Cash Pooling

Increase the liquidity, improve interest result and reduce external debts,

this is common do be achieved with Cash Pooling. As Zero-Balancing, Target-Balancing

or Notional Cash Pooling.

The primary target of each cash pooling is the optimization and use of surplus funds of all companies in a group in order to reduce external debt and increase the available liquidity. Furthermore, especially interest benefits in multiple ways can be achieved for the pool participants

debt and increase the available liquidity. Furthermore, especially interest benefits in multiple ways can be achieved for the pool participants on the payable and on the receivable side.

on the payable and on the receivable side. Type 1: Zero- or Target Balancing Cash Pool (physical)

Type 1: Zero- or Target Balancing Cash Pool (physical) The zero-balancing, also called cash-concentration or sweeping, is in his form the easiest way to introduce cash pooling. Depending on a

The zero-balancing, also called cash-concentration or sweeping, is in his form the easiest way to introduce cash pooling. Depending on a surplus or lack of cash, all cash balances in the Pool (Pool-Participants) will be transferred on daily basis automatic to or from the top-

surplus or lack of cash, all cash balances in the Pool (Pool-Participants) will be transferred on daily basis automatic to or from the top- mother account (Pool-Leader). A major positive effect is a shorter balance and therefore the key-figure of the debt-ratio improves. But there

mother account (Pool-Leader). A major positive effect is a shorter balance and therefore the key-figure of the debt-ratio improves. But there are also some disadvantages, e.g. liability-questions in case of a short-fall of the pool-leader (see Erb-Group and Swissair in

are also some disadvantages, e.g. liability-questions in case of a short-fall of the pool-leader (see Erb-Group and Swissair in Switzerland or Bremer Vulkan in Germany). Also there is a higher administrative work since all intercompany cash flows on a daily level

Switzerland or Bremer Vulkan in Germany). Also there is a higher administrative work since all intercompany cash flows on a daily level have to be booked at the pool-leader (can be automatized). The key-element of a zero- or target balancing is that all cash flows are

have to be booked at the pool-leader (can be automatized). The key-element of a zero- or target balancing is that all cash flows are physicly.

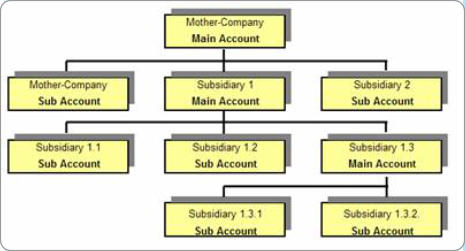

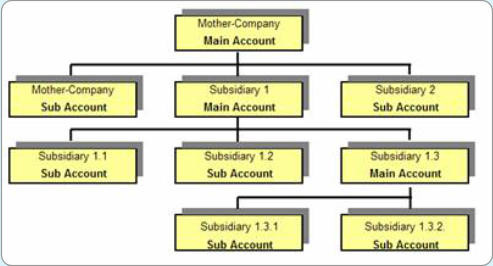

Setup of a Zero-Balancing-Pool

It is also important to respect tax considerations, i.e. transfer pricing. Because as already mentioned, the “classic” cash pooling is simply an

automatic loan transaction on daily basis. Some countries, also in Europe, have laws that either interest payment and/or loans in the

physicly.

Setup of a Zero-Balancing-Pool

It is also important to respect tax considerations, i.e. transfer pricing. Because as already mentioned, the “classic” cash pooling is simply an

automatic loan transaction on daily basis. Some countries, also in Europe, have laws that either interest payment and/or loans in the one or other direction are prohibited or even do not allow physical cash flows. This is typically a process of multinational groups and has

one or other direction are prohibited or even do not allow physical cash flows. This is typically a process of multinational groups and has negative impact on cross border transactions.

negative impact on cross border transactions. Process / Functionality of a Zero- or Target Cash Pool

Process / Functionality of a Zero- or Target Cash Pool Pooling Accounts of the Participants can be regulated in two ways, both fully automatic:

Pooling Accounts of the Participants can be regulated in two ways, both fully automatic: a) Zero-Balancing: all participating accounts, except the header-account, are set to 0 (zero) at the end of a day. Surplus balances are

a) Zero-Balancing: all participating accounts, except the header-account, are set to 0 (zero) at the end of a day. Surplus balances are debited, minus balances are credited to/from the header account.

debited, minus balances are credited to/from the header account. b) Target-Balancing: basically the same procedure as with zero-balancing, just with a number of extended parameter regarding the day-

b) Target-Balancing: basically the same procedure as with zero-balancing, just with a number of extended parameter regarding the day- end balance. For example every day a pre-defined balance remain on the account, which may be for instance used for lease-guarantee

end balance. For example every day a pre-defined balance remain on the account, which may be for instance used for lease-guarantee etc.

Because of technical restrictions all transfers can be

etc.

Because of technical restrictions all transfers can be booked at the next following day, but will be execured

booked at the next following day, but will be execured always with the correct value date.

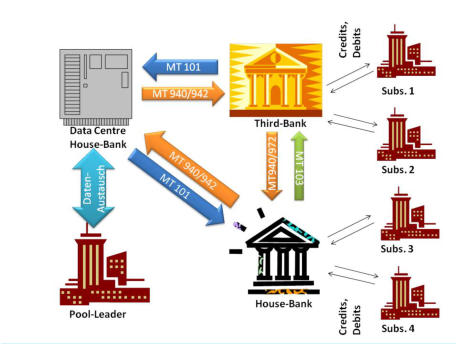

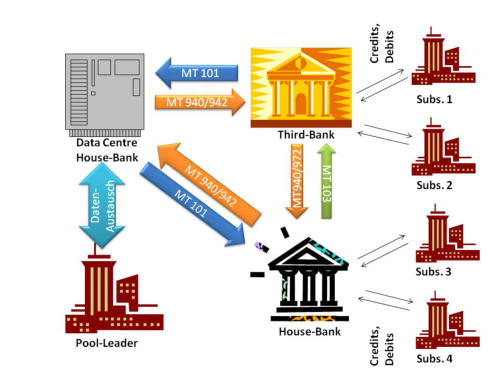

always with the correct value date. Here an example, how the communications for the

