Individual Ranking of Banks

Standard Ranking (S&P, Fitch etc.) is common ranking practice -but it cannot match all

your requirements to a Bank!

Up until end of 2007 many banks had the untouchable reputation that there is no doubt about that they are the best experts regarding safety. If anybody likes to ask for counterparty risk then it was always the bank who declined a request for funds due to reasons of reliability. But now the

anybody likes to ask for counterparty risk then it was always the bank who declined a request for funds due to reasons of reliability. But now the customer should also take this position, it may be even a matter of his existence. Doing business with the wrong bank may lead to total loss of

customer should also take this position, it may be even a matter of his existence. Doing business with the wrong bank may lead to total loss of liquidity. Easier told as done - but how how can one rate his current and/or desired bank?

liquidity. Easier told as done - but how how can one rate his current and/or desired bank?  The one who has the money is right. This anrupt conclusion was in the past (and is mostly still fact) the lived understanding of most heads of

The one who has the money is right. This anrupt conclusion was in the past (and is mostly still fact) the lived understanding of most heads of individuals which have the power of dealing with money - and they do it as it would be their own money. That’s obviously the reason for “a golden

individuals which have the power of dealing with money - and they do it as it would be their own money. That’s obviously the reason for “a golden key can open any door”. Plot-wise this money is not their property, they just administer it. In fact they have the same amount as liabilities by

key can open any door”. Plot-wise this money is not their property, they just administer it. In fact they have the same amount as liabilities by collecting money from other people / organsations. That’s not the same as it is for every corporate outside the banking business. It’s just a transfer

collecting money from other people / organsations. That’s not the same as it is for every corporate outside the banking business. It’s just a transfer from one person to the other and getting a margin for.

from one person to the other and getting a margin for. Rating of a Bank

Rating of a Bank Before you can make a rating it is important to get a customer-supplier view, free of emotions and all the time critical challenged whether the

Before you can make a rating it is important to get a customer-supplier view, free of emotions and all the time critical challenged whether the earned experience is correct resp. whether they are still actual. That’s the reason for the (allowedly little bit provocating) introducing explanations

earned experience is correct resp. whether they are still actual. That’s the reason for the (allowedly little bit provocating) introducing explanations which should make someone aware of trust in overall simple things.

which should make someone aware of trust in overall simple things. Example

The bank to be rated has good or very good rating at the well known rating agencies Standard & Poors, Moody's or Fitch.

Example

The bank to be rated has good or very good rating at the well known rating agencies Standard & Poors, Moody's or Fitch. 1.

Is this rating for a specific bond or really a overall credit-rating?

1.

Is this rating for a specific bond or really a overall credit-rating? 2.

Is the rating for the whole banking organsiation / group or is it just for a part of it, e.g. a single country or segment?

2.

Is the rating for the whole banking organsiation / group or is it just for a part of it, e.g. a single country or segment? 3.

How old is the rating? If it is older than a year you should better renounce it.

3.

How old is the rating? If it is older than a year you should better renounce it. 4.

If you buy any product from bank, is it really from you bank and not from another one, rated very much worser? Remind on practical

4.

If you buy any product from bank, is it really from you bank and not from another one, rated very much worser? Remind on practical examples, e.g. Credit Suisse vs. Lehman Brothers? They sold Lehman products, but the customer thought that ge made an investment at

examples, e.g. Credit Suisse vs. Lehman Brothers? They sold Lehman products, but the customer thought that ge made an investment at Credit Suisse. In fact, the customer lost everything when Lehman went bankcrupt suddenly over night!

Credit Suisse. In fact, the customer lost everything when Lehman went bankcrupt suddenly over night! That means, is the rating in fact what you are interested for, i.e. does it belongs to your business? If you don’t have a current and important,

That means, is the rating in fact what you are interested for, i.e. does it belongs to your business? If you don’t have a current and important, suitable rating, but also for every other rating for fully transparent analysis, you see below a proven approach to rate your current or future bank.

suitable rating, but also for every other rating for fully transparent analysis, you see below a proven approach to rate your current or future bank. Under all circumstances you should make your own personal analysis for a current existing rating. As you can see below, such an

Under all circumstances you should make your own personal analysis for a current existing rating. As you can see below, such an analysis can never be substituted by a general one.

