Stahr Treasury Software Help

Transactions - Menu FX TRANSACTIONS

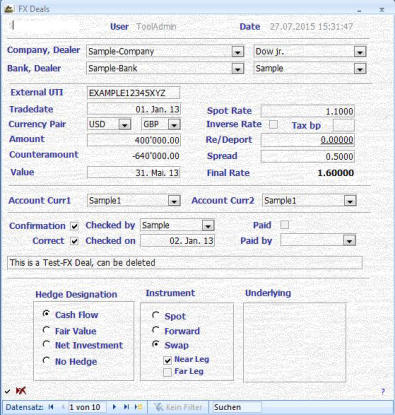

Spot, Forward and Swap Deals are captured in this menu. The entries made can be used for

be used for •

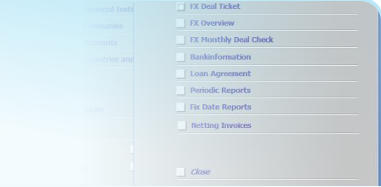

printing a deal agreement, Reports -> FX Deal Ticket

•

printing a deal agreement, Reports -> FX Deal Ticket •

fx confirmation and monthly deals check/breakdown, Reports -> Reports

•

fx confirmation and monthly deals check/breakdown, Reports -> Reports with a Fix Date -> FX Deals Check

with a Fix Date -> FX Deals Check •

a general breakdown, Reports -> Reports with a Period -> FX Overview,

•

a general breakdown, Reports -> Reports with a Period -> FX Overview, •

they are the source for the overall internal and external fx-position for the

•

they are the source for the overall internal and external fx-position for the group in menu Reports -> Reports with a Fix Date -> FX Trans. Pos.

group in menu Reports -> Reports with a Fix Date -> FX Trans. Pos. •

may be exported into Excel in Reports -> Reports with a Fix Date -> FX

•

may be exported into Excel in Reports -> Reports with a Fix Date -> FX Export

•

and they are calculated in a stress-test report for risk measurement

Export

•

and they are calculated in a stress-test report for risk measurement purpose in Reports -> FX Stress Test.

If you have questions regarding the navigation, please click here.

purpose in Reports -> FX Stress Test.

If you have questions regarding the navigation, please click here. Fields:

Company: This is the internal company who performs the transaction. Source is menu Standing Data -> Companies. Mandatory, pre-entered content.

Fields:

Company: This is the internal company who performs the transaction. Source is menu Standing Data -> Companies. Mandatory, pre-entered content. Dealer (Company): The person in the company who arranged the deal. Source is menu Standing Data -> Pesons. Mandatory, pre-entered content.

Dealer (Company): The person in the company who arranged the deal. Source is menu Standing Data -> Pesons. Mandatory, pre-entered content. Bank: The bank with which the deal is made. This can be an external or internal bank. In case it is a pure internal transactions, the Inhouse Bank

Bank: The bank with which the deal is made. This can be an external or internal bank. In case it is a pure internal transactions, the Inhouse Bank located in Group Treasury need to be entred first in the menu Standing Data -> Banks, Fin. Institutions. Mandatory, pre-entered content.

located in Group Treasury need to be entred first in the menu Standing Data -> Banks, Fin. Institutions. Mandatory, pre-entered content. Dealer (Bank):The person in the bank who arranged the deal. Source is menu Standing Data -> Pesons. Mandatory, pre-entered content.

Dealer (Bank):The person in the bank who arranged the deal. Source is menu Standing Data -> Pesons. Mandatory, pre-entered content. External UTI: In case the counterparty provides his own reference as the UTI (Unique Transaction Indentifier), this information need to be entered

External UTI: In case the counterparty provides his own reference as the UTI (Unique Transaction Indentifier), this information need to be entered into this field. Optional, free text.

Date of Trade: Date at which the trade was agreed. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date

into this field. Optional, free text.

