Group / Intercompany Netting

Do you have multiple subsidiaries with intercompany payments?

Do they pay the IC-invoices to each other direct? -

This bears high risks, is inefficient and cost a lot of money!

Netting, derived from the action "to net" is a process in which receivables and payables are compared to each other for all group companies and cleared, i.e. settled vs. each other through a centralized Netting Center - also called Corporated Netting Center. Final reason is the payment

cleared, i.e. settled vs. each other through a centralized Netting Center - also called Corporated Netting Center. Final reason is the payment (mostly, but not always in cash), reduced to just one amount which is paid / received only. But the largest benefits are not visible at a first glance!

(mostly, but not always in cash), reduced to just one amount which is paid / received only. But the largest benefits are not visible at a first glance!  Provided that at this point netting in organisational terms is only intended for for receivables and payabels occurred within a legal group

Provided that at this point netting in organisational terms is only intended for for receivables and payabels occurred within a legal group structure: the clearing of accounts receivables- and payables is also common practice, but ends with the single vendor-customer relationship.

structure: the clearing of accounts receivables- and payables is also common practice, but ends with the single vendor-customer relationship. However, the principle idea is the same.

However, the principle idea is the same. Way of posing a Problem / Task

Way of posing a Problem / Task Meet this example also your group?

Meet this example also your group? •

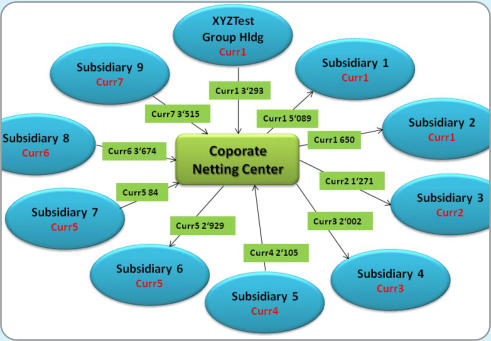

XYZTest Group, holding in country A with subsidiaries (controlled) in countries A, B, C, D, E and F.

•

A delivers to B and E and invoicesin currency A.

•

XYZTest Group, holding in country A with subsidiaries (controlled) in countries A, B, C, D, E and F.

•

A delivers to B and E and invoicesin currency A. •

C delivers to A and D and invoices in currency C.

•

C delivers to A and D and invoices in currency C. •

D delivers to E and invoices in currenc E.

•

D delivers to E and invoices in currenc E. •

etc etc.

Therefore following problems arised and in relation to it, these risks will arise:

•

etc etc.

Therefore following problems arised and in relation to it, these risks will arise: A) Quantitative Impact

A) Quantitative Impact 1.

High expenses for payment orders because of a large number of payment transactions.

1.

High expenses for payment orders because of a large number of payment transactions. 2.

Foreign exchange risk at the receiver of the rendered service. Those are often in other countries and/or receivables in other currencies

2.

Foreign exchange risk at the receiver of the rendered service. Those are often in other countries and/or receivables in other currencies than the one they need to settle the invoice. Conclusion: due to internal process external risks are build up! They can be measured

than the one they need to settle the invoice. Conclusion: due to internal process external risks are build up! They can be measured quantitative for example with Value at Risk resp. Cash Flow at Risk.

quantitative for example with Value at Risk resp. Cash Flow at Risk. 3.

Foreign Exchange costs: for the same reason as 2. above the reciever of the service has to pay relative quite low amounts. Often

3.

Foreign Exchange costs: for the same reason as 2. above the reciever of the service has to pay relative quite low amounts. Often dedited/credited from an account, which is denominated in another currency than the invoice-currency. These additional transaction costs

dedited/credited from an account, which is denominated in another currency than the invoice-currency. These additional transaction costs are approx. 2%-4% of the total invoice amount! In these days, where margins have to be calculated on the second digit after the comma

are approx. 2%-4% of the total invoice amount! In these days, where margins have to be calculated on the second digit after the comma and agreed in heavy negotiationes, this way of paying invoices can be considered as pure destruction of money.

and agreed in heavy negotiationes, this way of paying invoices can be considered as pure destruction of money. 4.

With every single payment also the risk increase of manual input errors that it will be paid too much or too less. This leads to binding of

4.

With every single payment also the risk increase of manual input errors that it will be paid too much or too less. This leads to binding of intensive human resource power what is at the end expensive. If you would measure these items for a specific period the one and other

intensive human resource power what is at the end expensive. If you would measure these items for a specific period the one and other CFO would wonder what he pays for this unfavourable process.

CFO would wonder what he pays for this unfavourable process. 5.

In case the foreign exchange risk would be centralized by a netting process, the netting center would be able a) to eliminate these fx-risk

5.

In case the foreign exchange risk would be centralized by a netting process, the netting center would be able a) to eliminate these fx-risk in a first step (overlay) and b) to manage the remaining amount per currency with hedging, for instance fx-swaps.

in a first step (overlay) and b) to manage the remaining amount per currency with hedging, for instance fx-swaps. B) Qualitative Impact

B) Qualitative Impact 1.

The counterparty risk increase with every single transaction. Imagine, you give your bank a payment order and your bank has no direct

1.

