it’s also a transfer pricing matter.

Last but not least it has to be mentioned that in many countries there is no explicit duty to prepare a written loan agreement. For instance in Switzerland art. 11 sect. 1 in connection with art. 312 OR. Even this happen in some laws it is very important to point out here that the

Switzerland art. 11 sect. 1 in connection with art. 312 OR. Even this happen in some laws it is very important to point out here that the consequences of missing writings may lead to serious problems at the lender and also at the borrower!

consequences of missing writings may lead to serious problems at the lender and also at the borrower! Legal Questions

Legal Questions 1.

Liability questions - wrong issued or booked loans my lead to serious problems!

1.

Liability questions - wrong issued or booked loans my lead to serious problems! 2.

Tax questions - transfer pricing: regarding internal loans; dependent on the direction (see above) there may be too high or to low

2.

Tax questions - transfer pricing: regarding internal loans; dependent on the direction (see above) there may be too high or to low interest rates applied and may be considered from the the tax departement as a hidden dividend.

interest rates applied and may be considered from the the tax departement as a hidden dividend. 3.

Documentation - is a written (legal binding) loan agreement issued and in case of prolongation, correct adjusted?

3.

Documentation - is a written (legal binding) loan agreement issued and in case of prolongation, correct adjusted? Contents of a Loan

Every on commercial basic principles based loan should consider the following points:

Contents of a Loan

Every on commercial basic principles based loan should consider the following points: 1.

Lender

1.

Lender 2.

Borrower

2.

Borrower 3.

Date of Agreement

3.

Date of Agreement 4.

Currency

4.

Currency 5.

Amount

6.

Start- and Enddate

5.

Amount

6.

Start- and Enddate 7.

Reference

7.

Reference 8.

Nature of the loan (internal or external)

8.

Nature of the loan (internal or external) 9.

Day count convention (Act/360, 30/360, Act/365, Act/Act)

10.

Interest definition (p.a., s.a.)

9.

Day count convention (Act/360, 30/360, Act/365, Act/Act)

10.

Interest definition (p.a., s.a.) 11.

Interst payment (fix, monthly, semi-annually etc.)

12.

Fix- or floating legs

11.

Interst payment (fix, monthly, semi-annually etc.)

12.

Fix- or floating legs 13.

Account of the lender

13.

Account of the lender 14.

Account of the borrower

14.

Account of the borrower 15.

A free text for remarks

15.

A free text for remarks 16.

Interest fixing dates

16.

Interest fixing dates 17.

Authorized signatures

17.

Authorized signatures Snake-Pits in the interest calculation

Mainly corporates which have no specialized treasury software (e.g. our system STS) calculate the interest in Excel and make sometimes

Snake-Pits in the interest calculation

Mainly corporates which have no specialized treasury software (e.g. our system STS) calculate the interest in Excel and make sometimes errors in the interest calculation. In the following the main problem posings:

errors in the interest calculation. In the following the main problem posings:  Day Count Convention

Day Count Convention Depending on the currency and the duration of the loan there are different methods of calculating interest based on international best

Depending on the currency and the duration of the loan there are different methods of calculating interest based on international best practice standards.

Example: Short-Term Loan, EUR for 1/2 year, 31.12.15 - 30.06.16 (2016 is a lump leap year)

practice standards.

Example: Short-Term Loan, EUR for 1/2 year, 31.12.15 - 30.06.16 (2016 is a lump leap year) 1.

Act/360

(1’000’000 x 1.0% x 182) / 360 x 100 = 5’055.56

2.

30/360

(1’000’000 x 1.0% x 180) / 360 x 100 = 5’000.00

3.

Act/365

(1’000’000 x 1.0% x 182) / 365 x 100 = 4’986.30

4.

Act/Act

(1’000’000 x 1.0% x 182) / 366 x 100 = 4’972.68

In this example for the short-term loan in EUR for 1/2 year the day count convention act/360 is correct. If others are applied, e.g. because of

1.

Act/360

(1’000’000 x 1.0% x 182) / 360 x 100 = 5’055.56

2.

30/360

(1’000’000 x 1.0% x 180) / 360 x 100 = 5’000.00

3.

Act/365

(1’000’000 x 1.0% x 182) / 365 x 100 = 4’986.30

4.

Act/Act

(1’000’000 x 1.0% x 182) / 366 x 100 = 4’972.68

In this example for the short-term loan in EUR for 1/2 year the day count convention act/360 is correct. If others are applied, e.g. because of a lack of professional knowledge, wrong interest is applied.

a lack of professional knowledge, wrong interest is applied. Time

We often saw in financial departments the problem that days are calculated wrong at all.

