Stahr Treasury Software Help

Transactions - Menu FX EXPOSURE REPORTING

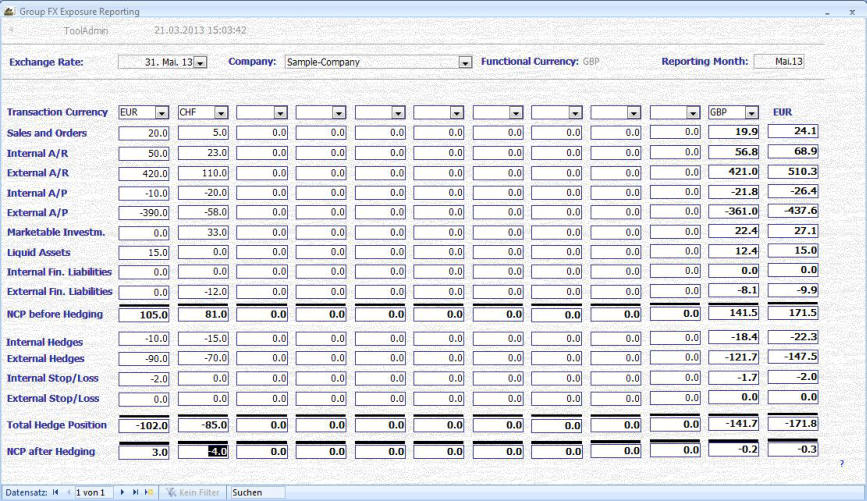

Knowing the groups and companies fx exposure is one the most important information a Treasurer needs to have in order to run his business, i.e. having the fx risks under control. This powerful reporting menu is completed by each entity periodically, e.g. monthly. The content summarizes all

having the fx risks under control. This powerful reporting menu is completed by each entity periodically, e.g. monthly. The content summarizes all relevant transactional fx exposure items and nets it with the corresponding hedging position per currency. Based on this information the group

relevant transactional fx exposure items and nets it with the corresponding hedging position per currency. Based on this information the group Treasurer is able to manage the overall fx exposure save and efficient. The results from this reporting are to be monitored in menu Reporting -> FX

Treasurer is able to manage the overall fx exposure save and efficient. The results from this reporting are to be monitored in menu Reporting -> FX Group Exposure Report.

Group Exposure Report. If you have questions regarding the navigation, please click here.

If you have questions regarding the navigation, please click here. Fields:

Exchange Rate: Please choose the available exchange rate. It is only possible to select fx rates with rate type “Month End”. That means, such a rate

Fields:

Exchange Rate: Please choose the available exchange rate. It is only possible to select fx rates with rate type “Month End”. That means, such a rate must be previously entered in menu Standing Data -> FX Rates and before defined in menu Standing Data -> FX Rates -> Rate Type. Mandatory, pre-

must be previously entered in menu Standing Data -> FX Rates and before defined in menu Standing Data -> FX Rates -> Rate Type. Mandatory, pre- entered content.

entered content. Company: This is the internal company who has the facility. Source is menu Standing Data -> Companies. Based on the entry made for the

Company: This is the internal company who has the facility. Source is menu Standing Data -> Companies. Based on the entry made for the companies functional currency in the standing data, this currency is automatically set in column #11 (just left from the group currency column) and is

companies functional currency in the standing data, this currency is automatically set in column #11 (just left from the group currency column) and is filled with the total of columns 1 - 10 numbers,converted into the functional currency at the exchang rate selected before. Mandatory, pre-entered

filled with the total of columns 1 - 10 numbers,converted into the functional currency at the exchang rate selected before. Mandatory, pre-entered content.

Reporting Month: Please enter the to be reported month. Important Notice: you must select the last day of a month!

content.

Reporting Month: Please enter the to be reported month. Important Notice: you must select the last day of a month! Columns 1 - 10

Columns 1 - 10 Whenever any change is made in the fields below, the columns #11 and #12 are calculated automatically.

