Stahr Treasury Software Help

Reporting - REPORTS WITH A PERIOD

Basically, there are three kind of possibilities for reporting:

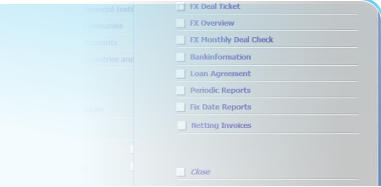

a) Reports for specific items, e.g. loan agreement, fx-deal confirmation

b) Reports with a specific reporting date, e.g. balance sheet

c) Reports with contents within a defined period, account balances

This menu is for reports c) with a start and an end date.

Please select in the block “From Date” the starting date. The content of the report

include this date and similar in the block “To Date” the end date of the desired

report. You may enter the date directly in the format of your system (i.e.

DD.MM.YY or in the US MM/DD/YY etc.) or you click on the calendar-icon right

next of the date-field and choose a date in the calendar.

Following reports are available in this menu:

a) Loan Breakdown

b) Export Loan Details for Accounting purpose

c) A breakdown of all new loans in a period

d) A breakdown of all fx-deals in a period

e) Balances of external (bank)accounts for the selected period

After having marked one of these possibilities, click on “Execute” and the desired report will appear.

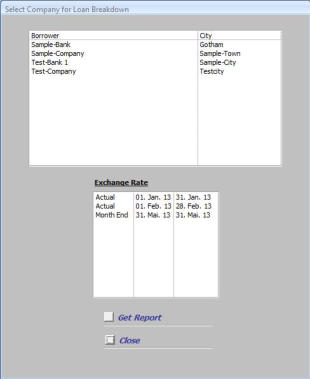

Loan Breakdown

This is a comprehensive loan breakdown, intended to confirm all outstanding loans to the counterparty and inform about the current booking-items.

A very helpful report to minimize the monthly reconciliation and to ensure that all bookings made correct. The reports shows for a defined period

fixed, accrued and settled interest in local and group currency.

The selection is over the borrowing party. Select the borrower by click on it. Afterwards the

exchange rate need to be selected at which the several items are calculated. Source is menu

Standing Data -> FX Rates. Then simply click on the button “Get Report” and the loan

breakdown will be generated.

Fields:

1.

Reporting Period: This is the period previously selected, see above.

2.

Lender: That’s the external or internal lending party incl. full address.

3.

Borrower: That’s the external or internal

borrowing party incl. full address.

4.

Currency, Exchange Rate: Currency of the

loan and fx-rate previously selected, see

above.

5.

General Loan Details: Block with all general

details of the loan. In case a borrower has

several loans they will be monitored one after

the other.

6.

Interest Leg Block:

a) Leg Start Date

b) Leg Maturity Date

c) Leg Interest Rate

d) Interest fixed for the leg

e) Interest accumulated for the specific leg.

This number is calculated from reporting-start

until the reporting-end or, if the maturity is

before the reporting-end, until the maturity of

the interest leg.

f) The interest for the selected period. This

number my perfectly used for periodical

accounting accruals and can be also exported

in menu “Export for Accounting”, see below.

g) Interest which has been settled in cash or through any other balance sheet account.

h) Interest unsettled shows the amount of interest due at the reporting end date.

7.

Subtotal: The subtotals are calculated first in the currency of the loan and in the second line converted into the group’s functional currency,

in this example it is EUR. For each loan a seperate subtotal will be monitored in both currencies.

8.

Total interest items in [EUR]: The overall total for all loans (in this example only one) converted into the gorup’s functional currency at the

exchange rate selected above.

9.

Notice and Confirmation: The borrower shall check all details and send the confirmation duly signed back. This confirms to the Treasurer

and the group accountant that all loans and interest details accepted and correct booked.

Export for Accounting

All loan- and interest details can be exported in a Excel File. This is a perfect interface to every accounting system and makes monthly bookings for

accruals very efficient. Because every company has his own ERP and own chart of accounts, this interface will be designed individually by Stahr

GmbH - Treasury Consulting.

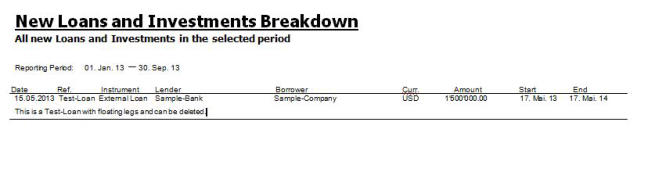

New Loans in a Period

Especially Accounting needs to have periodically the info about all new loans agreed in a specific period. But also internal- and external Audit may

use this information for their

audit process.

