Stahr Treasury Software Help

Transactions - Menu LIQUIDITY PLAN

Reasons for a Liquidity Plan are:

1.

Ensure short- and longterm solvency 2.

Minimizing the opportunity costs of too much cash

3.

Minimize the financing costs,

4.

Ensure efficient currency- and interest hedging, (see also

2.

Minimizing the opportunity costs of too much cash

3.

Minimize the financing costs,

4.

Ensure efficient currency- and interest hedging, (see also section “currency- and interest hedging”)

section “currency- and interest hedging”) 5.

Maximize return of investments,

5.

Maximize return of investments, 6.

Obtain financial independency.

6.

Obtain financial independency. With this format of our liquidity plan it is possible to:

•

Forgett the hundreds of Excel spreadsheets for common liquidity

reporting and make this process efficient and safe!

•

Distinguish between operational-, investement-, financing- and

other cash flows, i.e., it can be used also a direct cash flow

statement;

•

Each cash flow can be entered in the transaction of occurance,

i.e. it is also a perfect measurement to hedge future cash flows

for foreign exchange risks.

•

Compare actual with forecast results.

•

Monitor all cash flows by entity, by currency, on group level and

consolidated in the desired currency. For this, please refer to

section Reports -> Liquidity Planning.

If you have questions regarding the navigation, please click here.

Fields:

Company: This is the internal company which is the owner of the cash flow. Source is menu Standing Data -> Companies. Mandatory, pre-entered

With this format of our liquidity plan it is possible to:

•

Forgett the hundreds of Excel spreadsheets for common liquidity

reporting and make this process efficient and safe!

•

Distinguish between operational-, investement-, financing- and

other cash flows, i.e., it can be used also a direct cash flow

statement;

•

Each cash flow can be entered in the transaction of occurance,

i.e. it is also a perfect measurement to hedge future cash flows

for foreign exchange risks.

•

Compare actual with forecast results.

•

Monitor all cash flows by entity, by currency, on group level and

consolidated in the desired currency. For this, please refer to

section Reports -> Liquidity Planning.

If you have questions regarding the navigation, please click here.

Fields:

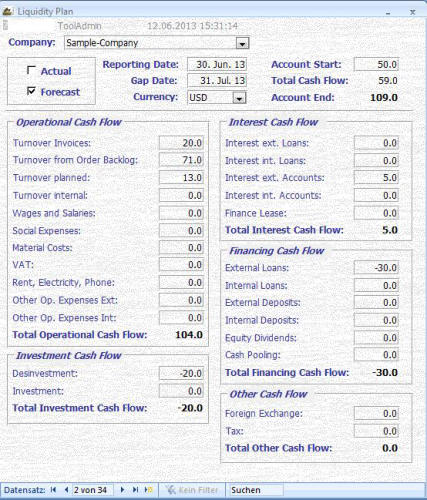

Company: This is the internal company which is the owner of the cash flow. Source is menu Standing Data -> Companies. Mandatory, pre-entered content.

Actual / Forecast: Select the status of the cash flow. Mandatory, given content.

content.

Actual / Forecast: Select the status of the cash flow. Mandatory, given content. Reporting Date: Date of the report, usually last day of a month, week etc. Mandatory, free date in the format of your computer (i.e., if your computer

Reporting Date: Date of the report, usually last day of a month, week etc. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Gap Date: Date of the gap. Depending on the phasing of the report it is a week, a month etc. after the reporting date. That means, you are free to

Gap Date: Date of the gap. Depending on the phasing of the report it is a week, a month etc. after the reporting date. That means, you are free to define your own gaps. For instance, the first month after the reporting date should be in a weekly phasing, the next 5 month up to the first half yaer

define your own gaps. For instance, the first month after the reporting date should be in a weekly phasing, the next 5 month up to the first half yaer monthly and upt to a year just quarterly. But you can define also just monthly gaps what most of the comanies do. Mandatory, free date in the

monthly and upt to a year just quarterly. But you can define also just monthly gaps what most of the comanies do. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Currency: The currency of the cash flow. Source is menu Standing Data -> Currencies. If you don’t like to report per single currency, you can just

Currency: The currency of the cash flow. Source is menu Standing Data -> Currencies. If you don’t like to report per single currency, you can just sum up the cash flows in one single currency, i.e. the functional currency of the reporting entity. But then an analysis of the fx-exposure is no longer

sum up the cash flows in one single currency, i.e. the functional currency of the reporting entity. But then an analysis of the fx-exposure is no longer possible. Mandatory, pre-entered content. I

possible. Mandatory, pre-entered content. I Note: the constallation Company, Actual/Forecast, Reporting Date, Gap Date and Currency must be unique. If you try to enter such a record twice it

