Stahr Treasury Software Help

Reporting - FX GROUP EXPOSURE REPORT

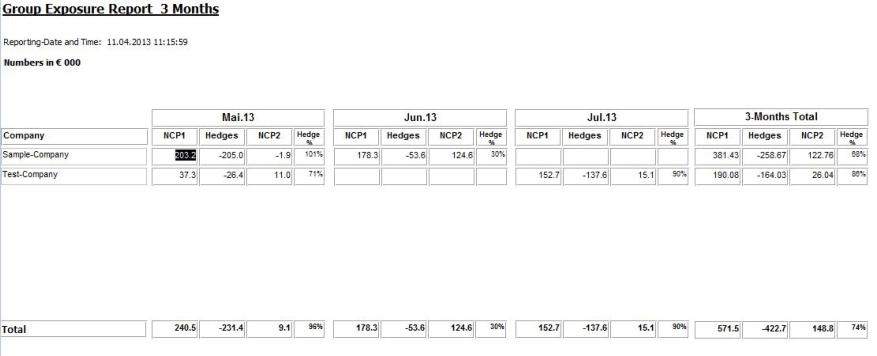

The FX Group Exposure Report is one of most useful informations every treasury

department may work with. This report monitors the overall foreign exchange exposure by

exposure item and hedge transaction per entity, currency and month.

First, please select the to be reported months. In total there are up to 12 months possible.

Then choose the number of reporting month to be monitored. Available are 3-, 6- or 12

months. Click on “Get Report” to generate the report.

The report shows the totals of all currencies, expressed in the group’s functional currency by company per month for

•

Net Currency Position before Hedging (NCP1)

•

All Hedge Transactions (Hedges)

•

The sum of NCP1 and Hedges = Net Currency Position after Hedging (NCP2) = Net FX Exposure

The conversion of all currencies is made already in the menu Transactions -> FX Exposure when having selected the exchange rate.

The Hedge Ratio monitors the relation of NCP1 vs. Hedges. This number is perfectly used to control the single hedge levels of a company. For

instance, if the corporate fx-policy requires a hedge ratio of minimum 80% and maximum 125% (according IAS hedge accounting), the treasurer is

now able to check the compliance with this requirement in this report without loosing time for intensive ad-hoc reports.

Most important overall number, which should be part of every top-level report to the Group-Treasurer, CFO or Executive Board is the NCP2-

number in the 3-Months Total block at the bottom (in this example 148.8) togher with the stress-test result of menu Reports -> FX Stress Test. The

exposure number shows the current unhedged exposure for the group and the hedge ratio just next to it, the overall hedge-level. That means, if a

group applies hedge accounting, the minimum hedge level of 80% is below that limit.