Time

We often saw in financial departments the problem that days are calculated wrong at all. Example: A loan is agreed from Jan. 1st 2016 - Mar. 31st 2016 and is going to be prolongated until Jun. 30th 2016.

Example: A loan is agreed from Jan. 1st 2016 - Mar. 31st 2016 and is going to be prolongated until Jun. 30th 2016. 1.

01.01.16 - 31.03.16 and 01.04.16 - 30.06.16 = 90 days + 90 days = 180 days

1.

01.01.16 - 31.03.16 and 01.04.16 - 30.06.16 = 90 days + 90 days = 180 days -> that’s wrong in two ways:

a) Interest calculation starts just at the date when the funds are on the account of the borrower (valude date, not booking date). On

-> that’s wrong in two ways:

a) Interest calculation starts just at the date when the funds are on the account of the borrower (valude date, not booking date). On 01.01.xx ni a year in most of the countries of the world this is no working day, hence there can’t be a credit on the account; earliest at

01.01.xx ni a year in most of the countries of the world this is no working day, hence there can’t be a credit on the account; earliest at 02.01.xx. But because 02.01.16 is a saturday (we assume, the loan is between a british- and a german company), the amount can be

02.01.xx. But because 02.01.16 is a saturday (we assume, the loan is between a british- and a german company), the amount can be credited earliest on 04.01.2016.

credited earliest on 04.01.2016. b) Between 31.03.16 and 01.04.2016 no interest was calculated.

b) Between 31.03.16 and 01.04.2016 no interest was calculated. 2.

04.01.16 - 31.03.16 und 31.03.16 - 30.06.16 = 87 days + 91 days = 178 days.

2.

04.01.16 - 31.03.16 und 31.03.16 - 30.06.16 = 87 days + 91 days = 178 days. Correct.

Correct. Interest Fixings

Interest Fixings The most applied interest sources are the official fixings for instance LIBOR or EURIBOR. Those rates cover the period up to one year in

The most applied interest sources are the official fixings for instance LIBOR or EURIBOR. Those rates cover the period up to one year in different time grids.

different time grids. LIBOR: Overnight, 1 Week, 2 Weeks und then 1, 2, 3 ..12 Months

EURIBOR: 1 Week, 2 Weeks, 3 Weeks und then 1, 2, 3 .. 12 Months

Important to know is at a fixing that there is a difference between FIXING-DATE und VALUE-DATE. The Fixing-Date is always 2 working

LIBOR: Overnight, 1 Week, 2 Weeks und then 1, 2, 3 ..12 Months

EURIBOR: 1 Week, 2 Weeks, 3 Weeks und then 1, 2, 3 .. 12 Months

Important to know is at a fixing that there is a difference between FIXING-DATE und VALUE-DATE. The Fixing-Date is always 2 working days (of the currency, not the country) prior the date when funds are physically transferred.

days (of the currency, not the country) prior the date when funds are physically transferred.  Examples:

3.

01.01.16 -> Value Date Monday, 04.01.16 -> Zinsfixing = Wednesday, 30.12.2015

Examples:

3.

01.01.16 -> Value Date Monday, 04.01.16 -> Zinsfixing = Wednesday, 30.12.2015 4.

15.03.16 -> Value Date Tuesday, 15.03.16 -> Zinsfixing = Friday, 11.03.16

Last but not least: always distinguish between booking and value-date!

4.

15.03.16 -> Value Date Tuesday, 15.03.16 -> Zinsfixing = Friday, 11.03.16

Last but not least: always distinguish between booking and value-date! Contact us, we would be glad to show you the possible opportunities!

Contact us, we would be glad to show you the possible opportunities!

Loans

Loans - that’s something everybody seems to know and understand.

Not necessarely! The practice often shows considerable

comprehension questions.

Loans are considered generally often as fiddling, totally intelligible and more over, as a simple financial agreement. But in practice

and more over, as a simple financial agreement. But in practice quite often comprehensive questions arise which lead sometimes to

quite often comprehensive questions arise which lead sometimes to serious problems because of a lack of technical knowledge and/or

serious problems because of a lack of technical knowledge and/or legal understandings.

Fundamentials

legal understandings.

Fundamentials Technical

(Please have a look to this site also on a Desktop-Screen and review

the Mind Map to undermentioned points, because this site is

Technical

(Please have a look to this site also on a Desktop-Screen and review

the Mind Map to undermentioned points, because this site is optimized for Smartphones / Tablets)

Loans are segregated primary for

1.

Internal / External

optimized for Smartphones / Tablets)

Loans are segregated primary for

1.