Date of Trade: Date at which the trade was agreed. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

numbers, enter MM.DD.YY, otherwise DD.MM.YY). Currency Pair: The first currency is the traded currency and refers to the field Amount. The second currency is the counter-currency and refers to the

Currency Pair: The first currency is the traded currency and refers to the field Amount. The second currency is the counter-currency and refers to the field Counteramount. Source for both is menu Standing Data -> Currencies. Mandatory, pre-entered content.

field Counteramount. Source for both is menu Standing Data -> Currencies. Mandatory, pre-entered content. Amount: Enter here the traded amount, i.e. the amount for the first currency. Important: by selling an amount, you need to set a minus “-” before the

Amount: Enter here the traded amount, i.e. the amount for the first currency. Important: by selling an amount, you need to set a minus “-” before the amount! Mandatory, free positive or negative number.

amount! Mandatory, free positive or negative number. Counteramount: This field is calculated automatically in the moment when entering a value in field Spot Rate, Re/Deport, Spread or by click on box

Counteramount: This field is calculated automatically in the moment when entering a value in field Spot Rate, Re/Deport, Spread or by click on box Inverse Rate. It can be not updated manually. Mandatory, automatic calculation.

Inverse Rate. It can be not updated manually. Mandatory, automatic calculation. Value: Value means Value-Date. Enter in this field the date when the phyiscal payments of the transaction will occur. Mandatory, free date in the

Value: Value means Value-Date. Enter in this field the date when the phyiscal payments of the transaction will occur. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Spot Rate: This field is for the spot rate, i.e. the basis exchange rate. Do not enter any other number than the pure spot rate. If you deal a forward

Spot Rate: This field is for the spot rate, i.e. the basis exchange rate. Do not enter any other number than the pure spot rate. If you deal a forward transaction or the far leg of a swap, enter in this spot field only the spot rate. Mandatory, free number with four digits.

transaction or the far leg of a swap, enter in this spot field only the spot rate. Mandatory, free number with four digits. Inverse Rate: In case you have only the inverse rate available, put a tick in this box. Example: Deal is EUR vs. USD, i.e. 1 EUR = n USD. The normal

Inverse Rate: In case you have only the inverse rate available, put a tick in this box. Example: Deal is EUR vs. USD, i.e. 1 EUR = n USD. The normal quote would be 1.3500, i.e. 1 EUR = 1.35 USD. But if you get from your bank only the inverse rate and you mentioned as first (traded) currency EUR

quote would be 1.3500, i.e. 1 EUR = 1.35 USD. But if you get from your bank only the inverse rate and you mentioned as first (traded) currency EUR and entered in the spot field not the normal rate, it is 1/1.3500, i.e. 0.740740. Optional, Y/N.

and entered in the spot field not the normal rate, it is 1/1.3500, i.e. 0.740740. Optional, Y/N. Tax bp: Financial Tax for derivative transactions, expressed in basis points. Optional, free number.

Tax bp: Financial Tax for derivative transactions, expressed in basis points. Optional, free number. Re/Deport: That’s the swap- or forwards points. Technically the pure interest rate difference of the two currency for the lifetime of the deal. If you

Re/Deport: That’s the swap- or forwards points. Technically the pure interest rate difference of the two currency for the lifetime of the deal. If you enter a forward transaction or the far leg of a swap, enter into this field the points. Those may be positive or negative. Optional, positive or negative

enter a forward transaction or the far leg of a swap, enter into this field the points. Those may be positive or negative. Optional, positive or negative number with max. 5 digits.

number with max. 5 digits. Spread: In case the deal is pure internal, you may want to add a spread, if not already part of the spot rate or the swap/forward points. Optional, free

Spread: In case the deal is pure internal, you may want to add a spread, if not already part of the spot rate or the swap/forward points. Optional, free number with max. 4 digits.

number with max. 4 digits. Final Rate: This is the final exchange rate at wich the counteramount will be calculated. The final rate is calculated automatically in the moment when

Final Rate: This is the final exchange rate at wich the counteramount will be calculated. The final rate is calculated automatically in the moment when entering a value in field Spot Rate, Re/Deport or Spread and cannot be updated directly. Mandatory, automatic calculation.

entering a value in field Spot Rate, Re/Deport or Spread and cannot be updated directly. Mandatory, automatic calculation. Account Curr1: Select from the drop-down the account to which the amount of currency 1 (traded currency) is to be paid. Source is menu Standing

Account Curr1: Select from the drop-down the account to which the amount of currency 1 (traded currency) is to be paid. Source is menu Standing Data -> Accounts. Mandatory, pre-entered content.

