Stahr Treasury Software Help

Reporting - LIQUIDITY PLANS

Liquidity Planning is the primary key-objective of every

Treasury department and it doesn’t matter how large a

company is, every enteprise needs a professional liquidity

reporting. Planning is the one, it can be just simple like

Account Beginning

- Expenses

+ Earngings

= Account End

But this is never sufficient to cover the needs of a group,

especially, if multiple currencies play a role. Hence, the key is

how to report the cash flows.

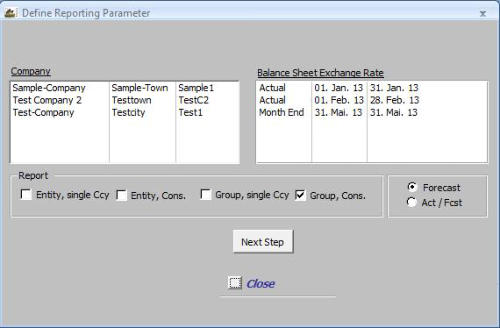

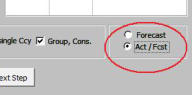

Depending whether you like to perform a report for a single

Entity or Group, by single transaction currency or

consolidated, you need to select the necessary parameter in

this primary selection menu (see left).

Select then the report of your desire in the frame “Report” and click on “Forecast” to get a a forecast report or “Act / Fcst” to get an actual / forecast

comparison. Click then on the button “Next Step”.

Forecast Reports

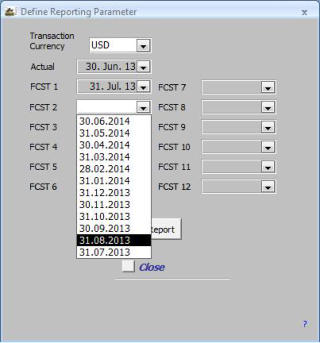

Fields:

[Transaction] Currency: The currency of the cash flows. Source is menu Standing Data -> Currencies. If you selected in the previous step “Entity, Cons.” or “Group, Cons”, the

Currencies. If you selected in the previous step “Entity, Cons.” or “Group, Cons”, the definition of this field changes from Transaction Currency to Consolidation Currency.

definition of this field changes from Transaction Currency to Consolidation Currency. Mandatory, pre-entered content.

Mandatory, pre-entered content. Actual: Every liquidity reports start with an actual value and monitor then future cash-flows

Actual: Every liquidity reports start with an actual value and monitor then future cash-flows starting at this point. Hence, you need to select a valid actual-date.

starting at this point. Hence, you need to select a valid actual-date. Hint: only dates for which transactions have been entered as an actual cash-flow are

Hint: only dates for which transactions have been entered as an actual cash-flow are possible to be selected. That means, if there is a cash-flow for a specific entity in USD

possible to be selected. That means, if there is a cash-flow for a specific entity in USD available but no one in EUR, the reporting dates appear only if in the field currency above

available but no one in EUR, the reporting dates appear only if in the field currency above USD is selected. For any other currency no date is available.

USD is selected. For any other currency no date is available. FCST [1 to 12]: Same like in the field Actual above, just with the difference that only dates

FCST [1 to 12]: Same like in the field Actual above, just with the difference that only dates for previously entered Forecast-Transactions are possible to be selected.

for previously entered Forecast-Transactions are possible to be selected. You must select at least an actual-date and may add up to 12 forecast dates.

Single Entity, transactions for a specific currency

You must select at least an actual-date and may add up to 12 forecast dates.

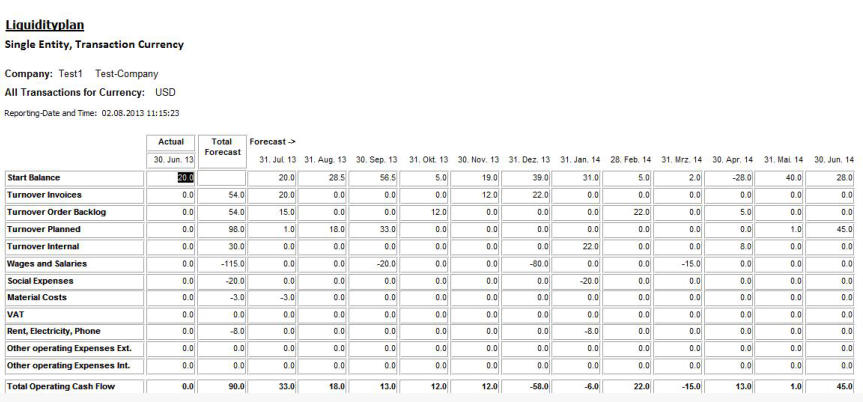

Single Entity, transactions for a specific currency This report show all transactions for the currency in which they have been entered. Note: this is not a re-calculation in a any reporting currency, it is

