Stahr Treasury Software Help

Reporting - REPORTS WITH A FIX DATE

Basically, there are three kind of possibilities for reporting:

a) Reports for specific items, e.g. loan agreement, fx-deal confirmation

b) Reports with a specific reporting date, e.g. balance sheet

c) Reports with contents within a defined period, account ledgers

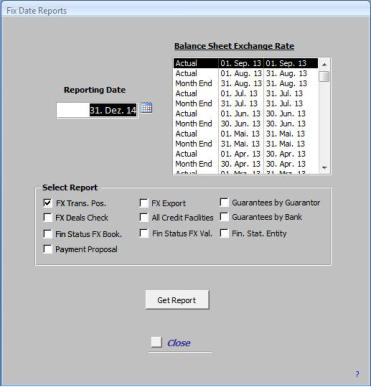

This menu is for reports b) with one fix reporting date. Most of all reports are as of a

specific date.

A) Please select in the block “Reporting Date” the starting resp. fix-date. The content

of the report includes this date.You may enter the date directly in the format of your

system (i.e. DD.MM.YY or in the US MM/DD/YY etc.) or you click on the calendar-icon

right next of the date-field and choose a date in the calendar.

B) Select then in the Block “Balance Sheet Exchange Rate” the desired fx rate for evtl.

foreign currency conversions. Source of these rates is menu Standing Data -> FX

Rates.

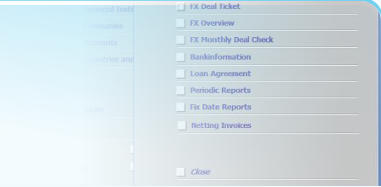

Following reports are available in this menu:

a) FX Transaction Position Report

b) FX Export function into Excel

c) FX Deals Check

d) All guarantees by guarantor

e) All guarantees by bank

f) All credit facilities

g) The total external Financial Status of a group by currency per instrument (e.g. bank/loans/facility) for a booking date

g) The total external Financial Status of a group by currency per instrument for a value date

h) The total external Financial Status of a group by company, currency and availability for booking- and value dates (Cash Report)

i) Payment Proposal Report for all kind FX-, MM- and Interest payments

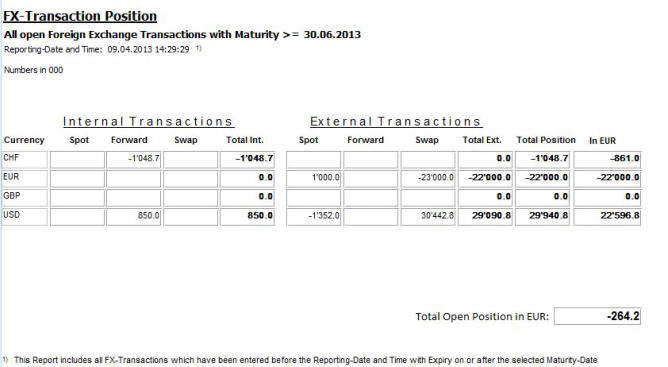

FX Transaction Position Report

After having marked one of these possibilities, click on “Get Report” and the desired report resp. submenu will appear.

The report is designed to

summarize all open fx-transactions

by currency and instrument and

group it by

internal or external transaction.

This allows the Treasurer to have a

comprehensive position vs. internal

parties and vs. external parties and

as a result, the net position per

currency. On top, the total open

position is summarized at the

bottom of the report and shows the

total amount of open fx-

transactions. That means, with this

report the Treasurer is able to

manage a complete fx portofolio

and can change the position throughout the whole currency spectrum while having always the total net position under control.

FX Transaction Export into Excel

Foreign Exchange Deals might want to be analyzed further in ad-hoc reports. Thus, this Treasury Software allows to export all fx-transactions into all

possible formats wich Microsoft supports. First a message appears with instructions:

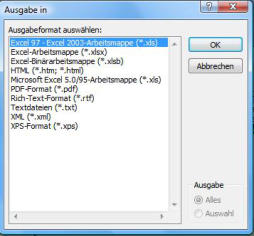

By click on OK you are asked

to choose the format into which

you like to export:

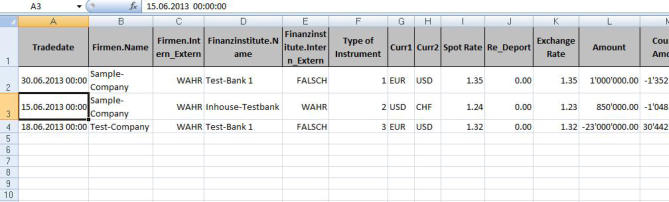

In case you like to export into

Microsoft Excel, the result looks

like this. Now you are able to

analyze all fx-transactions by

whatever you like to analyze it for.

FX Deals Check

Open FX-Deals should be confirmed regularely, not only when

having made the deal and confirmed with the FX-Deal Ticket.

This report shows all fx-deals by entity and has a field to check

and confirm it by manual signature.

Fields:

1.

Entity: Owner of the fx-deal vs. the internal or external

bank.

2.

Bank: Bank with which the fx-deal has been agreed. Can

be internal or external.

If an entity has deals with more than one bank, all banks with

their trades will be listed after another.

All Guarantees by Guarantor

Guarantees are daily business in every treasury department. Because guarantees require just rarely attantion, mostly just when they expire or when

they should be renewed, the threat of loosing control is given. With an easy and fast generated report the Treasurer has always a full overview about

all outstanding guarantees.

Fields:

1.

Reporting Date: Reporting date as previously

selected, see above.

2.

Guarantor: Company, who stand surety for the

guarantee.

3.

On behalf of: The company for which the

guarantee is intended (i.e. not the beneficiary).

This might be the guarantor itself or any other

company. In case one guarantor stands surety

for more than one company, the other “on

behalf of” are listed one after the other, see 3a.

4.

Detail Block: All relevant information about

the gurantee. If the currency of the guarantee

is not the same like the group’s functional

currency, the equivalent amount in the

functional currency (in this example EUR) is

calculated by the exchange rate having selected previously, see above. In case one guarantor stands surety for more than one company, the

other details are listed one after the other, see 4a.

5.

Total for [on behalf of]: The subtotal of all gurantees per “on behalf of” company, expressed in the group’s functional currency and converted

at the fx rate previously selected, see above.

6.

Total [Guarantor]: The total amount of all guarantees the guarantor stands surety for, expressed in the group’s functional currency and

converted at the fx rate previously selected, see above.

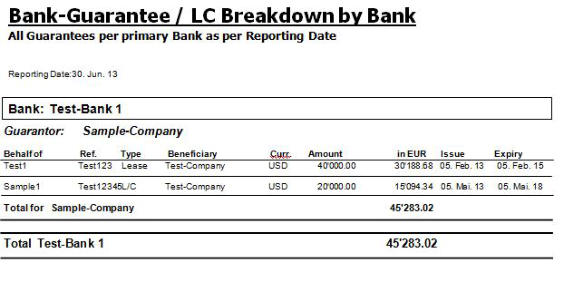

All Guarantees by Bank

The report Gurantees by Bank is basically the same

like the report Guarantees by Guarantor. Just with

the difference that now the analysis is made by

primary bank instead of primary guarantor.

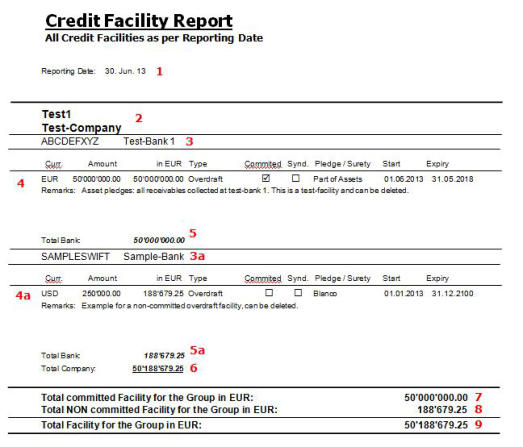

All Credit Facilities

The credit facility report is an important source of information for the group’s capital management. It monitors all credit facilities of a group as per

company, bank, currency and very important, with a segregation of committed and non-committed facilties.

Fields:

1.

Reporting Date: Reporting date as previously

selected, see above.

2.

Company: Short code and name of the company

who is the borrower of the facility.

3.

Bank: SWIFT code and name of the facility giving

bank.

4.

Detail Block: All relevant details about the specific

facility. If a facility is committed or syndicated it will

be indicated in a tick-box.

5.

Total Bank: The total amount of the facility xpressed

in the group’s functional currency and converted at

the fx rate previously selected, see above.

6.

Total Company: total amount of all facilities for the

company in the group’s functional currency.

7.

Total committed Facility: The total of all committed

facilities in the group’s functional currency.

8.

Total non-committed Facility: The total of all NON-

committed facilities in the group’s functional

currency.

9.

Total Facility for the Group: The sum of all

committed and non-committed credit facilities.

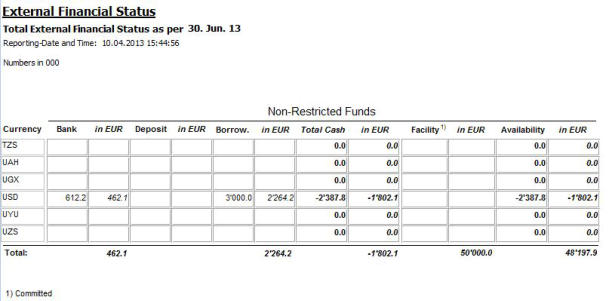

External Financial Status

The financial status is one of the most

important informations to manage a safe and

efficient optimal cash management. This

report summarizes per currency all bank-

accounts, deposits, borrowings = total cash,

adds the facility and calculates then the net-

availability. The user has the choice between

entries for booking date (Fin Status FX Book)

and entries for value date (Fin. Status FX

Val.) .

As soon any loan, deposit, facility, bank-

account entry is made, the software is

calculating immediately the new status. This

ensures a maximum fast information. Source

for this comprehensive report is:

Currency: Standing Data -> Currencies

Bank-Accounts: Transactions -> Account Balances

Deposits and Borrowings: Transactions -> Loans and Investements

Facility: Transactions -> Credit Facilities

Restrictions: Standing Data -> Countries and Regions

Exchange Rate to convert the totals: see above.

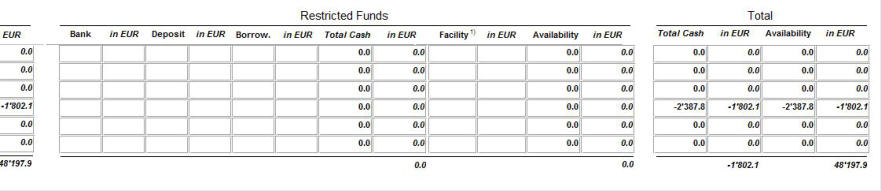

However, the multinational treasuer knows that there is a very important difference between available funds and restricted funds, i.e. trapped cash.

Hence, the financial status report has three blocks:

1) Non-Restricted Funds

2) Restricted Funds

3) Total

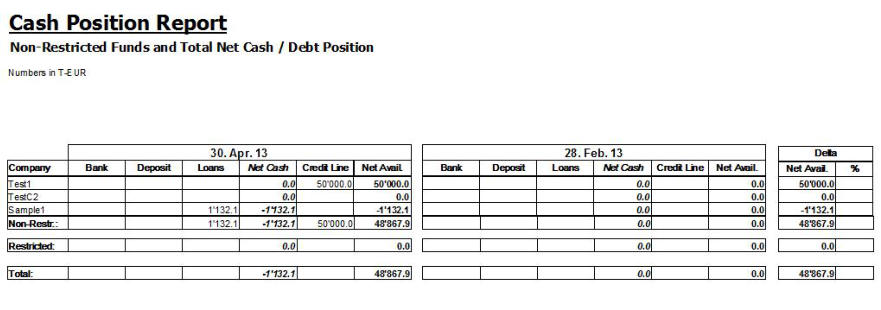

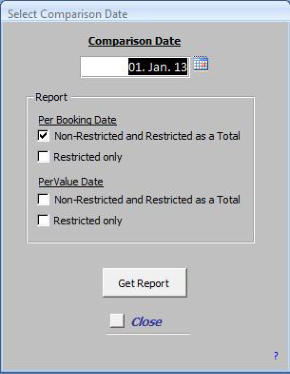

External Financial Status by Company (Cash Report)

To manage a funds-portfolio, the Treasuer needs two informations for a safe and efficient cash

management. The first is the porfolio by currency, see above, and in the second step. the information

where the funds are. This report is intended to monitor the funds-owners by availability and with a

comparison to a second date, free definable (e.g. actual vs. last day, week, month or year).