Here an example, how the communications for the transfer of balances may happen through the SWIFT-

transfer of balances may happen through the SWIFT- Network. Dependent from the executing Banks some

Network. Dependent from the executing Banks some differences can be the case. It is also often the case

differences can be the case. It is also often the case that the cash pool can be not managed by only one

that the cash pool can be not managed by only one Bank, because the House-Bank has not in every

Bank, because the House-Bank has not in every country a branch. This is commonly the case in

country a branch. This is commonly the case in Cross-Border Pools, see below. That means a third

Cross-Border Pools, see below. That means a third Bank must be included in the pool-network.

Bank must be included in the pool-network. This example is certainly strong simplified und

This example is certainly strong simplified und contains for instance no internal connections which

contains for instance no internal connections which are mandatory in the accounting of the Pool-Leader

are mandatory in the accounting of the Pool-Leader an all Subsidiaries.

an all Subsidiaries. Type 2: Notional Cash Pool (no physical transfer of funds)

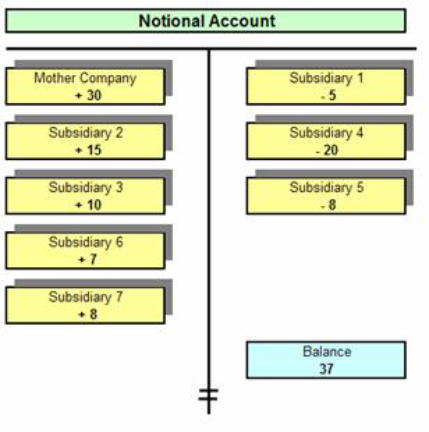

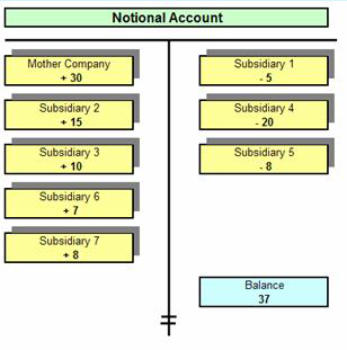

Type 2: Notional Cash Pool (no physical transfer of funds) The meaning of „notional“ name it: this pooling form is not real. But is is a 100% interest optimization. There are no physical transfers

The meaning of „notional“ name it: this pooling form is not real. But is is a 100% interest optimization. There are no physical transfers  between the accounts. The single balance accounts will be added together and netted against each other. Therefore each pool participant

between the accounts. The single balance accounts will be added together and netted against each other. Therefore each pool participant has his own bankaccount with the full physical balance, but the full interest spread remain within the group.

has his own bankaccount with the full physical balance, but the full interest spread remain within the group. Therefore this kind of pooling meets perfect the needs of companies which does not like to enter into any credit risk! In a few words:

Therefore this kind of pooling meets perfect the needs of companies which does not like to enter into any credit risk! In a few words: interest optimization without having the character of loans and related risks.

interest optimization without having the character of loans and related risks. An extended version of this pooling is a combination of different currencies in one and the same cash-pool. Some Banks offer this service,

An extended version of this pooling is a combination of different currencies in one and the same cash-pool. Some Banks offer this service, ask us for assistance. Technically, the Bank is just entereing into a number of overnight-swaps.

ask us for assistance. Technically, the Bank is just entereing into a number of overnight-swaps. Complex Topic: Cross Border Cash Pooling

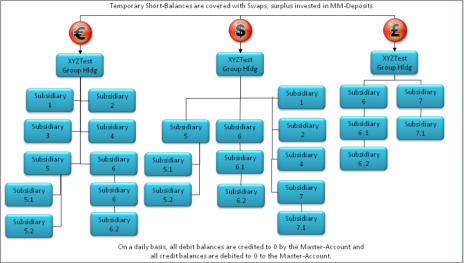

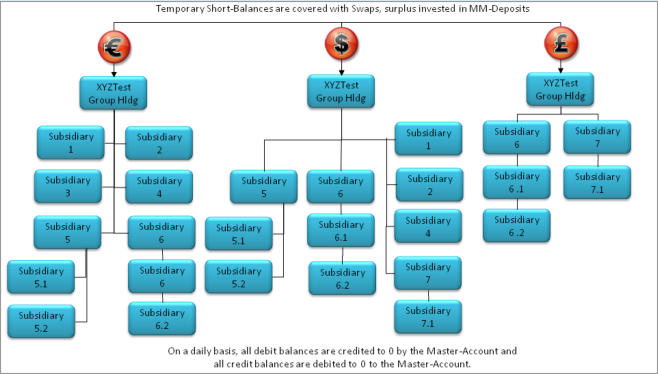

Complex Topic: Cross Border Cash Pooling A well tuned cash pool structure may not only transfer cash over the border, it can do it even in different currencies! So it is possible to

A well tuned cash pool structure may not only transfer cash over the border, it can do it even in different currencies! So it is possible to establish a cash pool for EUR, one for for CHF and one for USD. All cash flows will be transferred to / from the ultimate mother group

establish a cash pool for EUR, one for for CHF and one for USD. All cash flows will be transferred to / from the ultimate mother group account on daily basis and will be managed by the Treasurer as portfolio to cover gaps on daily or weekly with swaps, without entering

account on daily basis and will be managed by the Treasurer as portfolio to cover gaps on daily or weekly with swaps, without entering into any foreign exchange risk!

into any foreign exchange risk! Cross-Border Pooling is certainly the biggest advantage for a cash management who wants to generate a maximum benefit out of the cash

