Stahr Treasury Software Help

Reporting - CASH POOLING

Everything it needs to manage a Cash Pool can be reported in this menu. Although the structure

of a Cash Pool may be in some cases very complex and may include hundreds of bank-accounts,

at the end of the day it needs just a view functions to have it under control.

1.

Overview of the Cash Pool Structure

2.

A Breakdown of the interest rates per Pool

3.

Account Statements, and most important

4.

Invoices for the Cash Pool Members

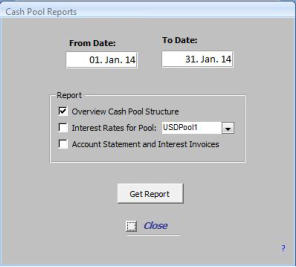

Select the period for which you like to get the report and click on the button.

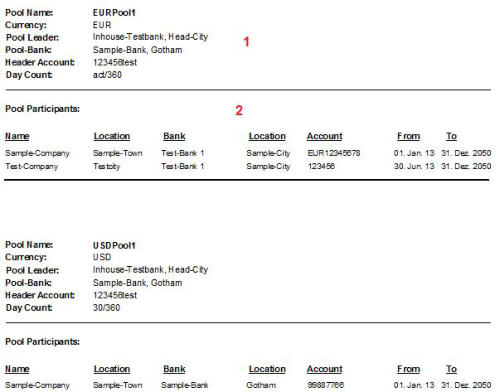

Overview Cash Pool Structure

Basically quite a simple report, but as more pools are in a

corporate group and as more members participate, as more

complex a cash pool landscape is and such information is

required many times to get an overview at a glance.

1.

Information about the Cash Pool itself, i.e. Name,

Currency, Leader etc.

2.

Information about the Participants (=Members) of a

Cash Pool, i.e. Name, Bank, Account and in which

period the Participant is active in the Pool.

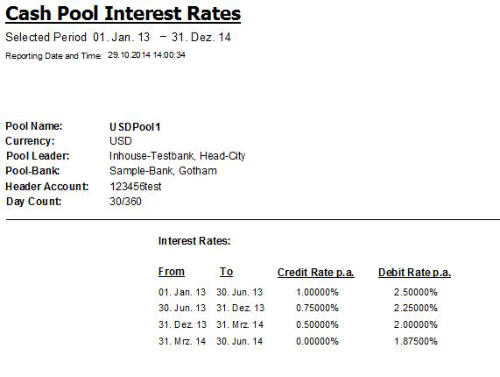

Cash Pool Interest Rates

This report shows by previously selected pool and reporting

period all interest rates which have been entered in menu

Standing Data -> Cash Pooling -> Interest Rates.

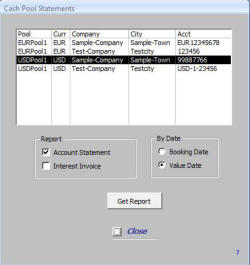

Account Statement and Interest Invoice

This sub-menu allows to select the pool-member for which the report is to be made and the kind of

statement. There are two reports available:

1.

Account Statements

2.

Interest Invoice

The Account Statement can be seletected by booking date or by value date, while the Interest Invoice is

only available by value date, which represents the true balance of a day for calculating items like interest.

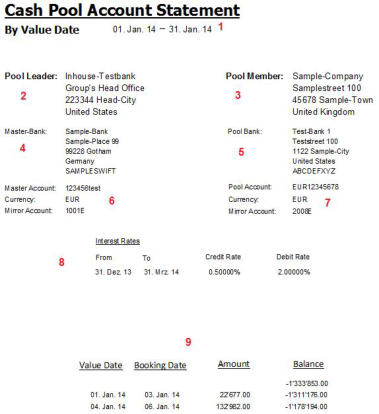

1. Account Statement

As a cash pool leader you act like a bank for your customers, i.e. you are a Inhouse-Bank. The bank is mostly the head-office of a group (same legal entity, but seperate cost-account) or a designated special financial company with own legal identity. The customers are the pool-members, i.e. the

entity, but seperate cost-account) or a designated special financial company with own legal identity. The customers are the pool-members, i.e. the internal group entities. Same like at a external bank, there must be an account statement available in order to reconcile all relevant transactions.

internal group entities. Same like at a external bank, there must be an account statement available in order to reconcile all relevant transactions. Fields

1.

Period which has been previously defined, see above.

Fields

1.

Period which has been previously defined, see above. 2.

Pool-Leader, i.e the Inhouse-Bank.

2.

Pool-Leader, i.e the Inhouse-Bank. 3.

Pool-Member, i.e. the Group-Entity.

4.

External Bank at which the master account is held.

5.

External Bank at which the pool account is held.

6.

External account number, currency and corresponding internal mirror

3.

Pool-Member, i.e. the Group-Entity.

4.

External Bank at which the master account is held.

5.

External Bank at which the pool account is held.

6.

External account number, currency and corresponding internal mirror account in Pool-Leader’s general ledger.

account in Pool-Leader’s general ledger. 7.

External account number, currency and corresponding internal mirror

7.