Whenever any change is made in the fields below, the columns #11 and #12 are calculated automatically. Transaction Currency: This is the currency for the following reported transactions. Source is menu Standing Data -> Currencies. That especially the

Transaction Currency: This is the currency for the following reported transactions. Source is menu Standing Data -> Currencies. That especially the Group Treasurer get’s a complete view about all transactions, you need also to report your own functional currency items, e.g. if your company is

Group Treasurer get’s a complete view about all transactions, you need also to report your own functional currency items, e.g. if your company is located in Germany, report also all EUR-transactions. Nevertheless, because it is your own functional currency, it is for yourselve no exposure.

located in Germany, report also all EUR-transactions. Nevertheless, because it is your own functional currency, it is for yourselve no exposure. Therefore you must off-set the total amount in NCP before hedging in the field Internal Hedges that the net amount in field NCP after hedging is 0. In

Therefore you must off-set the total amount in NCP before hedging in the field Internal Hedges that the net amount in field NCP after hedging is 0. In order that you don’t forget that you will be remembered with a pop-up for this event. Optional, pre-entered content.

order that you don’t forget that you will be remembered with a pop-up for this event. Optional, pre-entered content. Sales and Orders: All kind of sales and outstanding orders as far they are firm. Optional, positive number.

Sales and Orders: All kind of sales and outstanding orders as far they are firm. Optional, positive number. Internal A/R: That’s all internal trade receivables in the above selected currency. Optional, positive number.

Internal A/R: That’s all internal trade receivables in the above selected currency. Optional, positive number. External A/R: All external trade receivables including tax-refunds etc. in the above selected currency. Optional, positive number.

External A/R: All external trade receivables including tax-refunds etc. in the above selected currency. Optional, positive number. Internal A/P: All internal trade payables in the above selected currency. Optional, negative number.

Internal A/P: All internal trade payables in the above selected currency. Optional, negative number. External A/P: All external trade payables including VAT, social liabilities, rent incl. operational lease etc. in the above selected currency. Optional,

External A/P: All external trade payables including VAT, social liabilities, rent incl. operational lease etc. in the above selected currency. Optional, negative number.

negative number. Marketable Investments: Investments which can be made liquid in a short time, e.g. money market deposits, shares, etc. Optional, positive number.

Marketable Investments: Investments which can be made liquid in a short time, e.g. money market deposits, shares, etc. Optional, positive number. Liquid Assets: That means especially cash and cash equivalents, e.g. cheques. Optional, positive number

Liquid Assets: That means especially cash and cash equivalents, e.g. cheques. Optional, positive number Internal Fin. Liabilities: All kind of financial liabilities vs. internal parties only, e.g. loans. Optional, negative number.

Internal Fin. Liabilities: All kind of financial liabilities vs. internal parties only, e.g. loans. Optional, negative number. External Fin. Liabilities: For example external loans, financial leasing items. Optional, negative number.

External Fin. Liabilities: For example external loans, financial leasing items. Optional, negative number. NCP before Hedging: NCP means Net-Currency-Position. This number is the sum of all entries made above. Automatic calculated number.

NCP before Hedging: NCP means Net-Currency-Position. This number is the sum of all entries made above. Automatic calculated number. Internal Hedges: This is the total of all fx-hedge transactions made with Corporate (Group) Treasury. Optional, positive or negative number.

Internal Hedges: This is the total of all fx-hedge transactions made with Corporate (Group) Treasury. Optional, positive or negative number. External Hedges: All fx-hedge transactions made with external parties, i.e. banks.Optional, positive or negative number.

External Hedges: All fx-hedge transactions made with external parties, i.e. banks.Optional, positive or negative number. Internal Stop/Loss: All confirmed stop/loss orders placed at Corporate (Group) Treasury.Optional, positive or negative number.

Internal Stop/Loss: All confirmed stop/loss orders placed at Corporate (Group) Treasury.Optional, positive or negative number. External Stop/Loss: All confirmed stop/loss orders placed at external parties, i.e. banks.Optional, positive or negative number.

External Stop/Loss: All confirmed stop/loss orders placed at external parties, i.e. banks.Optional, positive or negative number. Total Hedge Position: The sum of all fx-hedge items entered above. Automatic calculated number.