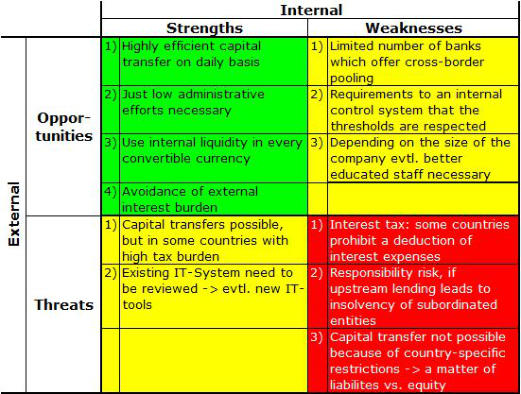

Cross-Border Pooling is certainly the biggest advantage for a cash management who wants to generate a maximum benefit out of the cash pool. But also the risk increase and therewith related, the ultimate accuracy for setting up or manage cross-border pools. Risk has per

pool. But also the risk increase and therewith related, the ultimate accuracy for setting up or manage cross-border pools. Risk has per definition the attribute as getting larger as more parameters need to be considered. The adavantages and disadvantages are different from

definition the attribute as getting larger as more parameters need to be considered. The adavantages and disadvantages are different from company to company, depending on the structure and planned pooling type. For instance, the right bank on your side is very important. To

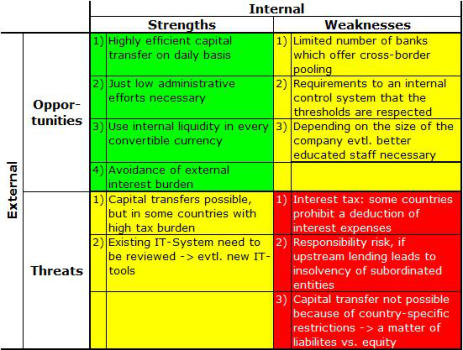

company to company, depending on the structure and planned pooling type. For instance, the right bank on your side is very important. To find out who this bank could be is described here. In the the following just a view arguments in a SWOT analysis which should be

find out who this bank could be is described here. In the the following just a view arguments in a SWOT analysis which should be considered very carefully:

considered very carefully: Controlling

Be aware - cash pooling can be also a threat if rights and liabilites are not clearly defined. For this we recommend a comprehensive

Controlling

Be aware - cash pooling can be also a threat if rights and liabilites are not clearly defined. For this we recommend a comprehensive Treasuy Policy - see here.

Software Support

A proper management of a cash pooling may become quite complex if there is no sufficient support by an adequated software. See here

Treasuy Policy - see here.

Software Support

A proper management of a cash pooling may become quite complex if there is no sufficient support by an adequated software. See here  how Cash Pooling can be managed easy and safe with the Cash Pool Module in our Treasury Software STS.

how Cash Pooling can be managed easy and safe with the Cash Pool Module in our Treasury Software STS. Country specific Items

Country specific Items Depending on the country where the bank-account for the cash pool is established, it is fully, partially or not allowed to operate such a pool.

Depending on the country where the bank-account for the cash pool is established, it is fully, partially or not allowed to operate such a pool. Based on our experience with cash pool projects world wide we composed a manuscript which gives an overview about the different

Based on our experience with cash pool projects world wide we composed a manuscript which gives an overview about the different country-specifications. Read more in detail here.

country-specifications. Read more in detail here. Reasons for Cash Pooling

Optimal allocation of internal liquid funds and max. reduction of external debts,

Reasons for Cash Pooling

Optimal allocation of internal liquid funds and max. reduction of external debts, •

Reduction of financing costs on group level,

•

Reduction of financing costs on group level, •

Improvement of investment return due to economies of scale,

•

Improvement of investment return due to economies of scale, •

Simplification of liquiditymanagagement on local level,

•

Simplification of liquiditymanagagement on local level, •

Reduction of external banking costs due to centralization,

•

Reduction of external banking costs due to centralization, •

Optimization of cash flow forecast because of coordination of financing cycles,

•

Optimization of cash flow forecast because of coordination of financing cycles, •

Break-Even of a cash pool starts at around 300’000.- required capital.

•

Break-Even of a cash pool starts at around 300’000.- required capital. Contact us, we would be glad to show you the possible opportunities!

Contact us, we would be glad to show you the possible opportunities!

debt and increase the available liquidity. Furthermore, especially interest benefits in multiple ways can be achieved for the pool participants

debt and increase the available liquidity. Furthermore, especially interest benefits in multiple ways can be achieved for the pool participants on the payable and on the receivable side.

on the payable and on the receivable side. Type 1: Zero- or Target Balancing Cash Pool (physical)

Type 1: Zero- or Target Balancing Cash Pool (physical) The zero-balancing, also called cash-concentration or sweeping, is in his form the easiest way to introduce cash pooling. Depending on a

The zero-balancing, also called cash-concentration or sweeping, is in his form the easiest way to introduce cash pooling. Depending on a surplus or lack of cash, all cash balances in the Pool (Pool-Participants) will be transferred on daily basis automatic to or from the top-

surplus or lack of cash, all cash balances in the Pool (Pool-Participants) will be transferred on daily basis automatic to or from the top- mother account (Pool-Leader). A major positive effect is a shorter balance and therefore the key-figure of the debt-ratio improves. But there

mother account (Pool-Leader). A major positive effect is a shorter balance and therefore the key-figure of the debt-ratio improves. But there are also some disadvantages, e.g. liability-questions in case of a short-fall of the pool-leader (see Erb-Group and Swissair in

are also some disadvantages, e.g. liability-questions in case of a short-fall of the pool-leader (see Erb-Group and Swissair in Switzerland or Bremer Vulkan in Germany). Also there is a higher administrative work since all intercompany cash flows on a daily level

Switzerland or Bremer Vulkan in Germany). Also there is a higher administrative work since all intercompany cash flows on a daily level have to be booked at the pool-leader (can be automatized). The key-element of a zero- or target balancing is that all cash flows are

have to be booked at the pool-leader (can be automatized). The key-element of a zero- or target balancing is that all cash flows are physicly.