External account number, currency and corresponding internal mirror account in Pool-Member’s general ledger.

account in Pool-Member’s general ledger. 8.

Internal interest rates for the selected period, given by the Pool-Leader.

8.

Internal interest rates for the selected period, given by the Pool-Leader. 9.

All transactions, i.e. daily cash flows including starting- and running balance.

9.

All transactions, i.e. daily cash flows including starting- and running balance. 2. Interest Invoice

The interest invoice is basically the most important report in a cash pool. It is the legal

2. Interest Invoice

The interest invoice is basically the most important report in a cash pool. It is the legal document for a credit/debit note from the Pool-Leader to the Pool-Member.

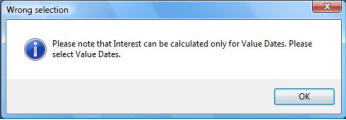

document for a credit/debit note from the Pool-Leader to the Pool-Member.  Because the correct calculation of bank balances can be done only for value dates, the

Because the correct calculation of bank balances can be done only for value dates, the interest invoice can be performed only for value dates, otherwise the user will be

interest invoice can be performed only for value dates, otherwise the user will be remembered, see popping up message:

remembered, see popping up message: As explained in more detail in our section Cash Pooling, the Pool-Leader with his header account is concentrating all funds of the respective cash

As explained in more detail in our section Cash Pooling, the Pool-Leader with his header account is concentrating all funds of the respective cash pool and is paying/colleting interest from/to this header-account at an external bank. On the opposite, the Pool-Leader has the function of a Inhouse-

pool and is paying/colleting interest from/to this header-account at an external bank. On the opposite, the Pool-Leader has the function of a Inhouse- Bank and is setting all interest rates to the Pool-Members.

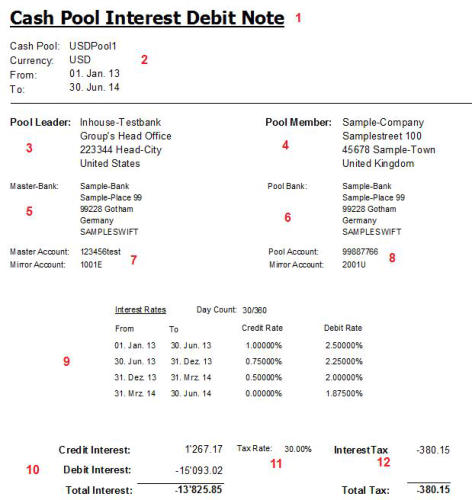

Fields

1.

Depending on the interest result monitored in point 10+12,

the title is Debit Note or Credit Note.

2.

Definition about the pool and selected period for the invoice.

3.

Pool-Leader, i.e the Inhouse-Bank.

4.

Pool-Member, i.e. the Group-Entity.

5.

External Bank at which the master account is held.

6.

External Bank at which the pool account is held.

7.

External account number, currency and corresponding

internal mirror account in Pool-Leader’s general ledger.

8.

External account number, currency and corresponding

internal mirror account in Pool-Member’s general ledger.

9.

Internal interest rates for the selected period, given by the

Pool-Leader and the defined day count method. Both to be

edited in menu Standing Data -> Cash Pooling -> Interest

Rates.

10.

The interest result from the first day of the selected period

until next following day of the last selected day. The result is

splltted in two parts:

a) Credit Interest, which may be subject of interest tax.

b) Debit Interest which is commonly not part of any tax.

11.

Tax Rate related to the Pool-Member account mentioned in 8

above. If the account is subject of interest tax, the tax rate is to be defined in menu Standing Data -> Accounts.

12.

Interest Tax: in case there is a credit interest, the interest tax is calculated [Credit Interest] x [Tax Rate]

Bank and is setting all interest rates to the Pool-Members.

Fields

1.

Depending on the interest result monitored in point 10+12,

the title is Debit Note or Credit Note.

2.

Definition about the pool and selected period for the invoice.

3.

Pool-Leader, i.e the Inhouse-Bank.

4.

Pool-Member, i.e. the Group-Entity.

5.

External Bank at which the master account is held.

6.

External Bank at which the pool account is held.

7.

External account number, currency and corresponding

internal mirror account in Pool-Leader’s general ledger.

8.

External account number, currency and corresponding

internal mirror account in Pool-Member’s general ledger.

9.

Internal interest rates for the selected period, given by the

Pool-Leader and the defined day count method. Both to be

edited in menu Standing Data -> Cash Pooling -> Interest

Rates.

10.

The interest result from the first day of the selected period

until next following day of the last selected day. The result is

splltted in two parts:

a) Credit Interest, which may be subject of interest tax.

b) Debit Interest which is commonly not part of any tax.

11.

Tax Rate related to the Pool-Member account mentioned in 8

above. If the account is subject of interest tax, the tax rate is to be defined in menu Standing Data -> Accounts.

12.