Internal / External 2.

Type

3.

Currency

4.

Surety

•

Secondly by direction -> Down-/Cross-/Upstream;

2.

Type

3.

Currency

4.

Surety

•

Secondly by direction -> Down-/Cross-/Upstream; •

Duration -> Short Term < 1 Year und Long Term > 1 Year;

•

Fix or floating interest;

•

Interest benchmark -> internal or external;

•

Interest environment -> Money Market or Capital Market;

•

Duration -> Short Term < 1 Year und Long Term > 1 Year;

•

Fix or floating interest;

•

Interest benchmark -> internal or external;

•

Interest environment -> Money Market or Capital Market; •

Instruments -> from fix loans through Repos, Bonds up to

•

Instruments -> from fix loans through Repos, Bonds up to syndicated Loans;

•

Day Count

•

Kind of Loan -> 1:1 or Cash Pooling

•

Kind of Surety -> simple or complex Coventants

syndicated Loans;

•

Day Count

•

Kind of Loan -> 1:1 or Cash Pooling

•

Kind of Surety -> simple or complex Coventants This small mindmap shows that a loan has many facings.

This small mindmap shows that a loan has many facings. Dependent, what the goal of a loans is, many different details should

Dependent, what the goal of a loans is, many different details should be considered carefully:

Technical Questions

1.

Interest source, e.g. from a newspaper or not approved google

be considered carefully:

Technical Questions

1.

Interest source, e.g. from a newspaper or not approved google hits instead of a common market source - e.g. LIBOR,

hits instead of a common market source - e.g. LIBOR, EURIBOR etc.

EURIBOR etc. 2.

Interest calculation, e.g.

2.

Interest calculation, e.g. because of the currency

and duration the correct

because of the currency

and duration the correct day-count coventions

day-count coventions need to be applied.

3.

Fundamential

need to be applied.

3.

Fundamential calculations, e.g. a loan

calculations, e.g. a loan which started at

which started at 30.06.xx and ends at

30.06.xx and ends at 31.12.xx with a prolongation to 30.06.yy is calculated 30.12.xx

31.12.xx with a prolongation to 30.06.yy is calculated 30.12.xx - 31.12.xx and 01.01.yy - 30.06.yy. Here, one day is missing,

- 31.12.xx and 01.01.yy - 30.06.yy. Here, one day is missing, the day from 31.12.xx- 01.01.yy!

Legal Aspects

The following explanations refer to the greatest possible extend on

the day from 31.12.xx- 01.01.yy!

Legal Aspects

The following explanations refer to the greatest possible extend on commercial law from 1. World countries, e.g. Middle-Europe, North-

commercial law from 1. World countries, e.g. Middle-Europe, North- America. But dependent on the specific country there may be clear

America. But dependent on the specific country there may be clear differences in the local law!

The substantial characteristics of a (money)loan is the obligation of

differences in the local law!

The substantial characteristics of a (money)loan is the obligation of the lender to deliver to the borrower a certain amount for a specific

the lender to deliver to the borrower a certain amount for a specific time by transfer of ownership (delivery-obligation) and the borrower

time by transfer of ownership (delivery-obligation) and the borrower has the obligation to repay the amount at the end (re-payment

has the obligation to repay the amount at the end (re-payment obligation). Additionally it is an essential attribute of the lender to

obligation). Additionally it is an essential attribute of the lender to leave the amount during the live-time of the loan at the borrower

leave the amount during the live-time of the loan at the borrower (relinquish-obligation).

However, the interest is for a loan not necessarely to be defined, as

(relinquish-obligation).

However, the interest is for a loan not necessarely to be defined, as exiting it may sound in the first moment. Because interest is not

exiting it may sound in the first moment. Because interest is not equal the loan, it is a separate item, i.e. the compensation of the

equal the loan, it is a separate item, i.e. the compensation of the lender for the usage of capital (= loan) during a certain period of

lender for the usage of capital (= loan) during a certain period of time. So, in common affairs interest is just payable if they had been

time. So, in common affairs interest is just payable if they had been agreed. Basically. But: in most of the laws there is an additional

agreed. Basically. But: in most of the laws there is an additional clause which says that in commercial business interest is payable

clause which says that in commercial business interest is payable also without a special agreement.

Interest has additionally fundamential legal characteristics: If an

also without a special agreement.