Note: the constallation Company, Actual/Forecast, Reporting Date, Gap Date and Currency must be unique. If you try to enter such a record twice it will be not saved on the end.

will be not saved on the end. Account Start: The starting balance of the corresponding account for the transaction. Right after having left the field “Currency” the system looks

Account Start: The starting balance of the corresponding account for the transaction. Right after having left the field “Currency” the system looks for the last previous end-balance and transfers this value. Nevertheless, under specific circumstances (e.g. you enter a new gap between two

for the last previous end-balance and transfers this value. Nevertheless, under specific circumstances (e.g. you enter a new gap between two existing gaps) it may happen that the transferred number could have been not evaluated correct. So please always re-check this number. You will

existing gaps) it may happen that the transferred number could have been not evaluated correct. So please always re-check this number. You will be remembered with a pop-up. Mandatory, free positive or negative number.

be remembered with a pop-up. Mandatory, free positive or negative number. Total Cash Flow: Automatic calculation based on the entries made in the cash flow sections below. No manual entry possible.

Account End: Automatic calculation based on the values in Account Start and Total Cash Flow. No manual entry possible.

Total Cash Flow: Automatic calculation based on the entries made in the cash flow sections below. No manual entry possible.

Account End: Automatic calculation based on the values in Account Start and Total Cash Flow. No manual entry possible. Fields in sections Operational-, Investment-, Interest-, Financing- and Other Cash Flow:

Fields in sections Operational-, Investment-, Interest-, Financing- and Other Cash Flow:  •

All numbers must be entered with the correct foresign, i.e. turnover usually as a normal number and expenses with a minus (-) before.

•

All numbers must be entered with the correct foresign, i.e. turnover usually as a normal number and expenses with a minus (-) before. •

Totals by section are calculated automatically.

•

You should enter the numbers at least in 000, not in effective numbers. But you can enter for example 154’358.65 as 154,35865 -> will be

•

Totals by section are calculated automatically.

•

You should enter the numbers at least in 000, not in effective numbers. But you can enter for example 154’358.65 as 154,35865 -> will be displayed as 154.4. Nevertheless, liquidity planning is not accounting and therefore such exactly numbers are not common standard.

displayed as 154.4. Nevertheless, liquidity planning is not accounting and therefore such exactly numbers are not common standard.

2.

Minimizing the opportunity costs of too much cash

3.

Minimize the financing costs,

4.

Ensure efficient currency- and interest hedging, (see also

2.

Minimizing the opportunity costs of too much cash

3.

Minimize the financing costs,

4.

Ensure efficient currency- and interest hedging, (see also section “currency- and interest hedging”)

section “currency- and interest hedging”) 5.

Maximize return of investments,

5.

Maximize return of investments, 6.

Obtain financial independency.

6.

Obtain financial independency. With this format of our liquidity plan it is possible to:

•

Forgett the hundreds of Excel spreadsheets for common liquidity

reporting and make this process efficient and safe!

•

Distinguish between operational-, investement-, financing- and

other cash flows, i.e., it can be used also a direct cash flow

statement;

•

Each cash flow can be entered in the transaction of occurance,

i.e. it is also a perfect measurement to hedge future cash flows

for foreign exchange risks.

•

Compare actual with forecast results.

•

Monitor all cash flows by entity, by currency, on group level and

consolidated in the desired currency. For this, please refer to

section Reports -> Liquidity Planning.

If you have questions regarding the navigation, please click here.

Fields:

Company: This is the internal company which is the owner of the cash flow. Source is menu Standing Data -> Companies. Mandatory, pre-entered

With this format of our liquidity plan it is possible to:

•

Forgett the hundreds of Excel spreadsheets for common liquidity

reporting and make this process efficient and safe!

•

Distinguish between operational-, investement-, financing- and

other cash flows, i.e., it can be used also a direct cash flow

statement;

•

Each cash flow can be entered in the transaction of occurance,

i.e. it is also a perfect measurement to hedge future cash flows

for foreign exchange risks.

•

Compare actual with forecast results.

•

Monitor all cash flows by entity, by currency, on group level and

consolidated in the desired currency. For this, please refer to

section Reports -> Liquidity Planning.