The counterparty risk increase with every single transaction. Imagine, you give your bank a payment order and your bank has no direct nostro account with the correspoding bank of the beneficiary. Such payment processes through intermediary banks are very common in

nostro account with the correspoding bank of the beneficiary. Such payment processes through intermediary banks are very common in the international payment system. Assume that the intermediary bank is Lehman Brothers. You as ordering party don’t know that and have

the international payment system. Assume that the intermediary bank is Lehman Brothers. You as ordering party don’t know that and have no control about it. But in case of a total shortfall of this intermediary bank you have to pay this total loss! Because this risk is

no control about it. But in case of a total shortfall of this intermediary bank you have to pay this total loss! Because this risk is just hardly to be quantified we mention it here as qualitative risk.

just hardly to be quantified we mention it here as qualitative risk. 2.

Monthly and quarterly intercompany reconciliation is unpopular, time consuming, fraught with risks and therefore need to be implicitely

2.

Monthly and quarterly intercompany reconciliation is unpopular, time consuming, fraught with risks and therefore need to be implicitely avoided. A centralized reconciliation which is always up to date can be outweight in these times with gold. Due to the permanent clearing

avoided. A centralized reconciliation which is always up to date can be outweight in these times with gold. Due to the permanent clearing process, the typical monthly- and quarterly differences will be (if they still happen) resolved in very short time. And: not by the Accountant

process, the typical monthly- and quarterly differences will be (if they still happen) resolved in very short time. And: not by the Accountant which is heavy under pressure during closing days, new by a Treasury Manager which has anyway the overview about all transactions

which is heavy under pressure during closing days, new by a Treasury Manager which has anyway the overview about all transactions throughout the month.

throughout the month. Concerned Transactions

The characteristic of the concerned transactions is given by the legal frame: receivables and payments need to be due and in their content need

Concerned Transactions

The characteristic of the concerned transactions is given by the legal frame: receivables and payments need to be due and in their content need to be qualified for netting. Most intercompany transactions are:

to be qualified for netting. Most intercompany transactions are: •

Local expenes which have been pre-paid by a entity

•

Local expenes which have been pre-paid by a entity •

Interest from intercompany loans

•

Interest from intercompany loans •

Products from a pre-production (e.g. unfinished goods)

•

Products from a pre-production (e.g. unfinished goods) •

Management Fee

•

Management Fee •

Service Fee

•

Service Fee •

Corp. Re-Charges with fix determined key

•

Corp. Re-Charges with fix determined key From Chaos to Order

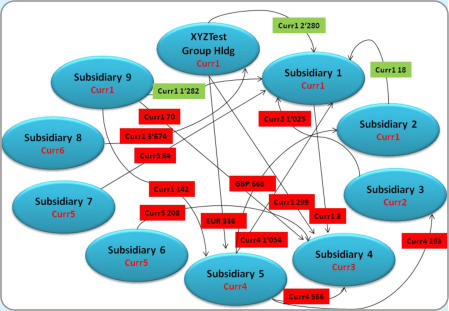

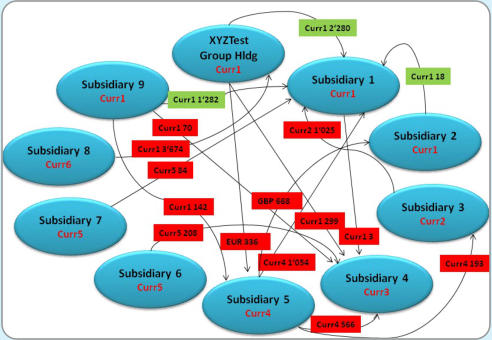

A) Before

From Chaos to Order

A) Before B) After

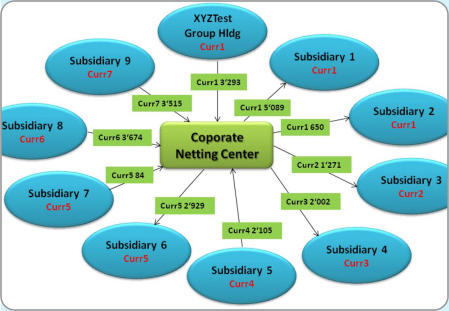

B) After Organization

Organization As monitored in the “After” picture above, the Corporate Netting Center is the central key-element between all group companies. Hence, the

As monitored in the “After” picture above, the Corporate Netting Center is the central key-element between all group companies. Hence, the question for the location of the corporate netting center is already given.

question for the location of the corporate netting center is already given. Preferrably the Netting Center should a) belong to the Treasury Department and b) at a location which should qualify for possible tax benefits

Preferrably the Netting Center should a) belong to the Treasury Department and b) at a location which should qualify for possible tax benefits because of double tax agreements and as less as possible restrictions by local authorities. Those are complicate and often discretionary by the

because of double tax agreements and as less as possible restrictions by local authorities. Those are complicate and often discretionary by the responsible officials. Positive examples are the Netherlands, Luxembourg (under the consideration that both have to apply European Untion

responsible officials. Positive examples are the Netherlands, Luxembourg (under the consideration that both have to apply European Untion law), Switzerland and especially Singapore. Negative examples are all countries in Africa, Russia, most of the Latin American coutnries,

law), Switzerland and especially Singapore. Negative examples are all countries in Africa, Russia, most of the Latin American coutnries, especially Venezuela and Argentina.

Risks

especially Venezuela and Argentina.

Risks Nothing in our world is without risk and nothing is for free (Adam Smith mention it already in his Wealth of Nations). Starting with the

Nothing in our world is without risk and nothing is for free (Adam Smith mention it already in his Wealth of Nations). Starting with the implementation risk that current processes are going to be changed can be a risk. With exact- and important, professional planning as well as

implementation risk that current processes are going to be changed can be a risk. With exact- and important, professional planning as well as balancing strenghts - weakness - chances in a project those risks are recognized and can be held under control. In order of completeness we

balancing strenghts - weakness - chances in a project those risks are recognized and can be held under control. In order of completeness we mention at this point the risk of transfer pricing, which, also recognized in time, is then no more risk.

Summary

mention at this point the risk of transfer pricing, which, also recognized in time, is then no more risk.

Summary By introducing a central clearing center, called Corporate Netting Center, many expensive costs are avoided with less complexetiy (mostly in

By introducing a central clearing center, called Corporate Netting Center, many expensive costs are avoided with less complexetiy (mostly in relation to IT-investments which are very low with our Treasury Software STS, valuable risks are reduced and reconciliation processes are made

relation to IT-investments which are very low with our Treasury Software STS, valuable risks are reduced and reconciliation processes are made clearly more simple . Order now a free presentation for managing Group Netting and see here how it works.

Contact us, we would be glad to show you the possible opportunities!

clearly more simple . Order now a free presentation for managing Group Netting and see here how it works.

Contact us, we would be glad to show you the possible opportunities!

cleared, i.e. settled vs. each other through a centralized Netting Center - also called Corporated Netting Center. Final reason is the payment

cleared, i.e. settled vs. each other through a centralized Netting Center - also called Corporated Netting Center. Final reason is the payment (mostly, but not always in cash), reduced to just one amount which is paid / received only. But the largest benefits are not visible at a first glance!

(mostly, but not always in cash), reduced to just one amount which is paid / received only. But the largest benefits are not visible at a first glance!  Provided that at this point netting in organisational terms is only intended for for receivables and payabels occurred within a legal group

Provided that at this point netting in organisational terms is only intended for for receivables and payabels occurred within a legal group structure: the clearing of accounts receivables- and payables is also common practice, but ends with the single vendor-customer relationship.

structure: the clearing of accounts receivables- and payables is also common practice, but ends with the single vendor-customer relationship. However, the principle idea is the same.

However, the principle idea is the same. Way of posing a Problem / Task

Way of posing a Problem / Task Meet this example also your group?

Meet this example also your group? •

XYZTest Group, holding in country A with subsidiaries (controlled) in countries A, B, C, D, E and F.

•

A delivers to B and E and invoicesin currency A.

•

XYZTest Group, holding in country A with subsidiaries (controlled) in countries A, B, C, D, E and F.

•

A delivers to B and E and invoicesin currency A. •

C delivers to A and D and invoices in currency C.

•

C delivers to A and D and invoices in currency C. •

D delivers to E and invoices in currenc E.

•

D delivers to E and invoices in currenc E. •

etc etc.

Therefore following problems arised and in relation to it, these risks will arise:

•

etc etc.

Therefore following problems arised and in relation to it, these risks will arise: A) Quantitative Impact

A) Quantitative Impact 1.

High expenses for payment orders because of a large number of payment transactions.

1.

High expenses for payment orders because of a large number of payment transactions. 2.

Foreign exchange risk at the receiver of the rendered service. Those are often in other countries and/or receivables in other currencies

2.

Foreign exchange risk at the receiver of the rendered service. Those are often in other countries and/or receivables in other currencies than the one they need to settle the invoice. Conclusion: due to internal process external risks are build up! They can be measured

than the one they need to settle the invoice. Conclusion: due to internal process external risks are build up! They can be measured quantitative for example with Value at Risk resp. Cash Flow at Risk.

quantitative for example with Value at Risk resp. Cash Flow at Risk. 3.

Foreign Exchange costs: for the same reason as 2. above the reciever of the service has to pay relative quite low amounts. Often

3.

Foreign Exchange costs: for the same reason as 2. above the reciever of the service has to pay relative quite low amounts. Often dedited/credited from an account, which is denominated in another currency than the invoice-currency. These additional transaction costs

dedited/credited from an account, which is denominated in another currency than the invoice-currency. These additional transaction costs are approx. 2%-4% of the total invoice amount! In these days, where margins have to be calculated on the second digit after the comma

are approx. 2%-4% of the total invoice amount! In these days, where margins have to be calculated on the second digit after the comma and agreed in heavy negotiationes, this way of paying invoices can be considered as pure destruction of money.

and agreed in heavy negotiationes, this way of paying invoices can be considered as pure destruction of money. 4.

With every single payment also the risk increase of manual input errors that it will be paid too much or too less. This leads to binding of

4.

With every single payment also the risk increase of manual input errors that it will be paid too much or too less. This leads to binding of intensive human resource power what is at the end expensive. If you would measure these items for a specific period the one and other

intensive human resource power what is at the end expensive. If you would measure these items for a specific period the one and other CFO would wonder what he pays for this unfavourable process.

CFO would wonder what he pays for this unfavourable process. 5.

In case the foreign exchange risk would be centralized by a netting process, the netting center would be able a) to eliminate these fx-risk

5.

In case the foreign exchange risk would be centralized by a netting process, the netting center would be able a) to eliminate these fx-risk in a first step (overlay) and b) to manage the remaining amount per currency with hedging, for instance fx-swaps.

in a first step (overlay) and b) to manage the remaining amount per currency with hedging, for instance fx-swaps. B) Qualitative Impact

B) Qualitative Impact 1.

The counterparty risk increase with every single transaction. Imagine, you give your bank a payment order and your bank has no direct

1.

The counterparty risk increase with every single transaction. Imagine, you give your bank a payment order and your bank has no direct nostro account with the correspoding bank of the beneficiary. Such payment processes through intermediary banks are very common in

nostro account with the correspoding bank of the beneficiary. Such payment processes through intermediary banks are very common in the international payment system. Assume that the intermediary bank is Lehman Brothers. You as ordering party don’t know that and have

the international payment system. Assume that the intermediary bank is Lehman Brothers. You as ordering party don’t know that and have no control about it. But in case of a total shortfall of this intermediary bank you have to pay this total loss! Because this risk is

no control about it. But in case of a total shortfall of this intermediary bank you have to pay this total loss! Because this risk is just hardly to be quantified we mention it here as qualitative risk.

just hardly to be quantified we mention it here as qualitative risk. 2.

Monthly and quarterly intercompany reconciliation is unpopular, time consuming, fraught with risks and therefore need to be implicitely

2.

Monthly and quarterly intercompany reconciliation is unpopular, time consuming, fraught with risks and therefore need to be implicitely avoided. A centralized reconciliation which is always up to date can be outweight in these times with gold. Due to the permanent clearing

avoided. A centralized reconciliation which is always up to date can be outweight in these times with gold. Due to the permanent clearing process, the typical monthly- and quarterly differences will be (if they still happen) resolved in very short time. And: not by the Accountant

process, the typical monthly- and quarterly differences will be (if they still happen) resolved in very short time. And: not by the Accountant which is heavy under pressure during closing days, new by a Treasury Manager which has anyway the overview about all transactions

which is heavy under pressure during closing days, new by a Treasury Manager which has anyway the overview about all transactions throughout the month.

throughout the month. Concerned Transactions

The characteristic of the concerned transactions is given by the legal frame: receivables and payments need to be due and in their content need

Concerned Transactions

The characteristic of the concerned transactions is given by the legal frame: receivables and payments need to be due and in their content need to be qualified for netting. Most intercompany transactions are:

to be qualified for netting. Most intercompany transactions are: •

Local expenes which have been pre-paid by a entity

•

Local expenes which have been pre-paid by a entity •

Interest from intercompany loans

•

Interest from intercompany loans •

Products from a pre-production (e.g. unfinished goods)

•

Products from a pre-production (e.g. unfinished goods) •

Management Fee

•

Management Fee •

Service Fee

•

Service Fee •

Corp. Re-Charges with fix determined key

•

Corp. Re-Charges with fix determined key From Chaos to Order

A) Before

From Chaos to Order

A) Before B) After

B) After Organization

Organization As monitored in the “After” picture above, the Corporate Netting Center is the central key-element between all group companies. Hence, the

As monitored in the “After” picture above, the Corporate Netting Center is the central key-element between all group companies. Hence, the question for the location of the corporate netting center is already given.

question for the location of the corporate netting center is already given. Preferrably the Netting Center should a) belong to the Treasury Department and b) at a location which should qualify for possible tax benefits

Preferrably the Netting Center should a) belong to the Treasury Department and b) at a location which should qualify for possible tax benefits because of double tax agreements and as less as possible restrictions by local authorities. Those are complicate and often discretionary by the

because of double tax agreements and as less as possible restrictions by local authorities. Those are complicate and often discretionary by the responsible officials. Positive examples are the Netherlands, Luxembourg (under the consideration that both have to apply European Untion

responsible officials. Positive examples are the Netherlands, Luxembourg (under the consideration that both have to apply European Untion law), Switzerland and especially Singapore. Negative examples are all countries in Africa, Russia, most of the Latin American coutnries,

law), Switzerland and especially Singapore. Negative examples are all countries in Africa, Russia, most of the Latin American coutnries, especially Venezuela and Argentina.

Risks

especially Venezuela and Argentina.

Risks Nothing in our world is without risk and nothing is for free (Adam Smith mention it already in his Wealth of Nations). Starting with the

Nothing in our world is without risk and nothing is for free (Adam Smith mention it already in his Wealth of Nations). Starting with the implementation risk that current processes are going to be changed can be a risk. With exact- and important, professional planning as well as

implementation risk that current processes are going to be changed can be a risk. With exact- and important, professional planning as well as balancing strenghts - weakness - chances in a project those risks are recognized and can be held under control. In order of completeness we

balancing strenghts - weakness - chances in a project those risks are recognized and can be held under control. In order of completeness we mention at this point the risk of transfer pricing, which, also recognized in time, is then no more risk.

Summary

mention at this point the risk of transfer pricing, which, also recognized in time, is then no more risk.

Summary By introducing a central clearing center, called Corporate Netting Center, many expensive costs are avoided with less complexetiy (mostly in

By introducing a central clearing center, called Corporate Netting Center, many expensive costs are avoided with less complexetiy (mostly in relation to IT-investments which are very low with our Treasury Software STS, valuable risks are reduced and reconciliation processes are made

relation to IT-investments which are very low with our Treasury Software STS, valuable risks are reduced and reconciliation processes are made clearly more simple . Order now a free presentation for managing Group Netting and see here how it works.

Contact us, we would be glad to show you the possible opportunities!

clearly more simple . Order now a free presentation for managing Group Netting and see here how it works.

Contact us, we would be glad to show you the possible opportunities!

Group / Intercompany Netting

Do you have multiple subsidiaries with intercompany payments?

Do they pay the IC-invoices to each other direct? -

This bears high risks, is inefficient and cost a lot of money!

Netting, derived from the action "to net" is a process in which receivables and payables are compared to each other for all group

receivables and payables are compared to each other for all group companies and cleared, i.e. settled vs. each other through a

companies and cleared, i.e. settled vs. each other through a centralized Netting Center - also called Corporated Netting Center.

centralized Netting Center - also called Corporated Netting Center. Final reason is the payment (mostly, but not always in cash),

Final reason is the payment (mostly, but not always in cash), reduced to just one amount which is paid / received only. But the

reduced to just one amount which is paid / received only. But the largest benefits are not visible at a first glance!

Provided that at this point netting in organisational terms is only

largest benefits are not visible at a first glance!

Provided that at this point netting in organisational terms is only intended for for receivables and payabels occurred within a legal

intended for for receivables and payabels occurred within a legal group structure: the clearing of accounts receivables- and payables

group structure: the clearing of accounts receivables- and payables is also common practice, but ends with the single vendor-customer

is also common practice, but ends with the single vendor-customer relationship. However, the principle idea is the same.

Way of posing a Problem / Task

Meet this example also your group?

relationship. However, the principle idea is the same.

Way of posing a Problem / Task

Meet this example also your group? •

XYZTest Group, holding in country A with subsidiaries

•

XYZTest Group, holding in country A with subsidiaries (controlled) in countries A, B, C, D, E and F.

•

A delivers to B and E and invoicesin currency A.

•

C delivers to A and D and invoices in currency C.

•

D delivers to E and invoices in currenc E.

•

etc etc.

Therefore following problems arised and in relation to it, these risks

(controlled) in countries A, B, C, D, E and F.

•

A delivers to B and E and invoicesin currency A.

•

C delivers to A and D and invoices in currency C.

•

D delivers to E and invoices in currenc E.

•

etc etc.

Therefore following problems arised and in relation to it, these risks will arise:

will arise: A) Quantitative Impact

A) Quantitative Impact 1.

High expenses for payment orders because of a large number

1.

High expenses for payment orders because of a large number of payment transactions.

2.

Foreign exchange risk at the receiver of the rendered service.

of payment transactions.

2.

Foreign exchange risk at the receiver of the rendered service. Those are often in other countries and/or receivables in other

Those are often in other countries and/or receivables in other currencies than the one they need to settle the invoice.

currencies than the one they need to settle the invoice. Conclusion: due to internal process external risks are

Conclusion: due to internal process external risks are build up! They can be measured quantitative for example with

build up! They can be measured quantitative for example with Value at Risk resp. Cash Flow at Risk.

3.

Foreign Exchange costs: for the same reason as 2. above the

Value at Risk resp. Cash Flow at Risk.

3.

Foreign Exchange costs: for the same reason as 2. above the reciever of the service has to pay relative quite low amounts.

reciever of the service has to pay relative quite low amounts. Often dedited/credited from an account, which is denominated

Often dedited/credited from an account, which is denominated in another currency than the invoice-currency. These additional

transaction costs are approx. 2%-4% of the total invoice

in another currency than the invoice-currency. These additional

transaction costs are approx. 2%-4% of the total invoice amount! In these days, where margins have to be calculated

amount! In these days, where margins have to be calculated on the second digit after the comma and agreed in heavy

on the second digit after the comma and agreed in heavy negotiationes, this way of paying invoices can be considered

negotiationes, this way of paying invoices can be considered as pure destruction of money.

4.

With every single payment also the risk increase of manual

as pure destruction of money.

4.

With every single payment also the risk increase of manual input errors that it will be paid too much or too less. This leads

input errors that it will be paid too much or too less. This leads to binding of intensive human resource power what is at the

to binding of intensive human resource power what is at the end expensive. If you would measure these items for a specific

end expensive. If you would measure these items for a specific period the one and other CFO would wonder what he pays for

period the one and other CFO would wonder what he pays for this unfavourable process.

5.

In case the foreign exchange risk would be centralized by a

this unfavourable process.

5.

In case the foreign exchange risk would be centralized by a netting process, the netting center would be able a) to

netting process, the netting center would be able a) to eliminate these fx-risk in a first step (overlay) and b) to

eliminate these fx-risk in a first step (overlay) and b) to manage the remaining amount per currency with hedging, for

manage the remaining amount per currency with hedging, for instance fx-swaps.

instance fx-swaps. B) Qualitative Impact

B) Qualitative Impact 1.

The counterparty risk increase with every single transaction.

1.

The counterparty risk increase with every single transaction. Imagine, you give your bank a payment order and your bank

Imagine, you give your bank a payment order and your bank has no direct nostro account with the correspoding bank of the

has no direct nostro account with the correspoding bank of the beneficiary. Such payment processes through intermediary

beneficiary. Such payment processes through intermediary banks are very common in the international payment system.

banks are very common in the international payment system. Assume that the intermediary bank is Lehman Brothers. You

Assume that the intermediary bank is Lehman Brothers. You as ordering party don’t know that and have no control about it.

as ordering party don’t know that and have no control about it. But in case of a total shortfall of this intermediary bank

But in case of a total shortfall of this intermediary bank you have to pay this total loss! Because this risk is just

you have to pay this total loss! Because this risk is just hardly to be quantified we mention it here as qualitative risk.

2.

Monthly and quarterly intercompany reconciliation is

hardly to be quantified we mention it here as qualitative risk.

2.

Monthly and quarterly intercompany reconciliation is unpopular, time consuming, fraught with risks and therefore

unpopular, time consuming, fraught with risks and therefore need to be implicitely avoided. A centralized reconciliation

need to be implicitely avoided. A centralized reconciliation which is always up to date can be outweight in these times

which is always up to date can be outweight in these times with gold. Due to the permanent clearing process, the typical

with gold. Due to the permanent clearing process, the typical monthly- and quarterly differences will be (if they still happen)

monthly- and quarterly differences will be (if they still happen) resolved in very short time. And: not by the Accountant which

resolved in very short time. And: not by the Accountant which is heavy under pressure during closing days, new by a

is heavy under pressure during closing days, new by a Treasury Manager which has anyway the overview about all

Treasury Manager which has anyway the overview about all transactions throughout the month.

Concerned Transactions

The characteristic of the concerned transactions is given by the legal

frame: receivables and payments need to be due and in their content

need to be qualified for netting. Most intercompany transactions are:

•

Local expenes which have been pre-paid by a entity

•

Interest from intercompany loans

•

Products from a pre-production (e.g. unfinished goods)

•

Management Fee

•

Service Fee

•

Corp. Re-Charges with fix determined key

transactions throughout the month.

Concerned Transactions

The characteristic of the concerned transactions is given by the legal

frame: receivables and payments need to be due and in their content

need to be qualified for netting. Most intercompany transactions are:

•

Local expenes which have been pre-paid by a entity

•

Interest from intercompany loans

•

Products from a pre-production (e.g. unfinished goods)

•

Management Fee

•

Service Fee

•

Corp. Re-Charges with fix determined key From Chaos to Order

From Chaos to Order A) Before

B) Afterwards

A) Before

B) Afterwards Organization

As monitored in the “After” picture above, the Corporate Netting

Organization

As monitored in the “After” picture above, the Corporate Netting Center is the central key-element between all group companies.

Center is the central key-element between all group companies. Hence, the question for the location of the corporate netting center is

already given.

Preferrably the Netting Center should a) belong to the Treasury

Hence, the question for the location of the corporate netting center is

already given.

Preferrably the Netting Center should a) belong to the Treasury Department and b) at a location which should qualify for possible tax

Department and b) at a location which should qualify for possible tax benefits because of double tax agreements and as less as possible

benefits because of double tax agreements and as less as possible restrictions by local authorities. Those are complicate and often

restrictions by local authorities. Those are complicate and often discretionary by the responsible officials. Positive examples are the

discretionary by the responsible officials. Positive examples are the Netherlands, Luxembourg (under the consideration that both have to

Netherlands, Luxembourg (under the consideration that both have to apply European Untion law), Switzerland and especially Singapore.

apply European Untion law), Switzerland and especially Singapore. Negative examples are all countries in Africa, Russia, most of the

Negative examples are all countries in Africa, Russia, most of the Latin American coutnries, especially Venezuela and Argentina.

Risks

Nothing in our world is without risk and nothing is for free (Adam

Latin American coutnries, especially Venezuela and Argentina.

Risks

Nothing in our world is without risk and nothing is for free (Adam Smith mention it already in his Wealth of Nations). Starting with the

Smith mention it already in his Wealth of Nations). Starting with the implementation risk that current processes are going to be changed

implementation risk that current processes are going to be changed can be a risk. With exact- and important, professional planning as

can be a risk. With exact- and important, professional planning as well as balancing strenghts - weakness - chances in a project those

well as balancing strenghts - weakness - chances in a project those risks are recognized and can be held under control. In order of

risks are recognized and can be held under control. In order of completeness we mention at this point the risk of transfer pricing,

completeness we mention at this point the risk of transfer pricing, which, also recognized in time, is then no more risk.

which, also recognized in time, is then no more risk. Summary

By introducing a central clearing center, called Corporate Netting

Summary

By introducing a central clearing center, called Corporate Netting Center, many expensive costs are avoided with less complexetiy

Center, many expensive costs are avoided with less complexetiy (mostly in relation to IT-investments which are very low with our

(mostly in relation to IT-investments which are very low with our Treasury Software STS, valuable risks are reduced and

Treasury Software STS, valuable risks are reduced and reconciliation processes are made clearly more simple . Order now

reconciliation processes are made clearly more simple . Order now a free presentation for managing Group Netting and see here

a free presentation for managing Group Netting and see here how it works.

how it works. Contact us, we would be glad to show you the possible

opportunities!

Contact us, we would be glad to show you the possible

opportunities!

receivables and payables are compared to each other for all group

receivables and payables are compared to each other for all group companies and cleared, i.e. settled vs. each other through a

companies and cleared, i.e. settled vs. each other through a centralized Netting Center - also called Corporated Netting Center.

centralized Netting Center - also called Corporated Netting Center. Final reason is the payment (mostly, but not always in cash),

Final reason is the payment (mostly, but not always in cash), reduced to just one amount which is paid / received only. But the

reduced to just one amount which is paid / received only. But the largest benefits are not visible at a first glance!

Provided that at this point netting in organisational terms is only

largest benefits are not visible at a first glance!

Provided that at this point netting in organisational terms is only intended for for receivables and payabels occurred within a legal

intended for for receivables and payabels occurred within a legal group structure: the clearing of accounts receivables- and payables

group structure: the clearing of accounts receivables- and payables is also common practice, but ends with the single vendor-customer

is also common practice, but ends with the single vendor-customer relationship. However, the principle idea is the same.

Way of posing a Problem / Task

Meet this example also your group?

relationship. However, the principle idea is the same.

Way of posing a Problem / Task

Meet this example also your group? •

XYZTest Group, holding in country A with subsidiaries

•

XYZTest Group, holding in country A with subsidiaries (controlled) in countries A, B, C, D, E and F.

•

A delivers to B and E and invoicesin currency A.

•

C delivers to A and D and invoices in currency C.

•

D delivers to E and invoices in currenc E.

•

etc etc.

Therefore following problems arised and in relation to it, these risks

(controlled) in countries A, B, C, D, E and F.

•

A delivers to B and E and invoicesin currency A.

•

C delivers to A and D and invoices in currency C.

•

D delivers to E and invoices in currenc E.

•

etc etc.

Therefore following problems arised and in relation to it, these risks will arise:

will arise: A) Quantitative Impact

A) Quantitative Impact 1.

High expenses for payment orders because of a large number

1.

High expenses for payment orders because of a large number of payment transactions.

2.

Foreign exchange risk at the receiver of the rendered service.

of payment transactions.

2.

Foreign exchange risk at the receiver of the rendered service. Those are often in other countries and/or receivables in other

Those are often in other countries and/or receivables in other currencies than the one they need to settle the invoice.

currencies than the one they need to settle the invoice. Conclusion: due to internal process external risks are

Conclusion: due to internal process external risks are build up! They can be measured quantitative for example with

build up! They can be measured quantitative for example with Value at Risk resp. Cash Flow at Risk.

3.

Foreign Exchange costs: for the same reason as 2. above the

Value at Risk resp. Cash Flow at Risk.

3.

Foreign Exchange costs: for the same reason as 2. above the reciever of the service has to pay relative quite low amounts.

reciever of the service has to pay relative quite low amounts. Often dedited/credited from an account, which is denominated

Often dedited/credited from an account, which is denominated in another currency than the invoice-currency. These additional

transaction costs are approx. 2%-4% of the total invoice

in another currency than the invoice-currency. These additional

transaction costs are approx. 2%-4% of the total invoice amount! In these days, where margins have to be calculated

amount! In these days, where margins have to be calculated on the second digit after the comma and agreed in heavy

on the second digit after the comma and agreed in heavy negotiationes, this way of paying invoices can be considered

negotiationes, this way of paying invoices can be considered as pure destruction of money.

4.

With every single payment also the risk increase of manual

as pure destruction of money.

4.

With every single payment also the risk increase of manual input errors that it will be paid too much or too less. This leads

input errors that it will be paid too much or too less. This leads to binding of intensive human resource power what is at the

to binding of intensive human resource power what is at the end expensive. If you would measure these items for a specific

end expensive. If you would measure these items for a specific period the one and other CFO would wonder what he pays for

period the one and other CFO would wonder what he pays for this unfavourable process.

5.

In case the foreign exchange risk would be centralized by a

this unfavourable process.

5.

In case the foreign exchange risk would be centralized by a netting process, the netting center would be able a) to

netting process, the netting center would be able a) to eliminate these fx-risk in a first step (overlay) and b) to

eliminate these fx-risk in a first step (overlay) and b) to manage the remaining amount per currency with hedging, for

manage the remaining amount per currency with hedging, for instance fx-swaps.

instance fx-swaps. B) Qualitative Impact

B) Qualitative Impact 1.

The counterparty risk increase with every single transaction.

1.