Interest has additionally fundamential legal characteristics: If an agreement for interest is missing, one may conclude that it is in fact

agreement for interest is missing, one may conclude that it is in fact not a loan in common sense, hence a repayment of the loan is not

not a loan in common sense, hence a repayment of the loan is not an obligation! This has impact especially in delicate situations, like

an obligation! This has impact especially in delicate situations, like insolvency of a group, where up- or cross-stream loans have been

insolvency of a group, where up- or cross-stream loans have been made between different legal firms; of course it is also an important

made between different legal firms; of course it is also an important topic for tax reasons. That means, it’s also a transfer pricing matter.

Last but not least it has to be mentioned that in many countries there

is no explicit duty to prepare a written loan agreement. For instance

topic for tax reasons. That means, it’s also a transfer pricing matter.

Last but not least it has to be mentioned that in many countries there

is no explicit duty to prepare a written loan agreement. For instance in Switzerland art. 11 sect. 1 in connection with art. 312 OR. Even

in Switzerland art. 11 sect. 1 in connection with art. 312 OR. Even this happen in some laws it is very important to point out here that

this happen in some laws it is very important to point out here that the consequences of missing writings may lead to serious problems

the consequences of missing writings may lead to serious problems at the lender and also at the borrower!

Legal Questions

at the lender and also at the borrower!

Legal Questions 1.

Liability questions - wrong issued or booked loans my lead to

1.

Liability questions - wrong issued or booked loans my lead to serious problems!

2.

Tax questions - transfer pricing: regarding internal loans;

serious problems!

2.

Tax questions - transfer pricing: regarding internal loans; dependent on the direction (see above) there may be too high

dependent on the direction (see above) there may be too high or to low interest rates applied and may be considered from

or to low interest rates applied and may be considered from the the tax departement as a hidden dividend.

3.

Documentation - is a written (legal binding) loan agreement

the the tax departement as a hidden dividend.

3.

Documentation - is a written (legal binding) loan agreement issued and in case of prolongation, correct adjusted?

Contents of a Loan

Every on commercial basic principles based loan should consider the

following points:

issued and in case of prolongation, correct adjusted?

Contents of a Loan

Every on commercial basic principles based loan should consider the

following points: 1.

Lender

2.

Borrower

3.

Date of Agreement

4.

Currency

5.

Amount

1.

Lender

2.

Borrower

3.

Date of Agreement

4.

Currency

5.

Amount 6.

Start- and Enddate

7.

Reference

8.

Nature of the loan (internal or external)

9.

Day count convention (Act/360, 30/360, Act/365, Act/Act)

10.

Interest definition (p.a., s.a.)

11.

Interst payment (fix, monthly, semi-annually etc.)

6.

Start- and Enddate

7.

Reference

8.

Nature of the loan (internal or external)

9.

Day count convention (Act/360, 30/360, Act/365, Act/Act)

10.

Interest definition (p.a., s.a.)

11.

Interst payment (fix, monthly, semi-annually etc.) 12.

Fix- or floating legs

13.

Account of the lender

14.

Account of the borrower

15.

A free text for remarks

16.

Interest fixing dates

12.

Fix- or floating legs

13.

Account of the lender

14.

Account of the borrower

15.

A free text for remarks

16.

Interest fixing dates 17.

Authorized signatures

Snake-Pits in the interest calculation

17.

Authorized signatures

Snake-Pits in the interest calculation Mainly corporates which have no specialized treasury software (e.g.

Mainly corporates which have no specialized treasury software (e.g. our system STS) calculate the interest in Excel and make sometimes

our system STS) calculate the interest in Excel and make sometimes errors in the interest calculation. In the following the main problem

errors in the interest calculation. In the following the main problem posings:

Day Count Convention

Depending on the currency and the duration of the loan there are

posings:

Day Count Convention

Depending on the currency and the duration of the loan there are different methods of calculating interest based on international best

different methods of calculating interest based on international best practice standards.

Example: Short-Term Loan, EUR for 1/2 year, 31.12.15 - 30.06.16

practice standards.

Example: Short-Term Loan, EUR for 1/2 year, 31.12.15 - 30.06.16  (2016 is a lump leap year)

1.

Act/360

(1’000’000 x 1.0% x 182) / 360 x 100 = 5’055.56

2.

30/360

(1’000’000 x 1.0% x 180) / 360 x 100 = 5’000.00

3.

Act/365

(1’000’000 x 1.0% x 182) / 365 x 100 = 4’986.30

4.

Act/Act

(1’000’000 x 1.0% x 182) / 366 x 100 = 4’972.68

In this example for the short-term loan in EUR for 1/2 year the day

(2016 is a lump leap year)

1.

Act/360

(1’000’000 x 1.0% x 182) / 360 x 100 = 5’055.56

2.

30/360

(1’000’000 x 1.0% x 180) / 360 x 100 = 5’000.00

3.