If you have questions regarding the navigation, please click here.

Fields:

Company: This is the internal company which is the owner of the cash flow. Source is menu Standing Data -> Companies. Mandatory, pre-entered content.

Actual / Forecast: Select the status of the cash flow. Mandatory, given content.

content.

Actual / Forecast: Select the status of the cash flow. Mandatory, given content. Reporting Date: Date of the report, usually last day of a month, week etc. Mandatory, free date in the format of your computer (i.e., if your computer

Reporting Date: Date of the report, usually last day of a month, week etc. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Gap Date: Date of the gap. Depending on the phasing of the report it is a week, a month etc. after the reporting date. That means, you are free to

Gap Date: Date of the gap. Depending on the phasing of the report it is a week, a month etc. after the reporting date. That means, you are free to define your own gaps. For instance, the first month after the reporting date should be in a weekly phasing, the next 5 month up to the first half yaer

define your own gaps. For instance, the first month after the reporting date should be in a weekly phasing, the next 5 month up to the first half yaer monthly and upt to a year just quarterly. But you can define also just monthly gaps what most of the comanies do. Mandatory, free date in the

monthly and upt to a year just quarterly. But you can define also just monthly gaps what most of the comanies do. Mandatory, free date in the format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY).

format of your computer (i.e., if your computer settings are set to american date numbers, enter MM.DD.YY, otherwise DD.MM.YY). Currency: The currency of the cash flow. Source is menu Standing Data -> Currencies. If you don’t like to report per single currency, you can just

Currency: The currency of the cash flow. Source is menu Standing Data -> Currencies. If you don’t like to report per single currency, you can just sum up the cash flows in one single currency, i.e. the functional currency of the reporting entity. But then an analysis of the fx-exposure is no longer

sum up the cash flows in one single currency, i.e. the functional currency of the reporting entity. But then an analysis of the fx-exposure is no longer possible. Mandatory, pre-entered content. I

possible. Mandatory, pre-entered content. I Note: the constallation Company, Actual/Forecast, Reporting Date, Gap Date and Currency must be unique. If you try to enter such a record twice it

Note: the constallation Company, Actual/Forecast, Reporting Date, Gap Date and Currency must be unique. If you try to enter such a record twice it will be not saved on the end.

will be not saved on the end. Account Start: The starting balance of the corresponding account for the transaction. Right after having left the field “Currency” the system looks

Account Start: The starting balance of the corresponding account for the transaction. Right after having left the field “Currency” the system looks for the last previous end-balance and transfers this value. Nevertheless, under specific circumstances (e.g. you enter a new gap between two

for the last previous end-balance and transfers this value. Nevertheless, under specific circumstances (e.g. you enter a new gap between two existing gaps) it may happen that the transferred number could have been not evaluated correct. So please always re-check this number. You will

existing gaps) it may happen that the transferred number could have been not evaluated correct. So please always re-check this number. You will be remembered with a pop-up. Mandatory, free positive or negative number.

be remembered with a pop-up. Mandatory, free positive or negative number. Total Cash Flow: Automatic calculation based on the entries made in the cash flow sections below. No manual entry possible.

Account End: Automatic calculation based on the values in Account Start and Total Cash Flow. No manual entry possible.

Total Cash Flow: Automatic calculation based on the entries made in the cash flow sections below. No manual entry possible.

Account End: Automatic calculation based on the values in Account Start and Total Cash Flow. No manual entry possible. Fields in sections Operational-, Investment-, Interest-, Financing- and Other Cash Flow:

Fields in sections Operational-, Investment-, Interest-, Financing- and Other Cash Flow:  •

All numbers must be entered with the correct foresign, i.e. turnover usually as a normal number and expenses with a minus (-) before.

•

All numbers must be entered with the correct foresign, i.e. turnover usually as a normal number and expenses with a minus (-) before. •

Totals by section are calculated automatically.

•

You should enter the numbers at least in 000, not in effective numbers. But you can enter for example 154’358.65 as 154,35865 -> will be

•

Totals by section are calculated automatically.

•

You should enter the numbers at least in 000, not in effective numbers. But you can enter for example 154’358.65 as 154,35865 -> will be displayed as 154.4. Nevertheless, liquidity planning is not accounting and therefore such exactly numbers are not common standard.

displayed as 154.4. Nevertheless, liquidity planning is not accounting and therefore such exactly numbers are not common standard.