Stahr Treasury Software Help

Transactions - Menu LOANS and INVESTMENTS

All kind of loans and financial investements (in other words, money market transactions) are to be captured in this menu. The entries made can be used for

transactions) are to be captured in this menu. The entries made can be used for •

printing a loan / investment agreement, Reports -> Loan Agreement

•

printing a loan / investment agreement, Reports -> Loan Agreement •

periodical loan breakdown for the lending and borrowing party, showing for

•

periodical loan breakdown for the lending and borrowing party, showing for a defined period fixed, accrued and settled interest in local and group

a defined period fixed, accrued and settled interest in local and group currency, Reports -> Reports with a Period -> Loan Breakdown

currency, Reports -> Reports with a Period -> Loan Breakdown •

all new loans in a period (e.g. for accounting), Reports -> Reports with a

•

all new loans in a period (e.g. for accounting), Reports -> Reports with a Period -> New Loans,

Period -> New Loans, •

export for accounting, i.e. all interest details can be exportet for automatic

•

export for accounting, i.e. all interest details can be exportet for automatic bookings in your ERP -> Reports -> Reports with a Period -> Export for

bookings in your ERP -> Reports -> Reports with a Period -> Export for Accounting (need to be set-up individually),

Accounting (need to be set-up individually), •

External Financial Status Report, Reports -> Reports with a Fix Date ->

•

External Financial Status Report, Reports -> Reports with a Fix Date -> Financial Status Ext.

If you have questions regarding the navigation, please click here.

Financial Status Ext.

If you have questions regarding the navigation, please click here. Hint: read also our arcticle about loans in our info-section!

Hint: read also our arcticle about loans in our info-section! Fields:

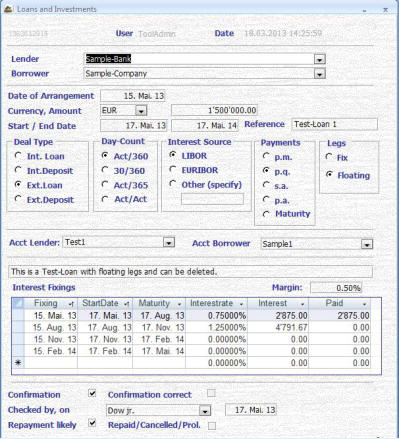

Lender: This may be an internal or external party who is lending funds to the borrower. Source is menu Standing Data -> Companies, for internal

Fields:

Lender: This may be an internal or external party who is lending funds to the borrower. Source is menu Standing Data -> Companies, for internal companies or Standing Data -> Banks, Fin. Institutions for external parties. Mandatory, pre-entered content.

companies or Standing Data -> Banks, Fin. Institutions for external parties. Mandatory, pre-entered content. Borrower: The same specifications like for the Lender. Mandatory, pre-entered content.

Borrower: The same specifications like for the Lender. Mandatory, pre-entered content. Date of Arrangement: Date at which the deal was agreed. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to

Date of Arrangement: Date at which the deal was agreed. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Currency: The currency of the loan / investment. Source is menu Standing Data -> Currencies. Mandatory, pre-entered content.

Currency: The currency of the loan / investment. Source is menu Standing Data -> Currencies. Mandatory, pre-entered content. Amount: Enter here the agreed amount, is always a positive number. Mandatory, free number.

Amount: Enter here the agreed amount, is always a positive number. Mandatory, free number. Start Date / End Date: This is the date when the deal is starting resp. ending. Mandatory, free date in the format of your computer (i.e., if your computer

Start Date / End Date: This is the date when the deal is starting resp. ending. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Reference: Important information to identify the deal. Mandatory, free text.

Reference: Important information to identify the deal. Mandatory, free text. Deal Type: There are 4 types of deals possible, select one of it. Mandatory, given content.

Deal Type: There are 4 types of deals possible, select one of it. Mandatory, given content. Day-Count: Definition of how to calculate the interest, see also definition here. Mandatory, given content.

Day-Count: Definition of how to calculate the interest, see also definition here. Mandatory, given content. Interest Source: Defines the source for the interest. The most populare can be simply selected, if there is another source, you can name it in the box

Interest Source: Defines the source for the interest. The most populare can be simply selected, if there is another source, you can name it in the box “other (specify)”. Mandatory, given content resp. free text.

“other (specify)”. Mandatory, given content resp. free text. Payments: This box is intended to define the interest payments. Those may be per month (p.m.), per quarter (p.q.), semi-annually (s.a.), annually

Payments: This box is intended to define the interest payments. Those may be per month (p.m.), per quarter (p.q.), semi-annually (s.a.), annually (p.a.) or just at maturity. Mandatory, given content.