Act/365

(1’000’000 x 1.0% x 182) / 365 x 100 = 4’986.30

4.

Act/Act

(1’000’000 x 1.0% x 182) / 366 x 100 = 4’972.68

In this example for the short-term loan in EUR for 1/2 year the day count convention act/360 is correct. If others are applied, e.g.

count convention act/360 is correct. If others are applied, e.g. because of a lack of professional knowledge, wrong interest is

because of a lack of professional knowledge, wrong interest is applied.

Time

We often saw in financial departments the problem that days are

applied.

Time

We often saw in financial departments the problem that days are calculated wrong at all.

Example: A loan is agreed from Jan. 1st 2016 - Mar. 31st 2016 and

calculated wrong at all.

Example: A loan is agreed from Jan. 1st 2016 - Mar. 31st 2016 and is going to be prolongated until Jun. 30th 2016.

1.

01.01.16 - 31.03.16 and 01.04.16 - 30.06.16 = 90 days + 90

is going to be prolongated until Jun. 30th 2016.

1.

01.01.16 - 31.03.16 and 01.04.16 - 30.06.16 = 90 days + 90 days = 180 days

-> that’s wrong in two ways:

days = 180 days

-> that’s wrong in two ways:  a) Interest calculation starts just at the date when the funds are

on the account of the borrower (valude date, not booking

a) Interest calculation starts just at the date when the funds are

on the account of the borrower (valude date, not booking date). On 01.01.xx ni a year in most of the countries of the

date). On 01.01.xx ni a year in most of the countries of the world this is no working day, hence there can’t be a credit on

world this is no working day, hence there can’t be a credit on the account; earliest at 02.01.xx. But because 02.01.16 is a

the account; earliest at 02.01.xx. But because 02.01.16 is a saturday (we assume, the loan is between a british- and a

saturday (we assume, the loan is between a british- and a german company), the amount can be credited earliest on

german company), the amount can be credited earliest on 04.01.2016.

b) Between 31.03.16 and 01.04.2016 no interest was

04.01.2016.

b) Between 31.03.16 and 01.04.2016 no interest was calculated.

2.

04.01.16 - 31.03.16 und 31.03.16 - 30.06.16 = 87 days + 91

calculated.

2.

04.01.16 - 31.03.16 und 31.03.16 - 30.06.16 = 87 days + 91 days = 178 days.

Correct.

Interest Fixings

days = 178 days.

Correct.

Interest Fixings The most applied interest sources are the official fixings for instance

The most applied interest sources are the official fixings for instance LIBOR or EURIBOR. Those rates cover the period up to one year in

LIBOR or EURIBOR. Those rates cover the period up to one year in different time grids.

LIBOR: Overnight, 1 Week, 2 Weeks und then 1, 2, 3 ..12 Months

EURIBOR: 1 Week, 2 Weeks, 3 Weeks und then 1, 2, 3 .. 12 Months

different time grids.

LIBOR: Overnight, 1 Week, 2 Weeks und then 1, 2, 3 ..12 Months

EURIBOR: 1 Week, 2 Weeks, 3 Weeks und then 1, 2, 3 .. 12 Months Important to know is at a fixing that there is a difference between

Important to know is at a fixing that there is a difference between FIXING-DATE und VALUE-DATE. The Fixing-Date is always 2

FIXING-DATE und VALUE-DATE. The Fixing-Date is always 2 working days (of the currency, not the country) prior the date when

working days (of the currency, not the country) prior the date when funds are physically transferred.

Examples:

funds are physically transferred.

Examples: 3.

01.01.16 -> Value Date Monday, 04.01.16 -> Zinsfixing =

3.

01.01.16 -> Value Date Monday, 04.01.16 -> Zinsfixing = Wednesday, 30.12.2015

4.

15.03.16 -> Value Date Tuesday, 15.03.16 -> Zinsfixing =

Wednesday, 30.12.2015

4.

15.03.16 -> Value Date Tuesday, 15.03.16 -> Zinsfixing = Friday, 11.03.16

Last but not least: always distinguish between booking and value-

Friday, 11.03.16

Last but not least: always distinguish between booking and value- date!

Contact us, we would be glad to show you the possible

opportunities!

date!

Contact us, we would be glad to show you the possible

opportunities!

and more over, as a simple financial agreement. But in practice

and more over, as a simple financial agreement. But in practice quite often comprehensive questions arise which lead sometimes to

quite often comprehensive questions arise which lead sometimes to serious problems because of a lack of technical knowledge and/or

serious problems because of a lack of technical knowledge and/or legal understandings.

Fundamentials

legal understandings.