Data -> Accounts. Mandatory, pre-entered content. Account Curr2: Select from the drop-down the account to which the amount of currency 2 (counter-currency) is to be paid. Source is menu Standing

Account Curr2: Select from the drop-down the account to which the amount of currency 2 (counter-currency) is to be paid. Source is menu Standing Data -> Accounts. Mandatory, pre-entered content.

Data -> Accounts. Mandatory, pre-entered content. Confirmation: Every fx deal should be checked with confirmations. If you get from your external bank a confirmation or you sent your confirmation to

Confirmation: Every fx deal should be checked with confirmations. If you get from your external bank a confirmation or you sent your confirmation to your internal party and they sent it back, set a tick this box. Important: If you have not confirmed fx deals, you will be remembered every time by the

your internal party and they sent it back, set a tick this box. Important: If you have not confirmed fx deals, you will be remembered every time by the software when starting it with a pop up, called “Missing FX Confirmation”. Optional, Y/N.

software when starting it with a pop up, called “Missing FX Confirmation”. Optional, Y/N. Confirmation correct: Even you got a confirmation, it may be not correct. Check this box if the confirmation is correct. Optional, Y/N.

Confirmation correct: Even you got a confirmation, it may be not correct. Check this box if the confirmation is correct. Optional, Y/N.  Checked by: The confirmation process is quite important and therefore the person who is responsible for checking the deal need to be mentioned in

Checked by: The confirmation process is quite important and therefore the person who is responsible for checking the deal need to be mentioned in this field. Source is Standing Data -> Persons. Optional, pre-entered content.

this field. Source is Standing Data -> Persons. Optional, pre-entered content. Checked on: This is the date when having checked the confirmation. Optional, free date in the format of your computer (i.e., if your computer settings are

Checked on: This is the date when having checked the confirmation. Optional, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Remarks: Free text for any remarks. Optional, free text.

Remarks: Free text for any remarks. Optional, free text. Hedge Designation: In case the fx deal is intended as a hedge, you can designate it in this box as Cash Flow-, Fair Value-, Net-Investment or as no

Hedge Designation: In case the fx deal is intended as a hedge, you can designate it in this box as Cash Flow-, Fair Value-, Net-Investment or as no Hedge. This selection is only informational. Optional, given context.

Hedge. This selection is only informational. Optional, given context. Instrument: Standard is a spot transaction. You should always mention the type of instrument, esepecially, if it is a swap. Optional, given context.

Instrument: Standard is a spot transaction. You should always mention the type of instrument, esepecially, if it is a swap. Optional, given context. Underlying: In case there is an underlying to the fx deal, you can enter into this box what it is. Optional, free text.

Underlying: In case there is an underlying to the fx deal, you can enter into this box what it is. Optional, free text.

be used for

be used for •

printing a deal agreement, Reports -> FX Deal Ticket

•

printing a deal agreement, Reports -> FX Deal Ticket •

fx confirmation and monthly deals check/breakdown, Reports -> Reports

•

fx confirmation and monthly deals check/breakdown, Reports -> Reports with a Fix Date -> FX Deals Check

with a Fix Date -> FX Deals Check •

a general breakdown, Reports -> Reports with a Period -> FX Overview,

•

a general breakdown, Reports -> Reports with a Period -> FX Overview, •

they are the source for the overall internal and external fx-position for the

•

they are the source for the overall internal and external fx-position for the group in menu Reports -> Reports with a Fix Date -> FX Trans. Pos.

group in menu Reports -> Reports with a Fix Date -> FX Trans. Pos. •

may be exported into Excel in Reports -> Reports with a Fix Date -> FX

•

may be exported into Excel in Reports -> Reports with a Fix Date -> FX Export

•

and they are calculated in a stress-test report for risk measurement

Export

•

and they are calculated in a stress-test report for risk measurement purpose in Reports -> FX Stress Test.

If you have questions regarding the navigation, please click here.

purpose in Reports -> FX Stress Test.

If you have questions regarding the navigation, please click here. Fields:

Company: This is the internal company who performs the transaction. Source is menu Standing Data -> Companies. Mandatory, pre-entered content.

Fields:

Company: This is the internal company who performs the transaction. Source is menu Standing Data -> Companies. Mandatory, pre-entered content. Dealer (Company): The person in the company who arranged the deal. Source is menu Standing Data -> Pesons. Mandatory, pre-entered content.