Legs: There are two possibilities for interest legs, fix or floating. Choose one of them. Mandatory, given content

(p.a.) or just at maturity. Mandatory, given content.

Legs: There are two possibilities for interest legs, fix or floating. Choose one of them. Mandatory, given content Account Lender / Borrower: Select from the drop-down the account of the lender resp. borrower. Source is menu Standing Data -> Accounts.

Account Lender / Borrower: Select from the drop-down the account of the lender resp. borrower. Source is menu Standing Data -> Accounts.  Mandatory, pre-entered content.

Mandatory, pre-entered content. Remarks: Free text for any remarks. Optional, free text.

Remarks: Free text for any remarks. Optional, free text. Margin: In case you have a margin on the deal, mention it here. Note: this field has just informational character. Optional, free percentage number.

Margin: In case you have a margin on the deal, mention it here. Note: this field has just informational character. Optional, free percentage number. Submenu Interest Fixings

Submenu Interest Fixings This submenu is responsible for all interest legs, minimum 1 leg, no maximum number of legs. When entering a new loan or investment, enter all legs

This submenu is responsible for all interest legs, minimum 1 leg, no maximum number of legs. When entering a new loan or investment, enter all legs at the first time, but enter only interest rate per leg, when it is fixed.

Fixing: Fixing date of the interest leg. Typically, this date is 2 working days prior the starting date of the leg. Mandatory, free date.

at the first time, but enter only interest rate per leg, when it is fixed.

Fixing: Fixing date of the interest leg. Typically, this date is 2 working days prior the starting date of the leg. Mandatory, free date. Start Date: Date, when the interest is starting to be counted (depending on the day count convention - see above - this date is including or not).

Start Date: Date, when the interest is starting to be counted (depending on the day count convention - see above - this date is including or not). Mandatory, free date.

Mandatory, free date. Maturity: Date, when the interest is ending to be counted (depending on the day count convention - see above - this date is including or not).

Maturity: Date, when the interest is ending to be counted (depending on the day count convention - see above - this date is including or not). Mandatory, free date.

Mandatory, free date. Interest Rate: Interest Rate for the interest leg. Note: in case you have margin on the interest, you must add it manually. Optional, free percentage

Interest Rate: Interest Rate for the interest leg. Note: in case you have margin on the interest, you must add it manually. Optional, free percentage number.

Interest: Very helpful for the person how enters a deal: depending on the day count convention, the start- and end date and the interest rate, this

number.

Interest: Very helpful for the person how enters a deal: depending on the day count convention, the start- and end date and the interest rate, this value is calculated automatically. Nevertheless, you can edit it manually. Optional resp. automatic calculation.

Paid: Enter here the amount which has been paid by the borrower. Optional, frree number.

value is calculated automatically. Nevertheless, you can edit it manually. Optional resp. automatic calculation.

Paid: Enter here the amount which has been paid by the borrower. Optional, frree number. Confirmation: Every loan / investement should be checked with confirmations. If you get from your external bank a confirmation or you sent your

Confirmation: Every loan / investement should be checked with confirmations. If you get from your external bank a confirmation or you sent your confirmation to your internal party and they sent it back, set a tick this box. Important: If you have not confirmed the deal, you will be remembered

confirmation to your internal party and they sent it back, set a tick this box. Important: If you have not confirmed the deal, you will be remembered every time by the software when starting it with a pop up, called “Missing Loan Confirmation”. Optional, Y/N.

every time by the software when starting it with a pop up, called “Missing Loan Confirmation”. Optional, Y/N. Confirmation correct: Even you got a confirmation, it may be not correct. Check this box if the confirmation is correct. Optional, Y/N.

Confirmation correct: Even you got a confirmation, it may be not correct. Check this box if the confirmation is correct. Optional, Y/N.  Checked by: The confirmation process is quite important and therefore the person who is responsible for checking the deal need to be mentioned in

Checked by: The confirmation process is quite important and therefore the person who is responsible for checking the deal need to be mentioned in this field. Source is Standing Data -> Persons. Optional, pre-entered content.

this field. Source is Standing Data -> Persons. Optional, pre-entered content. Checked on: This is the date when having checked the confirmation. Optional, free date in the format of your computer (i.e., if your computer settings are set

Checked on: This is the date when having checked the confirmation. Optional, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Repayment likely: Mark here if the repayment is likely. This has just informational character but helps the Treasurer to identify future cash flows for

Repayment likely: Mark here if the repayment is likely. This has just informational character but helps the Treasurer to identify future cash flows for the likelihood in the liquidity planning process. Optional, Y/N.

the likelihood in the liquidity planning process. Optional, Y/N. Repaid / Cancelled / Prolongated: If the deal is no longer active, tick this box. Optional, Y/N.

Repaid / Cancelled / Prolongated: If the deal is no longer active, tick this box. Optional, Y/N.

transactions) are to be captured in this menu. The entries made can be used for

transactions) are to be captured in this menu. The entries made can be used for •

printing a loan / investment agreement, Reports -> Loan Agreement

•

printing a loan / investment agreement, Reports -> Loan Agreement •

periodical loan breakdown for the lending and borrowing party, showing for

•

periodical loan breakdown for the lending and borrowing party, showing for a defined period fixed, accrued and settled interest in local and group

a defined period fixed, accrued and settled interest in local and group currency, Reports -> Reports with a Period -> Loan Breakdown

currency, Reports -> Reports with a Period -> Loan Breakdown •

all new loans in a period (e.g. for accounting), Reports -> Reports with a

•

all new loans in a period (e.g. for accounting), Reports -> Reports with a Period -> New Loans,

Period -> New Loans, •

export for accounting, i.e. all interest details can be exportet for automatic

•

export for accounting, i.e. all interest details can be exportet for automatic bookings in your ERP -> Reports -> Reports with a Period -> Export for

bookings in your ERP -> Reports -> Reports with a Period -> Export for Accounting (need to be set-up individually),

Accounting (need to be set-up individually), •

External Financial Status Report, Reports -> Reports with a Fix Date ->

•

External Financial Status Report, Reports -> Reports with a Fix Date -> Financial Status Ext.

If you have questions regarding the navigation, please click here.

Financial Status Ext.

If you have questions regarding the navigation, please click here. Hint: read also our arcticle about loans in our info-section!

Hint: read also our arcticle about loans in our info-section! Fields:

Lender: This may be an internal or external party who is lending funds to the borrower. Source is menu Standing Data -> Companies, for internal

Fields:

Lender: This may be an internal or external party who is lending funds to the borrower. Source is menu Standing Data -> Companies, for internal companies or Standing Data -> Banks, Fin. Institutions for external parties. Mandatory, pre-entered content.

companies or Standing Data -> Banks, Fin. Institutions for external parties. Mandatory, pre-entered content. Borrower: The same specifications like for the Lender. Mandatory, pre-entered content.

Borrower: The same specifications like for the Lender. Mandatory, pre-entered content. Date of Arrangement: Date at which the deal was agreed. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to

Date of Arrangement: Date at which the deal was agreed. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Currency: The currency of the loan / investment. Source is menu Standing Data -> Currencies. Mandatory, pre-entered content.

Currency: The currency of the loan / investment. Source is menu Standing Data -> Currencies. Mandatory, pre-entered content. Amount: Enter here the agreed amount, is always a positive number. Mandatory, free number.

Amount: Enter here the agreed amount, is always a positive number. Mandatory, free number. Start Date / End Date: This is the date when the deal is starting resp. ending. Mandatory, free date in the format of your computer (i.e., if your computer

Start Date / End Date: This is the date when the deal is starting resp. ending. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Reference: Important information to identify the deal. Mandatory, free text.

Reference: Important information to identify the deal. Mandatory, free text. Deal Type: There are 4 types of deals possible, select one of it. Mandatory, given content.

Deal Type: There are 4 types of deals possible, select one of it. Mandatory, given content. Day-Count: Definition of how to calculate the interest, see also definition here. Mandatory, given content.

Day-Count: Definition of how to calculate the interest, see also definition here. Mandatory, given content. Interest Source: Defines the source for the interest. The most populare can be simply selected, if there is another source, you can name it in the box

Interest Source: Defines the source for the interest. The most populare can be simply selected, if there is another source, you can name it in the box “other (specify)”. Mandatory, given content resp. free text.

“other (specify)”. Mandatory, given content resp. free text. Payments: This box is intended to define the interest payments. Those may be per month (p.m.), per quarter (p.q.), semi-annually (s.a.), annually

Payments: This box is intended to define the interest payments. Those may be per month (p.m.), per quarter (p.q.), semi-annually (s.a.), annually (p.a.) or just at maturity. Mandatory, given content.

Legs: There are two possibilities for interest legs, fix or floating. Choose one of them. Mandatory, given content

(p.a.) or just at maturity. Mandatory, given content.

Legs: There are two possibilities for interest legs, fix or floating. Choose one of them. Mandatory, given content Account Lender / Borrower: Select from the drop-down the account of the lender resp. borrower. Source is menu Standing Data -> Accounts.