Fundamentials Technical

(Please have a look to this site also on a Desktop-Screen and review

the Mind Map to undermentioned points, because this site is

Technical

(Please have a look to this site also on a Desktop-Screen and review

the Mind Map to undermentioned points, because this site is optimized for Smartphones / Tablets)

Loans are segregated primary for

1.

Internal / External

optimized for Smartphones / Tablets)

Loans are segregated primary for

1.

Internal / External 2.

Type

3.

Currency

4.

Surety

•

Secondly by direction -> Down-/Cross-/Upstream;

2.

Type

3.

Currency

4.

Surety

•

Secondly by direction -> Down-/Cross-/Upstream; •

Duration -> Short Term < 1 Year und Long Term > 1 Year;

•

Fix or floating interest;

•

Interest benchmark -> internal or external;

•

Interest environment -> Money Market or Capital Market;

•

Duration -> Short Term < 1 Year und Long Term > 1 Year;

•

Fix or floating interest;

•

Interest benchmark -> internal or external;

•

Interest environment -> Money Market or Capital Market; •

Instruments -> from fix loans through Repos, Bonds up to

•

Instruments -> from fix loans through Repos, Bonds up to syndicated Loans;

•

Day Count

•

Kind of Loan -> 1:1 or Cash Pooling

•

Kind of Surety -> simple or complex Coventants

syndicated Loans;

•

Day Count

•

Kind of Loan -> 1:1 or Cash Pooling

•

Kind of Surety -> simple or complex Coventants This small mindmap shows that a loan has many facings.

This small mindmap shows that a loan has many facings. Dependent, what the goal of a loans is, many different details should

Dependent, what the goal of a loans is, many different details should be considered carefully:

Technical Questions

1.

Interest source, e.g. from a newspaper or not approved google

be considered carefully:

Technical Questions

1.

Interest source, e.g. from a newspaper or not approved google hits instead of a common market source - e.g. LIBOR,

hits instead of a common market source - e.g. LIBOR, EURIBOR etc.

EURIBOR etc. 2.

Interest calculation, e.g.

2.

Interest calculation, e.g. because of the currency

and duration the correct

because of the currency

and duration the correct day-count coventions

day-count coventions need to be applied.

3.

Fundamential

need to be applied.

3.

Fundamential calculations, e.g. a loan

calculations, e.g. a loan which started at

which started at 30.06.xx and ends at

30.06.xx and ends at 31.12.xx with a prolongation to 30.06.yy is calculated 30.12.xx

31.12.xx with a prolongation to 30.06.yy is calculated 30.12.xx - 31.12.xx and 01.01.yy - 30.06.yy. Here, one day is missing,

- 31.12.xx and 01.01.yy - 30.06.yy. Here, one day is missing, the day from 31.12.xx- 01.01.yy!

Legal Aspects

The following explanations refer to the greatest possible extend on

the day from 31.12.xx- 01.01.yy!

Legal Aspects

The following explanations refer to the greatest possible extend on commercial law from 1. World countries, e.g. Middle-Europe, North-

commercial law from 1. World countries, e.g. Middle-Europe, North- America. But dependent on the specific country there may be clear

America. But dependent on the specific country there may be clear differences in the local law!

The substantial characteristics of a (money)loan is the obligation of

differences in the local law!

The substantial characteristics of a (money)loan is the obligation of the lender to deliver to the borrower a certain amount for a specific

the lender to deliver to the borrower a certain amount for a specific time by transfer of ownership (delivery-obligation) and the borrower

time by transfer of ownership (delivery-obligation) and the borrower has the obligation to repay the amount at the end (re-payment

has the obligation to repay the amount at the end (re-payment obligation). Additionally it is an essential attribute of the lender to

obligation). Additionally it is an essential attribute of the lender to leave the amount during the live-time of the loan at the borrower

leave the amount during the live-time of the loan at the borrower (relinquish-obligation).

However, the interest is for a loan not necessarely to be defined, as

(relinquish-obligation).

However, the interest is for a loan not necessarely to be defined, as exiting it may sound in the first moment. Because interest is not

exiting it may sound in the first moment. Because interest is not equal the loan, it is a separate item, i.e. the compensation of the

equal the loan, it is a separate item, i.e. the compensation of the lender for the usage of capital (= loan) during a certain period of

lender for the usage of capital (= loan) during a certain period of time. So, in common affairs interest is just payable if they had been

time. So, in common affairs interest is just payable if they had been agreed. Basically. But: in most of the laws there is an additional

agreed. Basically. But: in most of the laws there is an additional clause which says that in commercial business interest is payable

clause which says that in commercial business interest is payable also without a special agreement.