This report show all transactions for the currency in which they have been entered. Note: this is not a re-calculation in a any reporting currency, it is a report to monitor the cash-flow only in this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next

a report to monitor the cash-flow only in this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next article below.

article below. The vertical segregation is the same as it has been entered in menu Transactions -> Liquidity Plan. That means, the report monitors cash-flows

The vertical segregation is the same as it has been entered in menu Transactions -> Liquidity Plan. That means, the report monitors cash-flows segregated in operational-, investment-, interest-, financing- and other cash-flow. This allows the reader of the report to identify immediately at a

segregated in operational-, investment-, interest-, financing- and other cash-flow. This allows the reader of the report to identify immediately at a glance where how much cash has been collected or spend.

glance where how much cash has been collected or spend. The horizontal gaps reflect in the first column the actual values as starting point, followed by a total column for all forecast gaps and then for each

The horizontal gaps reflect in the first column the actual values as starting point, followed by a total column for all forecast gaps and then for each gap the single values.

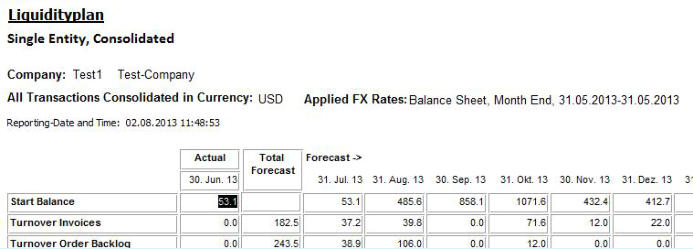

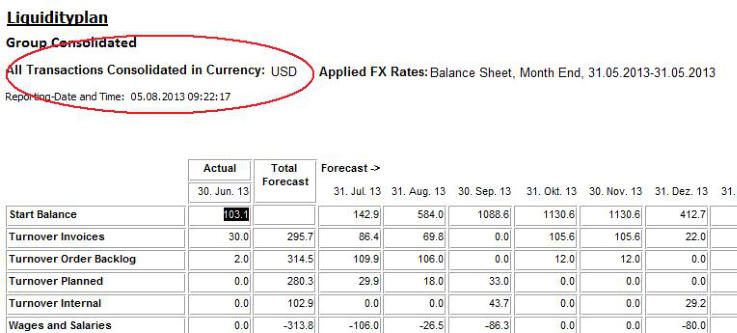

gap the single values. Single Entity, consolidated

Single Entity, consolidated The segregation is same like above, just with following differences:

The segregation is same like above, just with following differences: •

All transactions are

consolidated in the

desired currency;

•

The exchange rate of

the consolidation is

mentioned

Group, all transactions for a specific currency

•

All transactions are

consolidated in the

desired currency;

•

The exchange rate of

the consolidation is

mentioned

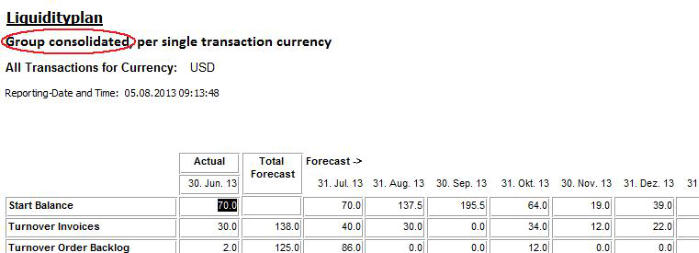

Group, all transactions for a specific currency The group-report contains all entities and has the same reporting structure as mentioned above. The flag whether a company is internal or external

The group-report contains all entities and has the same reporting structure as mentioned above. The flag whether a company is internal or external is made in menu Standing Data -> Companies -> Internal Flag. That means for this report, it monitors all existing transactions in a specific currency.

is made in menu Standing Data -> Companies -> Internal Flag. That means for this report, it monitors all existing transactions in a specific currency. Note: this is not a re-calculation into any reporting currency, it is a report to monitor the cash-flow only in this single one currency. If you like to

Note: this is not a re-calculation into any reporting currency, it is a report to monitor the cash-flow only in this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next article below.

