Stahr Treasury Software Help

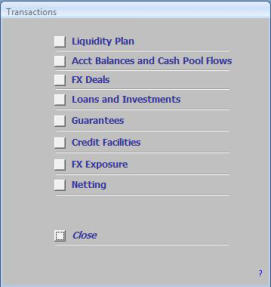

Transactions - Main Menu

This menu is the main navigation pannel for all kind of transactions within the Stahr Treasury Software STS. By clicking on one of the buttons, the respective transaction-menu will appear.

STS. By clicking on one of the buttons, the respective transaction-menu will appear. All relevant standing data, such as persons, banks, accounts and so on are managed in menu Standing

All relevant standing data, such as persons, banks, accounts and so on are managed in menu Standing Data. That means, there is no need to enter any information twice. Thus, redundancies are avoided and

Data. That means, there is no need to enter any information twice. Thus, redundancies are avoided and ensure a safe and unique management for all kind of transactions.

ensure a safe and unique management for all kind of transactions. Components

Components 1.

Liquidity Plan: Having the liquidity under control is one the most important key-tasks for every

1.

Liquidity Plan: Having the liquidity under control is one the most important key-tasks for every Treasury Department. With this module liquidity planning is standardised, safe and allows powerful

Treasury Department. With this module liquidity planning is standardised, safe and allows powerful reports.

reports. 2.

Account Balances and Cash Pool Flows: For every account opened in menu Standing-Data ->

2.

Account Balances and Cash Pool Flows: For every account opened in menu Standing-Data -> Accounts, account-balances can be entered. There is also an interface to upload account

Accounts, account-balances can be entered. There is also an interface to upload account information automatically from any source (need to be set-up individually). In the sub-menu Cash

information automatically from any source (need to be set-up individually). In the sub-menu Cash Pool Flows all cash flows for pool accounts are to be entered. Same like for the account balances, cash pool transactions (=cash flows) can be

Pool Flows all cash flows for pool accounts are to be entered. Same like for the account balances, cash pool transactions (=cash flows) can be imported automatically with an interface.

imported automatically with an interface. 3.

FX Deals: This is the menu where foreign exchange transactions are captured, i.e. Spot, Forward, Swap.

3.

FX Deals: This is the menu where foreign exchange transactions are captured, i.e. Spot, Forward, Swap. 4.

Loans and Investments: All kind of money market transactions, such as internal or external loans and/or investments are managed in this

4.

Loans and Investments: All kind of money market transactions, such as internal or external loans and/or investments are managed in this menu. Interest legs are also part of this menu.

menu. Interest legs are also part of this menu. 5.

Guarantees: Guarantees, such as pledges, sureties, rental-guarantees, custom-guarantees, letter of credits etc. are entered in this section.

5.

Guarantees: Guarantees, such as pledges, sureties, rental-guarantees, custom-guarantees, letter of credits etc. are entered in this section. 6.

Credit Facilities: Every company has credit facilities, larger and smaller ones. This menu manages all kind of them.

6.

Credit Facilities: Every company has credit facilities, larger and smaller ones. This menu manages all kind of them. 7.

FX Exposure: A very important information for every Treasurer: what is the entity- and group exposure by risk-type, hedging item, entity,

7.

FX Exposure: A very important information for every Treasurer: what is the entity- and group exposure by risk-type, hedging item, entity, currency etc. This menu is intended to report all kind of transactional exposures from the entity direct onto the Treasurers desk. Entities all over

currency etc. This menu is intended to report all kind of transactional exposures from the entity direct onto the Treasurers desk. Entities all over the world will have acces to this menu and report this way their exposures.

the world will have acces to this menu and report this way their exposures.  8.

Netting: A very powerful process to enable a maximum reduction of intercompany transactions, size of payable and receivable amounts,

8.