analysis can never be substituted by a general one. Segmentation

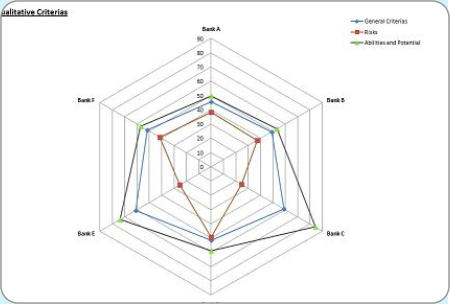

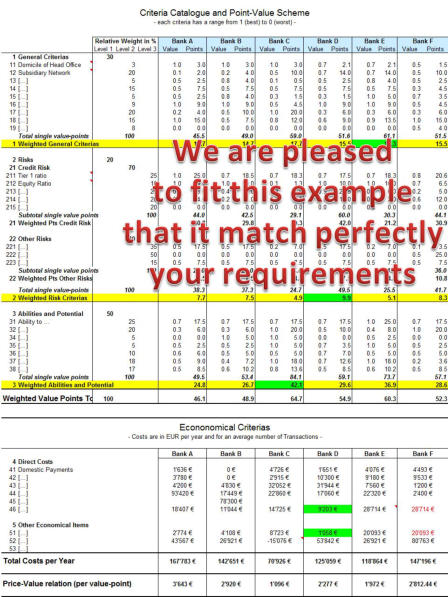

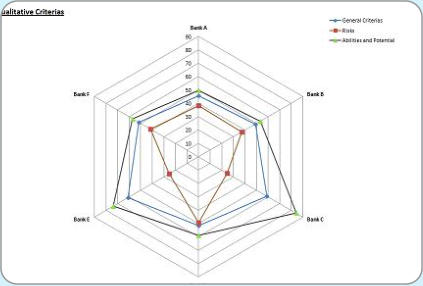

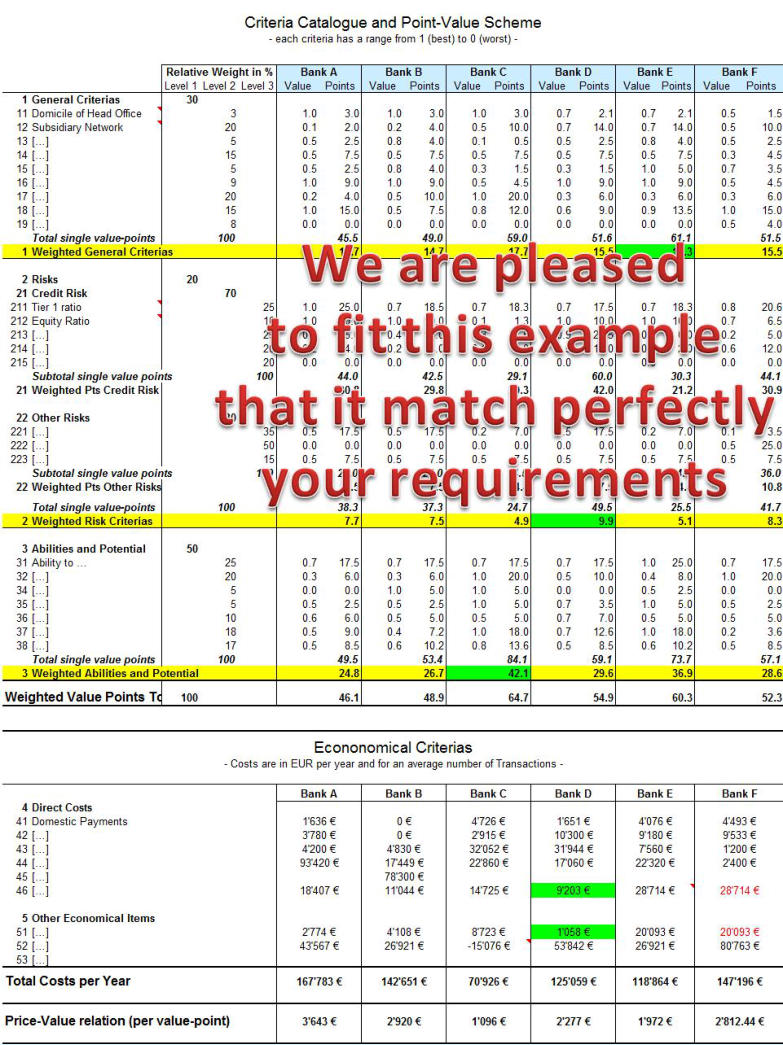

The result should be a cost-benefit analysis (i.e. two dimensions) which is segregated in general criterias, risk and potential. Ideally, a SWOT