Setup of a Zero-Balancing-Pool

It is also important to respect tax considerations, i.e. transfer pricing. Because as already mentioned, the “classic” cash pooling is simply an

automatic loan transaction on daily basis. Some countries, also in Europe, have laws that either interest payment and/or loans in the

physicly.

Setup of a Zero-Balancing-Pool

It is also important to respect tax considerations, i.e. transfer pricing. Because as already mentioned, the “classic” cash pooling is simply an

automatic loan transaction on daily basis. Some countries, also in Europe, have laws that either interest payment and/or loans in the one or other direction are prohibited or even do not allow physical cash flows. This is typically a process of multinational groups and has

one or other direction are prohibited or even do not allow physical cash flows. This is typically a process of multinational groups and has negative impact on cross border transactions.

negative impact on cross border transactions. Process / Functionality of a Zero- or Target Cash Pool

Process / Functionality of a Zero- or Target Cash Pool Pooling Accounts of the Participants can be regulated in two ways, both fully automatic:

Pooling Accounts of the Participants can be regulated in two ways, both fully automatic: a) Zero-Balancing: all participating accounts, except the header-account, are set to 0 (zero) at the end of a day. Surplus balances are

a) Zero-Balancing: all participating accounts, except the header-account, are set to 0 (zero) at the end of a day. Surplus balances are debited, minus balances are credited to/from the header account.

debited, minus balances are credited to/from the header account. b) Target-Balancing: basically the same procedure as with zero-balancing, just with a number of extended parameter regarding the day-

b) Target-Balancing: basically the same procedure as with zero-balancing, just with a number of extended parameter regarding the day- end balance. For example every day a pre-defined balance remain on the account, which may be for instance used for lease-guarantee

end balance. For example every day a pre-defined balance remain on the account, which may be for instance used for lease-guarantee etc.

Because of technical restrictions all transfers can be

etc.

Because of technical restrictions all transfers can be booked at the next following day, but will be execured

booked at the next following day, but will be execured always with the correct value date.

always with the correct value date. Here an example, how the communications for the

Here an example, how the communications for the transfer of balances may happen through the SWIFT-

transfer of balances may happen through the SWIFT- Network. Dependent from the executing Banks some

Network. Dependent from the executing Banks some differences can be the case. It is also often the case

differences can be the case. It is also often the case that the cash pool can be not managed by only one

that the cash pool can be not managed by only one Bank, because the House-Bank has not in every

Bank, because the House-Bank has not in every country a branch. This is commonly the case in

country a branch. This is commonly the case in Cross-Border Pools, see below. That means a third

Cross-Border Pools, see below. That means a third Bank must be included in the pool-network.

Bank must be included in the pool-network. This example is certainly strong simplified und

This example is certainly strong simplified und contains for instance no internal connections which

contains for instance no internal connections which are mandatory in the accounting of the Pool-Leader

are mandatory in the accounting of the Pool-Leader an all Subsidiaries.

an all Subsidiaries. Type 2: Notional Cash Pool (no physical transfer of funds)

Type 2: Notional Cash Pool (no physical transfer of funds) The meaning of „notional“ name it: this pooling form is not real. But is is a 100% interest optimization. There are no physical transfers

The meaning of „notional“ name it: this pooling form is not real. But is is a 100% interest optimization. There are no physical transfers  between the accounts. The single balance accounts will be added together and netted against each other. Therefore each pool participant

between the accounts. The single balance accounts will be added together and netted against each other. Therefore each pool participant has his own bankaccount with the full physical balance, but the full interest spread remain within the group.

has his own bankaccount with the full physical balance, but the full interest spread remain within the group. Therefore this kind of pooling meets perfect the needs of companies which does not like to enter into any credit risk! In a few words:

Therefore this kind of pooling meets perfect the needs of companies which does not like to enter into any credit risk! In a few words: interest optimization without having the character of loans and related risks.

interest optimization without having the character of loans and related risks. An extended version of this pooling is a combination of different currencies in one and the same cash-pool. Some Banks offer this service,

An extended version of this pooling is a combination of different currencies in one and the same cash-pool. Some Banks offer this service, ask us for assistance. Technically, the Bank is just entereing into a number of overnight-swaps.

ask us for assistance. Technically, the Bank is just entereing into a number of overnight-swaps. Complex Topic: Cross Border Cash Pooling

Complex Topic: Cross Border Cash Pooling A well tuned cash pool structure may not only transfer cash over the border, it can do it even in different currencies! So it is possible to

A well tuned cash pool structure may not only transfer cash over the border, it can do it even in different currencies! So it is possible to establish a cash pool for EUR, one for for CHF and one for USD. All cash flows will be transferred to / from the ultimate mother group

establish a cash pool for EUR, one for for CHF and one for USD. All cash flows will be transferred to / from the ultimate mother group account on daily basis and will be managed by the Treasurer as portfolio to cover gaps on daily or weekly with swaps, without entering

account on daily basis and will be managed by the Treasurer as portfolio to cover gaps on daily or weekly with swaps, without entering into any foreign exchange risk!

into any foreign exchange risk! Cross-Border Pooling is certainly the biggest advantage for a cash management who wants to generate a maximum benefit out of the cash

Cross-Border Pooling is certainly the biggest advantage for a cash management who wants to generate a maximum benefit out of the cash pool. But also the risk increase and therewith related, the ultimate accuracy for setting up or manage cross-border pools. Risk has per

pool. But also the risk increase and therewith related, the ultimate accuracy for setting up or manage cross-border pools. Risk has per definition the attribute as getting larger as more parameters need to be considered. The adavantages and disadvantages are different from

definition the attribute as getting larger as more parameters need to be considered. The adavantages and disadvantages are different from company to company, depending on the structure and planned pooling type. For instance, the right bank on your side is very important. To

company to company, depending on the structure and planned pooling type. For instance, the right bank on your side is very important. To find out who this bank could be is described here. In the the following just a view arguments in a SWOT analysis which should be

find out who this bank could be is described here. In the the following just a view arguments in a SWOT analysis which should be considered very carefully:

considered very carefully: Controlling

Be aware - cash pooling can be also a threat if rights and liabilites are not clearly defined. For this we recommend a comprehensive

Controlling

Be aware - cash pooling can be also a threat if rights and liabilites are not clearly defined. For this we recommend a comprehensive Treasuy Policy - see here.

Software Support

A proper management of a cash pooling may become quite complex if there is no sufficient support by an adequated software. See here

Treasuy Policy - see here.

Software Support

A proper management of a cash pooling may become quite complex if there is no sufficient support by an adequated software. See here  how Cash Pooling can be managed easy and safe with the Cash Pool Module in our Treasury Software STS.

how Cash Pooling can be managed easy and safe with the Cash Pool Module in our Treasury Software STS. Country specific Items

Country specific Items Depending on the country where the bank-account for the cash pool is established, it is fully, partially or not allowed to operate such a pool.

Depending on the country where the bank-account for the cash pool is established, it is fully, partially or not allowed to operate such a pool. Based on our experience with cash pool projects world wide we composed a manuscript which gives an overview about the different

Based on our experience with cash pool projects world wide we composed a manuscript which gives an overview about the different country-specifications. Read more in detail here.

country-specifications. Read more in detail here. Reasons for Cash Pooling

Optimal allocation of internal liquid funds and max. reduction of external debts,

Reasons for Cash Pooling

Optimal allocation of internal liquid funds and max. reduction of external debts, •

Reduction of financing costs on group level,

•

Reduction of financing costs on group level, •

Improvement of investment return due to economies of scale,

•

Improvement of investment return due to economies of scale, •

Simplification of liquiditymanagagement on local level,

•

Simplification of liquiditymanagagement on local level, •

Reduction of external banking costs due to centralization,

•

Reduction of external banking costs due to centralization, •

Optimization of cash flow forecast because of coordination of financing cycles,

•

Optimization of cash flow forecast because of coordination of financing cycles, •

Break-Even of a cash pool starts at around 300’000.- required capital.

•

Break-Even of a cash pool starts at around 300’000.- required capital. Contact us, we would be glad to show you the possible opportunities!

Contact us, we would be glad to show you the possible opportunities!

Cash Pooling

Increase the liquidity, improve interest result and reduce

external debts, this is common do be achieved with Cash

Pooling. As Zero-Balancing, Target-Balancing

or Notional Cash Pooling.

The primary target of each cash pooling is the optimization and use of

surplus funds of all companies in a group in order to reduce external debt and increase the available liquidity. Furthermore, especially

debt and increase the available liquidity. Furthermore, especially interest benefits in multiple ways can be achieved for the pool

interest benefits in multiple ways can be achieved for the pool participants on the payable and on the receivable side.

Type 1: Zero- or Target Balancing Cash Pool

(physical)

The zero-balancing, also called cash-concentration or sweeping, is

participants on the payable and on the receivable side.

Type 1: Zero- or Target Balancing Cash Pool

(physical)

The zero-balancing, also called cash-concentration or sweeping, is in his form the easiest way to introduce cash pooling. Depending on a

surplus or lack of cash, all cash balances in the Pool (Pool-

in his form the easiest way to introduce cash pooling. Depending on a

surplus or lack of cash, all cash balances in the Pool (Pool- Participants) will be transferred on daily basis automatic to or from

Participants) will be transferred on daily basis automatic to or from the top-mother account (Pool-Leader). A major positive effect is a

the top-mother account (Pool-Leader). A major positive effect is a shorter balance and therefore the key-figure of the debt-ratio

shorter balance and therefore the key-figure of the debt-ratio  improves. But there are also some disadvantages, e.g. liability-

improves. But there are also some disadvantages, e.g. liability- questions in case of a short-fall of the pool-leader (see Erb-Group

questions in case of a short-fall of the pool-leader (see Erb-Group and Swissair in Switzerland or Bremer Vulkan in Germany). Also

and Swissair in Switzerland or Bremer Vulkan in Germany). Also there is a higher administrative work since all intercompany cash

there is a higher administrative work since all intercompany cash flows on a daily level have to be booked at the pool-leader (can be

flows on a daily level have to be booked at the pool-leader (can be automatized). The key-element of a zero- or target balancing is that

automatized). The key-element of a zero- or target balancing is that all cash flows are physicly.

Setup of a Zero-Balancing-Pool

It is also important to respect tax considerations, i.e. transfer pricing.

all cash flows are physicly.

Setup of a Zero-Balancing-Pool

It is also important to respect tax considerations, i.e. transfer pricing. Because as already mentioned, the “classic” cash pooling is simply

Because as already mentioned, the “classic” cash pooling is simply an automatic loan transaction on daily basis. Some countries, also

an automatic loan transaction on daily basis. Some countries, also in Europe, have laws that either interest payment and/or loans in the

in Europe, have laws that either interest payment and/or loans in the one or other direction are prohibited or even do not allow physical

one or other direction are prohibited or even do not allow physical cash flows. This is typically a process of multinational groups and has

cash flows. This is typically a process of multinational groups and has negative impact on cross border transactions.

Process / Functionality of a Zero- or Target Cash Pool

negative impact on cross border transactions.

Process / Functionality of a Zero- or Target Cash Pool Pooling Accounts of the Participants can be regulated in two ways,

Pooling Accounts of the Participants can be regulated in two ways, both fully automatic:

both fully automatic: a) Zero-Balancing: all participating accounts, except the header-

a) Zero-Balancing: all participating accounts, except the header- account, are set to 0 (zero) at the end of a day. Surplus balances are

account, are set to 0 (zero) at the end of a day. Surplus balances are debited, minus balances are credited to/from the header account.

b) Target-Balancing: basically the same procedure as with zero-

debited, minus balances are credited to/from the header account.

b) Target-Balancing: basically the same procedure as with zero- balancing, just with a number of extended parameter regarding the

balancing, just with a number of extended parameter regarding the day-end balance. For example every day a pre-defined balance

day-end balance. For example every day a pre-defined balance remain on the account, which may be for instance used for lease-

remain on the account, which may be for instance used for lease- guarantee etc.

Because of technical restrictions all transfers can be booked at the

guarantee etc.

Because of technical restrictions all transfers can be booked at the next following day, but will be execured always with the correct value

next following day, but will be execured always with the correct value date.

Here an example, how the communications for the transfer of

date.

Here an example, how the communications for the transfer of balances may happen through the SWIFT-Network. Dependent from

balances may happen through the SWIFT-Network. Dependent from the executing Banks some differences can be the case. It is also

the executing Banks some differences can be the case. It is also often the case that the cash pool can be not managed by only one

often the case that the cash pool can be not managed by only one Bank, because the House-Bank has not in every country a branch.

Bank, because the House-Bank has not in every country a branch. This is commonly the case in Cross-Border Pools, see below. That

This is commonly the case in Cross-Border Pools, see below. That means a third Bank must be included in the pool-network.

This example is certainly strong simplified und contains for instance

means a third Bank must be included in the pool-network.

This example is certainly strong simplified und contains for instance no internal connections which are mandatory in the accounting of the

no internal connections which are mandatory in the accounting of the Pool-Leader an all Subsidiaries.

Type 2: Notional Cash Pool

Pool-Leader an all Subsidiaries.

Type 2: Notional Cash Pool (no physical transfer of funds)

(no physical transfer of funds) The meaning of „notional“ name it: this pooling form is not real. But is

The meaning of „notional“ name it: this pooling form is not real. But is is a 100% interest optimization. There are no physical transfers

is a 100% interest optimization. There are no physical transfers  between the accounts. The single balance accounts will be added

between the accounts. The single balance accounts will be added together and netted against each other. Therefore each pool

together and netted against each other. Therefore each pool participant has his own bankaccount with the full physical balance,

participant has his own bankaccount with the full physical balance, but the full interest spread remain within the group.

Therefore this kind of pooling meets perfect the needs of companies

but the full interest spread remain within the group.

Therefore this kind of pooling meets perfect the needs of companies which does not like to enter into any credit risk! In a few words:

which does not like to enter into any credit risk! In a few words: interest optimization without having the character of loans and related

interest optimization without having the character of loans and related risks.

An extended version of this pooling is a combination of different

risks.

An extended version of this pooling is a combination of different currencies in one and the same cash-pool. Some Banks offer this

currencies in one and the same cash-pool. Some Banks offer this service, ask us for assistance. Technically, the Bank is just entereing

service, ask us for assistance. Technically, the Bank is just entereing into a number of overnight-swaps.

Complex Topic: Cross Border Cash Pooling

into a number of overnight-swaps.

Complex Topic: Cross Border Cash Pooling A well tuned cash pool structure may not only transfer cash over the

A well tuned cash pool structure may not only transfer cash over the border, it can do it even in different currencies! So it is possible to

border, it can do it even in different currencies! So it is possible to establish a cash pool for EUR, one for for CHF and one for USD. All

establish a cash pool for EUR, one for for CHF and one for USD. All cash flows will be transferred to / from the ultimate mother group

cash flows will be transferred to / from the ultimate mother group account on daily basis and will be managed by the Treasurer as

account on daily basis and will be managed by the Treasurer as portfolio to cover gaps on daily or weekly with swaps, without

portfolio to cover gaps on daily or weekly with swaps, without entering into any foreign exchange risk!

Cross-Border Pooling is certainly the biggest advantage for a cash

entering into any foreign exchange risk!

Cross-Border Pooling is certainly the biggest advantage for a cash management who wants to generate a maximum benefit out of the

management who wants to generate a maximum benefit out of the cash pool. But also the risk increase and therewith related, the

cash pool. But also the risk increase and therewith related, the ultimate accuracy for setting up or manage cross-border pools. Risk

ultimate accuracy for setting up or manage cross-border pools. Risk has per definition the attribute as getting larger as more parameters

has per definition the attribute as getting larger as more parameters need to be considered. The adavantages and disadvantages are

need to be considered. The adavantages and disadvantages are different from company to company, depending on the structure and

different from company to company, depending on the structure and planned pooling type. For instance, the right bank on your side is very

important. To find out who this bank could be is described here. In the

the following just a view arguments in a SWOT analysis which should

planned pooling type. For instance, the right bank on your side is very

important. To find out who this bank could be is described here. In the

the following just a view arguments in a SWOT analysis which should be considered very carefully:

Controlling

Be aware - cash pooling can be also a threat if rights and liabilites are

not clearly defined. For this we recommend a comprehensive Treasuy

Policy - see here.

Software Support

A proper management of a cash pooling may become quite complex

be considered very carefully:

Controlling

Be aware - cash pooling can be also a threat if rights and liabilites are

not clearly defined. For this we recommend a comprehensive Treasuy

Policy - see here.

Software Support

A proper management of a cash pooling may become quite complex if there is no sufficient support by an adequated software. See here

if there is no sufficient support by an adequated software. See here  how Cash Pooling can be managed easy and safe with the Cash Pool

how Cash Pooling can be managed easy and safe with the Cash Pool Module in our Treasury Software STS.