Netting: A very powerful process to enable a maximum reduction of intercompany transactions, size of payable and receivable amounts, maximum transparancy all day (not only at month end), ease month-end / year-end closings, make them faster and safer, reduce currency

maximum transparancy all day (not only at month end), ease month-end / year-end closings, make them faster and safer, reduce currency exposure and so on.

exposure and so on.

STS. By clicking on one of the buttons, the respective transaction-menu will appear.

STS. By clicking on one of the buttons, the respective transaction-menu will appear. All relevant standing data, such as persons, banks, accounts and so on are managed in menu Standing

All relevant standing data, such as persons, banks, accounts and so on are managed in menu Standing Data. That means, there is no need to enter any information twice. Thus, redundancies are avoided and

Data. That means, there is no need to enter any information twice. Thus, redundancies are avoided and ensure a safe and unique management for all kind of transactions.

ensure a safe and unique management for all kind of transactions. Components

Components 1.

Liquidity Plan: Having the liquidity under control is one the most important key-tasks for every

1.

Liquidity Plan: Having the liquidity under control is one the most important key-tasks for every Treasury Department. With this module liquidity planning is standardised, safe and allows powerful

Treasury Department. With this module liquidity planning is standardised, safe and allows powerful reports.

reports. 2.

Account Balances and Cash Pool Flows: For every account opened in menu Standing-Data ->

2.

Account Balances and Cash Pool Flows: For every account opened in menu Standing-Data -> Accounts, account-balances can be entered. There is also an interface to upload account

Accounts, account-balances can be entered. There is also an interface to upload account information automatically from any source (need to be set-up individually). In the sub-menu Cash

information automatically from any source (need to be set-up individually). In the sub-menu Cash Pool Flows all cash flows for pool accounts are to be entered. Same like for the account balances, cash pool transactions (=cash flows) can be

Pool Flows all cash flows for pool accounts are to be entered. Same like for the account balances, cash pool transactions (=cash flows) can be imported automatically with an interface.

imported automatically with an interface. 3.

FX Deals: This is the menu where foreign exchange transactions are captured, i.e. Spot, Forward, Swap.

3.

FX Deals: This is the menu where foreign exchange transactions are captured, i.e. Spot, Forward, Swap. 4.

Loans and Investments: All kind of money market transactions, such as internal or external loans and/or investments are managed in this

4.

Loans and Investments: All kind of money market transactions, such as internal or external loans and/or investments are managed in this menu. Interest legs are also part of this menu.

menu. Interest legs are also part of this menu. 5.

Guarantees: Guarantees, such as pledges, sureties, rental-guarantees, custom-guarantees, letter of credits etc. are entered in this section.

5.

Guarantees: Guarantees, such as pledges, sureties, rental-guarantees, custom-guarantees, letter of credits etc. are entered in this section. 6.

Credit Facilities: Every company has credit facilities, larger and smaller ones. This menu manages all kind of them.

6.

Credit Facilities: Every company has credit facilities, larger and smaller ones. This menu manages all kind of them. 7.

FX Exposure: A very important information for every Treasurer: what is the entity- and group exposure by risk-type, hedging item, entity,

7.

FX Exposure: A very important information for every Treasurer: what is the entity- and group exposure by risk-type, hedging item, entity, currency etc. This menu is intended to report all kind of transactional exposures from the entity direct onto the Treasurers desk. Entities all over

currency etc. This menu is intended to report all kind of transactional exposures from the entity direct onto the Treasurers desk. Entities all over the world will have acces to this menu and report this way their exposures.

the world will have acces to this menu and report this way their exposures.  8.

Netting: A very powerful process to enable a maximum reduction of intercompany transactions, size of payable and receivable amounts,

8.

Netting: A very powerful process to enable a maximum reduction of intercompany transactions, size of payable and receivable amounts, maximum transparancy all day (not only at month end), ease month-end / year-end closings, make them faster and safer, reduce currency

maximum transparancy all day (not only at month end), ease month-end / year-end closings, make them faster and safer, reduce currency exposure and so on.

exposure and so on.