Segmentation

The result should be a cost-benefit analysis (i.e. two dimensions) which is segregated in general criterias, risk and potential. Ideally, a SWOT analysis was made before.

analysis was made before.

anybody likes to ask for counterparty risk then it was always the bank who declined a request for funds due to reasons of reliability. But now the

anybody likes to ask for counterparty risk then it was always the bank who declined a request for funds due to reasons of reliability. But now the customer should also take this position, it may be even a matter of his existence. Doing business with the wrong bank may lead to total loss of

customer should also take this position, it may be even a matter of his existence. Doing business with the wrong bank may lead to total loss of liquidity. Easier told as done - but how how can one rate his current and/or desired bank?

liquidity. Easier told as done - but how how can one rate his current and/or desired bank?  The one who has the money is right. This anrupt conclusion was in the past (and is mostly still fact) the lived understanding of most heads of

The one who has the money is right. This anrupt conclusion was in the past (and is mostly still fact) the lived understanding of most heads of individuals which have the power of dealing with money - and they do it as it would be their own money. That’s obviously the reason for “a golden

individuals which have the power of dealing with money - and they do it as it would be their own money. That’s obviously the reason for “a golden key can open any door”. Plot-wise this money is not their property, they just administer it. In fact they have the same amount as liabilities by

key can open any door”. Plot-wise this money is not their property, they just administer it. In fact they have the same amount as liabilities by collecting money from other people / organsations. That’s not the same as it is for every corporate outside the banking business. It’s just a transfer

collecting money from other people / organsations. That’s not the same as it is for every corporate outside the banking business. It’s just a transfer from one person to the other and getting a margin for.

from one person to the other and getting a margin for. Rating of a Bank

Rating of a Bank Before you can make a rating it is important to get a customer-supplier view, free of emotions and all the time critical challenged whether the

Before you can make a rating it is important to get a customer-supplier view, free of emotions and all the time critical challenged whether the earned experience is correct resp. whether they are still actual. That’s the reason for the (allowedly little bit provocating) introducing explanations

earned experience is correct resp. whether they are still actual. That’s the reason for the (allowedly little bit provocating) introducing explanations which should make someone aware of trust in overall simple things.

which should make someone aware of trust in overall simple things. Example

The bank to be rated has good or very good rating at the well known rating agencies Standard & Poors, Moody's or Fitch.

Example

The bank to be rated has good or very good rating at the well known rating agencies Standard & Poors, Moody's or Fitch. 1.

Is this rating for a specific bond or really a overall credit-rating?

1.

Is this rating for a specific bond or really a overall credit-rating? 2.

Is the rating for the whole banking organsiation / group or is it just for a part of it, e.g. a single country or segment?

2.

Is the rating for the whole banking organsiation / group or is it just for a part of it, e.g. a single country or segment? 3.

How old is the rating? If it is older than a year you should better renounce it.

3.

How old is the rating? If it is older than a year you should better renounce it. 4.

If you buy any product from bank, is it really from you bank and not from another one, rated very much worser? Remind on practical

4.

If you buy any product from bank, is it really from you bank and not from another one, rated very much worser? Remind on practical examples, e.g. Credit Suisse vs. Lehman Brothers? They sold Lehman products, but the customer thought that ge made an investment at

examples, e.g. Credit Suisse vs. Lehman Brothers? They sold Lehman products, but the customer thought that ge made an investment at Credit Suisse. In fact, the customer lost everything when Lehman went bankcrupt suddenly over night!