Country specific Items

Module in our Treasury Software STS.

Country specific Items Depending on the country where the bank-account for the cash pool

Depending on the country where the bank-account for the cash pool is established, it is fully, partially or not allowed to operate such a

is established, it is fully, partially or not allowed to operate such a pool. Based on our experience with cash pool projects world wide we

pool. Based on our experience with cash pool projects world wide we composed a manuscript which gives an overview about the different

composed a manuscript which gives an overview about the different country-specifications. Read more in detail here.

Reasons for Cash Pooling

Optimal allocation of internal liquid funds and max. reduction of

country-specifications. Read more in detail here.

Reasons for Cash Pooling

Optimal allocation of internal liquid funds and max. reduction of external debts,

•

Reduction of financing costs on group level,

•

Improvement of investment return due to economies of scale,

•

Simplification of liquiditymanagagement on local level,

external debts,

•

Reduction of financing costs on group level,

•

Improvement of investment return due to economies of scale,

•

Simplification of liquiditymanagagement on local level, •

Reduction of external banking costs due to centralization,

•

Optimization of cash flow forecast because of coordination of

•

Reduction of external banking costs due to centralization,

•

Optimization of cash flow forecast because of coordination of financing cycles,

•

Break-Even of a cash pool starts at around 300’000.- required

financing cycles,

•

Break-Even of a cash pool starts at around 300’000.- required capital.

Contact us, we would be glad to show you the possible

opportunities!

capital.

Contact us, we would be glad to show you the possible

opportunities!

debt and increase the available liquidity. Furthermore, especially

debt and increase the available liquidity. Furthermore, especially interest benefits in multiple ways can be achieved for the pool

interest benefits in multiple ways can be achieved for the pool participants on the payable and on the receivable side.

Type 1: Zero- or Target Balancing Cash Pool

(physical)

The zero-balancing, also called cash-concentration or sweeping, is

participants on the payable and on the receivable side.

Type 1: Zero- or Target Balancing Cash Pool

(physical)

The zero-balancing, also called cash-concentration or sweeping, is in his form the easiest way to introduce cash pooling. Depending on a

surplus or lack of cash, all cash balances in the Pool (Pool-

in his form the easiest way to introduce cash pooling. Depending on a

surplus or lack of cash, all cash balances in the Pool (Pool- Participants) will be transferred on daily basis automatic to or from

Participants) will be transferred on daily basis automatic to or from the top-mother account (Pool-Leader). A major positive effect is a

the top-mother account (Pool-Leader). A major positive effect is a shorter balance and therefore the key-figure of the debt-ratio

shorter balance and therefore the key-figure of the debt-ratio  improves. But there are also some disadvantages, e.g. liability-

improves. But there are also some disadvantages, e.g. liability- questions in case of a short-fall of the pool-leader (see Erb-Group

questions in case of a short-fall of the pool-leader (see Erb-Group and Swissair in Switzerland or Bremer Vulkan in Germany). Also

and Swissair in Switzerland or Bremer Vulkan in Germany). Also there is a higher administrative work since all intercompany cash

there is a higher administrative work since all intercompany cash flows on a daily level have to be booked at the pool-leader (can be

flows on a daily level have to be booked at the pool-leader (can be automatized). The key-element of a zero- or target balancing is that

automatized). The key-element of a zero- or target balancing is that all cash flows are physicly.

Setup of a Zero-Balancing-Pool

It is also important to respect tax considerations, i.e. transfer pricing.

all cash flows are physicly.

Setup of a Zero-Balancing-Pool

It is also important to respect tax considerations, i.e. transfer pricing. Because as already mentioned, the “classic” cash pooling is simply

Because as already mentioned, the “classic” cash pooling is simply an automatic loan transaction on daily basis. Some countries, also

an automatic loan transaction on daily basis. Some countries, also in Europe, have laws that either interest payment and/or loans in the

in Europe, have laws that either interest payment and/or loans in the one or other direction are prohibited or even do not allow physical

one or other direction are prohibited or even do not allow physical cash flows. This is typically a process of multinational groups and has

cash flows. This is typically a process of multinational groups and has negative impact on cross border transactions.

Process / Functionality of a Zero- or Target Cash Pool

negative impact on cross border transactions.

Process / Functionality of a Zero- or Target Cash Pool Pooling Accounts of the Participants can be regulated in two ways,

Pooling Accounts of the Participants can be regulated in two ways, both fully automatic:

both fully automatic: a) Zero-Balancing: all participating accounts, except the header-

a) Zero-Balancing: all participating accounts, except the header- account, are set to 0 (zero) at the end of a day. Surplus balances are

account, are set to 0 (zero) at the end of a day. Surplus balances are debited, minus balances are credited to/from the header account.

b) Target-Balancing: basically the same procedure as with zero-

debited, minus balances are credited to/from the header account.

b) Target-Balancing: basically the same procedure as with zero- balancing, just with a number of extended parameter regarding the

balancing, just with a number of extended parameter regarding the day-end balance. For example every day a pre-defined balance

day-end balance. For example every day a pre-defined balance remain on the account, which may be for instance used for lease-

remain on the account, which may be for instance used for lease- guarantee etc.

Because of technical restrictions all transfers can be booked at the

guarantee etc.

Because of technical restrictions all transfers can be booked at the next following day, but will be execured always with the correct value

next following day, but will be execured always with the correct value date.

Here an example, how the communications for the transfer of

date.

Here an example, how the communications for the transfer of balances may happen through the SWIFT-Network. Dependent from

balances may happen through the SWIFT-Network. Dependent from the executing Banks some differences can be the case. It is also

the executing Banks some differences can be the case. It is also often the case that the cash pool can be not managed by only one

often the case that the cash pool can be not managed by only one Bank, because the House-Bank has not in every country a branch.