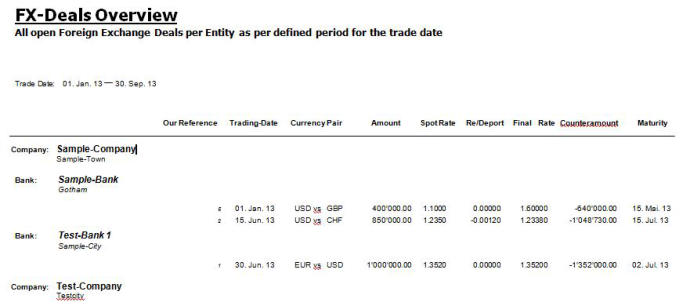

New FX Deals in a Period

Same as for the loans, this report monitors all new foreign exchange agreements made in a specific period.

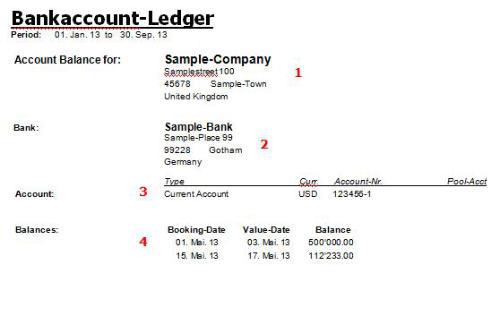

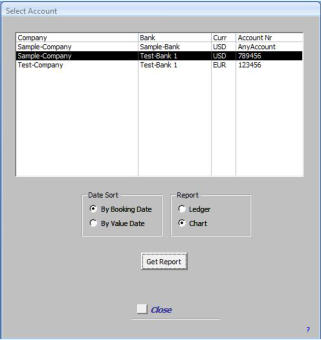

Account Ledger for external Accounts

Some Companies need several days or weeks to monitor account balances in their ERP

reporting system. Treasury operates always with the utmost actual numbers and this account

ledger allows the Treasurer or any other interested person to review the daily balances of the

bank accounts fast and simple. On top, a quick chart-analysis for the selected account is also

possible.

Source of the account balances is menu Transactions - > Account Balances. All information

may be automatically uploaded from external sources.

1.

Select the account to be reported,

2.

select the relevant date order, i.e. by booking date or by value date,

3.

select the kind of report, i.e. as a ledger or as a chart.

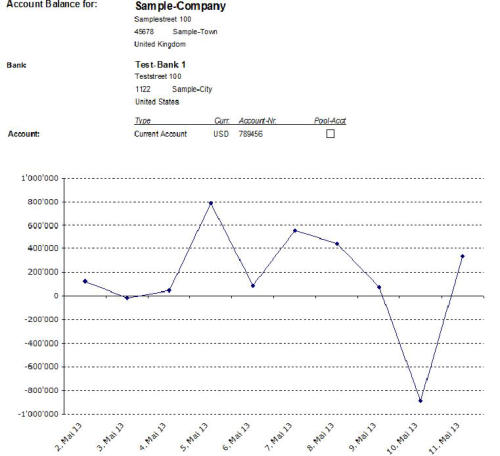

Fields:

1.

Account Balance for: Internal company which is the

owner of the account, incl. full address.

2.

Bank: Bank, at which the account is held. In case of a

inhouse-bank approach this bank can be also

internally.

3.

Account: General account description. In case of a

pool account this will be mentioned extra.

4.

Balances: All balances per day in ascending order by

- booking date (if “By Booking Date” was selected)

- value date (if “By Value Date” was selected)

- balance (in the currency of the account)

Chart:

The same basic information like in the ledger format is also

available in the chart report. The difference is that in this

report the numbers are displayed as a graphical chart.

In case “By Booking Date” is previously selected, the dates

are only booking dates. Corresponding the selction “By Value

Date” only value dates are relevant.

Interesting information actually is if the user opens two

reports at the same time, one per booking date and one per

value date. The difference of those two is perfectly

monitored.

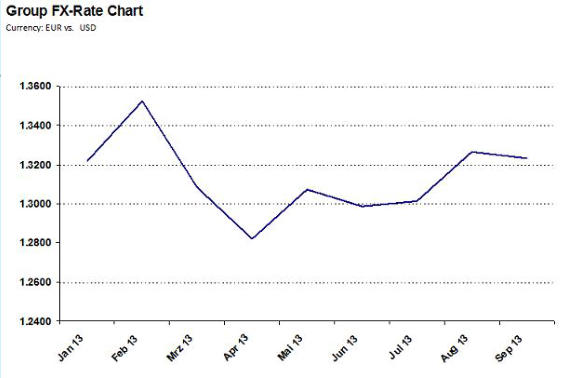

FX Rate Charts

Charts for FX-Rates can bei reviewed at multiple

sources in the web. But the specific FX-Rate for

the group rates might be different. Therefore Stahr

Treasury Software (STS) has integrated a report to

monitor the internal rates in a chart. Select the

desired currency and the period to be monitored

and click on “Execute”.

Note: only rates which are related to rate type

“Balance Sheet, Actual”, to be uploaded in the

menu Standing Data -> FX Rates -> Type of

Exchange Rates, are subject of the chart.