Interest Tax: in case there is a credit interest, the interest tax is calculated [Credit Interest] x [Tax Rate]

entity, but seperate cost-account) or a designated special financial company with own legal identity. The customers are the pool-members, i.e. the

entity, but seperate cost-account) or a designated special financial company with own legal identity. The customers are the pool-members, i.e. the internal group entities. Same like at a external bank, there must be an account statement available in order to reconcile all relevant transactions.

internal group entities. Same like at a external bank, there must be an account statement available in order to reconcile all relevant transactions. Fields

1.

Period which has been previously defined, see above.

Fields

1.

Period which has been previously defined, see above. 2.

Pool-Leader, i.e the Inhouse-Bank.

2.

Pool-Leader, i.e the Inhouse-Bank. 3.

Pool-Member, i.e. the Group-Entity.

4.

External Bank at which the master account is held.

5.

External Bank at which the pool account is held.

6.

External account number, currency and corresponding internal mirror

3.

Pool-Member, i.e. the Group-Entity.

4.

External Bank at which the master account is held.

5.

External Bank at which the pool account is held.

6.

External account number, currency and corresponding internal mirror account in Pool-Leader’s general ledger.

account in Pool-Leader’s general ledger. 7.

External account number, currency and corresponding internal mirror

7.

External account number, currency and corresponding internal mirror account in Pool-Member’s general ledger.

account in Pool-Member’s general ledger. 8.

Internal interest rates for the selected period, given by the Pool-Leader.

8.

Internal interest rates for the selected period, given by the Pool-Leader. 9.

All transactions, i.e. daily cash flows including starting- and running balance.

9.

All transactions, i.e. daily cash flows including starting- and running balance. 2. Interest Invoice

The interest invoice is basically the most important report in a cash pool. It is the legal

2. Interest Invoice

The interest invoice is basically the most important report in a cash pool. It is the legal document for a credit/debit note from the Pool-Leader to the Pool-Member.

document for a credit/debit note from the Pool-Leader to the Pool-Member.  Because the correct calculation of bank balances can be done only for value dates, the

Because the correct calculation of bank balances can be done only for value dates, the interest invoice can be performed only for value dates, otherwise the user will be

interest invoice can be performed only for value dates, otherwise the user will be remembered, see popping up message:

remembered, see popping up message: As explained in more detail in our section Cash Pooling, the Pool-Leader with his header account is concentrating all funds of the respective cash

As explained in more detail in our section Cash Pooling, the Pool-Leader with his header account is concentrating all funds of the respective cash pool and is paying/colleting interest from/to this header-account at an external bank. On the opposite, the Pool-Leader has the function of a Inhouse-

pool and is paying/colleting interest from/to this header-account at an external bank. On the opposite, the Pool-Leader has the function of a Inhouse- Bank and is setting all interest rates to the Pool-Members.

Fields

1.

Depending on the interest result monitored in point 10+12,

the title is Debit Note or Credit Note.

2.

Definition about the pool and selected period for the invoice.

3.

Pool-Leader, i.e the Inhouse-Bank.

4.

Pool-Member, i.e. the Group-Entity.

5.

External Bank at which the master account is held.

6.

External Bank at which the pool account is held.

7.

External account number, currency and corresponding

internal mirror account in Pool-Leader’s general ledger.

8.

External account number, currency and corresponding

internal mirror account in Pool-Member’s general ledger.

9.

Internal interest rates for the selected period, given by the

Pool-Leader and the defined day count method. Both to be

edited in menu Standing Data -> Cash Pooling -> Interest

Rates.

10.

The interest result from the first day of the selected period

until next following day of the last selected day. The result is

splltted in two parts:

a) Credit Interest, which may be subject of interest tax.

b) Debit Interest which is commonly not part of any tax.

11.

Tax Rate related to the Pool-Member account mentioned in 8

above. If the account is subject of interest tax, the tax rate is to be defined in menu Standing Data -> Accounts.

12.

Interest Tax: in case there is a credit interest, the interest tax is calculated [Credit Interest] x [Tax Rate]

Bank and is setting all interest rates to the Pool-Members.

Fields

1.

Depending on the interest result monitored in point 10+12,

the title is Debit Note or Credit Note.

2.

Definition about the pool and selected period for the invoice.

3.

Pool-Leader, i.e the Inhouse-Bank.

4.

Pool-Member, i.e. the Group-Entity.

5.

External Bank at which the master account is held.

6.

External Bank at which the pool account is held.

7.

External account number, currency and corresponding

internal mirror account in Pool-Leader’s general ledger.

8.

External account number, currency and corresponding

internal mirror account in Pool-Member’s general ledger.

9.

Internal interest rates for the selected period, given by the

Pool-Leader and the defined day count method. Both to be

edited in menu Standing Data -> Cash Pooling -> Interest

Rates.

10.

The interest result from the first day of the selected period

until next following day of the last selected day. The result is

splltted in two parts:

a) Credit Interest, which may be subject of interest tax.

b) Debit Interest which is commonly not part of any tax.

11.

Tax Rate related to the Pool-Member account mentioned in 8

above. If the account is subject of interest tax, the tax rate is to be defined in menu Standing Data -> Accounts.

12.

Interest Tax: in case there is a credit interest, the interest tax is calculated [Credit Interest] x [Tax Rate]