Stahr Treasury Software Help

Reporting - FX STRESS TEST

A stress test is showing the impact in the group income statement as maximum loss result if the

exchange rate is shifting a certain percentage up or down. The stress test is made for the group’s

overall foreign exchange exposure, whereas the source is the fx exposure report in Transactions ->

FX Exposure. That means, please make sure that all exposure reports are made before starting the

stress test. In order to enable a state of the art fx risk management, every treasury department

should work frequently with these numbers and should mention it in every top-level report to the

Group-Treasurer, CFO or Executive Board in line with the absolute fx exposure number, calculated in

menu Reports -> FX Group Exposure.

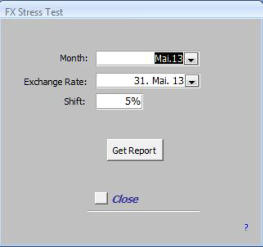

To generate a stress-test report, just select the month to be reported, the desired base-exchange rate

and the desired shift ratio. Most common are shifts for 5% and 10%. Afterwards click “Get Report”.

All numbers are expressed in the group’s functional currency

for all currencies entered in menu Standing Data ->

Currencies.

Worst Case

In the worst case scenario only all negative impacts are

calculated. That means, it cannot come worser than this

number shows.

Best Case

The best case scenario shows negative and positive impacts

on the shift. This is the likely case of a shift.