Stahr Treasury Software Help

Reporting - LOAN / INVESTMENT AGREEMENT

Loan Agreements are essential for every agreed debt or investment. Often

such agreements are just rarely prepared. Stahr Treasury Tool allows the

user to print such an agreement fast, safe and efficient.

The legal background should be part of a Treasury Policy, chapter “Master

/ Legal Agreements” as Stahr GmbH - Treasury Consulting offers it here.

A loan agreement is issued right after the trader has entered the deal and

then forwarded the agreement to the counterparty, if appropriate. That

means, if the deal is made with an external bank, usually the bank sends

the legal agreement. Nevertheless, most loan agreements are internal

and daily business of every treasury department. This loan agreement

might be also used for authorizing the payments regarding that deal. To

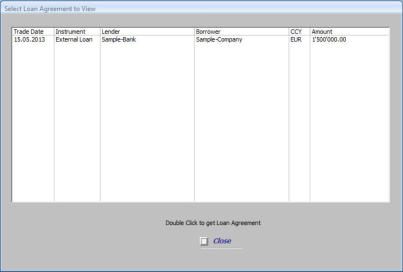

select the loan agreement to be printed, double-click on one of the deals

mentioned in the list. This list shows all deals available in the system, sorted by deal date in descending order.

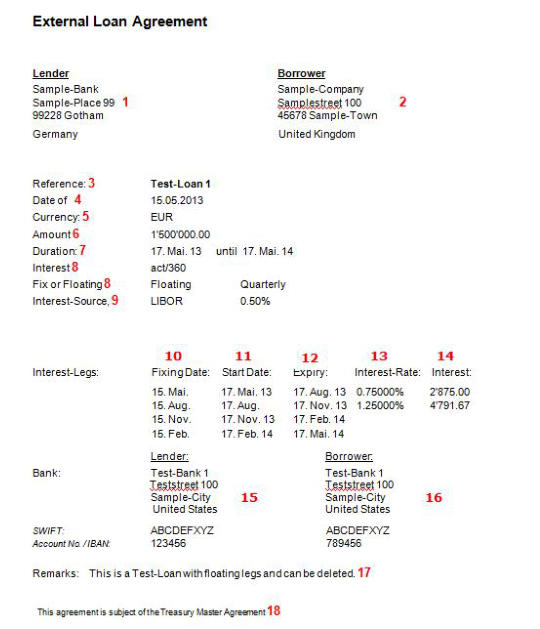

The definition of external or internal Loan Agreement in the header is defined by the entry made in the Loan Menu by selecting the instrument (deal

type).

Fields:

1.

Lender: That’s the external or internal lending

party incl. full address.

2.

Borrower: That’s the external or internal

borrowing party incl. full address.

3.

Reference: Reference of the agreement.

4.

Date of: Deal date, date of agreement.

5.

Currency: Currency of the loan.

6.

Amount: Amount of the loan.

7.

Duration: Duration of the agreement with start

date and end date (both incl. that date).

8.

Interest: The day count convention.

9.

Interest Source, Margin: Source of the interest,

e.g. LIBOR and Margin on the interest rate

mentioned in 13. below.

10.

Fixing Date: The fixing date of the interest leg,

usually 2 working days prior the start date.

11.

Start Date: Start date of the interest leg.

Depending on the day count convention incl. or

excluding that date.

12.

Expiry: Expiry or maturity date of the interest leg.

Depending on the day count convention incl. or

excluding that date.

13.

Interest Rate: The interest rate for the specific

interest leg, including margin.

14.

Interest: Automatic calculated interest of the

interest leg depending on the various parameters.

For more info read the help in menu Transactions

-> Loans/Investments.

15.

Lender: Bankinformation of the lender incl. all

necessary payment instructions.

16.

Borrower: Bankinformation of the borrower incl. all necessary payment instructions.

17.

Remarks: Any free remarks.

18.

Legal Notice: A loan agreement is an important legal document and need to be as clear as possible including all legal aspects. Because

especially the legal items require large documentation, this part should be integrated in a separate frame-agreement as we recommend it in our

treasury policy, section master agreement. Thus, the loan agreement can be as lean as possible, concentrating only on the technical details

and all other items, e.g. what happens if the borrower comes into default etc. are agreed separately for all loan agreements.