Credit Suisse. In fact, the customer lost everything when Lehman went bankcrupt suddenly over night! That means, is the rating in fact what you are interested for, i.e. does it belongs to your business? If you don’t have a current and important,

That means, is the rating in fact what you are interested for, i.e. does it belongs to your business? If you don’t have a current and important, suitable rating, but also for every other rating for fully transparent analysis, you see below a proven approach to rate your current or future bank.

suitable rating, but also for every other rating for fully transparent analysis, you see below a proven approach to rate your current or future bank. Under all circumstances you should make your own personal analysis for a current existing rating. As you can see below, such an

Under all circumstances you should make your own personal analysis for a current existing rating. As you can see below, such an analysis can never be substituted by a general one.

analysis can never be substituted by a general one. Segmentation

The result should be a cost-benefit analysis (i.e. two dimensions) which is segregated in general criterias, risk and potential. Ideally, a SWOT

Segmentation

The result should be a cost-benefit analysis (i.e. two dimensions) which is segregated in general criterias, risk and potential. Ideally, a SWOT analysis was made before.

analysis was made before.

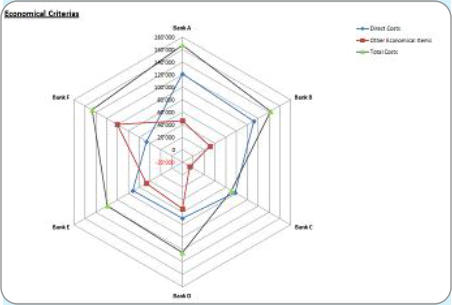

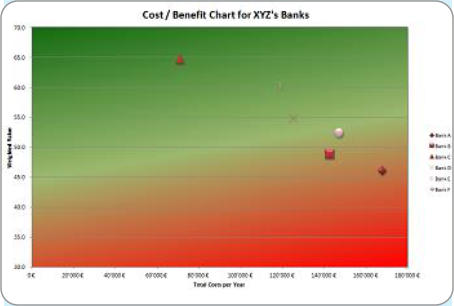

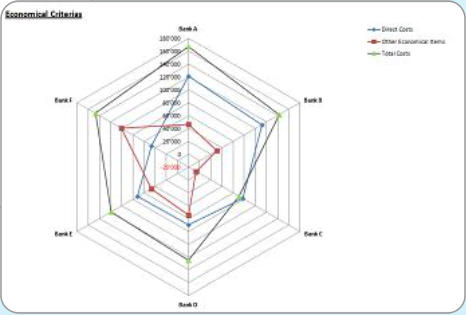

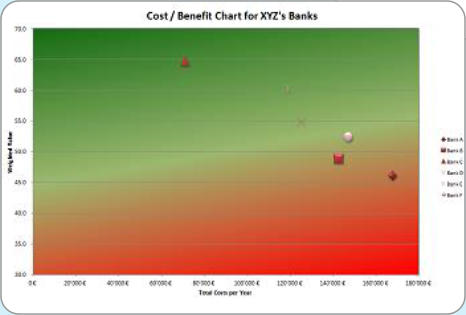

The weighted points are now set in comparison to the total costs. Due to this, a meaningful graphic analyis about the cost-benefits can be made. regarding a future bank relationship. As an example, the graphs my look like the ones below:

regarding a future bank relationship. As an example, the graphs my look like the ones below:

regarding a future bank relationship. As an example, the graphs my look like the ones below:

regarding a future bank relationship. As an example, the graphs my look like the ones below:

Qualitative

Economical

Cost-Benefit

With this analysis you are able now to segregate the expensive ones with poor performance from the ones

expensive ones with poor performance from the ones with more competitive prices and better offers. You

with more competitive prices and better offers. You can now invite the 2 - 3 best banks for a personal

can now invite the 2 - 3 best banks for a personal meeting. The bank will now show clear more respect

meeting. The bank will now show clear more respect and makes more concessions, if you show them from

and makes more concessions, if you show them from the beginning that you are interested in a very

the beginning that you are interested in a very professional relationship and that you are able to

professional relationship and that you are able to manage your business well. Because the bank is your

manage your business well. Because the bank is your vendor and you her customer. Same like in your

vendor and you her customer. Same like in your operational business you rely on one of the very most

operational business you rely on one of the very most important points in a business: CONFIDENCE.

important points in a business: CONFIDENCE.

expensive ones with poor performance from the ones

expensive ones with poor performance from the ones with more competitive prices and better offers. You

with more competitive prices and better offers. You can now invite the 2 - 3 best banks for a personal

can now invite the 2 - 3 best banks for a personal meeting. The bank will now show clear more respect

meeting. The bank will now show clear more respect and makes more concessions, if you show them from

and makes more concessions, if you show them from the beginning that you are interested in a very

the beginning that you are interested in a very professional relationship and that you are able to

professional relationship and that you are able to manage your business well. Because the bank is your

manage your business well. Because the bank is your vendor and you her customer. Same like in your

vendor and you her customer. Same like in your operational business you rely on one of the very most

operational business you rely on one of the very most important points in a business: CONFIDENCE.

important points in a business: CONFIDENCE.

