Stahr Treasury Software Help

Reporting - NETTING INVOICE & EXPORT

To get an overview about Netting

as a topic, please read our arcticle.

All single intercompany invoices

previously captured in menu

Transactions -> Netting are

summarized in this reporting as an

invoice, a pre-check to minimize

the monthly reconcilation efforts

and to export in to a free definable

format according Microsoft

supported files.

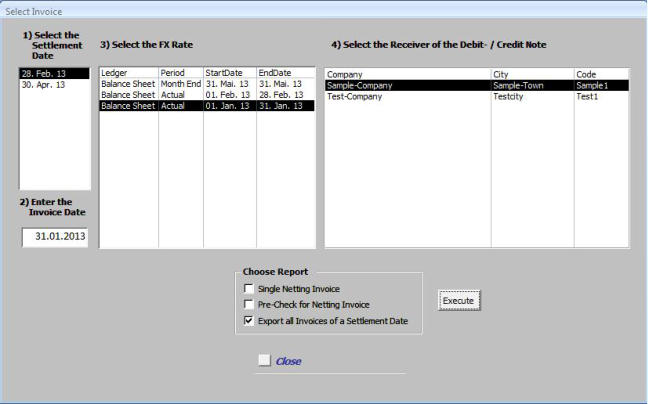

1.

Select the settlement date of

the invoice. This is the date when funds are transferred to/from the invoicing party to/from Corporate Netting Center. By clicking on any

specific date only the companies with existing intercompany invoices will be monitored.

2.

Enter the date of the netting-invoice.

3.

Select a fx-rate previously entered in menu Standing Data -> FX Rates, submenu Rate Type.

4.

Select finally the company which is going to invoiced resp. credited.

5.

Choose one of these reporting possibilities:

a) The regular netting invoice

b) A pre-check before issue of the netting invoice. This is quite helpful in order to minimize the monthly reconciliation work and ensures a fast

monthly / yearly close of the books.

c) Export of the respective invoice into a file, e.g. Microsoft Excel.

Netting Invoice

The structure of this invoice resp. credit

note allows among the general netting

benefits also a significant reduction of

the fx-exposure by calculating the net

amount automatically in the functional

currency of the invoice receiver. Thus, all

companies of the group have no more

foreign currency out of internal

transactions in their books and all

currencies are netted only in the

corporate netting center. More about this

very beneficial procedure in our article.

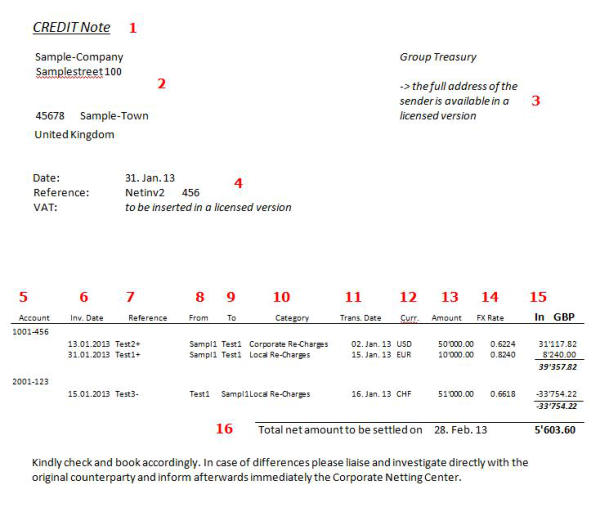

Fields

1.

Title: Depending on the net-

amount in nr. 16 below, the title is

automatically “Credit Note” or

“Debit Note”.

2.

Receivers Address: Full address

of the reciveiver of the credit /

debit note.

3.

Senders Address: Usually a fix

address for the Corporate Netting

Center at the Group Head Office.

4.

References: Block with the basic reference information for invoice date, the unique reference of the invoice and the VAT number of the

sender, i.e. Head Office.

5.

Account: Internal account of the invoice receiver in the books of the invoice sender, i.e. Head Office. All single internal invoices, i.e. the

basis of the calculation previously entered in menu Transactions -> Netting, are summarized by company and cash flow (+ or -). In this

example, the company with short-code Test1 (=netting invoice receiving party) invoiced to the company with short code Sampl two invoices

for USD 50’000 and EUR 10’000 and has received from Sampl one invoice for CHF 51’000.

6.

Inv. Date: Date of the internal invoice.

7.

Reference: Reference of the internal invoice.

8.

From: Short code of the invoicing party for the internal invoice.

9.

To: Short code of the receiver, i.e. ower of the internal invoice.

10.

Category: Definition of the invoice’s purpose.

11.

Trans.Date: Transaction date of the internal invoice.

12.

Curr: Transaction currency of the internal invoice.

13.

Amount: Amount of the internal in the currency mentioned before.

14.

FX Rate: Exchange rate previously selected, see above vs. the functional currency of the netting invoice receiver.

15.

Amount in Functional Currency: Amount of nr. 13 expressed in the functional currency of the netting invoice receiver.

16.

Overal Balance: Net amount,expressed in the functional currency of the netting invoice receiver which has to be settled on the selected

date.

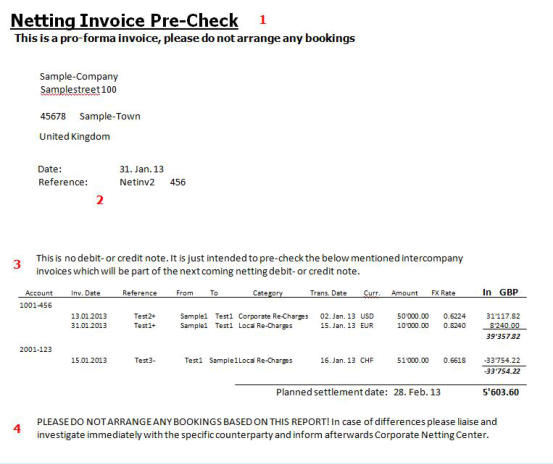

Pre-Check for Netting Invoice

in order to minimize the monthly, quarterly and

yearly internal reconcilation efforts and to ensure a

fast close for the books this function allows the user

to send out weekly or just a view days before the

closing date such a pre-check note. All possible

differences can be investigated in this step and

when sending out the final netting invoice, all

involved parties can book acccordingly without

loosing time.

Basically the content of the pre-check is the same

like the official netting invoice mentioned above.

The differences are in numbers 1 - 4, see on the

right. They make clear that this document is not

invoice. Instead, it is just used for reconcilation

purpose.

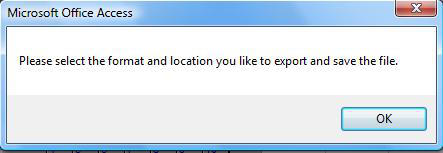

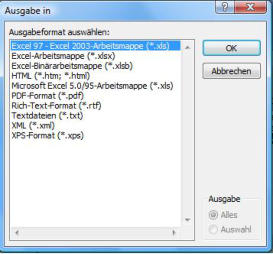

Netting Export

All internal transactions which are subject of group netting might want to be analyzed further in ad-hoc reports. Thus, this Treasury Software allows

to export all transactions into all possible formats Microsoft supports.

First a message appears with instructions:

By click on OK you are

asked

to choose the format into

which

you like to export:

If you like to export as an Excel file, the result looks like this: