Finance- and Liquidity Plans

Transparent finance- liquidity planning is the heart of every financial department

and essential to survive

.

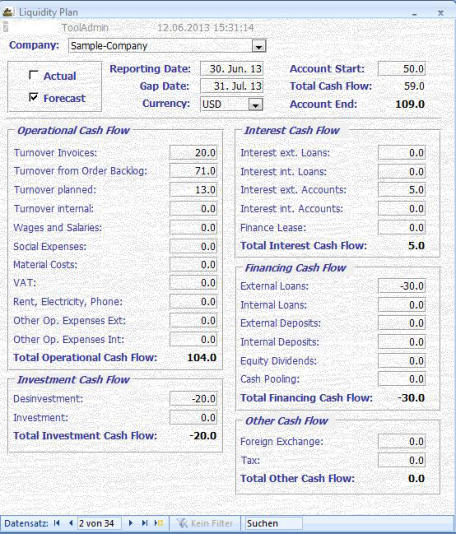

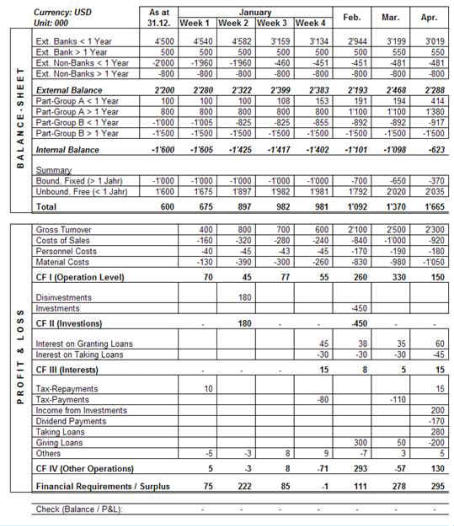

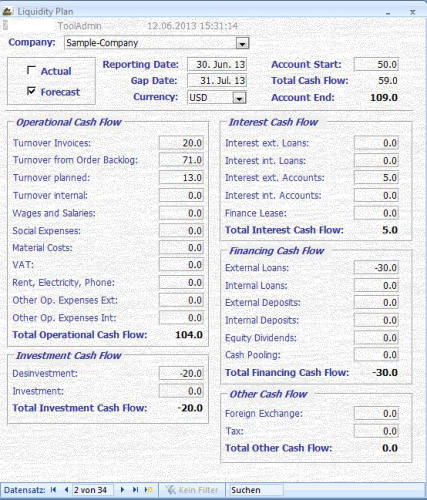

Example of a combined Finance- and Liquidityplan including a Cash Flow Summary

A) In a Excel Spreadsheet B) In our Treasury Software

A Financeplan is primary intended for a strategic longterm period (more than a year) and also for a operational short-term period -> Liquidity Plan. It is a basic requirement for the economical controlling of the liquidity-risk! The financeplan is defined as a companies forecast about the expected

It is a basic requirement for the economical controlling of the liquidity-risk! The financeplan is defined as a companies forecast about the expected revenues and expenses in a specific period, completed by the movement of payables and loan inventory.

revenues and expenses in a specific period, completed by the movement of payables and loan inventory. However, to obtain a best possible fx-hedging, natural or by derivatives, such a finance plan can be used perfectly also as a direct fx-liquidity plan

However, to obtain a best possible fx-hedging, natural or by derivatives, such a finance plan can be used perfectly also as a direct fx-liquidity plan if this plan is segregated by currency! Our model of a combined finance- and liquidity plan is successful introduced in many small-, mid-, large

if this plan is segregated by currency! Our model of a combined finance- and liquidity plan is successful introduced in many small-, mid-, large and multinational groups. It is the perfect tool to monitor quick and comprehensive direct cashflows, where they come from and where they

and multinational groups. It is the perfect tool to monitor quick and comprehensive direct cashflows, where they come from and where they are going to including correspondent balance sheet accounts. On top, a cash flow report is intergrated in the liquidity part to have full

are going to including correspondent balance sheet accounts. On top, a cash flow report is intergrated in the liquidity part to have full overview at a glance (and not just once a month / quarter after accounting prepared the closing).

overview at a glance (and not just once a month / quarter after accounting prepared the closing). Reasons for a combined Finance- and Liquidity Plan

Reasons for a combined Finance- and Liquidity Plan 1.

Ensure short- and longterm solvency

1.

Ensure short- and longterm solvency 2.

Minimizing the opportunity costs of too much cash

3.

Minimize the financing costs,

4.

Ensure efficient currency- and interest hedging, (see also section “currency- and interest hedging”)

2.

Minimizing the opportunity costs of too much cash

3.

Minimize the financing costs,

4.

Ensure efficient currency- and interest hedging, (see also section “currency- and interest hedging”) 5.

Maximize return of investments,

5.

Maximize return of investments, 6.

Obtain financial independency.

6.

Obtain financial independency. Contact us, we would be glad to show you the possible opportunities!

Contact us, we would be glad to show you the possible opportunities!

It is a basic requirement for the economical controlling of the liquidity-risk! The financeplan is defined as a companies forecast about the expected

It is a basic requirement for the economical controlling of the liquidity-risk! The financeplan is defined as a companies forecast about the expected revenues and expenses in a specific period, completed by the movement of payables and loan inventory.

revenues and expenses in a specific period, completed by the movement of payables and loan inventory. However, to obtain a best possible fx-hedging, natural or by derivatives, such a finance plan can be used perfectly also as a direct fx-liquidity plan

However, to obtain a best possible fx-hedging, natural or by derivatives, such a finance plan can be used perfectly also as a direct fx-liquidity plan if this plan is segregated by currency! Our model of a combined finance- and liquidity plan is successful introduced in many small-, mid-, large

if this plan is segregated by currency! Our model of a combined finance- and liquidity plan is successful introduced in many small-, mid-, large and multinational groups. It is the perfect tool to monitor quick and comprehensive direct cashflows, where they come from and where they

and multinational groups. It is the perfect tool to monitor quick and comprehensive direct cashflows, where they come from and where they are going to including correspondent balance sheet accounts. On top, a cash flow report is intergrated in the liquidity part to have full

are going to including correspondent balance sheet accounts. On top, a cash flow report is intergrated in the liquidity part to have full overview at a glance (and not just once a month / quarter after accounting prepared the closing).

overview at a glance (and not just once a month / quarter after accounting prepared the closing). Reasons for a combined Finance- and Liquidity Plan

Reasons for a combined Finance- and Liquidity Plan 1.

Ensure short- and longterm solvency

1.

Ensure short- and longterm solvency 2.

Minimizing the opportunity costs of too much cash

3.

Minimize the financing costs,

4.

Ensure efficient currency- and interest hedging, (see also section “currency- and interest hedging”)

2.

Minimizing the opportunity costs of too much cash

3.

Minimize the financing costs,

4.

Ensure efficient currency- and interest hedging, (see also section “currency- and interest hedging”) 5.

Maximize return of investments,

5.

Maximize return of investments, 6.

Obtain financial independency.

6.

Obtain financial independency. Contact us, we would be glad to show you the possible opportunities!

Contact us, we would be glad to show you the possible opportunities!

Finance- and Liquidity Plans

Transparent finance- liquidity planning is the heart of

every financial department and essential to survive.

Example of a combined Finance- and Liquidityplan

including a Cash Flow Summary

A) In a Excel Spreadsheet

B) In our Treasury Software

A Financeplan is primary intended for a strategic longterm period (more than a year) and also for a operational short-term period ->

(more than a year) and also for a operational short-term period -> Liquidity Plan. It is a basic requirement for the economical controlling

Liquidity Plan. It is a basic requirement for the economical controlling of the liquidity-risk! The financeplan is defined as a companies

of the liquidity-risk! The financeplan is defined as a companies forecast about the expected revenues and expenses in a specific

forecast about the expected revenues and expenses in a specific period, completed by the movement of payables and loan inventory.

However, to obtain a best possible fx-hedging, natural or by

period, completed by the movement of payables and loan inventory.

However, to obtain a best possible fx-hedging, natural or by derivatives, such a finance plan can be used perfectly also as a direct

fx-liquidity plan if this plan is segregated by currency! Our model of

a combined finance- and liquidity plan is successful introduced in

derivatives, such a finance plan can be used perfectly also as a direct

fx-liquidity plan if this plan is segregated by currency! Our model of

a combined finance- and liquidity plan is successful introduced in many small-, mid-, large and multinational groups. It is the perfect

many small-, mid-, large and multinational groups. It is the perfect tool to monitor quick and comprehensive direct cashflows, where

tool to monitor quick and comprehensive direct cashflows, where they come from and where they are going to including

they come from and where they are going to including  correspondent balance sheet accounts. On top, a cash flow

correspondent balance sheet accounts. On top, a cash flow report is intergrated in the liquidity part to have full overview at a

report is intergrated in the liquidity part to have full overview at a glance (and not just once a month / quarter after accounting prepared

the closing.

Reasons for a combined Finance- and Liquidity Plan

glance (and not just once a month / quarter after accounting prepared

the closing.

Reasons for a combined Finance- and Liquidity Plan 1.

Ensure short- and longterm solvency

2.

Minimizing the opportunity costs of too much cash

1.

Ensure short- and longterm solvency

2.

Minimizing the opportunity costs of too much cash 3.

Minimize the financing costs,

3.

Minimize the financing costs, 4.

Ensure efficient currency- and interest hedging, (see also

section “currency- and interest hedging”)

5.

Maximize return of investments,

4.

Ensure efficient currency- and interest hedging, (see also

section “currency- and interest hedging”)

5.

Maximize return of investments, 6.

Obtain financial independency.

Contact us, we would be glad to show you the possible

opportunities!

6.

Obtain financial independency.

Contact us, we would be glad to show you the possible

opportunities!

(more than a year) and also for a operational short-term period ->

(more than a year) and also for a operational short-term period -> Liquidity Plan. It is a basic requirement for the economical controlling

Liquidity Plan. It is a basic requirement for the economical controlling of the liquidity-risk! The financeplan is defined as a companies

of the liquidity-risk! The financeplan is defined as a companies forecast about the expected revenues and expenses in a specific

forecast about the expected revenues and expenses in a specific period, completed by the movement of payables and loan inventory.

However, to obtain a best possible fx-hedging, natural or by

period, completed by the movement of payables and loan inventory.

However, to obtain a best possible fx-hedging, natural or by derivatives, such a finance plan can be used perfectly also as a direct

fx-liquidity plan if this plan is segregated by currency! Our model of

a combined finance- and liquidity plan is successful introduced in

derivatives, such a finance plan can be used perfectly also as a direct

fx-liquidity plan if this plan is segregated by currency! Our model of

a combined finance- and liquidity plan is successful introduced in many small-, mid-, large and multinational groups. It is the perfect

many small-, mid-, large and multinational groups. It is the perfect tool to monitor quick and comprehensive direct cashflows, where

tool to monitor quick and comprehensive direct cashflows, where they come from and where they are going to including

they come from and where they are going to including  correspondent balance sheet accounts. On top, a cash flow

correspondent balance sheet accounts. On top, a cash flow report is intergrated in the liquidity part to have full overview at a

report is intergrated in the liquidity part to have full overview at a glance (and not just once a month / quarter after accounting prepared

the closing.

Reasons for a combined Finance- and Liquidity Plan

glance (and not just once a month / quarter after accounting prepared

the closing.

Reasons for a combined Finance- and Liquidity Plan 1.

Ensure short- and longterm solvency

2.

Minimizing the opportunity costs of too much cash

1.

Ensure short- and longterm solvency

2.

Minimizing the opportunity costs of too much cash 3.

Minimize the financing costs,

3.

Minimize the financing costs, 4.

Ensure efficient currency- and interest hedging, (see also

section “currency- and interest hedging”)

5.

Maximize return of investments,

4.

Ensure efficient currency- and interest hedging, (see also

section “currency- and interest hedging”)

5.

Maximize return of investments, 6.

Obtain financial independency.

Contact us, we would be glad to show you the possible

opportunities!

6.

Obtain financial independency.

Contact us, we would be glad to show you the possible

opportunities!