Contact us, we would be glad to show you the possible opportunities!

Individual Ranking of Banks

Standard Ranking (S&P, Fitch etc.) is common ranking practice

-but it cannot match all your requirements to a Bank!

Up until end of 2007 many banks had the untouchable reputation that there is no doubt about that they are the best experts regarding

that there is no doubt about that they are the best experts regarding safety. If anybody likes to ask for counterparty risk then it was always

safety. If anybody likes to ask for counterparty risk then it was always the bank who declined a request for funds due to reasons of

the bank who declined a request for funds due to reasons of reliability. But now the customer should also take this position, it may

reliability. But now the customer should also take this position, it may be even a matter of his existence. Doing business with the wrong

be even a matter of his existence. Doing business with the wrong bank may lead to total loss of liquidity. Easier told as done - but how

bank may lead to total loss of liquidity. Easier told as done - but how how can one rate his current and/or desired bank?

The one who has the money is right. This anrupt conclusion was in

how can one rate his current and/or desired bank?

The one who has the money is right. This anrupt conclusion was in the past (and is mostly still fact) the lived understanding of most

the past (and is mostly still fact) the lived understanding of most heads of individuals which have the power of dealing with money -

heads of individuals which have the power of dealing with money - and they do it as it would be their own money. That’s obviously the

and they do it as it would be their own money. That’s obviously the reason for “a golden key can open any door”. Plot-wise this money is

reason for “a golden key can open any door”. Plot-wise this money is not their property, they just administer it. In fact they have the same

not their property, they just administer it. In fact they have the same amount as liabilities by collecting money from other people /

amount as liabilities by collecting money from other people / organsations. That’s not the same as it is for every corporate outside

organsations. That’s not the same as it is for every corporate outside the banking business. It’s just a transfer from one person to the other

the banking business. It’s just a transfer from one person to the other and getting a margin for.

Rating of a Bank

Before you can make a rating it is important to get a customer-

and getting a margin for.

Rating of a Bank

Before you can make a rating it is important to get a customer- supplier view, free of emotions and all the time critical challenged

supplier view, free of emotions and all the time critical challenged whether the earned experience is correct resp. whether they are still

whether the earned experience is correct resp. whether they are still actual. That’s the reason for the (allowedly little bit provocating)

actual. That’s the reason for the (allowedly little bit provocating) introducing explanations which should make someone aware of trust

introducing explanations which should make someone aware of trust in overall simple things.

in overall simple things. Example

Example The bank to be rated has good or very good rating at the well known

The bank to be rated has good or very good rating at the well known rating agencies Standard & Poors, Moody's or Fitch.

1.

Is this rating for a specific bond or really a overall credit-rating?

2.

Is the rating for the whole banking organsiation / group or is it

rating agencies Standard & Poors, Moody's or Fitch.

1.

Is this rating for a specific bond or really a overall credit-rating?

2.

Is the rating for the whole banking organsiation / group or is it just for a part of it, e.g. a single country or segment?

3.

How old is the rating? If it is older than a year you should better

just for a part of it, e.g. a single country or segment?

3.

How old is the rating? If it is older than a year you should better renounce it.

4.

If you buy any product from bank, is it really from you bank and

renounce it.

4.

If you buy any product from bank, is it really from you bank and not from another one, rated very much worser? Remind on

not from another one, rated very much worser? Remind on practical examples, e.g. Credit Suisse vs. Lehman Brothers?

practical examples, e.g. Credit Suisse vs. Lehman Brothers? They sold Lehman products, but the customer thought that ge

They sold Lehman products, but the customer thought that ge made an investment at Credit Suisse. In fact, the customer lost

made an investment at Credit Suisse. In fact, the customer lost everything when Lehman went bankcrupt suddenly over night!