Account Lender / Borrower: Select from the drop-down the account of the lender resp. borrower. Source is menu Standing Data -> Accounts.  Mandatory, pre-entered content.

Mandatory, pre-entered content. Remarks: Free text for any remarks. Optional, free text.

Remarks: Free text for any remarks. Optional, free text. Margin: In case you have a margin on the deal, mention it here. Note: this field has just informational character. Optional, free percentage number.

Margin: In case you have a margin on the deal, mention it here. Note: this field has just informational character. Optional, free percentage number. Submenu Interest Fixings

Submenu Interest Fixings This submenu is responsible for all interest legs, minimum 1 leg, no maximum number of legs. When entering a new loan or investment, enter all legs

This submenu is responsible for all interest legs, minimum 1 leg, no maximum number of legs. When entering a new loan or investment, enter all legs at the first time, but enter only interest rate per leg, when it is fixed.

Fixing: Fixing date of the interest leg. Typically, this date is 2 working days prior the starting date of the leg. Mandatory, free date.

at the first time, but enter only interest rate per leg, when it is fixed.

Fixing: Fixing date of the interest leg. Typically, this date is 2 working days prior the starting date of the leg. Mandatory, free date. Start Date: Date, when the interest is starting to be counted (depending on the day count convention - see above - this date is including or not).

Start Date: Date, when the interest is starting to be counted (depending on the day count convention - see above - this date is including or not). Mandatory, free date.

Mandatory, free date. Maturity: Date, when the interest is ending to be counted (depending on the day count convention - see above - this date is including or not).

Maturity: Date, when the interest is ending to be counted (depending on the day count convention - see above - this date is including or not). Mandatory, free date.

Mandatory, free date. Interest Rate: Interest Rate for the interest leg. Note: in case you have margin on the interest, you must add it manually. Optional, free percentage

Interest Rate: Interest Rate for the interest leg. Note: in case you have margin on the interest, you must add it manually. Optional, free percentage number.

Interest: Very helpful for the person how enters a deal: depending on the day count convention, the start- and end date and the interest rate, this

number.

Interest: Very helpful for the person how enters a deal: depending on the day count convention, the start- and end date and the interest rate, this value is calculated automatically. Nevertheless, you can edit it manually. Optional resp. automatic calculation.

Paid: Enter here the amount which has been paid by the borrower. Optional, frree number.

value is calculated automatically. Nevertheless, you can edit it manually. Optional resp. automatic calculation.

Paid: Enter here the amount which has been paid by the borrower. Optional, frree number. Confirmation: Every loan / investement should be checked with confirmations. If you get from your external bank a confirmation or you sent your

Confirmation: Every loan / investement should be checked with confirmations. If you get from your external bank a confirmation or you sent your confirmation to your internal party and they sent it back, set a tick this box. Important: If you have not confirmed the deal, you will be remembered

confirmation to your internal party and they sent it back, set a tick this box. Important: If you have not confirmed the deal, you will be remembered every time by the software when starting it with a pop up, called “Missing Loan Confirmation”. Optional, Y/N.

every time by the software when starting it with a pop up, called “Missing Loan Confirmation”. Optional, Y/N. Confirmation correct: Even you got a confirmation, it may be not correct. Check this box if the confirmation is correct. Optional, Y/N.

Confirmation correct: Even you got a confirmation, it may be not correct. Check this box if the confirmation is correct. Optional, Y/N.  Checked by: The confirmation process is quite important and therefore the person who is responsible for checking the deal need to be mentioned in

Checked by: The confirmation process is quite important and therefore the person who is responsible for checking the deal need to be mentioned in this field. Source is Standing Data -> Persons. Optional, pre-entered content.

this field. Source is Standing Data -> Persons. Optional, pre-entered content. Checked on: This is the date when having checked the confirmation. Optional, free date in the format of your computer (i.e., if your computer settings are set

Checked on: This is the date when having checked the confirmation. Optional, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Repayment likely: Mark here if the repayment is likely. This has just informational character but helps the Treasurer to identify future cash flows for

Repayment likely: Mark here if the repayment is likely. This has just informational character but helps the Treasurer to identify future cash flows for the likelihood in the liquidity planning process. Optional, Y/N.

the likelihood in the liquidity planning process. Optional, Y/N. Repaid / Cancelled / Prolongated: If the deal is no longer active, tick this box. Optional, Y/N.

Repaid / Cancelled / Prolongated: If the deal is no longer active, tick this box. Optional, Y/N.