Dealer (Company): The person in the company who arranged the deal. Source is menu Standing Data -> Pesons. Mandatory, pre-entered content. Bank: The bank with which the deal is made. This can be an external or internal bank. In case it is a pure internal transactions, the Inhouse Bank

Bank: The bank with which the deal is made. This can be an external or internal bank. In case it is a pure internal transactions, the Inhouse Bank located in Group Treasury need to be entred first in the menu Standing Data -> Banks, Fin. Institutions. Mandatory, pre-entered content.

located in Group Treasury need to be entred first in the menu Standing Data -> Banks, Fin. Institutions. Mandatory, pre-entered content. Dealer (Bank):The person in the bank who arranged the deal. Source is menu Standing Data -> Pesons. Mandatory, pre-entered content.

Dealer (Bank):The person in the bank who arranged the deal. Source is menu Standing Data -> Pesons. Mandatory, pre-entered content. External UTI: In case the counterparty provides his own reference as the UTI (Unique Transaction Indentifier), this information need to be entered

External UTI: In case the counterparty provides his own reference as the UTI (Unique Transaction Indentifier), this information need to be entered into this field. Optional, free text.

Date of Trade: Date at which the trade was agreed. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date

into this field. Optional, free text.

Date of Trade: Date at which the trade was agreed. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

numbers, enter MM.DD.YY, otherwise DD.MM.YY). Currency Pair: The first currency is the traded currency and refers to the field Amount. The second currency is the counter-currency and refers to the

Currency Pair: The first currency is the traded currency and refers to the field Amount. The second currency is the counter-currency and refers to the field Counteramount. Source for both is menu Standing Data -> Currencies. Mandatory, pre-entered content.

field Counteramount. Source for both is menu Standing Data -> Currencies. Mandatory, pre-entered content. Amount: Enter here the traded amount, i.e. the amount for the first currency. Important: by selling an amount, you need to set a minus “-” before the

Amount: Enter here the traded amount, i.e. the amount for the first currency. Important: by selling an amount, you need to set a minus “-” before the amount! Mandatory, free positive or negative number.

amount! Mandatory, free positive or negative number. Counteramount: This field is calculated automatically in the moment when entering a value in field Spot Rate, Re/Deport, Spread or by click on box

Counteramount: This field is calculated automatically in the moment when entering a value in field Spot Rate, Re/Deport, Spread or by click on box Inverse Rate. It can be not updated manually. Mandatory, automatic calculation.

Inverse Rate. It can be not updated manually. Mandatory, automatic calculation. Value: Value means Value-Date. Enter in this field the date when the phyiscal payments of the transaction will occur. Mandatory, free date in the

Value: Value means Value-Date. Enter in this field the date when the phyiscal payments of the transaction will occur. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Spot Rate: This field is for the spot rate, i.e. the basis exchange rate. Do not enter any other number than the pure spot rate. If you deal a forward

Spot Rate: This field is for the spot rate, i.e. the basis exchange rate. Do not enter any other number than the pure spot rate. If you deal a forward transaction or the far leg of a swap, enter in this spot field only the spot rate. Mandatory, free number with four digits.

transaction or the far leg of a swap, enter in this spot field only the spot rate. Mandatory, free number with four digits. Inverse Rate: In case you have only the inverse rate available, put a tick in this box. Example: Deal is EUR vs. USD, i.e. 1 EUR = n USD. The normal

Inverse Rate: In case you have only the inverse rate available, put a tick in this box. Example: Deal is EUR vs. USD, i.e. 1 EUR = n USD. The normal quote would be 1.3500, i.e. 1 EUR = 1.35 USD. But if you get from your bank only the inverse rate and you mentioned as first (traded) currency EUR

quote would be 1.3500, i.e. 1 EUR = 1.35 USD. But if you get from your bank only the inverse rate and you mentioned as first (traded) currency EUR and entered in the spot field not the normal rate, it is 1/1.3500, i.e. 0.740740. Optional, Y/N.

and entered in the spot field not the normal rate, it is 1/1.3500, i.e. 0.740740. Optional, Y/N. Tax bp: Financial Tax for derivative transactions, expressed in basis points. Optional, free number.