Group,consolidated (overall)

This is the ultimate top-consolidation report all over the group. That means, all cash-flows for all currencies and all entities consolidated at the

see cash-flows consolidated in a specific currency, read the next article below.

Group,consolidated (overall)

This is the ultimate top-consolidation report all over the group. That means, all cash-flows for all currencies and all entities consolidated at the desired exchange rate. If you like to know what your total predicted cash-flow situation over-all is, select this report. Also here, the structure is same

desired exchange rate. If you like to know what your total predicted cash-flow situation over-all is, select this report. Also here, the structure is same like above.

like above.  Actual / Forecast Comparison

Actual / Forecast Comparison Every Treasurer know this situation: the actual result of liquiquidity reporting is often quite far away from the result origininally forecasted. There is

Every Treasurer know this situation: the actual result of liquiquidity reporting is often quite far away from the result origininally forecasted. There is only one instrument to analyse the reason of the differences: an actual vs. forecast comparison. This allows the Treasurer to monitor the specific

only one instrument to analyse the reason of the differences: an actual vs. forecast comparison. This allows the Treasurer to monitor the specific items of wrong forecasts. For instance, an entity may report all numbers quite correct, but has problems to predict interest items. The basic

items of wrong forecasts. For instance, an entity may report all numbers quite correct, but has problems to predict interest items. The basic difference is acknowledged just in the balance of the (bank)-account(s), but this does not allow to identify where the difference has happend.

difference is acknowledged just in the balance of the (bank)-account(s), but this does not allow to identify where the difference has happend. Stahr Treasury Software (STS) has an Actual vs. Forecast comparison module included which allows the user to identify very exactly how much and

Stahr Treasury Software (STS) has an Actual vs. Forecast comparison module included which allows the user to identify very exactly how much and where differences occur.

where differences occur. By selecting the option Act/Fcst in the primary selection window

(further details see on top of this site), a new window will open.

By selecting the option Act/Fcst in the primary selection window

(further details see on top of this site), a new window will open.  The basic principles are the same like for the forecast reports,

The basic principles are the same like for the forecast reports, just with the difference that now the user may select up to 3 actual and 3 forecast gaps. All other

just with the difference that now the user may select up to 3 actual and 3 forecast gaps. All other components, like selecting the kind of report, the company or the exchange rate is done in the

components, like selecting the kind of report, the company or the exchange rate is done in the previous step, see above.

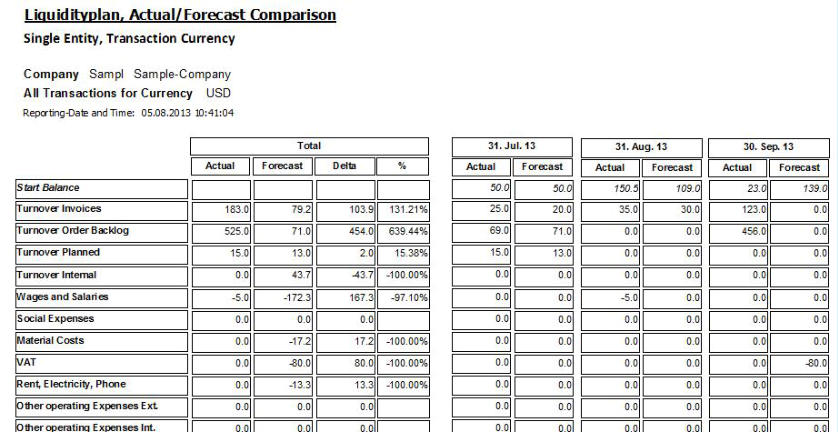

previous step, see above. Single Entity, transactions for a specific currency

Single Entity, transactions for a specific currency This report shows for all gaps each one actual and one forecast column. (Note: the date of the gap is based on the selected actual date). The first

This report shows for all gaps each one actual and one forecast column. (Note: the date of the gap is based on the selected actual date). The first Total-Block contains all actual values, all forecast values, the difference (Delta) of those two and the difference in % based on the forecast number.