Bank, because the House-Bank has not in every country a branch. This is commonly the case in Cross-Border Pools, see below. That

This is commonly the case in Cross-Border Pools, see below. That means a third Bank must be included in the pool-network.

This example is certainly strong simplified und contains for instance

means a third Bank must be included in the pool-network.

This example is certainly strong simplified und contains for instance no internal connections which are mandatory in the accounting of the

no internal connections which are mandatory in the accounting of the Pool-Leader an all Subsidiaries.

Type 2: Notional Cash Pool

Pool-Leader an all Subsidiaries.

Type 2: Notional Cash Pool (no physical transfer of funds)

(no physical transfer of funds) The meaning of „notional“ name it: this pooling form is not real. But is

The meaning of „notional“ name it: this pooling form is not real. But is is a 100% interest optimization. There are no physical transfers

is a 100% interest optimization. There are no physical transfers  between the accounts. The single balance accounts will be added

between the accounts. The single balance accounts will be added together and netted against each other. Therefore each pool

together and netted against each other. Therefore each pool participant has his own bankaccount with the full physical balance,

participant has his own bankaccount with the full physical balance, but the full interest spread remain within the group.

Therefore this kind of pooling meets perfect the needs of companies

but the full interest spread remain within the group.

Therefore this kind of pooling meets perfect the needs of companies which does not like to enter into any credit risk! In a few words:

which does not like to enter into any credit risk! In a few words: interest optimization without having the character of loans and related

interest optimization without having the character of loans and related risks.

An extended version of this pooling is a combination of different

risks.

An extended version of this pooling is a combination of different currencies in one and the same cash-pool. Some Banks offer this

currencies in one and the same cash-pool. Some Banks offer this service, ask us for assistance. Technically, the Bank is just entereing

service, ask us for assistance. Technically, the Bank is just entereing into a number of overnight-swaps.

Complex Topic: Cross Border Cash Pooling

into a number of overnight-swaps.

Complex Topic: Cross Border Cash Pooling A well tuned cash pool structure may not only transfer cash over the

A well tuned cash pool structure may not only transfer cash over the border, it can do it even in different currencies! So it is possible to

border, it can do it even in different currencies! So it is possible to establish a cash pool for EUR, one for for CHF and one for USD. All

establish a cash pool for EUR, one for for CHF and one for USD. All cash flows will be transferred to / from the ultimate mother group

cash flows will be transferred to / from the ultimate mother group account on daily basis and will be managed by the Treasurer as

account on daily basis and will be managed by the Treasurer as portfolio to cover gaps on daily or weekly with swaps, without

portfolio to cover gaps on daily or weekly with swaps, without entering into any foreign exchange risk!

Cross-Border Pooling is certainly the biggest advantage for a cash

entering into any foreign exchange risk!

Cross-Border Pooling is certainly the biggest advantage for a cash management who wants to generate a maximum benefit out of the

management who wants to generate a maximum benefit out of the cash pool. But also the risk increase and therewith related, the

cash pool. But also the risk increase and therewith related, the ultimate accuracy for setting up or manage cross-border pools. Risk

ultimate accuracy for setting up or manage cross-border pools. Risk has per definition the attribute as getting larger as more parameters

has per definition the attribute as getting larger as more parameters need to be considered. The adavantages and disadvantages are

need to be considered. The adavantages and disadvantages are different from company to company, depending on the structure and

different from company to company, depending on the structure and planned pooling type. For instance, the right bank on your side is very

important. To find out who this bank could be is described here. In the

the following just a view arguments in a SWOT analysis which should

planned pooling type. For instance, the right bank on your side is very

important. To find out who this bank could be is described here. In the

the following just a view arguments in a SWOT analysis which should be considered very carefully:

Controlling

Be aware - cash pooling can be also a threat if rights and liabilites are

not clearly defined. For this we recommend a comprehensive Treasuy

Policy - see here.

Software Support

A proper management of a cash pooling may become quite complex

be considered very carefully:

Controlling

Be aware - cash pooling can be also a threat if rights and liabilites are

not clearly defined. For this we recommend a comprehensive Treasuy

Policy - see here.

Software Support

A proper management of a cash pooling may become quite complex if there is no sufficient support by an adequated software. See here

if there is no sufficient support by an adequated software. See here  how Cash Pooling can be managed easy and safe with the Cash Pool

how Cash Pooling can be managed easy and safe with the Cash Pool Module in our Treasury Software STS.

Country specific Items

Module in our Treasury Software STS.

Country specific Items Depending on the country where the bank-account for the cash pool

Depending on the country where the bank-account for the cash pool is established, it is fully, partially or not allowed to operate such a

is established, it is fully, partially or not allowed to operate such a pool. Based on our experience with cash pool projects world wide we

pool. Based on our experience with cash pool projects world wide we composed a manuscript which gives an overview about the different

composed a manuscript which gives an overview about the different country-specifications. Read more in detail here.

Reasons for Cash Pooling

Optimal allocation of internal liquid funds and max. reduction of

country-specifications. Read more in detail here.

Reasons for Cash Pooling

Optimal allocation of internal liquid funds and max. reduction of external debts,

•

Reduction of financing costs on group level,

•

Improvement of investment return due to economies of scale,

•

Simplification of liquiditymanagagement on local level,

external debts,

•

Reduction of financing costs on group level,

•

Improvement of investment return due to economies of scale,

•

Simplification of liquiditymanagagement on local level, •

Reduction of external banking costs due to centralization,

•

Optimization of cash flow forecast because of coordination of

•

Reduction of external banking costs due to centralization,

•

Optimization of cash flow forecast because of coordination of financing cycles,

•

Break-Even of a cash pool starts at around 300’000.- required

financing cycles,

•

Break-Even of a cash pool starts at around 300’000.- required capital.

Contact us, we would be glad to show you the possible

opportunities!

capital.

Contact us, we would be glad to show you the possible

opportunities!