That means, is the rating in fact what you are interested for, i.e. does

everything when Lehman went bankcrupt suddenly over night!

That means, is the rating in fact what you are interested for, i.e. does it belongs to your business? If you don’t have a current and

it belongs to your business? If you don’t have a current and important, suitable rating, but also for every other rating for fully

important, suitable rating, but also for every other rating for fully transparent analysis, you see below a proven approach to rate your

transparent analysis, you see below a proven approach to rate your current or future bank.

Under all circumstances you should make your own personal

current or future bank.

Under all circumstances you should make your own personal analysis for a current existing rating. As you can see below,

analysis for a current existing rating. As you can see below, such an analysis can never be substituted by a general one.

Segmentation

The result should be a cost-benefit analysis (i.e. two dimensions)

such an analysis can never be substituted by a general one.

Segmentation

The result should be a cost-benefit analysis (i.e. two dimensions) which is segregated in general criterias, risk and potential. Ideally, a

which is segregated in general criterias, risk and potential. Ideally, a SWOT analysis was made before.

SWOT analysis was made before. The weighted points are now set in comparison to the total costs. Due to

The weighted points are now set in comparison to the total costs. Due to this, a meaningful graphic analyis about the cost-benefits can be made.

this, a meaningful graphic analyis about the cost-benefits can be made. regarding a future bank relationship. As an example, the graphs my look

regarding a future bank relationship. As an example, the graphs my look like the ones below:

like the ones below: Qualitative

Economical

Qualitative

Economical Cost-Benefit

With this analysis you are able now to segregate the expensive ones

Cost-Benefit

With this analysis you are able now to segregate the expensive ones with poor performance from the ones with more competitive prices

with poor performance from the ones with more competitive prices and better offers. You can now invite the 2 - 3 best banks for a

and better offers. You can now invite the 2 - 3 best banks for a personal meeting. The bank will now show clear more respect and

personal meeting. The bank will now show clear more respect and makes more concessions, if you show them from the beginning that

makes more concessions, if you show them from the beginning that you are interested in a very professional relationship and that you are

able to manage your business well. Because the bank is your vendor

you are interested in a very professional relationship and that you are

able to manage your business well. Because the bank is your vendor and you her customer. Same like in your operational business you

and you her customer. Same like in your operational business you rely on one of the very most important points in a business:

rely on one of the very most important points in a business: CONFIDENCE.

CONFIDENCE. Contact us, we would be glad to show you the possible

opportunities!

Contact us, we would be glad to show you the possible

opportunities!

that there is no doubt about that they are the best experts regarding

that there is no doubt about that they are the best experts regarding safety. If anybody likes to ask for counterparty risk then it was always

safety. If anybody likes to ask for counterparty risk then it was always the bank who declined a request for funds due to reasons of

the bank who declined a request for funds due to reasons of reliability. But now the customer should also take this position, it may

reliability. But now the customer should also take this position, it may be even a matter of his existence. Doing business with the wrong

be even a matter of his existence. Doing business with the wrong bank may lead to total loss of liquidity. Easier told as done - but how

bank may lead to total loss of liquidity. Easier told as done - but how how can one rate his current and/or desired bank?

The one who has the money is right. This anrupt conclusion was in

how can one rate his current and/or desired bank?

The one who has the money is right. This anrupt conclusion was in the past (and is mostly still fact) the lived understanding of most

the past (and is mostly still fact) the lived understanding of most heads of individuals which have the power of dealing with money -

heads of individuals which have the power of dealing with money - and they do it as it would be their own money. That’s obviously the

and they do it as it would be their own money. That’s obviously the reason for “a golden key can open any door”. Plot-wise this money is

reason for “a golden key can open any door”. Plot-wise this money is not their property, they just administer it. In fact they have the same

not their property, they just administer it. In fact they have the same amount as liabilities by collecting money from other people /

amount as liabilities by collecting money from other people / organsations. That’s not the same as it is for every corporate outside

organsations. That’s not the same as it is for every corporate outside the banking business. It’s just a transfer from one person to the other

the banking business. It’s just a transfer from one person to the other and getting a margin for.

Rating of a Bank

Before you can make a rating it is important to get a customer-

and getting a margin for.