Total-Block contains all actual values, all forecast values, the difference (Delta) of those two and the difference in % based on the forecast number. Same as described in the forecast report above, this single entity transaction currency report shows all transactions in the currency previously

Same as described in the forecast report above, this single entity transaction currency report shows all transactions in the currency previously entered in menu Transactions -> Liquidity Plan for the desired company only. If you like to see a report for all transactions consolidated, see below.

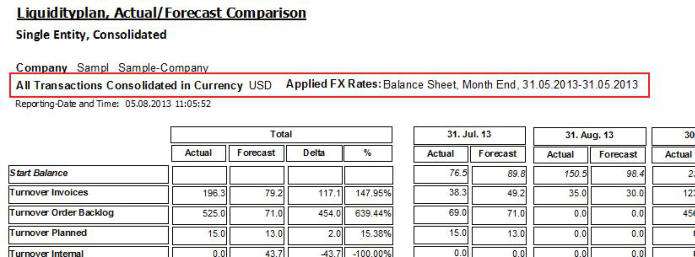

entered in menu Transactions -> Liquidity Plan for the desired company only. If you like to see a report for all transactions consolidated, see below. Single Entity, consolidated

Single Entity, consolidated The segregation is same like above, just with following differences:

The segregation is same like above, just with following differences: •

All transactions are

consolidated in the

desired currency;

•

The exchange rate of

the consolidation is

mentioned

Group, all transactions for a specific currency

•

All transactions are

consolidated in the

desired currency;

•

The exchange rate of

the consolidation is

mentioned

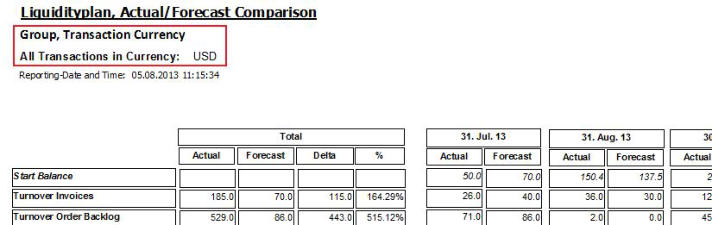

Group, all transactions for a specific currency The group-report

The group-report contains all entities and

contains all entities and has the same reporting

has the same reporting structure as mentioned

structure as mentioned above. The flag whether

above. The flag whether a company is internal or

a company is internal or external is made in menu

external is made in menu Standing Data ->

Standing Data -> Companies -> Internal

Companies -> Internal Flag. That means for this

Flag. That means for this report, it monitors all

report, it monitors all existing transactions in a specific currency. Note: this is not a re-calculation into any reporting currency, it is a report to monitor the cash-flow only in

this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next article below.

existing transactions in a specific currency. Note: this is not a re-calculation into any reporting currency, it is a report to monitor the cash-flow only in

this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next article below. Group, consolidated (overall)

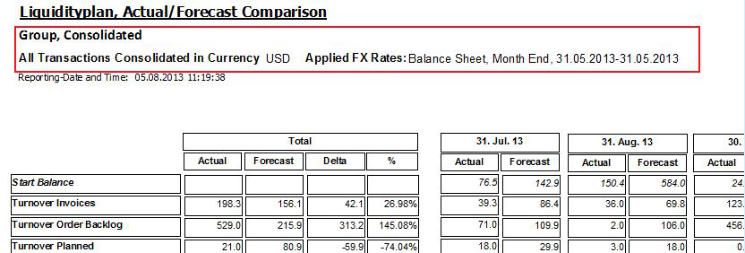

This is the ultimate top-consolidation report all over the group. That means, all cash-flows for all currencies and all entities consolidated at the

Group, consolidated (overall)

This is the ultimate top-consolidation report all over the group. That means, all cash-flows for all currencies and all entities consolidated at the desired exchange rate. If you like to know what your total predicted cash-flow situation is over-all, select this report. Also here, the structure is same

desired exchange rate. If you like to know what your total predicted cash-flow situation is over-all, select this report. Also here, the structure is same like above.

like above.

Currencies. If you selected in the previous step “Entity, Cons.” or “Group, Cons”, the

Currencies. If you selected in the previous step “Entity, Cons.” or “Group, Cons”, the definition of this field changes from Transaction Currency to Consolidation Currency.

definition of this field changes from Transaction Currency to Consolidation Currency. Mandatory, pre-entered content.