The counterparty risk increase with every single transaction. Imagine, you give your bank a payment order and your bank

Imagine, you give your bank a payment order and your bank has no direct nostro account with the correspoding bank of the

has no direct nostro account with the correspoding bank of the beneficiary. Such payment processes through intermediary

beneficiary. Such payment processes through intermediary banks are very common in the international payment system.

banks are very common in the international payment system. Assume that the intermediary bank is Lehman Brothers. You

Assume that the intermediary bank is Lehman Brothers. You as ordering party don’t know that and have no control about it.

as ordering party don’t know that and have no control about it. But in case of a total shortfall of this intermediary bank

But in case of a total shortfall of this intermediary bank you have to pay this total loss! Because this risk is just

you have to pay this total loss! Because this risk is just hardly to be quantified we mention it here as qualitative risk.

2.

Monthly and quarterly intercompany reconciliation is

hardly to be quantified we mention it here as qualitative risk.

2.

Monthly and quarterly intercompany reconciliation is unpopular, time consuming, fraught with risks and therefore

unpopular, time consuming, fraught with risks and therefore need to be implicitely avoided. A centralized reconciliation

need to be implicitely avoided. A centralized reconciliation which is always up to date can be outweight in these times

which is always up to date can be outweight in these times with gold. Due to the permanent clearing process, the typical

with gold. Due to the permanent clearing process, the typical monthly- and quarterly differences will be (if they still happen)

monthly- and quarterly differences will be (if they still happen) resolved in very short time. And: not by the Accountant which

resolved in very short time. And: not by the Accountant which is heavy under pressure during closing days, new by a

is heavy under pressure during closing days, new by a Treasury Manager which has anyway the overview about all

Treasury Manager which has anyway the overview about all transactions throughout the month.

Concerned Transactions

The characteristic of the concerned transactions is given by the legal

frame: receivables and payments need to be due and in their content

need to be qualified for netting. Most intercompany transactions are:

•

Local expenes which have been pre-paid by a entity

•

Interest from intercompany loans

•

Products from a pre-production (e.g. unfinished goods)

•

Management Fee

•

Service Fee

•

Corp. Re-Charges with fix determined key

transactions throughout the month.

Concerned Transactions

The characteristic of the concerned transactions is given by the legal

frame: receivables and payments need to be due and in their content

need to be qualified for netting. Most intercompany transactions are:

•

Local expenes which have been pre-paid by a entity

•

Interest from intercompany loans

•

Products from a pre-production (e.g. unfinished goods)

•

Management Fee

•

Service Fee

•

Corp. Re-Charges with fix determined key From Chaos to Order

From Chaos to Order A) Before

B) Afterwards

A) Before

B) Afterwards Organization

As monitored in the “After” picture above, the Corporate Netting

Organization

As monitored in the “After” picture above, the Corporate Netting Center is the central key-element between all group companies.

Center is the central key-element between all group companies. Hence, the question for the location of the corporate netting center is

already given.

Preferrably the Netting Center should a) belong to the Treasury

Hence, the question for the location of the corporate netting center is

already given.

Preferrably the Netting Center should a) belong to the Treasury Department and b) at a location which should qualify for possible tax

Department and b) at a location which should qualify for possible tax benefits because of double tax agreements and as less as possible

benefits because of double tax agreements and as less as possible restrictions by local authorities. Those are complicate and often

restrictions by local authorities. Those are complicate and often discretionary by the responsible officials. Positive examples are the

discretionary by the responsible officials. Positive examples are the Netherlands, Luxembourg (under the consideration that both have to

Netherlands, Luxembourg (under the consideration that both have to apply European Untion law), Switzerland and especially Singapore.

apply European Untion law), Switzerland and especially Singapore. Negative examples are all countries in Africa, Russia, most of the

Negative examples are all countries in Africa, Russia, most of the Latin American coutnries, especially Venezuela and Argentina.

Risks

Nothing in our world is without risk and nothing is for free (Adam

Latin American coutnries, especially Venezuela and Argentina.

Risks

Nothing in our world is without risk and nothing is for free (Adam Smith mention it already in his Wealth of Nations). Starting with the

Smith mention it already in his Wealth of Nations). Starting with the implementation risk that current processes are going to be changed

implementation risk that current processes are going to be changed can be a risk. With exact- and important, professional planning as

can be a risk. With exact- and important, professional planning as well as balancing strenghts - weakness - chances in a project those

well as balancing strenghts - weakness - chances in a project those risks are recognized and can be held under control. In order of

risks are recognized and can be held under control. In order of completeness we mention at this point the risk of transfer pricing,

completeness we mention at this point the risk of transfer pricing, which, also recognized in time, is then no more risk.

which, also recognized in time, is then no more risk. Summary

By introducing a central clearing center, called Corporate Netting

Summary

By introducing a central clearing center, called Corporate Netting Center, many expensive costs are avoided with less complexetiy

Center, many expensive costs are avoided with less complexetiy (mostly in relation to IT-investments which are very low with our

(mostly in relation to IT-investments which are very low with our Treasury Software STS, valuable risks are reduced and

Treasury Software STS, valuable risks are reduced and reconciliation processes are made clearly more simple . Order now

reconciliation processes are made clearly more simple . Order now a free presentation for managing Group Netting and see here

a free presentation for managing Group Netting and see here how it works.

how it works. Contact us, we would be glad to show you the possible

opportunities!

Contact us, we would be glad to show you the possible

opportunities!