The user has the choice for these four reports:

1) Basically the distinction between booking dates and value dates, then

a) All companies whose funds are non-restricted and available for group-treasury. At the bottom of

the report a summary of restricted funds is also included, as well as the overall net cash / debt

position number that gives this report the character of an overall cash flash.

b) All companies whose funds are restricted, i.e. trapped cash.

The information of which funds are available and which funds are not available is made in menu

Standing Data -> Countries and Regions by setting a tick in restriction type “IC-Clearing

Crossborder”.

The report has three blocks, one for the reporting date, one for the comparison date and one for the difference between those two. Depending on the

flag “Internal “in menu Standing Data -> Companies all such companies are part of this report.

There are three total-lines:

1. Total of all Non-Restricted funds

2. Total of all Restricted funds

3. Total of all funds = Net Cash / Debt Position

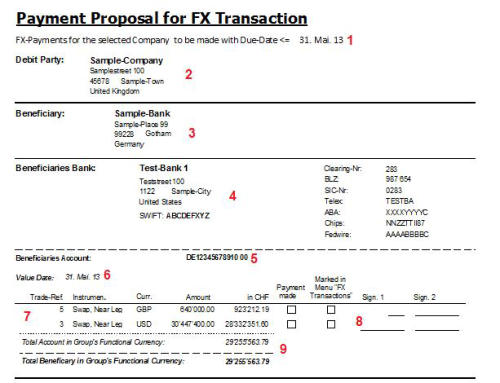

Payment Proposal for FX-, MM- and Interest Payments

This is a very useful report! Based on the entries made in the Transactions Menu for FX-Trades and Money Market Loans/Deposits Stahr Treasury

Software provides the user with a detailed proposal report for the upcoming payments to be made.

1.

The user select in the previous menu “Fix Date Reports” the value date up until all unsettled

payments shall be reported and tick the box “Payment Proposal”.

2.

In the selection box all internal companies are listed and for which company what kind of

payment is unsettled up until the date previously selected.

a) If you like to get a report for a specific company, select the desired entity and click in the

box below on “specific”.

b) If you like to get a payment proposal report for all companies, simply click “All”. This is

especially very helpful for Shared Service Centers.

3.

Select the payment item, Foreign Exchange-, Money Market or Interest and click on “Get

Report”.

Report

The Foreign Exchange Report is used here as an example, the Money Market- and the Interest Report is analogue:

Fields:

1.

Due Date: All payments with due date until and inluding

that date are considered for the report, as long they are

not marked as “paid” in the respective transaction menu.

2.

Debit Party: Thats’s the internal company who has to

make the payment.

3.

Beneficiary: This is the internal- or external party who

recieves the payment.

4.

Beneficiaries Bank: This is the bank of the beneficiary

to which the the payment has to be made. Among the

name and address all relevant payment information

such as SWIFT etc. are mentioned.

5.

Beneficiaries Account: If the account has an IBAN,

this one will be reported, otherwise the normal external

account number is mentioned.

6.

Value Date: The value date for the payment.

7.

Payment Details, Currency, Amount: The trade

reference, the instrument and currency of the payment, followed by the amount in the payment-currency. All amounts are converted also in the

groups functional currency (Trigger: menu Standing Data -> Currency).

8.

Payment Control: Very important! The person who is responsible to make the payment must be also responsible to mark the fiields

“Payment made”, goes afterwards to the respective transaction menu (Foreign Exchange or Loans/Investments) and marks the transaction as

paid and set a cross to “Marked in Menu FX Transactions” resp. “Loans/Investments”. Secondly this person verify that by signing the payment

report with the first signature.

Usually, all groups have at least two signatures for a payment. That means, Person #1 who made the payment in the banking software is

forwarding this payment report to Person #2 who confirm and release the payment finally and as last step, signs the report as well.