Interest has additionally fundamential legal characteristics: If an

also without a special agreement.

Interest has additionally fundamential legal characteristics: If an agreement for interest is missing, one may conclude that it is in fact

agreement for interest is missing, one may conclude that it is in fact not a loan in common sense, hence a repayment of the loan is not

not a loan in common sense, hence a repayment of the loan is not an obligation! This has impact especially in delicate situations, like

an obligation! This has impact especially in delicate situations, like insolvency of a group, where up- or cross-stream loans have been

insolvency of a group, where up- or cross-stream loans have been made between different legal firms; of course it is also an important

made between different legal firms; of course it is also an important topic for tax reasons. That means, it’s also a transfer pricing matter.

Last but not least it has to be mentioned that in many countries there

is no explicit duty to prepare a written loan agreement. For instance

topic for tax reasons. That means, it’s also a transfer pricing matter.

Last but not least it has to be mentioned that in many countries there

is no explicit duty to prepare a written loan agreement. For instance in Switzerland art. 11 sect. 1 in connection with art. 312 OR. Even

in Switzerland art. 11 sect. 1 in connection with art. 312 OR. Even this happen in some laws it is very important to point out here that

this happen in some laws it is very important to point out here that the consequences of missing writings may lead to serious problems

the consequences of missing writings may lead to serious problems at the lender and also at the borrower!

Legal Questions

at the lender and also at the borrower!

Legal Questions 1.

Liability questions - wrong issued or booked loans my lead to

1.

Liability questions - wrong issued or booked loans my lead to serious problems!

2.

Tax questions - transfer pricing: regarding internal loans;

serious problems!

2.

Tax questions - transfer pricing: regarding internal loans; dependent on the direction (see above) there may be too high

dependent on the direction (see above) there may be too high or to low interest rates applied and may be considered from

or to low interest rates applied and may be considered from the the tax departement as a hidden dividend.

3.

Documentation - is a written (legal binding) loan agreement

the the tax departement as a hidden dividend.

3.

Documentation - is a written (legal binding) loan agreement issued and in case of prolongation, correct adjusted?

Contents of a Loan

Every on commercial basic principles based loan should consider the

following points:

issued and in case of prolongation, correct adjusted?

Contents of a Loan

Every on commercial basic principles based loan should consider the

following points: 1.

Lender

2.

Borrower

3.

Date of Agreement

4.

Currency

5.

Amount

1.

Lender

2.

Borrower

3.

Date of Agreement

4.

Currency

5.

Amount 6.

Start- and Enddate

7.

Reference

8.

Nature of the loan (internal or external)

9.

Day count convention (Act/360, 30/360, Act/365, Act/Act)

10.

Interest definition (p.a., s.a.)

11.

Interst payment (fix, monthly, semi-annually etc.)

6.

Start- and Enddate

7.

Reference

8.

Nature of the loan (internal or external)

9.

Day count convention (Act/360, 30/360, Act/365, Act/Act)

10.

Interest definition (p.a., s.a.)

11.

Interst payment (fix, monthly, semi-annually etc.) 12.

Fix- or floating legs

13.

Account of the lender

14.

Account of the borrower

15.

A free text for remarks

16.

Interest fixing dates

12.

Fix- or floating legs

13.

Account of the lender

14.

Account of the borrower

15.

A free text for remarks

16.

Interest fixing dates 17.

Authorized signatures

Snake-Pits in the interest calculation

17.

Authorized signatures

Snake-Pits in the interest calculation Mainly corporates which have no specialized treasury software (e.g.

Mainly corporates which have no specialized treasury software (e.g. our system STS) calculate the interest in Excel and make sometimes

our system STS) calculate the interest in Excel and make sometimes errors in the interest calculation. In the following the main problem

errors in the interest calculation. In the following the main problem posings:

Day Count Convention

Depending on the currency and the duration of the loan there are

posings:

Day Count Convention

Depending on the currency and the duration of the loan there are different methods of calculating interest based on international best

different methods of calculating interest based on international best practice standards.

Example: Short-Term Loan, EUR for 1/2 year, 31.12.15 - 30.06.16

practice standards.

Example: Short-Term Loan, EUR for 1/2 year, 31.12.15 - 30.06.16  (2016 is a lump leap year)

1.

Act/360

(1’000’000 x 1.0% x 182) / 360 x 100 = 5’055.56

2.

30/360

(1’000’000 x 1.0% x 180) / 360 x 100 = 5’000.00

3.

Act/365

(1’000’000 x 1.0% x 182) / 365 x 100 = 4’986.30

4.

Act/Act

(1’000’000 x 1.0% x 182) / 366 x 100 = 4’972.68

In this example for the short-term loan in EUR for 1/2 year the day

(2016 is a lump leap year)

1.

Act/360

(1’000’000 x 1.0% x 182) / 360 x 100 = 5’055.56

2.

30/360

(1’000’000 x 1.0% x 180) / 360 x 100 = 5’000.00

3.

Act/365

(1’000’000 x 1.0% x 182) / 365 x 100 = 4’986.30

4.

Act/Act

(1’000’000 x 1.0% x 182) / 366 x 100 = 4’972.68

In this example for the short-term loan in EUR for 1/2 year the day count convention act/360 is correct. If others are applied, e.g.

count convention act/360 is correct. If others are applied, e.g. because of a lack of professional knowledge, wrong interest is

because of a lack of professional knowledge, wrong interest is applied.

Time

We often saw in financial departments the problem that days are

applied.

Time

We often saw in financial departments the problem that days are calculated wrong at all.

Example: A loan is agreed from Jan. 1st 2016 - Mar. 31st 2016 and

calculated wrong at all.

Example: A loan is agreed from Jan. 1st 2016 - Mar. 31st 2016 and is going to be prolongated until Jun. 30th 2016.

1.

01.01.16 - 31.03.16 and 01.04.16 - 30.06.16 = 90 days + 90

is going to be prolongated until Jun. 30th 2016.

1.

01.01.16 - 31.03.16 and 01.04.16 - 30.06.16 = 90 days + 90 days = 180 days

-> that’s wrong in two ways:

days = 180 days

-> that’s wrong in two ways:  a) Interest calculation starts just at the date when the funds are

on the account of the borrower (valude date, not booking

a) Interest calculation starts just at the date when the funds are

on the account of the borrower (valude date, not booking date). On 01.01.xx ni a year in most of the countries of the

date). On 01.01.xx ni a year in most of the countries of the world this is no working day, hence there can’t be a credit on

world this is no working day, hence there can’t be a credit on the account; earliest at 02.01.xx. But because 02.01.16 is a

the account; earliest at 02.01.xx. But because 02.01.16 is a saturday (we assume, the loan is between a british- and a

saturday (we assume, the loan is between a british- and a german company), the amount can be credited earliest on

german company), the amount can be credited earliest on 04.01.2016.

b) Between 31.03.16 and 01.04.2016 no interest was

04.01.2016.

b) Between 31.03.16 and 01.04.2016 no interest was calculated.

2.

04.01.16 - 31.03.16 und 31.03.16 - 30.06.16 = 87 days + 91

calculated.

2.

04.01.16 - 31.03.16 und 31.03.16 - 30.06.16 = 87 days + 91 days = 178 days.

Correct.

Interest Fixings

days = 178 days.

Correct.

Interest Fixings The most applied interest sources are the official fixings for instance

The most applied interest sources are the official fixings for instance LIBOR or EURIBOR. Those rates cover the period up to one year in

LIBOR or EURIBOR. Those rates cover the period up to one year in different time grids.

LIBOR: Overnight, 1 Week, 2 Weeks und then 1, 2, 3 ..12 Months

EURIBOR: 1 Week, 2 Weeks, 3 Weeks und then 1, 2, 3 .. 12 Months

different time grids.

LIBOR: Overnight, 1 Week, 2 Weeks und then 1, 2, 3 ..12 Months

EURIBOR: 1 Week, 2 Weeks, 3 Weeks und then 1, 2, 3 .. 12 Months Important to know is at a fixing that there is a difference between

Important to know is at a fixing that there is a difference between FIXING-DATE und VALUE-DATE. The Fixing-Date is always 2

FIXING-DATE und VALUE-DATE. The Fixing-Date is always 2 working days (of the currency, not the country) prior the date when

working days (of the currency, not the country) prior the date when funds are physically transferred.

Examples:

funds are physically transferred.

Examples: 3.

01.01.16 -> Value Date Monday, 04.01.16 -> Zinsfixing =

3.

01.01.16 -> Value Date Monday, 04.01.16 -> Zinsfixing = Wednesday, 30.12.2015

4.

15.03.16 -> Value Date Tuesday, 15.03.16 -> Zinsfixing =

Wednesday, 30.12.2015

4.

15.03.16 -> Value Date Tuesday, 15.03.16 -> Zinsfixing = Friday, 11.03.16

Last but not least: always distinguish between booking and value-

Friday, 11.03.16

Last but not least: always distinguish between booking and value- date!

Contact us, we would be glad to show you the possible

opportunities!

date!

Contact us, we would be glad to show you the possible

opportunities!