Mandatory, pre-entered content. Actual: Every liquidity reports start with an actual value and monitor then future cash-flows

Actual: Every liquidity reports start with an actual value and monitor then future cash-flows starting at this point. Hence, you need to select a valid actual-date.

starting at this point. Hence, you need to select a valid actual-date. Hint: only dates for which transactions have been entered as an actual cash-flow are

Hint: only dates for which transactions have been entered as an actual cash-flow are possible to be selected. That means, if there is a cash-flow for a specific entity in USD

possible to be selected. That means, if there is a cash-flow for a specific entity in USD available but no one in EUR, the reporting dates appear only if in the field currency above

available but no one in EUR, the reporting dates appear only if in the field currency above USD is selected. For any other currency no date is available.

USD is selected. For any other currency no date is available. FCST [1 to 12]: Same like in the field Actual above, just with the difference that only dates

FCST [1 to 12]: Same like in the field Actual above, just with the difference that only dates for previously entered Forecast-Transactions are possible to be selected.

for previously entered Forecast-Transactions are possible to be selected. You must select at least an actual-date and may add up to 12 forecast dates.

Single Entity, transactions for a specific currency

You must select at least an actual-date and may add up to 12 forecast dates.

Single Entity, transactions for a specific currency This report show all transactions for the currency in which they have been entered. Note: this is not a re-calculation in a any reporting currency, it is

This report show all transactions for the currency in which they have been entered. Note: this is not a re-calculation in a any reporting currency, it is a report to monitor the cash-flow only in this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next

a report to monitor the cash-flow only in this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next article below.

article below. The vertical segregation is the same as it has been entered in menu Transactions -> Liquidity Plan. That means, the report monitors cash-flows

The vertical segregation is the same as it has been entered in menu Transactions -> Liquidity Plan. That means, the report monitors cash-flows segregated in operational-, investment-, interest-, financing- and other cash-flow. This allows the reader of the report to identify immediately at a

segregated in operational-, investment-, interest-, financing- and other cash-flow. This allows the reader of the report to identify immediately at a glance where how much cash has been collected or spend.

glance where how much cash has been collected or spend. The horizontal gaps reflect in the first column the actual values as starting point, followed by a total column for all forecast gaps and then for each

The horizontal gaps reflect in the first column the actual values as starting point, followed by a total column for all forecast gaps and then for each gap the single values.

gap the single values. Single Entity, consolidated

Single Entity, consolidated The segregation is same like above, just with following differences:

The segregation is same like above, just with following differences: •

All transactions are

consolidated in the

desired currency;

•

The exchange rate of

the consolidation is

mentioned

Group, all transactions for a specific currency

•

All transactions are

consolidated in the

desired currency;

•

The exchange rate of

the consolidation is

mentioned

Group, all transactions for a specific currency The group-report contains all entities and has the same reporting structure as mentioned above. The flag whether a company is internal or external

The group-report contains all entities and has the same reporting structure as mentioned above. The flag whether a company is internal or external is made in menu Standing Data -> Companies -> Internal Flag. That means for this report, it monitors all existing transactions in a specific currency.

is made in menu Standing Data -> Companies -> Internal Flag. That means for this report, it monitors all existing transactions in a specific currency. Note: this is not a re-calculation into any reporting currency, it is a report to monitor the cash-flow only in this single one currency. If you like to

Note: this is not a re-calculation into any reporting currency, it is a report to monitor the cash-flow only in this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next article below.

Group,consolidated (overall)

This is the ultimate top-consolidation report all over the group. That means, all cash-flows for all currencies and all entities consolidated at the

see cash-flows consolidated in a specific currency, read the next article below.