Rating of a Bank

Before you can make a rating it is important to get a customer- supplier view, free of emotions and all the time critical challenged

supplier view, free of emotions and all the time critical challenged whether the earned experience is correct resp. whether they are still

whether the earned experience is correct resp. whether they are still actual. That’s the reason for the (allowedly little bit provocating)

actual. That’s the reason for the (allowedly little bit provocating) introducing explanations which should make someone aware of trust

introducing explanations which should make someone aware of trust in overall simple things.

in overall simple things. Example

Example The bank to be rated has good or very good rating at the well known

The bank to be rated has good or very good rating at the well known rating agencies Standard & Poors, Moody's or Fitch.

1.

Is this rating for a specific bond or really a overall credit-rating?

2.

Is the rating for the whole banking organsiation / group or is it

rating agencies Standard & Poors, Moody's or Fitch.

1.

Is this rating for a specific bond or really a overall credit-rating?

2.

Is the rating for the whole banking organsiation / group or is it just for a part of it, e.g. a single country or segment?

3.

How old is the rating? If it is older than a year you should better

just for a part of it, e.g. a single country or segment?

3.

How old is the rating? If it is older than a year you should better renounce it.

4.

If you buy any product from bank, is it really from you bank and

renounce it.

4.

If you buy any product from bank, is it really from you bank and not from another one, rated very much worser? Remind on

not from another one, rated very much worser? Remind on practical examples, e.g. Credit Suisse vs. Lehman Brothers?

practical examples, e.g. Credit Suisse vs. Lehman Brothers? They sold Lehman products, but the customer thought that ge

They sold Lehman products, but the customer thought that ge made an investment at Credit Suisse. In fact, the customer lost

made an investment at Credit Suisse. In fact, the customer lost everything when Lehman went bankcrupt suddenly over night!

That means, is the rating in fact what you are interested for, i.e. does

everything when Lehman went bankcrupt suddenly over night!

That means, is the rating in fact what you are interested for, i.e. does it belongs to your business? If you don’t have a current and

it belongs to your business? If you don’t have a current and important, suitable rating, but also for every other rating for fully

important, suitable rating, but also for every other rating for fully transparent analysis, you see below a proven approach to rate your

transparent analysis, you see below a proven approach to rate your current or future bank.

Under all circumstances you should make your own personal

current or future bank.

Under all circumstances you should make your own personal analysis for a current existing rating. As you can see below,

analysis for a current existing rating. As you can see below, such an analysis can never be substituted by a general one.

Segmentation

The result should be a cost-benefit analysis (i.e. two dimensions)

such an analysis can never be substituted by a general one.

Segmentation

The result should be a cost-benefit analysis (i.e. two dimensions) which is segregated in general criterias, risk and potential. Ideally, a

which is segregated in general criterias, risk and potential. Ideally, a SWOT analysis was made before.

SWOT analysis was made before. The weighted points are now set in comparison to the total costs. Due to

The weighted points are now set in comparison to the total costs. Due to this, a meaningful graphic analyis about the cost-benefits can be made.

this, a meaningful graphic analyis about the cost-benefits can be made. regarding a future bank relationship. As an example, the graphs my look

regarding a future bank relationship. As an example, the graphs my look like the ones below:

like the ones below: Qualitative

Economical

Qualitative

Economical Cost-Benefit

With this analysis you are able now to segregate the expensive ones

Cost-Benefit

With this analysis you are able now to segregate the expensive ones with poor performance from the ones with more competitive prices

with poor performance from the ones with more competitive prices and better offers. You can now invite the 2 - 3 best banks for a

and better offers. You can now invite the 2 - 3 best banks for a personal meeting. The bank will now show clear more respect and

personal meeting. The bank will now show clear more respect and makes more concessions, if you show them from the beginning that

makes more concessions, if you show them from the beginning that you are interested in a very professional relationship and that you are

able to manage your business well. Because the bank is your vendor

you are interested in a very professional relationship and that you are

able to manage your business well. Because the bank is your vendor and you her customer. Same like in your operational business you

and you her customer. Same like in your operational business you rely on one of the very most important points in a business:

rely on one of the very most important points in a business: CONFIDENCE.

CONFIDENCE. Contact us, we would be glad to show you the possible

opportunities!

Contact us, we would be glad to show you the possible

opportunities!