Tax bp: Financial Tax for derivative transactions, expressed in basis points. Optional, free number. Re/Deport: That’s the swap- or forwards points. Technically the pure interest rate difference of the two currency for the lifetime of the deal. If you

Re/Deport: That’s the swap- or forwards points. Technically the pure interest rate difference of the two currency for the lifetime of the deal. If you enter a forward transaction or the far leg of a swap, enter into this field the points. Those may be positive or negative. Optional, positive or negative

enter a forward transaction or the far leg of a swap, enter into this field the points. Those may be positive or negative. Optional, positive or negative number with max. 5 digits.

number with max. 5 digits. Spread: In case the deal is pure internal, you may want to add a spread, if not already part of the spot rate or the swap/forward points. Optional, free

Spread: In case the deal is pure internal, you may want to add a spread, if not already part of the spot rate or the swap/forward points. Optional, free number with max. 4 digits.

number with max. 4 digits. Final Rate: This is the final exchange rate at wich the counteramount will be calculated. The final rate is calculated automatically in the moment when

Final Rate: This is the final exchange rate at wich the counteramount will be calculated. The final rate is calculated automatically in the moment when entering a value in field Spot Rate, Re/Deport or Spread and cannot be updated directly. Mandatory, automatic calculation.

entering a value in field Spot Rate, Re/Deport or Spread and cannot be updated directly. Mandatory, automatic calculation. Account Curr1: Select from the drop-down the account to which the amount of currency 1 (traded currency) is to be paid. Source is menu Standing

Account Curr1: Select from the drop-down the account to which the amount of currency 1 (traded currency) is to be paid. Source is menu Standing Data -> Accounts. Mandatory, pre-entered content.

Data -> Accounts. Mandatory, pre-entered content. Account Curr2: Select from the drop-down the account to which the amount of currency 2 (counter-currency) is to be paid. Source is menu Standing

Account Curr2: Select from the drop-down the account to which the amount of currency 2 (counter-currency) is to be paid. Source is menu Standing Data -> Accounts. Mandatory, pre-entered content.

Data -> Accounts. Mandatory, pre-entered content. Confirmation: Every fx deal should be checked with confirmations. If you get from your external bank a confirmation or you sent your confirmation to

Confirmation: Every fx deal should be checked with confirmations. If you get from your external bank a confirmation or you sent your confirmation to your internal party and they sent it back, set a tick this box. Important: If you have not confirmed fx deals, you will be remembered every time by the

your internal party and they sent it back, set a tick this box. Important: If you have not confirmed fx deals, you will be remembered every time by the software when starting it with a pop up, called “Missing FX Confirmation”. Optional, Y/N.

software when starting it with a pop up, called “Missing FX Confirmation”. Optional, Y/N. Confirmation correct: Even you got a confirmation, it may be not correct. Check this box if the confirmation is correct. Optional, Y/N.

Confirmation correct: Even you got a confirmation, it may be not correct. Check this box if the confirmation is correct. Optional, Y/N.  Checked by: The confirmation process is quite important and therefore the person who is responsible for checking the deal need to be mentioned in

Checked by: The confirmation process is quite important and therefore the person who is responsible for checking the deal need to be mentioned in this field. Source is Standing Data -> Persons. Optional, pre-entered content.

this field. Source is Standing Data -> Persons. Optional, pre-entered content. Checked on: This is the date when having checked the confirmation. Optional, free date in the format of your computer (i.e., if your computer settings are

Checked on: This is the date when having checked the confirmation. Optional, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Remarks: Free text for any remarks. Optional, free text.

Remarks: Free text for any remarks. Optional, free text. Hedge Designation: In case the fx deal is intended as a hedge, you can designate it in this box as Cash Flow-, Fair Value-, Net-Investment or as no

Hedge Designation: In case the fx deal is intended as a hedge, you can designate it in this box as Cash Flow-, Fair Value-, Net-Investment or as no Hedge. This selection is only informational. Optional, given context.

Hedge. This selection is only informational. Optional, given context. Instrument: Standard is a spot transaction. You should always mention the type of instrument, esepecially, if it is a swap. Optional, given context.

Instrument: Standard is a spot transaction. You should always mention the type of instrument, esepecially, if it is a swap. Optional, given context. Underlying: In case there is an underlying to the fx deal, you can enter into this box what it is. Optional, free text.

Underlying: In case there is an underlying to the fx deal, you can enter into this box what it is. Optional, free text.