Total Hedge Position: The sum of all fx-hedge items entered above. Automatic calculated number. NCP after Hedging: This is the open fx-exposure for the reported currency. Net Currency Position is calculated for NCP before Hedging + Total

NCP after Hedging: This is the open fx-exposure for the reported currency. Net Currency Position is calculated for NCP before Hedging + Total Hedge Position. Automatic calculated number.

Column 11

Hedge Position. Automatic calculated number.

Column 11 This is the column of totals for columns 1-10, converted into the functional currency of the reporting entity at the exchange rate selected in the first

This is the column of totals for columns 1-10, converted into the functional currency of the reporting entity at the exchange rate selected in the first step, see above.

step, see above. Column 12

Column 12 The total of columns 1-10, converted into the group currency at the exchange rate selected in the first step, see above.

The total of columns 1-10, converted into the group currency at the exchange rate selected in the first step, see above.

having the fx risks under control. This powerful reporting menu is completed by each entity periodically, e.g. monthly. The content summarizes all

having the fx risks under control. This powerful reporting menu is completed by each entity periodically, e.g. monthly. The content summarizes all relevant transactional fx exposure items and nets it with the corresponding hedging position per currency. Based on this information the group

relevant transactional fx exposure items and nets it with the corresponding hedging position per currency. Based on this information the group Treasurer is able to manage the overall fx exposure save and efficient. The results from this reporting are to be monitored in menu Reporting -> FX

Treasurer is able to manage the overall fx exposure save and efficient. The results from this reporting are to be monitored in menu Reporting -> FX Group Exposure Report.

Group Exposure Report. If you have questions regarding the navigation, please click here.

If you have questions regarding the navigation, please click here. Fields:

Exchange Rate: Please choose the available exchange rate. It is only possible to select fx rates with rate type “Month End”. That means, such a rate

Fields:

Exchange Rate: Please choose the available exchange rate. It is only possible to select fx rates with rate type “Month End”. That means, such a rate must be previously entered in menu Standing Data -> FX Rates and before defined in menu Standing Data -> FX Rates -> Rate Type. Mandatory, pre-

must be previously entered in menu Standing Data -> FX Rates and before defined in menu Standing Data -> FX Rates -> Rate Type. Mandatory, pre- entered content.

entered content. Company: This is the internal company who has the facility. Source is menu Standing Data -> Companies. Based on the entry made for the

Company: This is the internal company who has the facility. Source is menu Standing Data -> Companies. Based on the entry made for the companies functional currency in the standing data, this currency is automatically set in column #11 (just left from the group currency column) and is

companies functional currency in the standing data, this currency is automatically set in column #11 (just left from the group currency column) and is filled with the total of columns 1 - 10 numbers,converted into the functional currency at the exchang rate selected before. Mandatory, pre-entered

filled with the total of columns 1 - 10 numbers,converted into the functional currency at the exchang rate selected before. Mandatory, pre-entered content.

Reporting Month: Please enter the to be reported month. Important Notice: you must select the last day of a month!

content.

Reporting Month: Please enter the to be reported month. Important Notice: you must select the last day of a month! Columns 1 - 10

Columns 1 - 10 Whenever any change is made in the fields below, the columns #11 and #12 are calculated automatically.

Whenever any change is made in the fields below, the columns #11 and #12 are calculated automatically. Transaction Currency: This is the currency for the following reported transactions. Source is menu Standing Data -> Currencies. That especially the

Transaction Currency: This is the currency for the following reported transactions. Source is menu Standing Data -> Currencies. That especially the Group Treasurer get’s a complete view about all transactions, you need also to report your own functional currency items, e.g. if your company is

Group Treasurer get’s a complete view about all transactions, you need also to report your own functional currency items, e.g. if your company is located in Germany, report also all EUR-transactions. Nevertheless, because it is your own functional currency, it is for yourselve no exposure.

located in Germany, report also all EUR-transactions. Nevertheless, because it is your own functional currency, it is for yourselve no exposure. Therefore you must off-set the total amount in NCP before hedging in the field Internal Hedges that the net amount in field NCP after hedging is 0. In

Therefore you must off-set the total amount in NCP before hedging in the field Internal Hedges that the net amount in field NCP after hedging is 0. In order that you don’t forget that you will be remembered with a pop-up for this event. Optional, pre-entered content.

order that you don’t forget that you will be remembered with a pop-up for this event. Optional, pre-entered content. Sales and Orders: All kind of sales and outstanding orders as far they are firm. Optional, positive number.