Group,consolidated (overall)

This is the ultimate top-consolidation report all over the group. That means, all cash-flows for all currencies and all entities consolidated at the desired exchange rate. If you like to know what your total predicted cash-flow situation over-all is, select this report. Also here, the structure is same

desired exchange rate. If you like to know what your total predicted cash-flow situation over-all is, select this report. Also here, the structure is same like above.

like above.  Actual / Forecast Comparison

Actual / Forecast Comparison Every Treasurer know this situation: the actual result of liquiquidity reporting is often quite far away from the result origininally forecasted. There is

Every Treasurer know this situation: the actual result of liquiquidity reporting is often quite far away from the result origininally forecasted. There is only one instrument to analyse the reason of the differences: an actual vs. forecast comparison. This allows the Treasurer to monitor the specific

only one instrument to analyse the reason of the differences: an actual vs. forecast comparison. This allows the Treasurer to monitor the specific items of wrong forecasts. For instance, an entity may report all numbers quite correct, but has problems to predict interest items. The basic

items of wrong forecasts. For instance, an entity may report all numbers quite correct, but has problems to predict interest items. The basic difference is acknowledged just in the balance of the (bank)-account(s), but this does not allow to identify where the difference has happend.

difference is acknowledged just in the balance of the (bank)-account(s), but this does not allow to identify where the difference has happend. Stahr Treasury Software (STS) has an Actual vs. Forecast comparison module included which allows the user to identify very exactly how much and

Stahr Treasury Software (STS) has an Actual vs. Forecast comparison module included which allows the user to identify very exactly how much and where differences occur.

where differences occur. By selecting the option Act/Fcst in the primary selection window

(further details see on top of this site), a new window will open.

By selecting the option Act/Fcst in the primary selection window

(further details see on top of this site), a new window will open.  The basic principles are the same like for the forecast reports,

The basic principles are the same like for the forecast reports, just with the difference that now the user may select up to 3 actual and 3 forecast gaps. All other

just with the difference that now the user may select up to 3 actual and 3 forecast gaps. All other components, like selecting the kind of report, the company or the exchange rate is done in the

components, like selecting the kind of report, the company or the exchange rate is done in the previous step, see above.

previous step, see above. Single Entity, transactions for a specific currency

Single Entity, transactions for a specific currency This report shows for all gaps each one actual and one forecast column. (Note: the date of the gap is based on the selected actual date). The first

This report shows for all gaps each one actual and one forecast column. (Note: the date of the gap is based on the selected actual date). The first Total-Block contains all actual values, all forecast values, the difference (Delta) of those two and the difference in % based on the forecast number.

Total-Block contains all actual values, all forecast values, the difference (Delta) of those two and the difference in % based on the forecast number. Same as described in the forecast report above, this single entity transaction currency report shows all transactions in the currency previously

Same as described in the forecast report above, this single entity transaction currency report shows all transactions in the currency previously entered in menu Transactions -> Liquidity Plan for the desired company only. If you like to see a report for all transactions consolidated, see below.

entered in menu Transactions -> Liquidity Plan for the desired company only. If you like to see a report for all transactions consolidated, see below. Single Entity, consolidated

Single Entity, consolidated The segregation is same like above, just with following differences:

The segregation is same like above, just with following differences: •

All transactions are

consolidated in the

desired currency;

•

The exchange rate of

the consolidation is

mentioned

Group, all transactions for a specific currency

•

All transactions are

consolidated in the

desired currency;

•

The exchange rate of

the consolidation is

mentioned

Group, all transactions for a specific currency The group-report

The group-report contains all entities and

contains all entities and has the same reporting

has the same reporting structure as mentioned

structure as mentioned above. The flag whether

above. The flag whether a company is internal or

a company is internal or external is made in menu

external is made in menu Standing Data ->

Standing Data -> Companies -> Internal

Companies -> Internal Flag. That means for this

Flag. That means for this report, it monitors all

report, it monitors all existing transactions in a specific currency. Note: this is not a re-calculation into any reporting currency, it is a report to monitor the cash-flow only in

this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next article below.

existing transactions in a specific currency. Note: this is not a re-calculation into any reporting currency, it is a report to monitor the cash-flow only in

this single one currency. If you like to see cash-flows consolidated in a specific currency, read the next article below. Group, consolidated (overall)

This is the ultimate top-consolidation report all over the group. That means, all cash-flows for all currencies and all entities consolidated at the

Group, consolidated (overall)

This is the ultimate top-consolidation report all over the group. That means, all cash-flows for all currencies and all entities consolidated at the desired exchange rate. If you like to know what your total predicted cash-flow situation is over-all, select this report. Also here, the structure is same

desired exchange rate. If you like to know what your total predicted cash-flow situation is over-all, select this report. Also here, the structure is same like above.

like above.