Sales and Orders: All kind of sales and outstanding orders as far they are firm. Optional, positive number. Internal A/R: That’s all internal trade receivables in the above selected currency. Optional, positive number.

Internal A/R: That’s all internal trade receivables in the above selected currency. Optional, positive number. External A/R: All external trade receivables including tax-refunds etc. in the above selected currency. Optional, positive number.

External A/R: All external trade receivables including tax-refunds etc. in the above selected currency. Optional, positive number. Internal A/P: All internal trade payables in the above selected currency. Optional, negative number.

Internal A/P: All internal trade payables in the above selected currency. Optional, negative number. External A/P: All external trade payables including VAT, social liabilities, rent incl. operational lease etc. in the above selected currency. Optional,

External A/P: All external trade payables including VAT, social liabilities, rent incl. operational lease etc. in the above selected currency. Optional, negative number.

negative number. Marketable Investments: Investments which can be made liquid in a short time, e.g. money market deposits, shares, etc. Optional, positive number.

Marketable Investments: Investments which can be made liquid in a short time, e.g. money market deposits, shares, etc. Optional, positive number. Liquid Assets: That means especially cash and cash equivalents, e.g. cheques. Optional, positive number

Liquid Assets: That means especially cash and cash equivalents, e.g. cheques. Optional, positive number Internal Fin. Liabilities: All kind of financial liabilities vs. internal parties only, e.g. loans. Optional, negative number.

Internal Fin. Liabilities: All kind of financial liabilities vs. internal parties only, e.g. loans. Optional, negative number. External Fin. Liabilities: For example external loans, financial leasing items. Optional, negative number.

External Fin. Liabilities: For example external loans, financial leasing items. Optional, negative number. NCP before Hedging: NCP means Net-Currency-Position. This number is the sum of all entries made above. Automatic calculated number.

NCP before Hedging: NCP means Net-Currency-Position. This number is the sum of all entries made above. Automatic calculated number. Internal Hedges: This is the total of all fx-hedge transactions made with Corporate (Group) Treasury. Optional, positive or negative number.

Internal Hedges: This is the total of all fx-hedge transactions made with Corporate (Group) Treasury. Optional, positive or negative number. External Hedges: All fx-hedge transactions made with external parties, i.e. banks.Optional, positive or negative number.

External Hedges: All fx-hedge transactions made with external parties, i.e. banks.Optional, positive or negative number. Internal Stop/Loss: All confirmed stop/loss orders placed at Corporate (Group) Treasury.Optional, positive or negative number.

Internal Stop/Loss: All confirmed stop/loss orders placed at Corporate (Group) Treasury.Optional, positive or negative number. External Stop/Loss: All confirmed stop/loss orders placed at external parties, i.e. banks.Optional, positive or negative number.

External Stop/Loss: All confirmed stop/loss orders placed at external parties, i.e. banks.Optional, positive or negative number. Total Hedge Position: The sum of all fx-hedge items entered above. Automatic calculated number.

Total Hedge Position: The sum of all fx-hedge items entered above. Automatic calculated number. NCP after Hedging: This is the open fx-exposure for the reported currency. Net Currency Position is calculated for NCP before Hedging + Total

NCP after Hedging: This is the open fx-exposure for the reported currency. Net Currency Position is calculated for NCP before Hedging + Total Hedge Position. Automatic calculated number.

Column 11

Hedge Position. Automatic calculated number.

Column 11 This is the column of totals for columns 1-10, converted into the functional currency of the reporting entity at the exchange rate selected in the first

This is the column of totals for columns 1-10, converted into the functional currency of the reporting entity at the exchange rate selected in the first step, see above.

step, see above. Column 12

Column 12 The total of columns 1-10, converted into the group currency at the exchange rate selected in the first step, see above.

The total of columns 1-10, converted into the group currency at the exchange rate selected in the first step, see above.